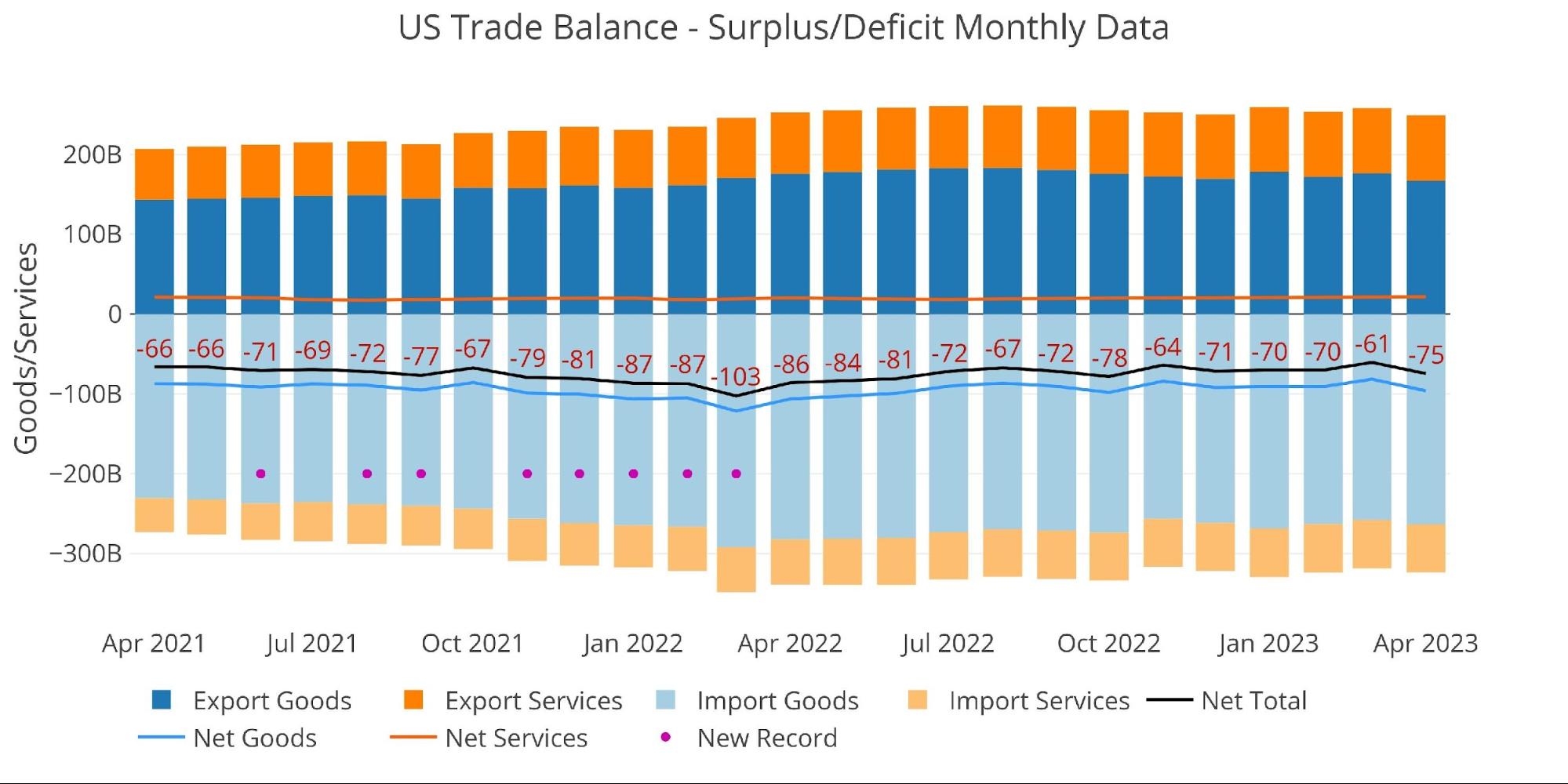

Trade Deficit Surges to Highest Level in Six Months

The April trade deficit came in at -$74.5B which was the largest trade deficit since October 2022.

