The CPI is Two Months Away From Bottoming Before the Next Leg Up

The CPI rose in March by 0.37%, which was much larger than last month’s 0.06%. As shown below, this was driven by the energy component flipping from negative to positive.

Figure: 1 Month Over Month Inflation

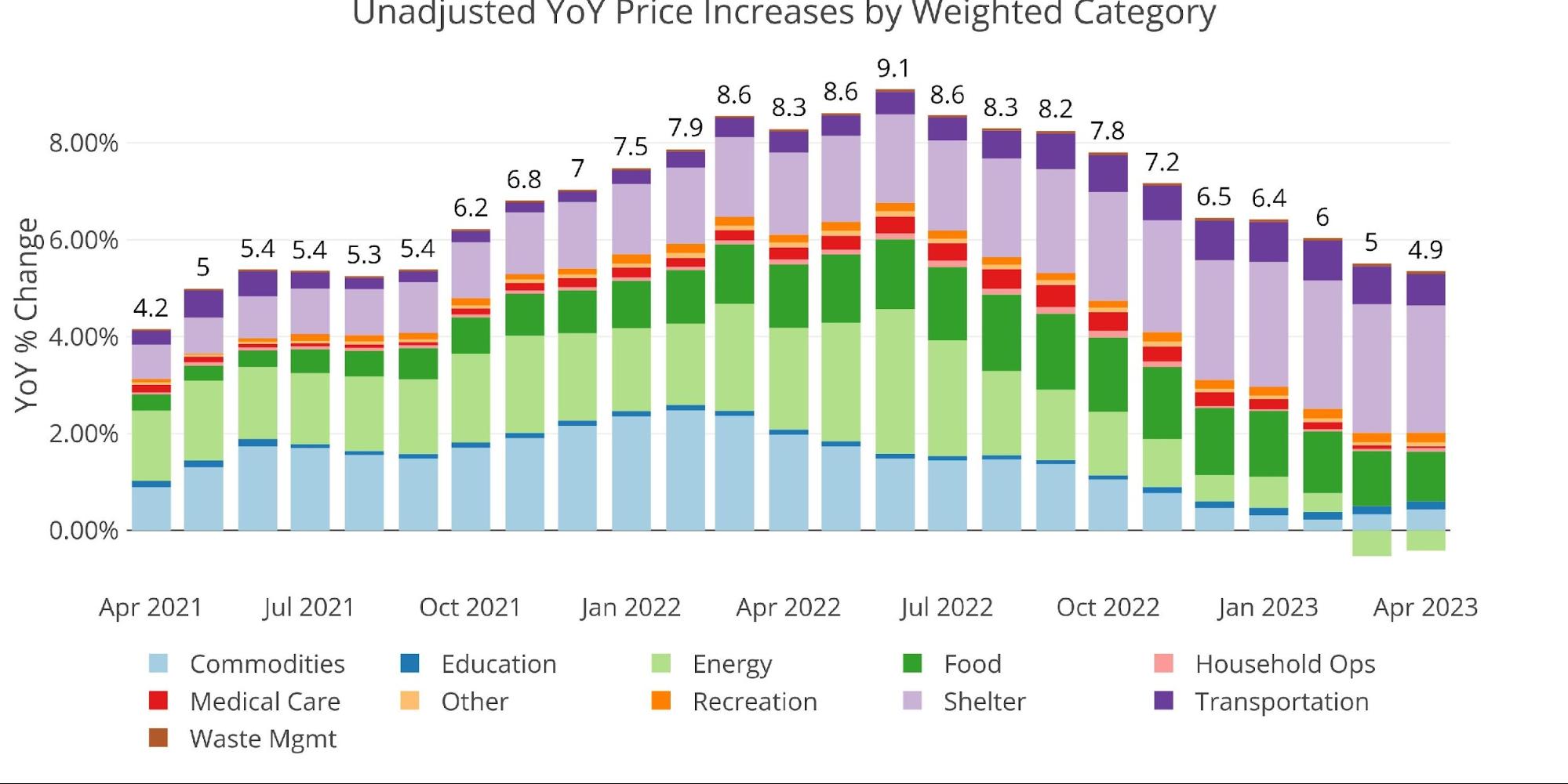

The YoY CPI rise was the smallest amount since April 2021. While this may seem like good news, there are two critical factors to consider. First, the YoY figure fell because last April came off the calendar. The CPI last April was 0.4% which means the drop is due to a bigger number coming off the board. This will likely play into the May and June CPI especially as 0.92% and 1.21% fall off the YoY calculation. This will greatly help the CPI YoY come down further over the next two months.

