Peter Schiff: Inflation Is Going to Get Much Worse (Interview)

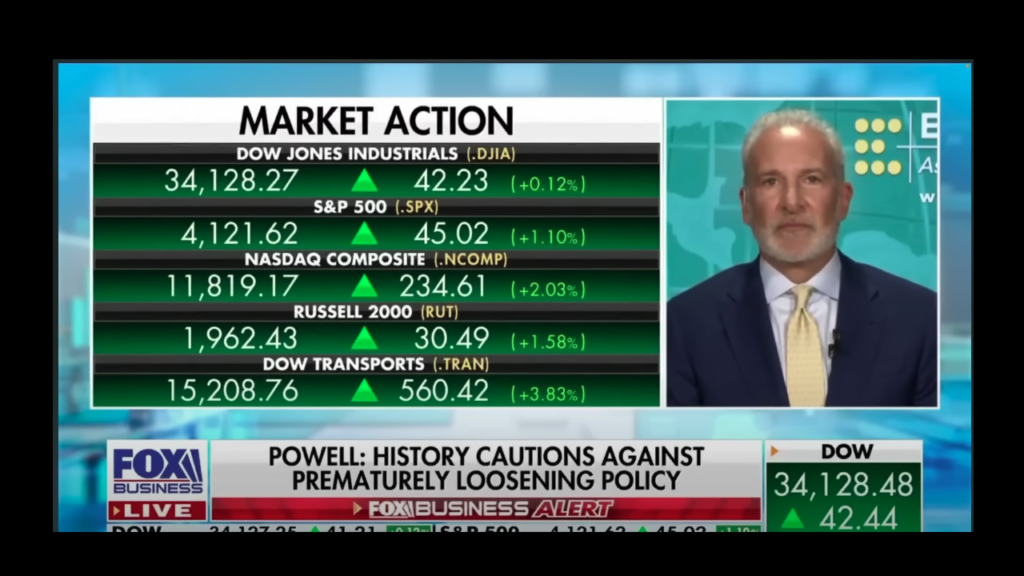

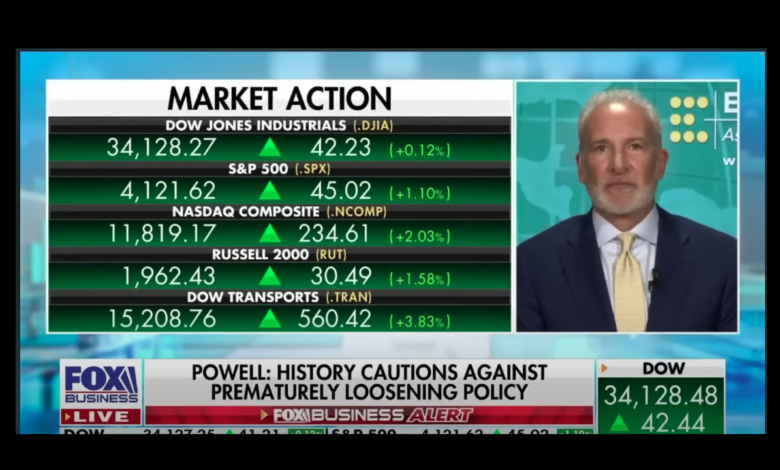

The mainstream seems more and more convinced that the Federal Reserve can bring inflation back down to 2% without creating any significant problems in the economy. After the February FOMC meeting, Fed chair Jerome Powell even suggested that the economy would avoid dipping into a recession. But in an interview on Fox Business with Liz Claman, Peter Schiff argued that the Fed won’t beat inflation or get a soft landing. He said the looming economic slowdown will fuel the inflation fire.

Natalliance global Fixed income head Andrew Brenner also appeared with Peter and Liz. He took the mainstream view that the Fed is winding down the inflation fight. In fact, he said this would likely be the last rate increase. Brenner said Powell doesn’t need to raise rates any more. “The markets will do the rest for him and the markets do not believe he is going to tighten further.”

Peter said it could be the last rate hike, but not because inflation is coming down.

Inflation is going to get much worse.”

Peter said he heard a lot of economic ignorance coming out of Powell’s mouth, especially when it comes to inflation. He noted that Powell said the Fed welcomed “disinflation.”

That disinflation is transitory. Maybe he doesn’t realize that yet, but it is.”

Powell also said inflation is caused by consumer expectations.

He’s wrong. Expectations don’t cause inflation. Neither do wages and prices. He said he was worried that maybe a wage-price spiral could develop and that’s why the Fed wants to make sure it doesn’t happen. The wage-price spiral was a fiction invented by Keynesians. Inflation is caused by the government. It is caused by the Federal Reserve printing money and then Congress spending money. That’s it. And spending is going up.”

In fact, Powell encouraged Congress to raise the debt ceiling so it can spend even more money.

Ultimately, the Fed is going to monetize that debt, and we’ve only seen the beginning of inflation. In fact, Powell said inflation is creating misery for families. It’s the government that is creating that misery — and the Fed — because they’re the ones creating the inflation.”

Peter noted that the Fed has slowed down the pace of interest rate increases. And even if we get a couple more 25-basis point rate hikes, it’s still not nearly enough. He also said you have to look at the impact higher rates have had on consumer behavior.

Which is pretty much nothing. Credit card debt is at an all-time high. Savings are at an all-time low. So, the higher interest rates have not stopped spending and encouraged saving, which is exactly what has to happen to bring down inflation.”

Meanwhile, the government continues to spend billions of dollars every single month.

Peter said if Powell thinks a slowdown in the economy is going to cool inflation, he’s wrong again.

That’s actually going to fuel the inflation fire. The real risk is that we end up with a financial crisis and a much more severe recession than the Fed recognizes. And then the Fed tries to prop up the economy to try to stimulate, or combat the financial crisis by creating even more inflation.”

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Buka akaun dagangan patuh syariah anda di Weltrade.

Source link