Figure: 1 Monthly Plot Detail

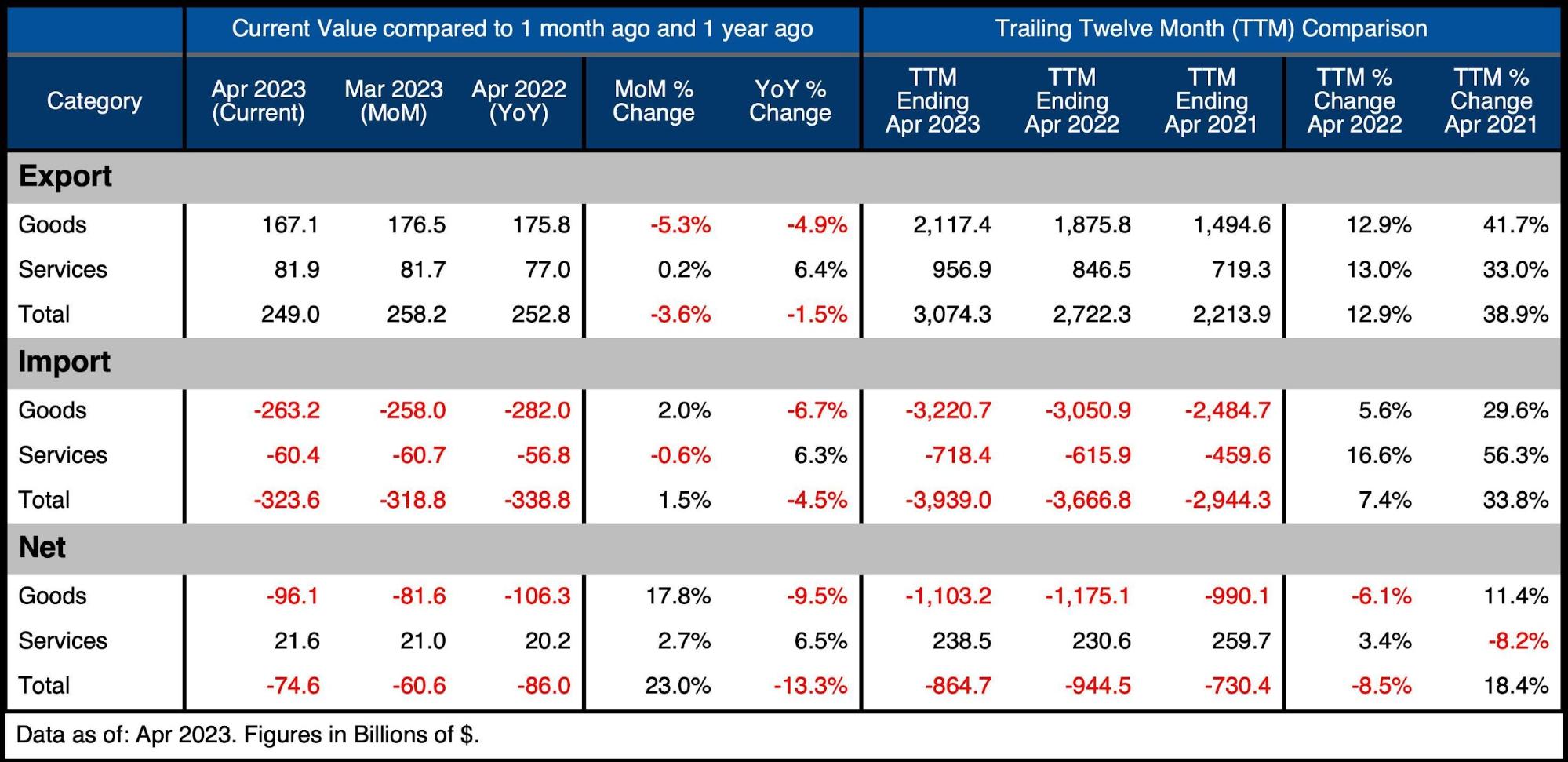

The table below provides detail.