That said, one must still consider the second factor. A monthly rise of 0.37% translates into an annual rise of 4.5% after compounding. That is still a big number and way above the Fed target rate. After June falls off, the data starts to normalize and there are even some very low months that will be rolling off (-0.04% in July and 0.21% in August). If the windfall from falling Energy prices is over, then it’s unlikely the YoY CPI will drop into the Fed’s target range anytime soon.

Figure: 2 Year Over Year Inflation

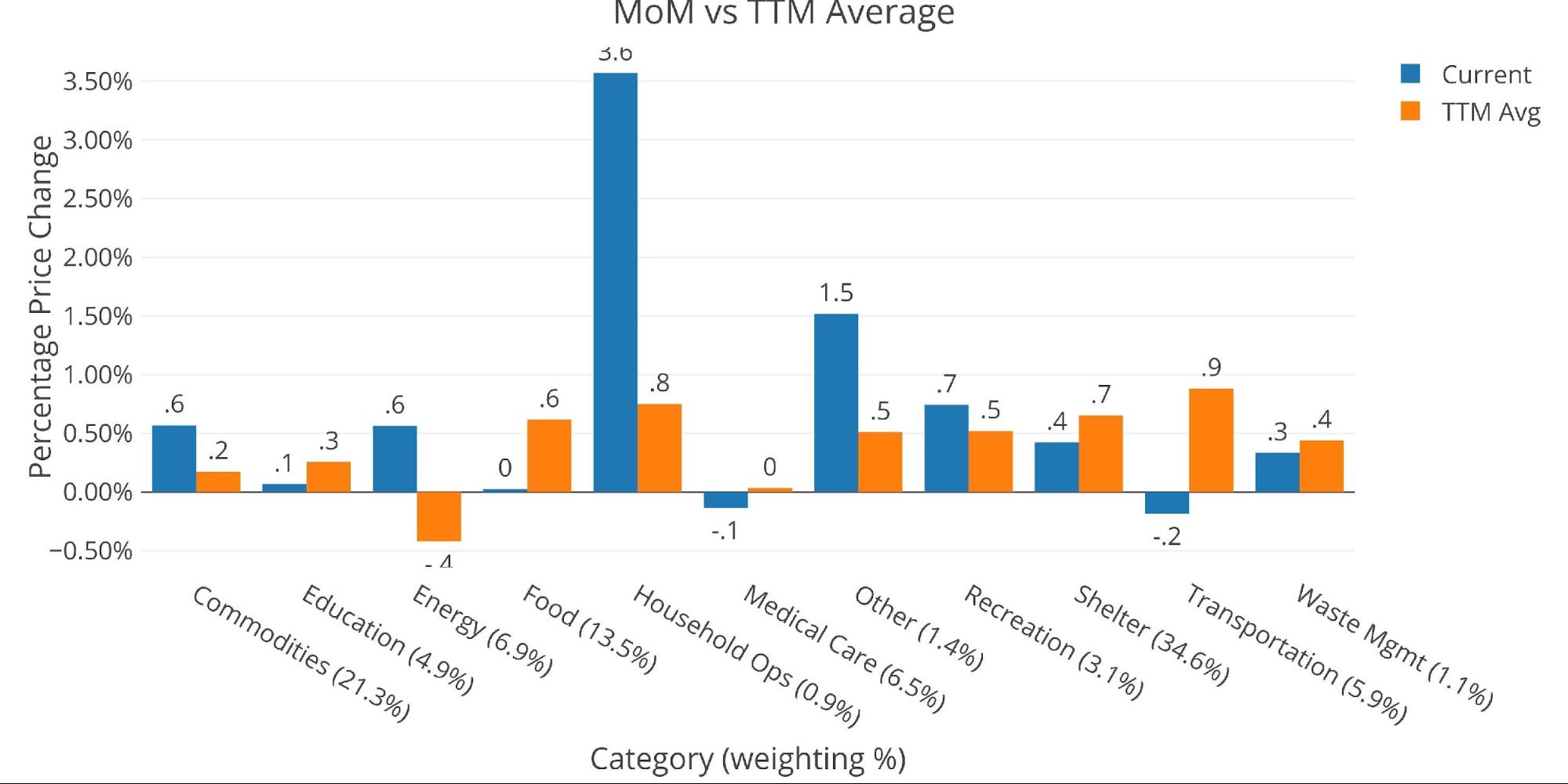

Looking at the 12-month trend shows that 5 categories are actually growing faster than the 12-month average representing 33.6% of the CPI weighting. Shelter finally fell below the 12-month average but still increased at an annual 5.1% pace. When this is considered, it means that more than 65% of the CPI is still growing at a pace greater than 5% annually!

