Comex Update: Platinum Shorts on Edge While Silver Longs Still Wait?

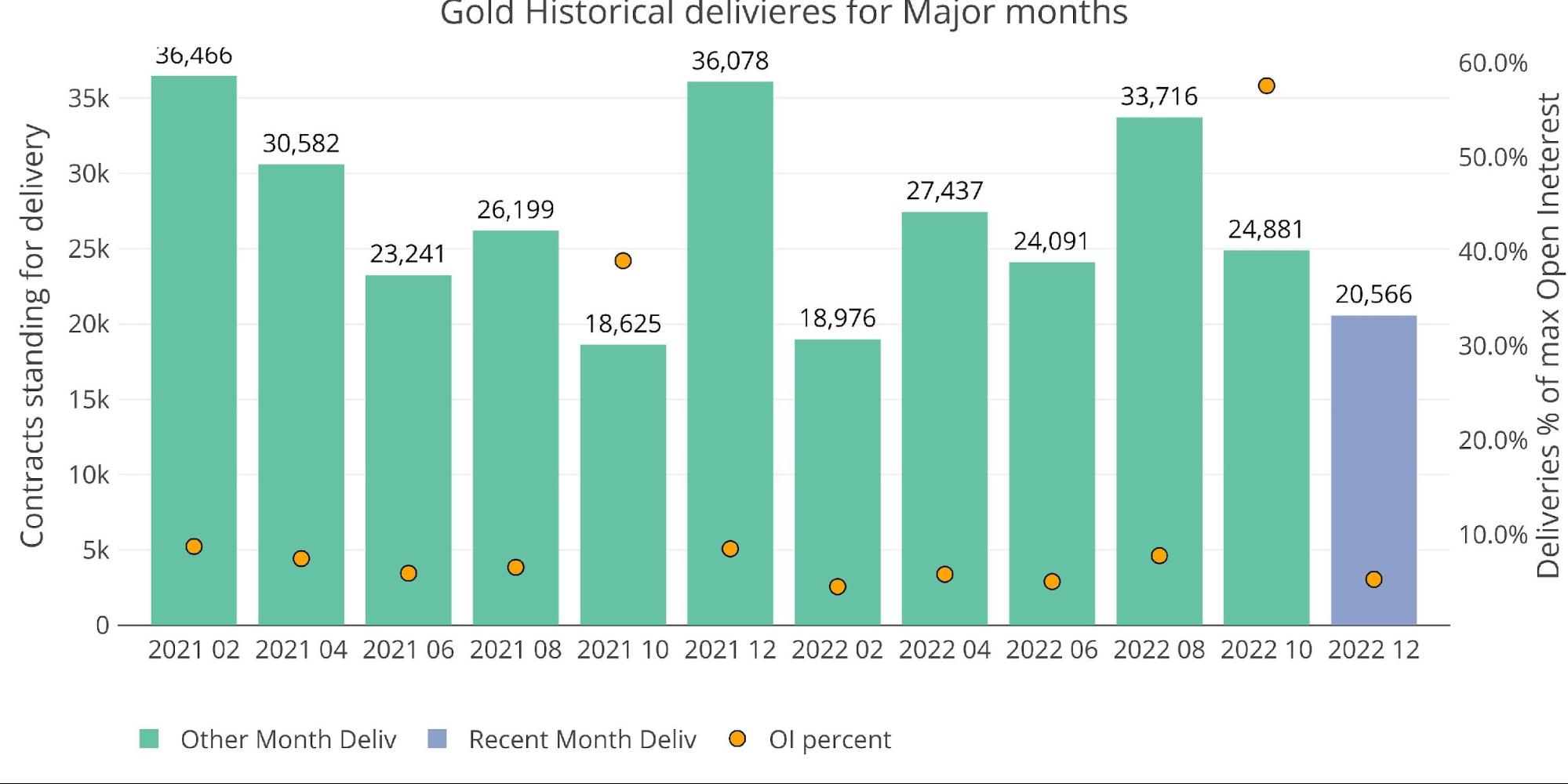

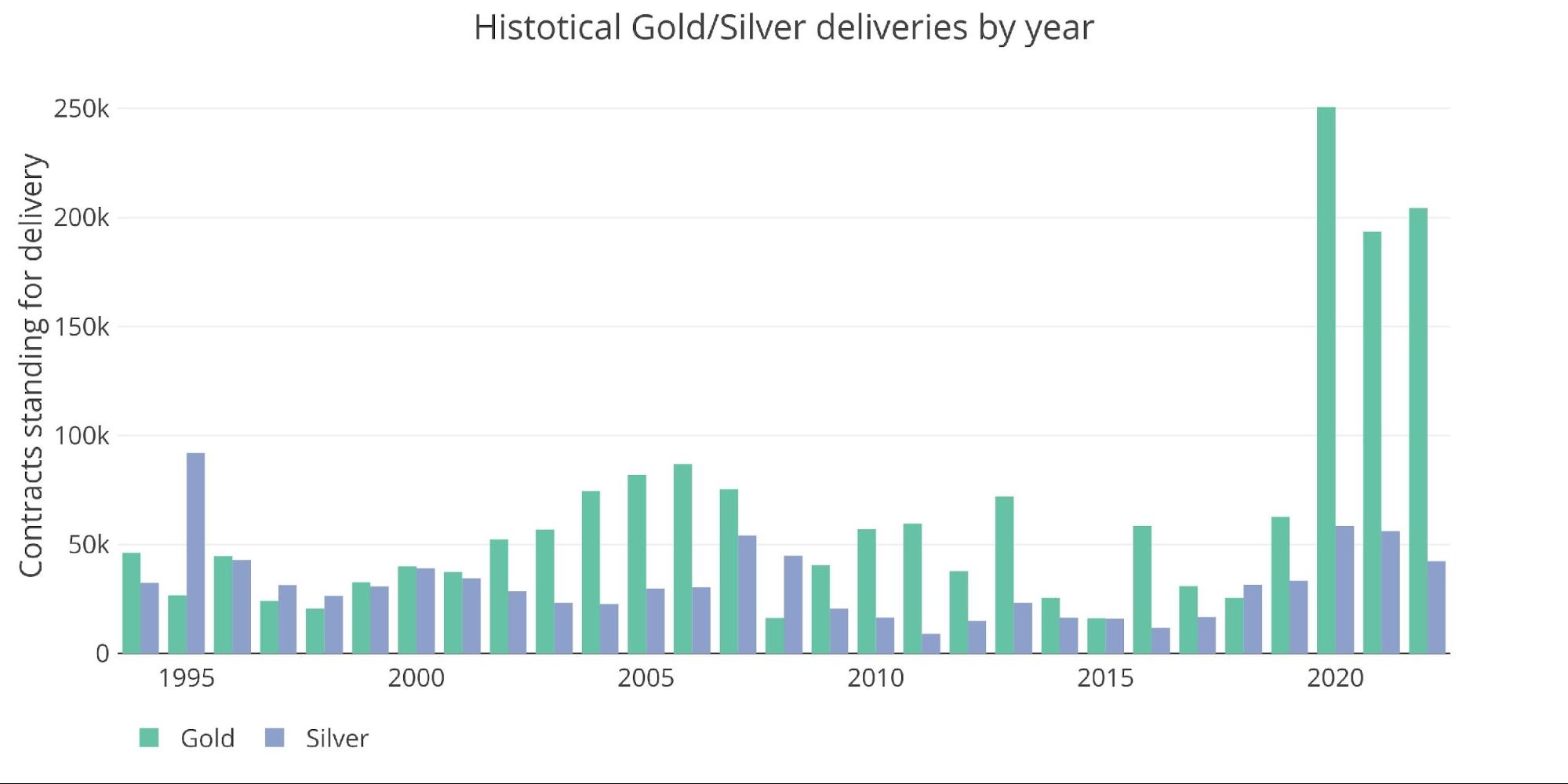

December gold is having the weakest major delivery month since February. This is surprising given the recent strength in gold and considering that last December saw quite a large number of contracts deliver (36k). I commented on this a few weeks ago, suggesting that the lower volume was a result of thinner supplies. I think the silver shortage is well underway and it is just starting in gold. This is why gold is showing signs that silver showed 6-12 months ago.