Monthly Trade Deficit

-

- The increase was driven by a combined drop in Exports with a rise in Imports

-

- Specifically, Goods Imports rose $5B or 2% while Exports fell more than $9B or 5.3%

-

- Services was the reverse with Imported Services falling while Exported Services increased

-

- Both were negligible amounts

-

- The increase in Net Goods was a whopping 17.8% MoM but was actually down from the highs last year, off 9.5% YoY

- The increase was driven by a combined drop in Exports with a rise in Imports

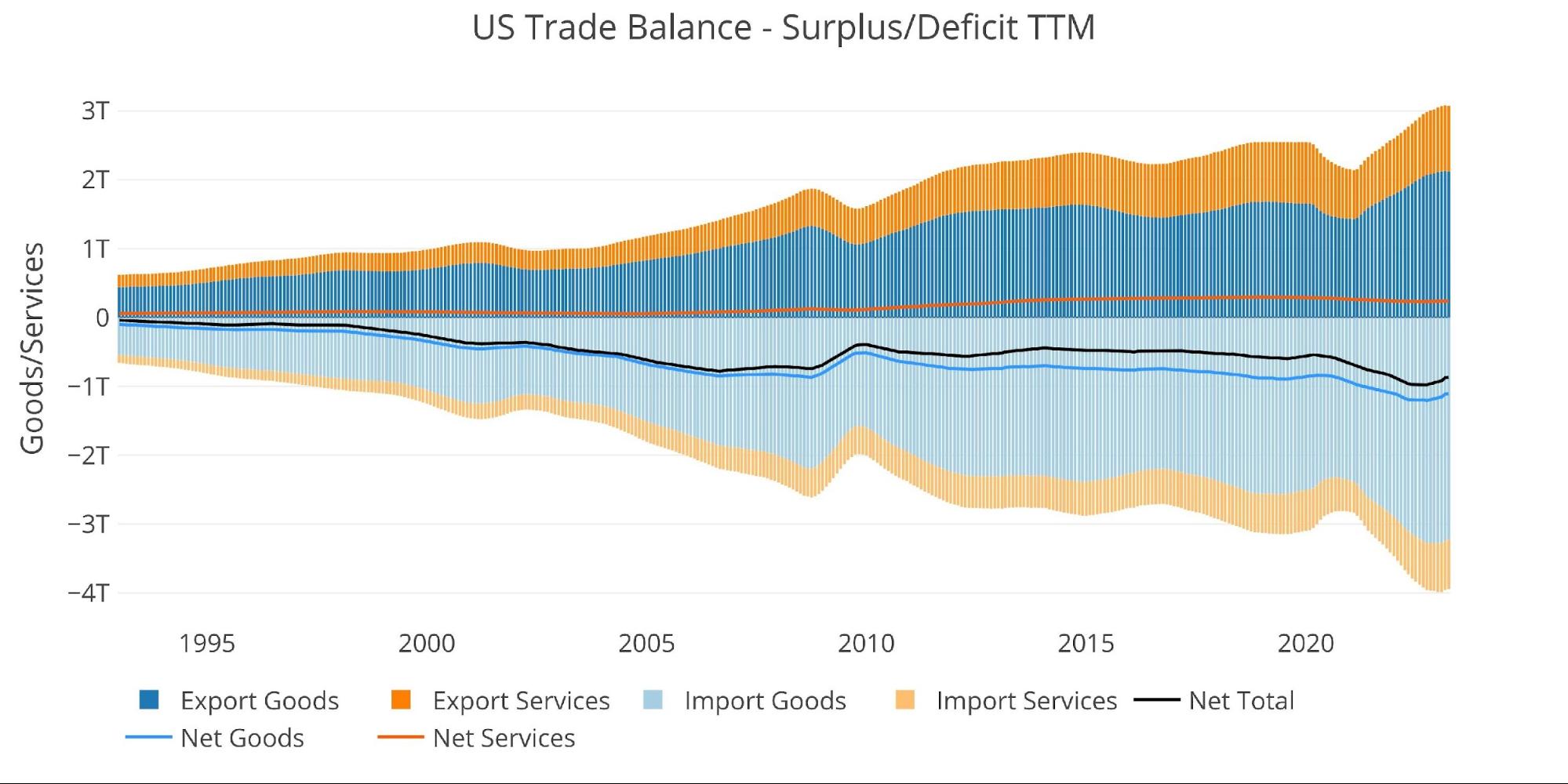

Looking at Trailing Twelve Month:

-

- On a TTM basis, the Net Goods Deficit actually contracted by 6%, but remains well over $1T

-

- The Services Surplus increased 3.4%

- In aggregate, the TTM deficit fell 8.5% or about $80B

-

- On a TTM basis, the Net Goods Deficit actually contracted by 6%, but remains well over $1T

While the TTM Deficit is falling, it remains extremely large. It had been improving some in recent months but has gone the other way in the latest month.

