The CPI Scam — Health Insurance Version

The Consumer Price Index (CPI) drives markets and motivates policy, but it is nothing but speculation, estimation and wild guesses.

A recent “tweak” to the health insurance CPI reveals the formula is basically a scam.

As I’ve emphasized over and over, the CPI generally understates rising prices. The formula is designed to do so, and in the 1990s, the government made it even worse.

In 1998, the Bureau of Labor Statistics (BLS) followed the recommendations of the Boskin Commission, a committee appointed by the Senate in 1995. Initially called the “Advisory Commission to Study the Consumer Price Index,” its job was to study possible bias in the computation of the CPI. Unsurprisingly, it determined that the index overstated inflation — by about 1.1% per year in 1996 and about 1.3% prior to 1996. The 1998 changes to CPI were meant to address this “issue” by ensuring the formula consistently spits out a smaller number.

In effect, the government cooked the books.

If we used the 1970s formula today, the CPI would approximately double.

That’s not to say that the 1970s formula accurately reflected rising prices. The entire process is suspect. The BLS builds in all kinds of geometric weighting, substitution and hedonics into the calculation. By manipulating the numbers in the formula, the government can basically create an index that outputs whatever it wants.

A close look at how the BLS calculates rental costs provides a good example.

Owner equivalent rent is supposed to reflect the amount of money a homeowner would have to pay in rent to live in the same house. The Bureau of Labor Statistics determines this number in a survey, asking homeowners, “If someone were to rent your home today, how much do you think it would rent for monthly, unfurnished and without utilities?” It is literally nothing more than the opinion of the homeowner. It has virtually no correlation to the actual cost of the home.

In fact, during the early stages of the latest price inflation surge, CPI only showed modest rises in rent even as actual rental costs skyrocketed.

THE HEALTH INSURANCE DEBACLE

In October, the BLS made an adjustment to the health insurance CPI formula that resulted in a 1.1% increase in health insurance costs. That’s a significant jump, but it wouldn’t surprise anybody who has actually priced health insurance recently.

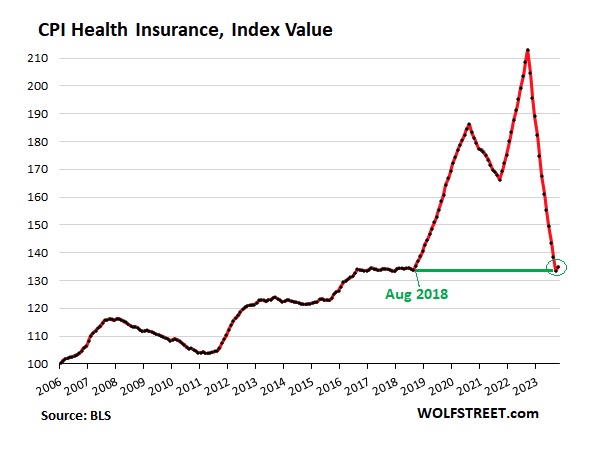

But the dirty little secret is the BLS made the adjustment because the old formula reflected a 37% collapse in the cost of health insurance between September 2022 and September 2023. Through that 12-month period, according to the CPI, health insurance costs fell an average of 4% every single month. This dropped the health insurance CPI to 2018 levels.

Does any sane person living in the real world think health insurance costs dropped 37% over the last year?

Of course not!

This means that monthly CPI and core CPI were significantly understated for 12 straight months, and the annual numbers will carry this distortion forward for the next year.

But don’t fret; the BLS “fixed” the problem. In October, it introduced adjustments that will raise the CPI cost of health insurance over the next 12 months. The little upward tick on the right side of this chart shows the first adjustment.

As WolfStreet put it, “The BLS has turned the health insurance CPI into chickensh!t.”

Here’s what happened.

This ignominious fiasco of an important metric within the CPI data occurred because the model that the BLS used to estimate the health insurance CPI – the ‘retained earnings method’ – after working reasonably well for years, blew up amid the distortions and money flows during the pandemic.

“Rather than coming up with an alternative estimate right away, back in 2021 when these issues became apparent, the BLS let this fiasco run for two years, overestimating by a moderate amount health insurance inflation in 2022, and causing health insurance CPI to just collapse over the past 12 months through September 2023, back to 2018 levels.”

And this was just a tweak. The BLS didn’t rework the formula. It continues to use the same “retained earnings” method that blew up back in 2020.

If the BLS blew it this badly on health insurance, why should we believe what it tells us about the cost of food, energy or anything else?

This debacle reveals the sham that is the CPI. It is detached from reality. And yet economists, financial analysts and policymakers treat this data as if it was handed down from heaven on stone tablets.

Get Peter Schiff’s most important gold headlines once per week – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning how to buy gold and buy silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Buka akaun dagangan patuh syariah anda di Weltrade.

Source link