Figure: 1 Recent like-month delivery volume

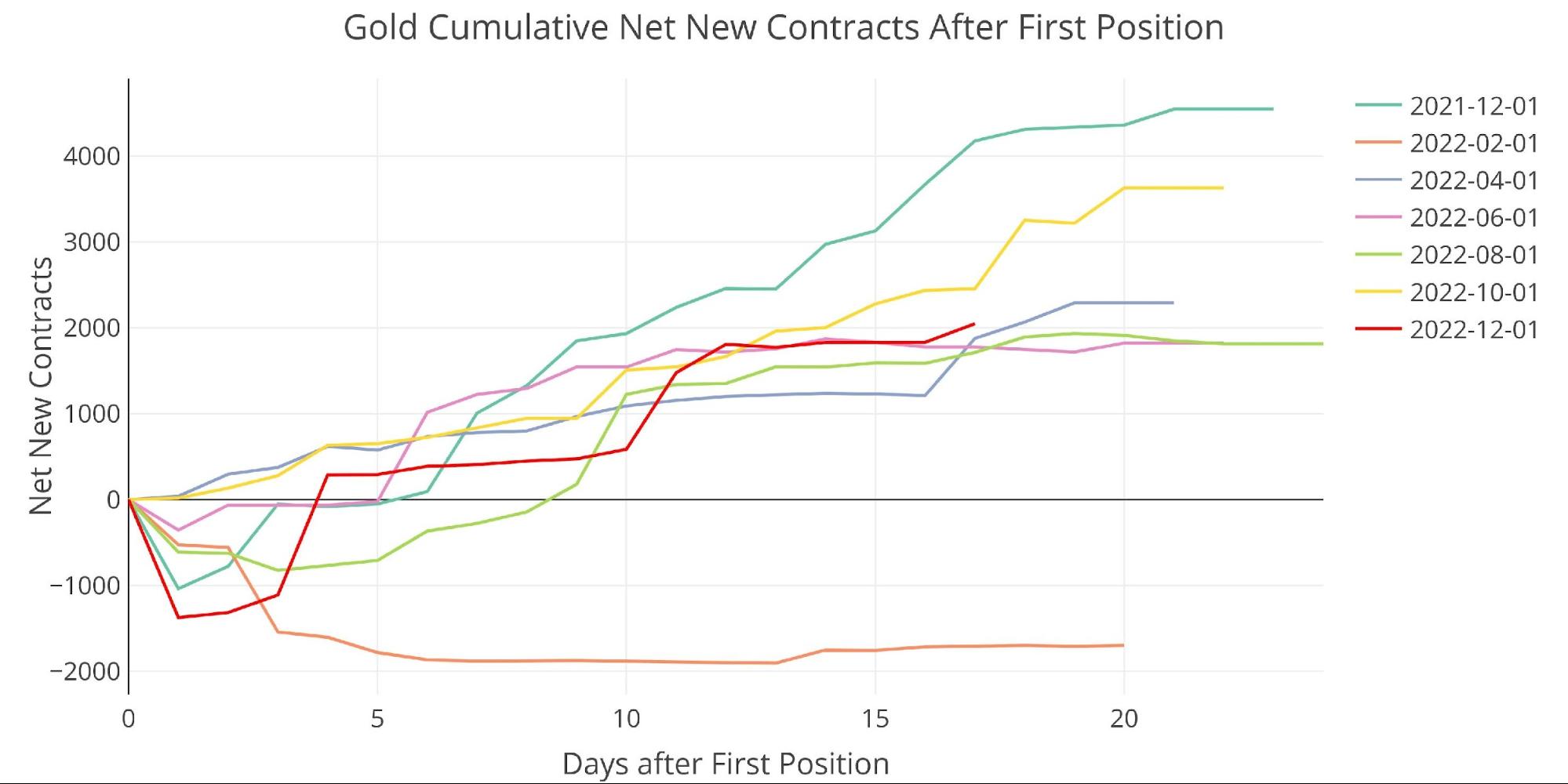

That said, net new contracts did show some strength late in the month. After seeing a ton of contracts cash settle on the first day of delivery (1,373 – a recent record), the contract turned and saw a decent number of contracts open mid-month for immediate delivery.

Figure: 2 Cumulative Net New Contracts

The bank house accounts have seen activity pick up. BofA replenished its outflow from November and then some (1,762 out in Nov vs 3,689 in for Dec). This came at the expense of the other house accounts though, which collectively saw the biggest net reduction (7,544) since February of this year and the second biggest net reduction ever.