Figure: 2 Trade Balance Detail

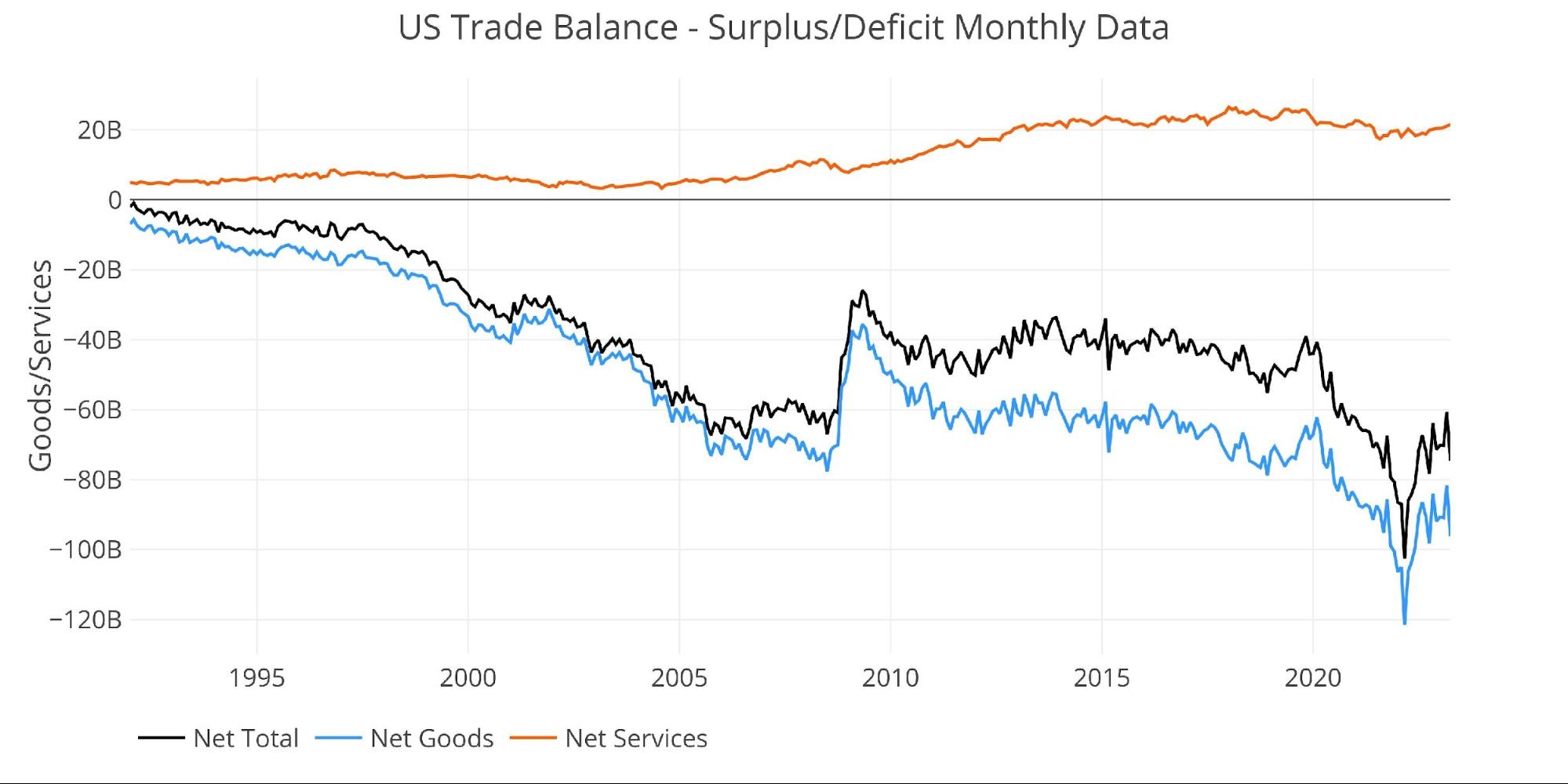

Historical Perspective

Zooming out and focusing on the net numbers shows the longer-term trend. Recent months have been very volatile, so it is hard to tell what trend is being established. The big spike down was clearly an outlier, but the monthly deficit has settled to the lows that existed right before the Great Financial Crisis. The Services Surplus definitely looks to have established a slight upward trend going back to Aug 2021 when it bottomed at $17.4B. That said, at $21.5B, it remains below the pre-Covid highs of around $25B.

