The Advantages of Including Gold in Your IRA

You can hold physical gold and silver in an IRA, and there are certain advantages to doing so.

Historically, IRAs with an allocation to precious metals perform better than IRAs with no exposure to silver or gold. There are also tax benefits when contributing to an IRA.

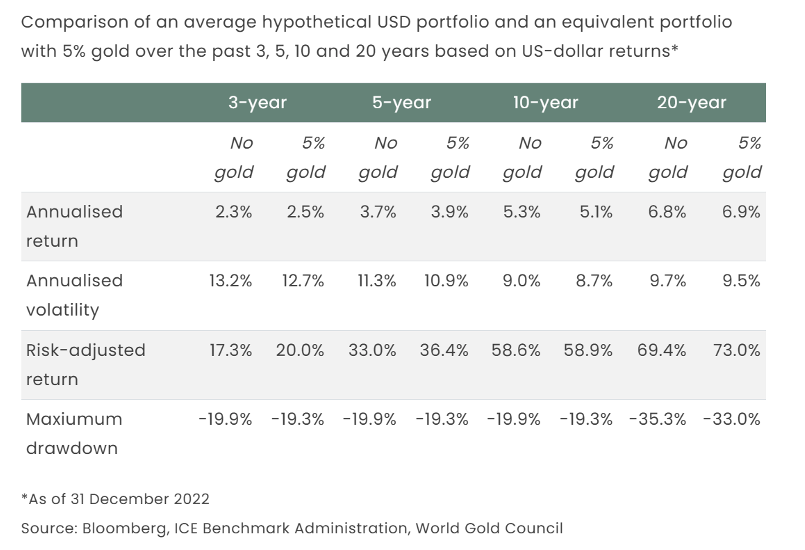

According to research by the World Gold Council, strategic allocation to gold can provide higher long-term returns and lower overall portfolio volatility.

According to the WGC, the favorable impacts of including gold in an IRA are due to its liquidity and unique performance behavior that is driven by both investment and consumer demand.

The ‘dual nature’ of gold as both an investment asset and a consumer good makes gold an excellent addition to a diversified portfolio and delivers long-term returns in both good and bad economic environments.”

Paper or Physical Gold?

Most custodians can allocate gold ETFs in an IRA.

ETFs are backed by physical gold held by the issuer and are traded on the market like stocks. They are sometimes referred to as “paper gold.” An ETF allows investors to play gold without having to buy full ounces of gold at the spot price. Since their purchase is just a number in a computer, they can trade their investment into another stock or cash pretty much whenever they want, even multiple times on the same day. Many speculative investors appreciate this liquidity.

There are good reasons to invest in ETFs, but they aren’t a substitute for owning physical metal. In an overall investment strategy, SchiffGold recommends buying gold bullion first.

Fortunately, you can also hold physical gold in an IRA.

Unfortunately, most traditional IRAs and employer-sponsored retirement plans — 401(k)s, TSPs, SIMPLE IRAs — are limited by their custodian or company’s policyholder. These limitations do not allow for physical ownership of gold and silver, and generally only offer precious metal alternatives via financial derivatives including ETFs and futures.

With these limitations, you may need to open a self-directed IRA in order to include physical gold. You can also roll an existing IRA into a self-directed account.

With the right custodian, one can simply buy gold/silver coins and bars within their own IRA. This eliminates virtually all third-party risks. Precious metals held in a “Physical Precious Metal IRA” are 100% allocated in a vault of the client’s choosing and can be segregated from other accounts. The physical bars and coins are safeguarded in the client’s name and are in the exclusive control of the client.

A “Physical Precious Metal IRA” is an unofficial term used to describe an Individual Retirement Account holding gold, silver, platinum, or palladium in the form of physical bars or coins. From a legal standpoint, it is no different than any other IRA. In fact, there is nothing in the IRS code defining a precious metal IRA. The only difference is that the custodian maintains the infrastructure to include physical precious metals.

The term “Physical Precious Metal IRA” is also synonymous with “Gold IRA,” “Silver IRA,” or “Physical Metal IRA.” The tax benefits and functionality of a Physical Precious Metal IRA are identical to a regular IRA, except the owner holds physical precious metals instead of derivative paper assets such as precious metal ETFs, CFDs, options, futures, etc. In other words, the owner of a Physical Precious Metal IRA maintains direct ownership of physical coins or bars.

Tax Benefits

Up to certain limits, contributions to an IRA can be deducted from their income for federal tax purposes.

In addition to tax deductions, IRAs grow tax-deferred. Buying and selling assets within an IRA creates no immediate tax liability. Tax liability only occurs when an individual begins withdrawing money. ) And in some cases, there is zero tax liability for withdrawals; this is true for Roth IRAs.

Setting up a self-directed IRA may sound daunting, but it is actually pretty simple. You can download SchiffGold’s IRA Guide HERE and learn more about precious metal IRAs and how to set one up. Or you can contact a SchiffGold precious metals specialist by calling 1-888-GOLD-160 or emailing [email protected].

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Buka akaun dagangan patuh syariah anda di Weltrade.

Source link