Figure: 3 House Account Activity

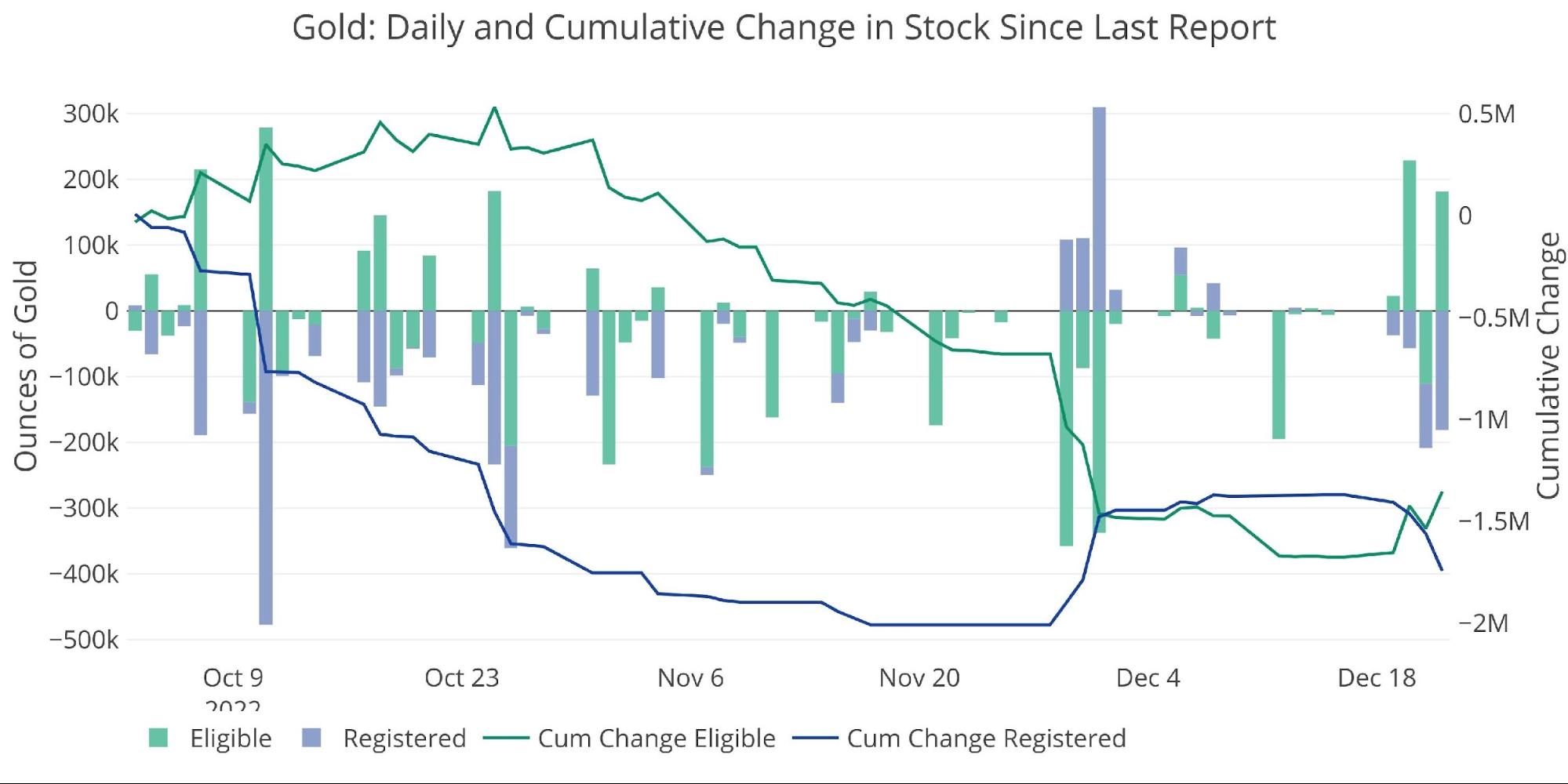

As shown in the recent stock report, the continued plummeting of supplies had finally seen some slowdown. However, Registered has already started to see that metal flow back out.

I will reiterate that this activity makes Registered look like it is getting closer to finding the bottom of its supply.