Figure: 3 MoM vs TTM

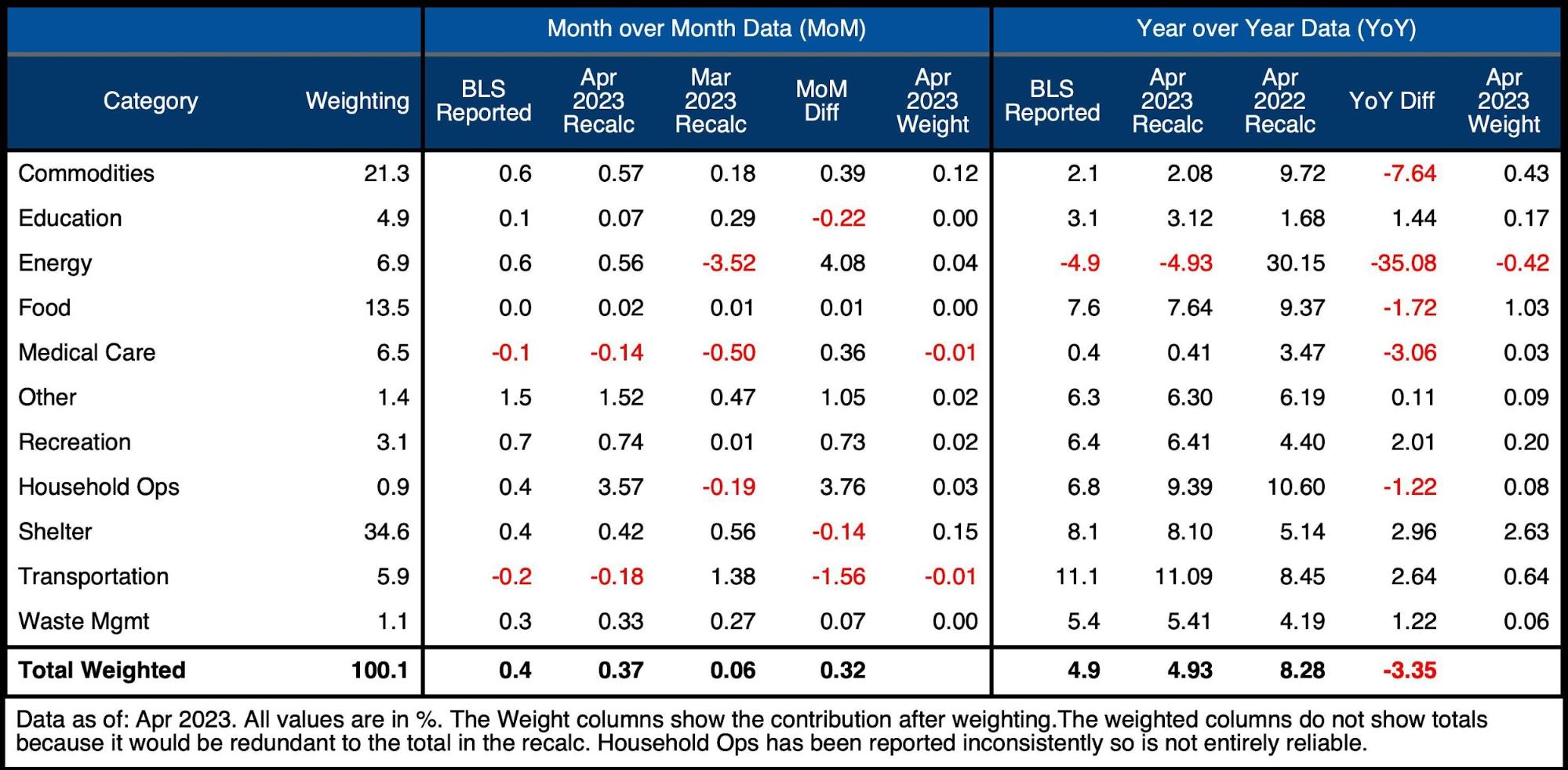

The table below gives a more detailed breakdown of the numbers. It shows the actual figures reported by the BLS side by side with the recalculated and unrounded numbers. The weighted column shows the contribution each value makes to the aggregated number. Details can be found on the BLS Website.

Some key takeaways:

-

- Food finally took a breather, with no increase MoM

-

- Food is still up 7.64% YoY on the heels of a 9.37% increase last April

-

- Shelter came down for a second month in a row, last month it was 0.56% following a 0.76% increase in February

- Household Ops, Shelter, and Food were all up greater than 8% YoY. For most people, this is the majority of their expenses, but the BLS has this weighted at just a bit over 40%

