GBP/USD Weekly Outlook – Action Forex

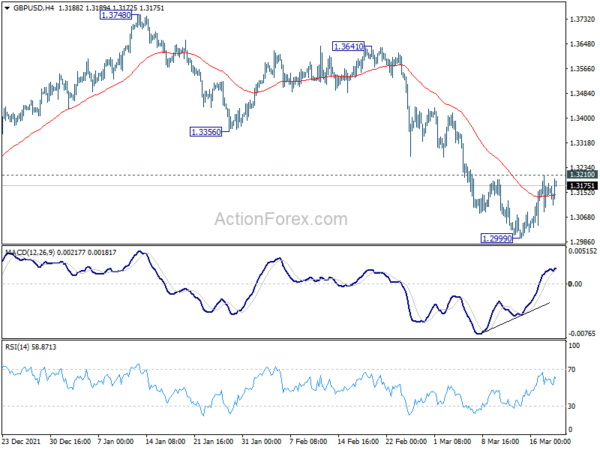

GBP/USD recovered after edging lower to 1.2999 last week. But recovery was capped at 1.3210. Initial bias remains neutral this week first. On the downside, break of 1.2999 will resume later down trend from 1.4248. However, firm break of 1.3210 should confirm short term bottoming. Stronger rise should be seen back to 55 day EMA (now at 1.3369).

In the bigger picture, current development suggests that the up trend from 1.1409 (2020 low) has completed at 1.4248. Decline from 1.4248 could still be a corrective move, or it could be the start of a long term down trend. In either case, deeper decline would be seen back to 61.8% retracement of 2.1161 to 1.1409 at 1.2493. In any case, break of 1.3748 resistance is needed to indicate medium term bottoming, or outlook will stay bearish.

In the longer term picture, rebound from 1.1409 long term bottom could have completed at 1.4248 already, ahead of 38.2% retracement of 2.1161 to 1.1409 at 1.5134. The development argues that price actions from 1.1409 are developing into a corrective pattern only. That is, long term bearishness is retained for resuming the downside from 2.1161 (2007 high) at a later stage.

Source link