Figure: 4 Recent Monthly Stock Change

Gold: Next Delivery Month

Jumping ahead to January actually shows gold again looking a bit quiet. Only slightly more than 1k contracts are open headed into the delivery period. This is well below recent months.

Figure: 5 Open Interest Countdown

Even when looking as a percentage of Registered, January is still on the lower end of the spectrum. This comes shortly after November showed record strength headed into close (the line below that surges at the end).

Figure: 6 Countdown Percent

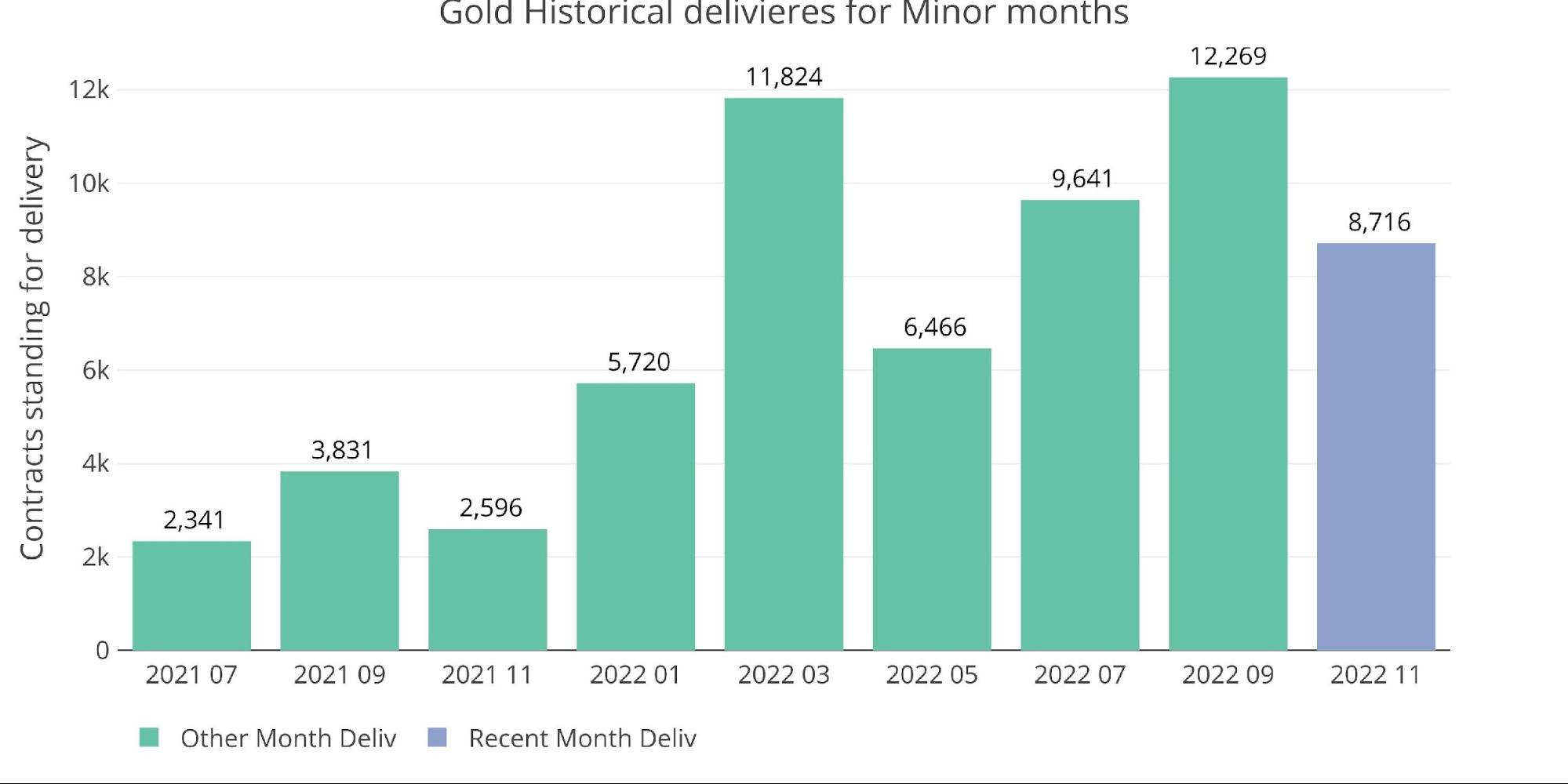

Minor months have been showing a strengthening trend of delivery volume with some volatility along the way. January looks set to buck that trend for now.