- Food finally took a breather, with no increase MoM

Figure: 4 Inflation Detail

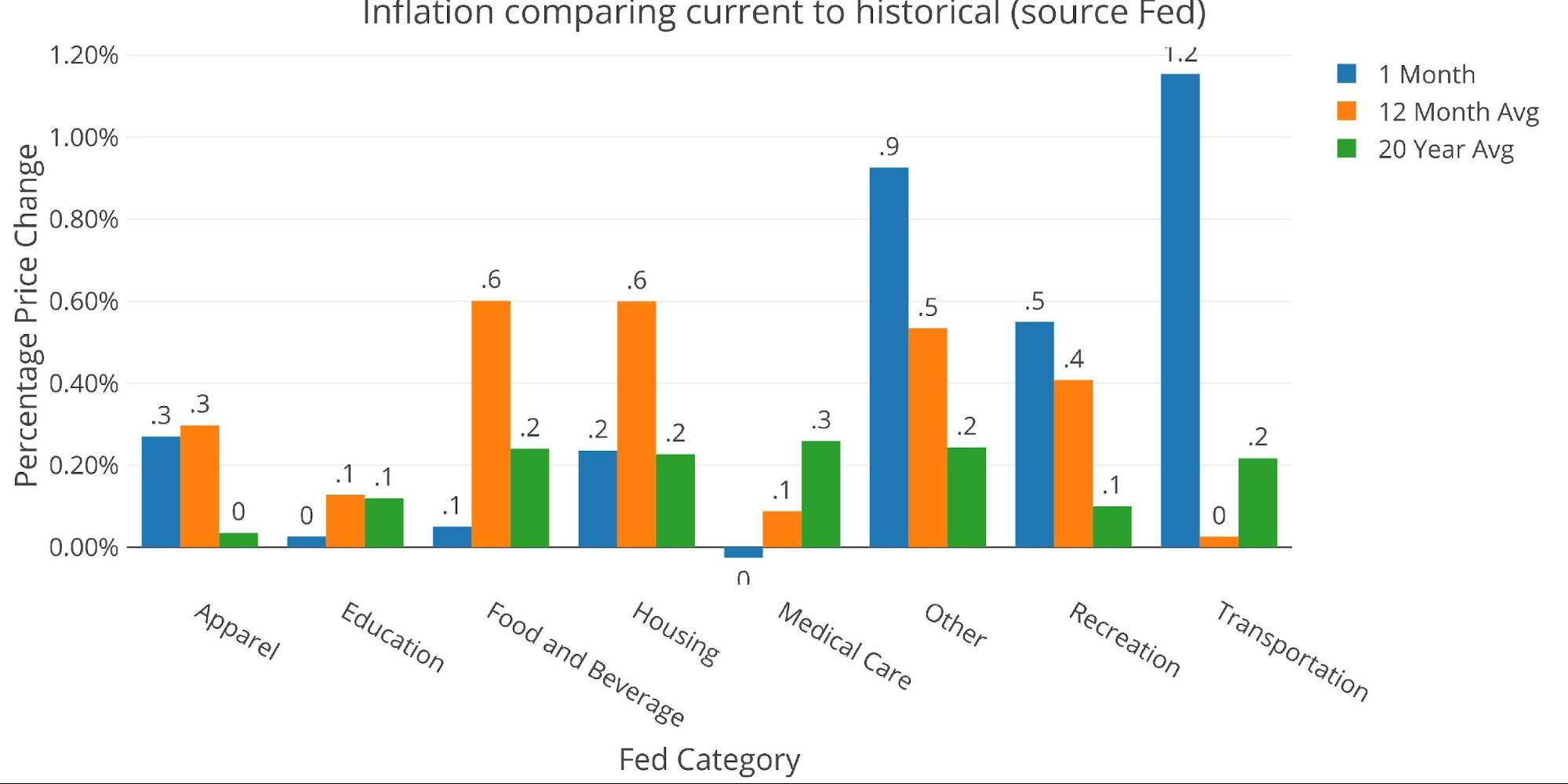

Looking at the Fed Numbers

While the Fed does have different categories (e.g., Energy is in transportation), their aggregate numbers match to the BLS. Their categories show some big gains in Other, Recreation, and Transportation. Shelter and Food are well below the 12-month average and back near the 20-year average.

