Another Hot CPI Read Backs the Fed Deeper into a Corner

Fed Chair Jerome Powell and other members of the central bank have continued to talk tough about fighting inflation. But I’m pretty certain that in private, they were desperately hoping to see some cooling in the inflation data so they could start backing out of the ring. With a recession pretty clearly on the horizon (if not already here), you can bet that the central bankers don’t want to keep tightening monetary policy.

They didn’t get their wish.

The latest Consumer Price Index data backs the Federal Reserve even deeper into a corner. Because, once again, the CPI came out much hotter than expected.

On an annual basis, CPI rose by 9.1%. That is the biggest jump in consumer prices since November 1981, and the largest increase in this inflationary cycle. The projection was for an 8.8% increase.

Month-on-month, the CPI rose a sizzling 1.3%. The estimate was for a 1.1% rise.

Stripping out food and energy prices, core inflation rose 5.9% on an annual basis, down just a tick from last month’s 6% print. Month-on-month, core CPI was up 0.7%. That was higher than last month’s 0.6% read. The projection was for core CPI to cool to 5.7% on an annual basis and a 0.5% month on month.

Energy prices surged another 7.5% in June. The energy category charted a 41.6% annual increase. Medical-care costs climbed 0.7% during the month. And rents rose 0.8% in June, the biggest monthly increase since 1986.

Inflation is crushing American consumers. Wages are rising, but not nearly as fast as prices. According to a separate Bureau of Labor Statistics report, average hourly earnings fell 1% for the month of June and were down 3.6% year on year. In the last month, hourly earnings rose by 0.3%, but real wages fall by 1% when you factor in the 1.3% monthly increase in prices.

According to calculations by Bloomberg Economics last month, the inflation tax costs American households $433 per month. That comes to a $5,200 annual increase in household costs.

This undercuts the popular narrative that “inflation isn’t really that bad” because wages increase as well. Rising wages don’t keep up with rising prices. As a result, American consumers are running up record levels of debt and burning through savings to make ends meet.

And as I mention every time I talk about CPI, it’s even worse than these awful numbers suggest. This CPI uses a government formula that understates the actual rise in prices. Based on the CPI formula used in the 1970s, CPI is well above 18% — a historically high number.

President Joe Biden lamented rising prices, calling them unacceptably high, but then claimed the CPI data was “out-of-date” because it doesn’t take into account the recent drop in gasoline prices. But increasing month-on-month core CPI undercuts this narrative. In fact, prices rose in every CPI category, and 8 of the 11 categories charted increases higher than the 12-month trend.

The Fed in a Corner

The next question is how will the Federal Reserve play this?

It has two choices.

- Keep tightening and risk completely blowing up the bubble economy

- Ease off tightening and allow inflation to keep running rampant.

Neither option is particularly inviting.

It’s pretty clear that the Fed is winging it. The central bankers don’t have a real plan. They are simply reacting based on the latest headline data. So, it makes sense that a lot of people think the central bank will go with a full 1% interest rate hike at its July meeting. Based on Federal funds futures, the chance of a 100-basis-point hike at the upcoming meeting is now above 80%. That compares to a roughly one-in-nine chance before the CPI data came out.

As you’ll recall, a 75-basis point hike was “off the table” until we got a hotter than expected CPI report in May. But worried about its credibility, the FOMC members slapped that 3/4% increase right down on the table.

In a nutshell, Powell & Company hoped inflation had peaked earlier in the spring, but with the “surprising” increase in CPI, the central bankers felt compelled to go big. Why? Because they are suddenly concerned about their credibility. This is clear from the June meeting minutes.

Many participants judged that a significant risk now facing the Committee was that elevated inflation could become entrenched if the public began to question the resolve of the Committee to adjust the stance of policy as warranted.” [Emphasis added]

Well, the Fed can’t back down now, can it? Not with inflation running even hotter than last month, despite the “aggressive” 75 basis-point hike.

The problem is the economy is already on shaky ground. We had a negative GDP print in Q1 and the Atlanta Fed projects another contraction in Q2. That’s an official recession. Central banking 101 teaches that you don’t hike into a recession. But here we are.

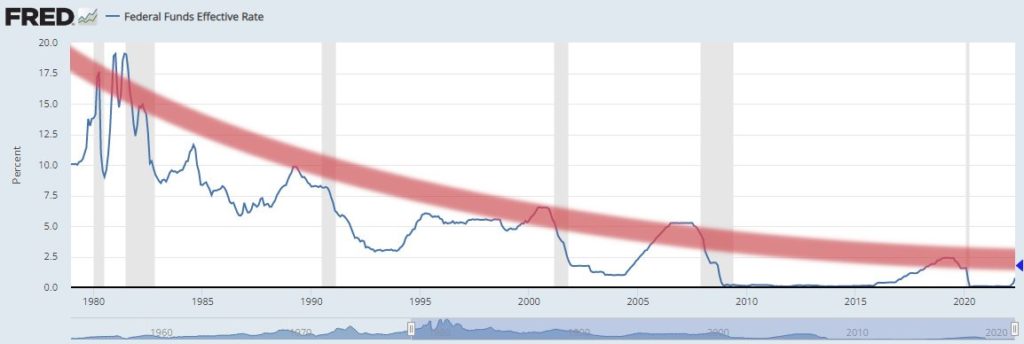

The Fed has already driven rates very close to the limit. If rates go much higher, there is every reason to believe the economy will completely implode. In 2019, 2.5% was the max. At that point, the economy got shaky, the stock market crashed, and the Fed went right back to loose monetary policy. (Not that 2.5% interest rates are particularly tight.) In 2019, the Fed cut rates three times and had already gone back to QE – even before the pandemic.

So, what makes anybody think the Fed can push rates to 3 or 3.5% today with even more debt in the economy?

In simple terms, the Fed blew up a bubble economy during the pandemic with artificially low interest rates and by creating trillions of dollars out of thin air. This led to the spate of inflation we’re seeing now. When the Fed started tightening monetary policy to fight inflation, it pricked the bubble. And it appears poised to pop it completely.

The mainstream seems to have resigned itself to a recession, but the consensus is that it will be short and shallow. Keep in mind that these are the same people who told you inflation would be transitory. Peter Schiff said the notion that this would be a mild recession is a fantasy.

The idea that this recession could be anything but severe is farcical. There is no way we can have a shallow recession.”

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Buka akaun dagangan patuh syariah anda di Weltrade.

Source link