Figure: 7 Historical Deliveries

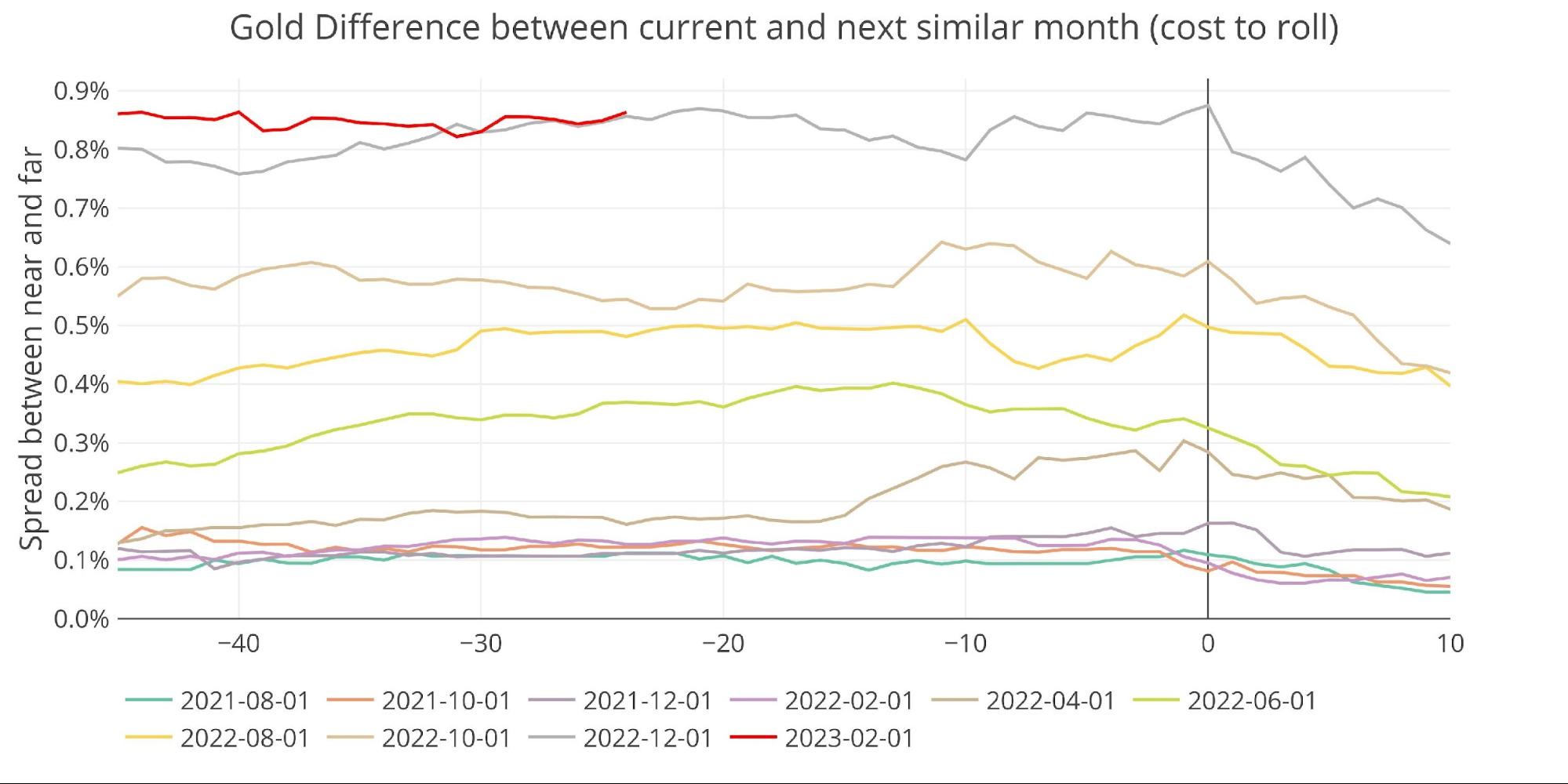

Spreads

What’s interesting is that the market is still in strong contango. This makes it more expensive for contract holders to roll their contracts as the market anticipates higher prices ahead.