Figure: 5 Current vs History

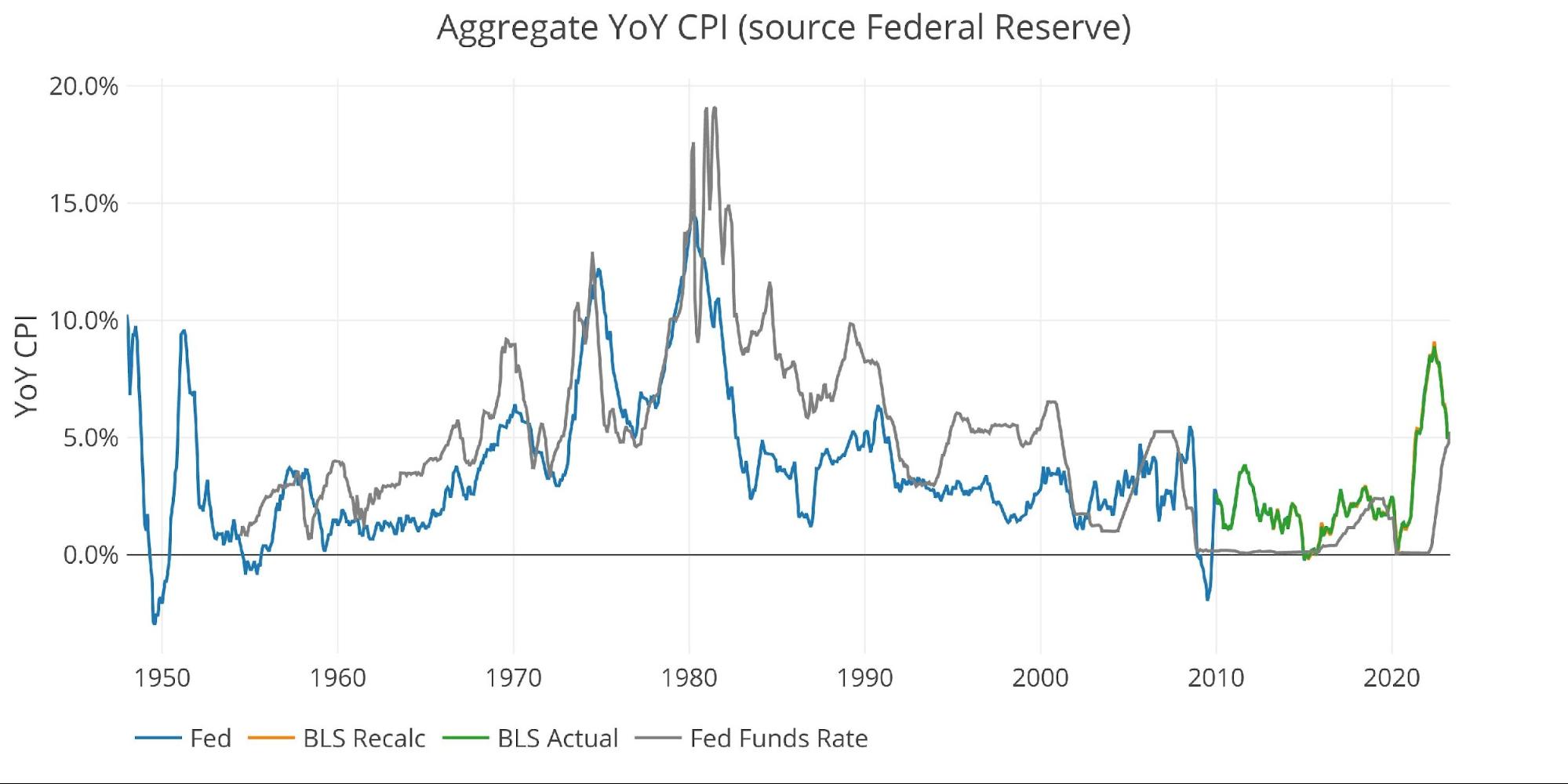

Fed Historical Perspective

The Fed is only now seeing the CPI and interest rates converge. Unfortunately, the Fed has probably just done their final rate hike of the cycle, with the market pricing in a 44% chance of a cut in interest rates as soon as July. Even with Powell maintaining a hawkish stance last week, the market is showing that they don’t believe him. This isn’t totally surprising since many market participants now view the Commercial Real Estate market as the next market to blow up.

Regardless of what blows up next, the Fed will not be able to get away with a weekend bailout like SVB. They will have to do more to support the market. That is what always happens. The chart below shows that the Fed never stays long at an elevated target. They raise rates until something breaks and then immediately start cutting rates.