Figure: 3 Historical Net Trade Balance

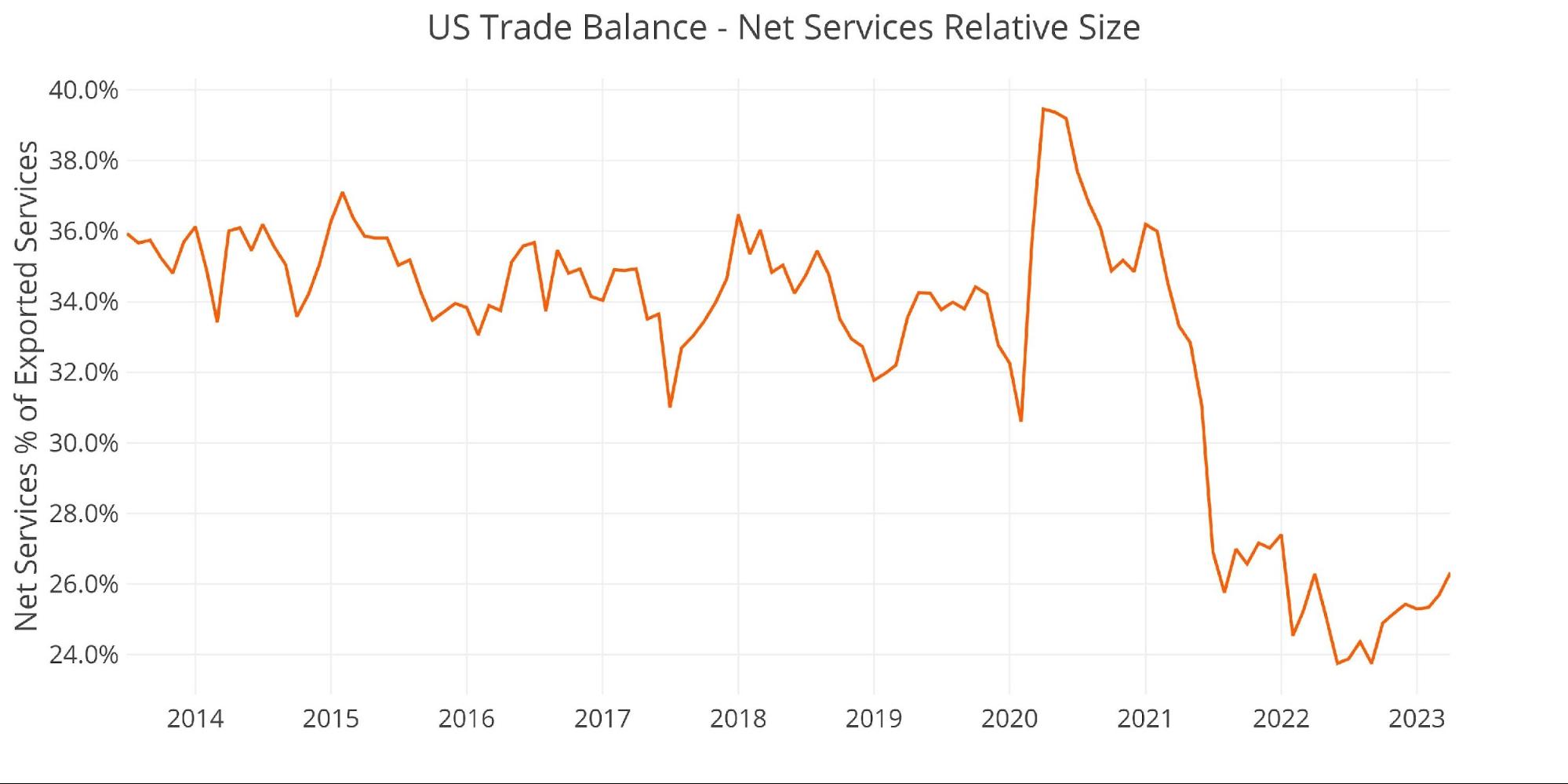

The Services Surplus upward trend can be seen more clearly in the chart below. It shows the surplus relative to total Exported Services and has reached 26.3% in the current month. This is above the 2022 lows of 23.7% but well below the range near 35% pre-Covid.

Figure: 4 Historical Services Surplus

To put it all together and remove some of the noise, the next plot below shows the Trailing Twelve Month (TTM) values for each month (i.e., each period represents the summation of the previous 12-months). The global surge in consumption post-Covid is clear to see below but has clearly leveled off over the last year.

Figure: 5 Trailing 12 Months (TTM)

The TTM Net Trade Deficit has improved which has brought the total down relative to GDP. After peaking at 3.85% in June 2022 it has dropped to 3.26% in the latest month.