Figure: 8 Futures Spreads

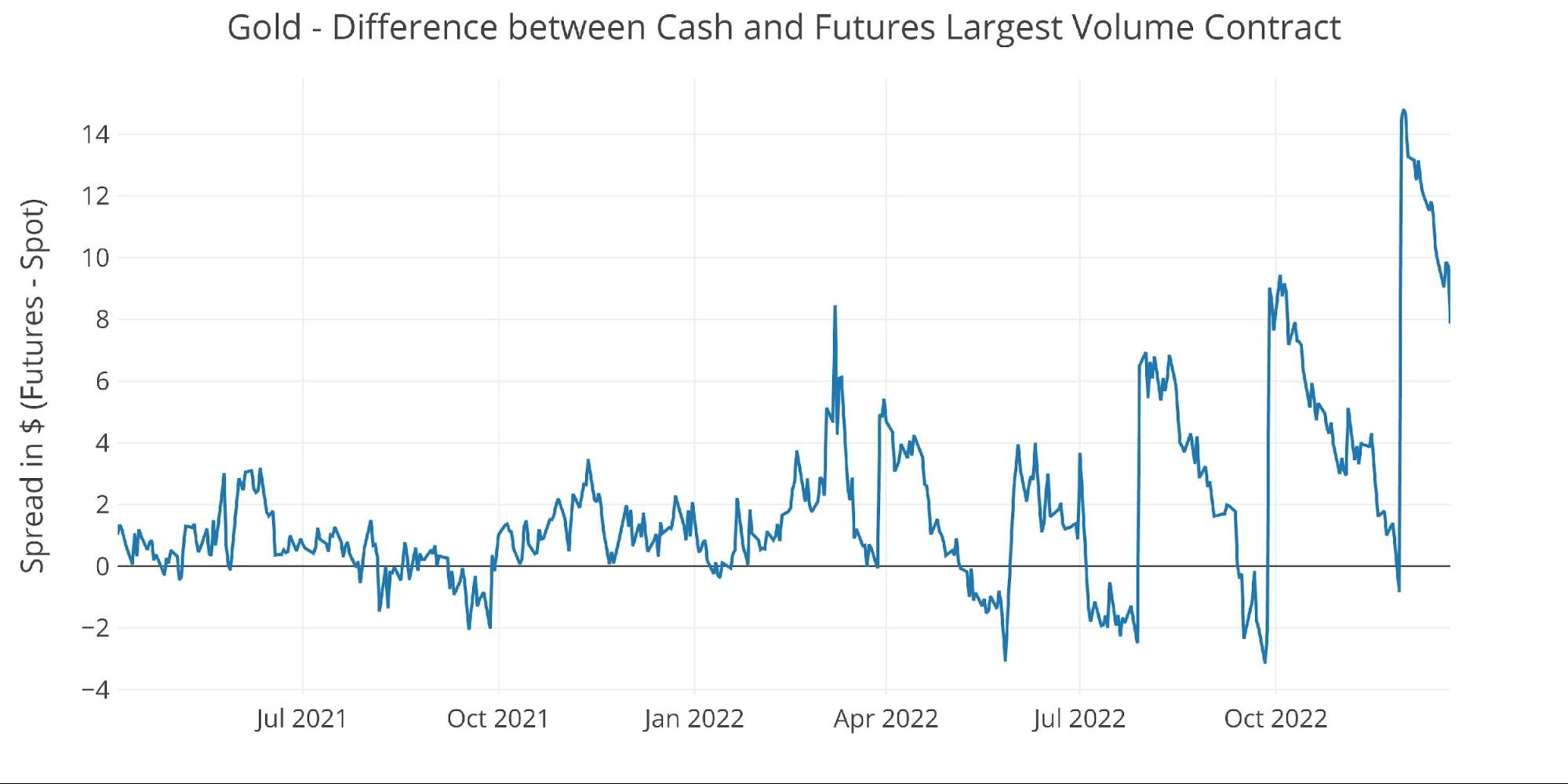

This can be seen more clearly when looking at the spread in the spot market which has become increasingly more volatile.