Figure: 6 Fed CPI

BLS Historical Perspective

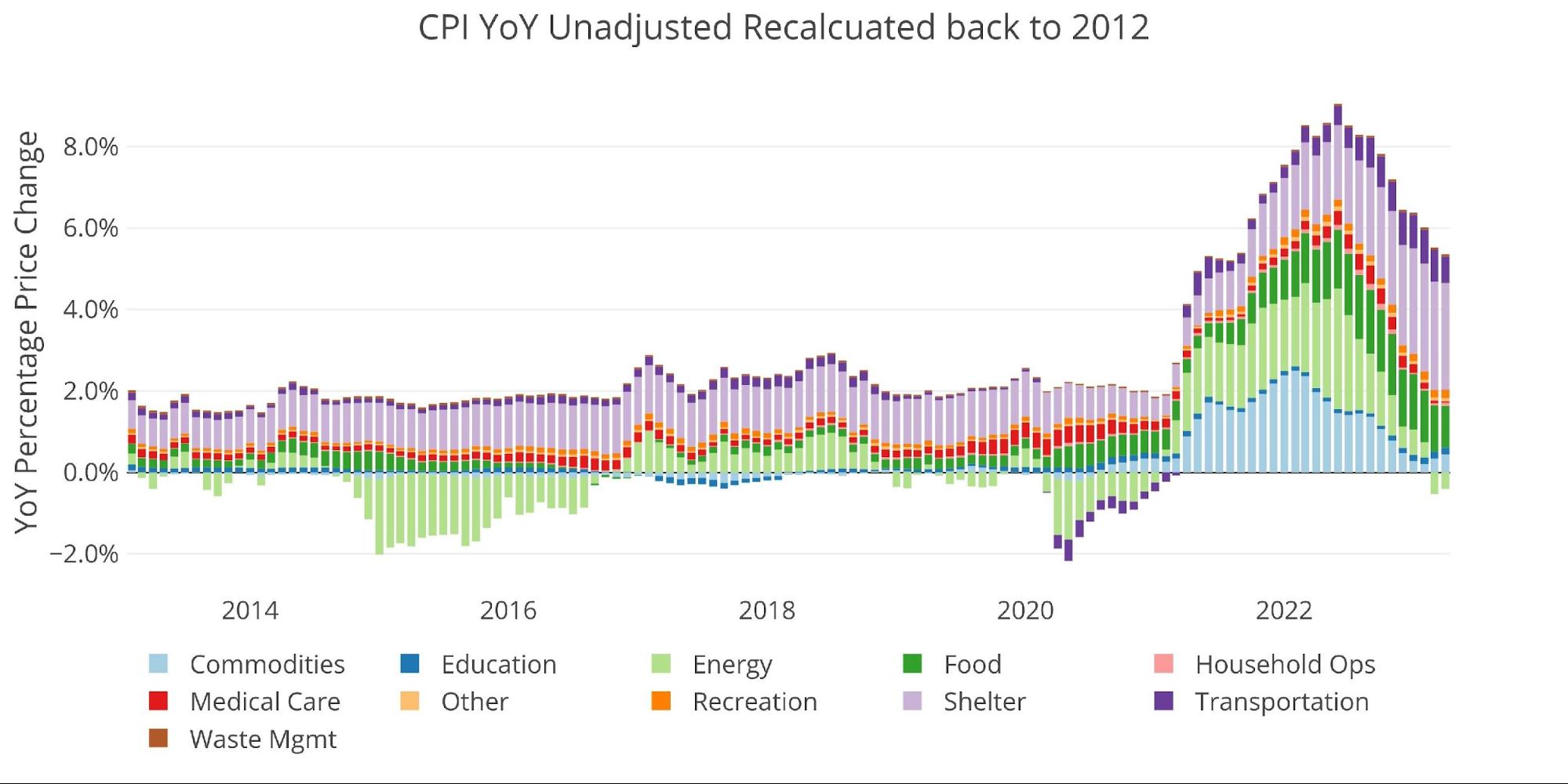

As the chart below shows, the CPI really popped in early 2021. Based on the recent numbers coming in, it does not look like the CPI will see a similar fall to undo the initial pop. Instead, the price increases look sticky and long-lasting.

The original drivers of the CPI (Energy and Commodities) are no longer driving the CPI higher. Bringing down the other components will prove more difficult which will make undoing the initial pop higher nearly impossible. Elevated inflation is here to stay and likely to get worse once the Fed has to return to easy money.

Figure: 7 Historical CPI

Wrapping Up

The market rejoiced over a 4.9% inflation print. Excitement may be greater in the next two months as the YoY number falls further when May and June fall off the YoY calculation. After that, the CPI is likely to flat-line or begin increasing at a rate that will be starting from a number well north of 3%.

The Fed is pretty much out of time. If the market is correctly forecasting rate cuts in July, then we have likely seen the end of falling monthly inflation numbers. In the months and years ahead, the world will continue to de-dollarize, Federal budgets will surge even higher, and the Fed will re-enter the easy-money game to fight a vicious recession. All of these factors will bring the CPI back up. In this environment, no one will be deceived by the Fed talk and gold will not get hit like it did this time around. Record highs in gold are near and likely the beginning of the next leg up in the precious metals.

Data Source: https://www.bls.gov/cpi/ and https://fred.stlouisfed.org/series/CPIAUCSL

Data Updated: Monthly within first 10 business days

Last Updated: Apr 2023

Interactive charts and graphs can always be found on the Exploring Finance dashboard: https://exploringfinance.shinyapps.io/USDebt/

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Buka akaun dagangan patuh syariah anda di Weltrade.

Source link