How Rate Hikes May Trigger a Recession

Commentary

The history of economic development can’t be understood without the importance of recession periods. Recessions are often the result of the excess accumulated in previous years. Creative destruction after a period of excess used to drive a stronger recovery and continued economic development. That was until risky assets became the biggest concern for policymakers.

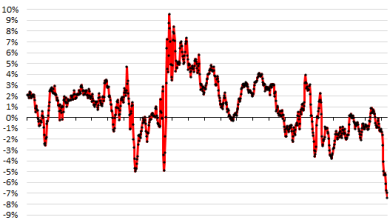

From the late seventies and early eighties U.S. housing slump and automobile industry crisis to the technology and housing bubble burst, there’s a clear process of causation created by interest rate policy. Constant decreases in interest rates lead to excessive risk-taking, complacency, and accumulation of exposure to increasingly expensive assets under the perception that there’s no risk. Bubbles become larger and more dangerous, because interest rates are kept abnormally low for a prolonged period, and it disguises risk, clouding citizens’ and investors’ perception of danger in elevated valuations. Cheap money leads to generalized and dangerous risk exposure.

After every recession, central banks keep rates too low for too long, even in growth periods, because policymakers’ fear asset price corrections, and this leads to complacency and the creation of bubbles everywhere. Once policymakers decide to raise rates, they often cause a recession, because the amount of risk taken by even the most conservative investor or household is simply too high. By the time central banks decide to finally raise rates, the bubbles are already more than a market headline; they’re a dangerous and widespread accumulation of risk that negatively affects millions of unsuspecting citizens.

The question is what is worse, the rate cuts or the rate hikes? Rate hikes tend to trigger recessions, as Jesse Colombo or Lance Roberts have shown in numerous charts, but what causes them is previous extraordinary levels of accumulated risks throughout the economy.

The boom-and-bust cycle is now more severe and frequent, as we have seen since the late seventies. That’s why central banks never truly normalize policy, and rates remain in negative territory in real terms. And investors know it. That’s why there’s a perverse incentive for households, businesses, and investors to buy any correction.

The fear of interest rate hikes allows us to analyze what has happened in other similar periods.

As Dan Tapiero shared on Twitter, between 1985 and 1990, the Fed raised rates 325 basis points and the S&P 500 rose 45 percent. The rate-hike cycle drove emerging economies such as Mexico into the ground, and states such as California went bankrupt.

Between 1993 and 2000, the Fed also raised rates by 325 basis points and the U.S. stock market shot up 225 percent. In that period, we saw the tech bubble burst and the early 2000s recession. In the 2003 to 2007 period, the Fed raised rates by 375 basis points and the market rose 30 percent. It brought the great financial crisis and the housing bubble burst.

Between 2015 and 2020, rates rose 200 basis points and the U.S. index advanced 65 percent. In that period, in 2018, we saw the Fed change its rate-hike course rapidly after a market correction.

Will the Federal Reserve change its rate-hike plan this time? History shows us that central banks care much more about risky assets—stocks and bonds—than they say, and certainly a lot more than they do about inflation.

As shown by Varad Markets, at the beginning of 2016, faced with a cycle of expected rate hikes, the S&P 500 corrected 11.3 percent up to Jan. 20. The Federal Reserve ended up raising rates just once that year, despite announcing four hikes. Why did they change? “Geopolitical risk and weakening financial conditions.” Exactly what’s happening now.

In December 2018, after years of a bull market, the U.S. stock market fell by 9 percent, and on Jan. 3, 2019, it corrected another 2.5 percent. On Jan. 30, the Federal Reserve announced (pdf) that it “will be patient” and stopped its rate-hike path in its tracks.

It’s true that inflation was not 7 percent then, and the Federal Reserve may probably be more tolerant of a market correction than when the U.S. Consumer Price Index was at 3 percent, but we can’t forget that history shows us that central banks always maintain looser conditions than it seems from their messages and headlines.

The evidence of the U.S. economic slowdown is everywhere: retail sales, job creation, stagnant labor force participation, declining real wages, and slowing capital expenditure. To all this we must add the continued rise in energy commodities due to the Ukraine tensions.

The Federal Reserve is aware of the “bubble of everything” created in recent years and the elevated levels of debt throughout the economy. Unfortunately, the Fed has already left rates low, and asset purchases high, for too long to prevent an inevitable negative economic effect. Even worse, the solution will likely be to repeat the same policies that created the conditions for excess.

Views expressed in this article are the opinions of the author and do not necessarily reflect the views of The Epoch Times.

Buka akaun dagangan patuh syariah anda di Weltrade.

Source link