USD/TRY Forex Signal: 2-Month Low

We expect the price of the lira to decline as long as it continues trading above the mentioned support levels.

Today’s USD/TRY Signal

Risk 0.50%.

Yesterday’s buy trade was activated and reached the stop loss point

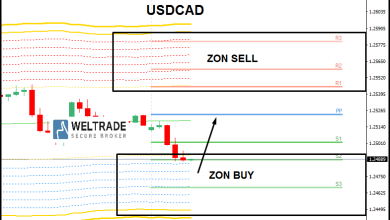

Best buy entry points

- Entering a long position with a pending order from 14.02 levels.

- Place your stop-loss point below the 13.88 support levels.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit equal to 75 pips and leave the rest of the contracts until the strong resistance levels at 14.89.

Best selling entry points

- Entering a short position with a pending order from 15.00 levels.

- The best points to place the stop loss are the highest levels of 15.19.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit equal to 75 pips and leave the rest of the contracts until the support levels 14.60

The lira fell sharply during trading on Thursday as the dollar rose against the major currencies and emerging market currencies, amid the demand for safe haven currencies after the Russian military moves in Ukraine. These are moves that the country’s President, Recep Tayyip Erdogan, objected to in yesterday’s statements, as he told his Russian counterpart Vladimir Putin on Wednesday that Ankara does not recognize Moscow’s decision to recognize the independent People’s Republics of Donetsk and Lugansk. “President Erdogan indicated that Turkey does not recognize steps that contradict the sovereignty and territorial integrity of Ukraine,” the Turkish presidency said in a statement after the phone conversation between the two leaders. Erdogan also told Putin that “the aggravation of the situation” in Ukraine, and “the military conflict in particular, will not benefit anyone.” At the present time, an escalation of conditions may mean greater weakness in the price of the lira, especially with the demand for gold, the yen and the dollar as safe havens.

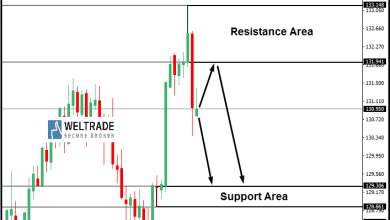

On the technical front, the price of the Turkish lira fell against the dollar during today’s trading. The USD/TRY has broken the upper boundary of a bullish price channel on the four-hour time frame shown on the provided chart. The pair is also trading above the 50, 100 and 200 moving averages, respectively, on the daily time frame and the four-hour time frame. The lira is trading the highest support levels at 13.91 and 14.01, respectively. On the other hand, the lira is trading below the resistance levels that are concentrated at 15.03 and 15.16, respectively. We expect the price of the lira to decline as long as it continues trading above the mentioned support levels, with the expectation of some corrections, as the momentum indicator indicates a saturation in the bullish direction, as it targets the mentioned resistance levels. Please adhere to the numbers in the recommendation with the need to maintain capital management.

Source link