Figure: 6 TTM vs GDP

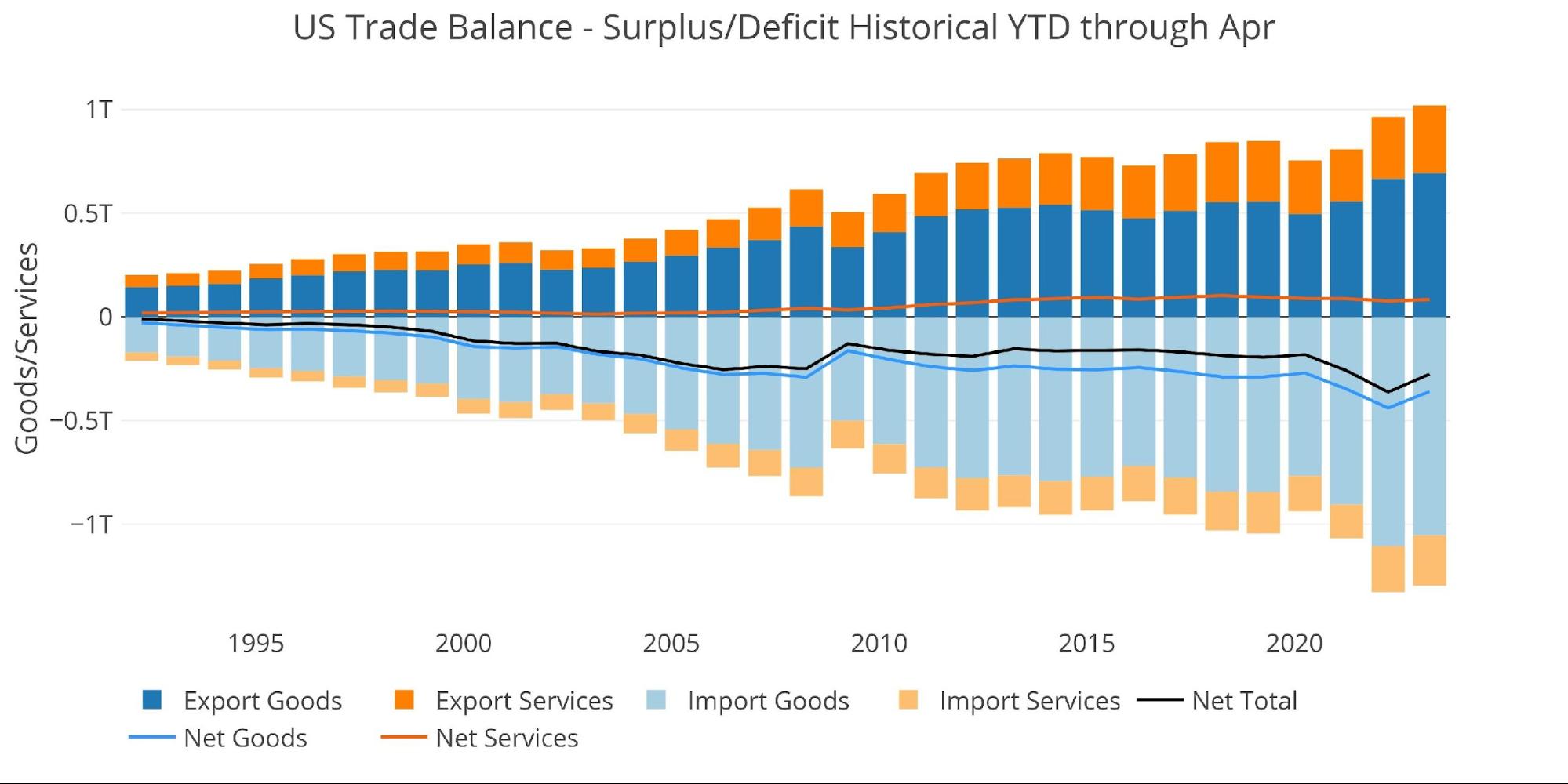

The chart below shows the YTD values. Total Exports have actually increased while total Imports have decreased when compared to the same period last year.

Figure: 7 Year to Date

Wrapping Up

The Trade Deficit still gets very little attention, but it serves as a huge windfall and potential risk for the US. Currently, foreign countries are willing to provide goods and services in exchange for USD that far exceeds what they are buying with the USD they earn.

If the desire for the Dollar were to fall, then the US consumer’s ability to consume more than it produces would vanish. Furthermore, it could create a massive inflation problem. The US has printed large trade deficits for decades, flooding the world with Dollars. If that flow were to reverse then Dollars would come back to the US and bid up prices domestically. The Fed could do nothing to stop this.

The Trade Deficit peaked last summer and then trended back down. It has now found a new level around the $70B range. This is a massive monthly deficit and puts more strain on the USD reserve status. US consumers can protect themselves against the trade deficit risk with a global currency that has stood the test of time: gold (and silver).

Data Source: https://fred.stlouisfed.org/series/BOPGSTB

Data Updated: Monthly on one month lag

Last Updated: Jun 07, 2023 for Apr 2023

US Debt interactive charts and graphs can always be found on the Exploring Finance dashboard: https://exploringfinance.shinyapps.io/USDebt/

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Buka akaun dagangan patuh syariah anda di Weltrade.

Source link