Bold policy response needed to restore Fed credibility on inflation – AUSTINARIES

The author is the president of Queens College of Cambridge and an advisor to Allianz and Grammersie.

Pointing out that the US Federal Reserve should stop falling behind inflation is a clear indication of what to do at the World Bank’s policy committee meeting this week.

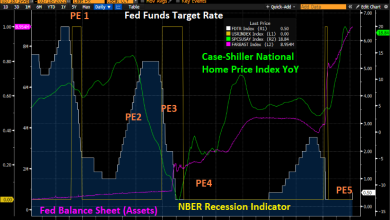

Clearly, the federation should immediately discontinue its asset purchase program, keep markets up to three and possibly higher interest rates this year, and announce plans to reduce its balance sheet by March. It should also explain how he managed to make inflation so erratic and why he was so slow to respond.

Otherwise, he will struggle to regain his political credibility and credibility.

Since the last meeting of the Federal Open Market Committee on December 14-15, the US Consumer Price Index breached by 7%. The main measure of inflation is the expansion of drivers by more than 5 percent. Unemployment has dropped by less than 4 percent, and labor force participation remains below pre-epidemic levels.

In addition, the federation’s forecast for inflation – the main personal consumption expenditure index – is 4.4 percent, more than double what it was a year ago, and is projected to rise by 2.7 percent to 2022. More up-to-date reviews for 2022 are definitely on the cards.

All of this information points directly to the federal order. They suggest that monetary policy should no longer be handled. But uber is still a stimulant, and is on its way to staying for a while.

Instead of hitting the brakes, the federation is still on its toes. While the stimulus program is about to end at the end of this quarter, the money market is still declining.

The chairman of the federation, Jay Powell, has made significant strides in analysts’ policy since his “retirement” in late November, but it is not surprising that the financial situation has remained tense.

Predictable inflationary pressures continue to push the system forward, not only with the price of producers but also with the continued shortage of manpower, supply shortages and a 10 percent increase in oil prices in January.

Because inflation is so bad for most of 2021 and one policy window is missing after another, the relentless delay in responding to federal policy endangers Paul himself as a “serious threat” to life. Accordingly, it is clear from this week’s meeting that it will focus on tackling inflation.

This should be done in the immediate aftermath of QE, a three-year interest rate hike and a risk-adjusted balance toward strict policies. The federation must announce its “Strengthening Number” plan by March.

To make it all credible, the authorities need to be clear about why they have been reading inflation for so long (I believe this will be one of the worst inflation scenarios in the history of the Central Bank). Now it is better to include a wide range of pointers in macro modeling and forecasting.

This is what I believe the federation should do. But I’m worried it won’t happen.

With the experience of three years ago, market volatility has changed dramatically in recent years. Turn around, turn around, turn around.

Of course, such an approach would open the way for systematic adjustments in the policy by eliminating some prolonged inflation, slowing economic growth, and eliminating unstable financial instability. But that window is too small and too dangerous.

In terms of vulnerability, the threat to society is one of the reasons why the federation has been forced to enter into a wider range of contract financing by the end of this year. The result would be a loss of life, severe financial instability, a catastrophic domestic catastrophe, and a further threat to the world economy and financial security.

The federation has a chance to find the facts on the ground this week and regain some of its lost credibility. He must be brave to do this. Continuing the current path will endanger another significant policy error by the end of this year.

Source link