Figure: 9 Spot vs Futures

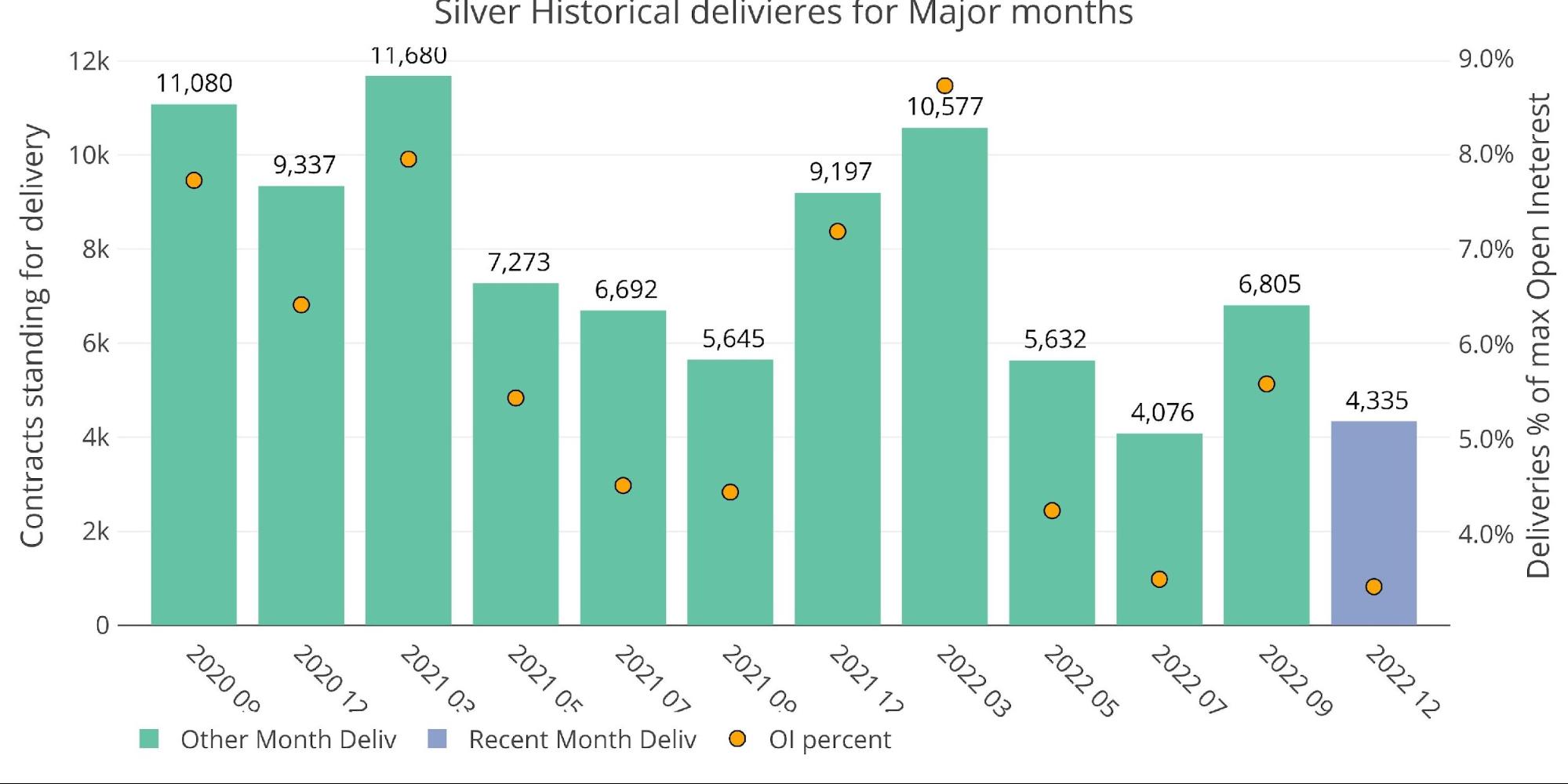

Silver: Recent Delivery Month

Similar to gold, silver is showing a relatively weak delivery month with only 4,335 contracts delivered so far. There are two primary reasons for this, first is the fall in net new contract activity and the second is the amount of remaining open interest.

Figure: 10 Recent like-month delivery volume

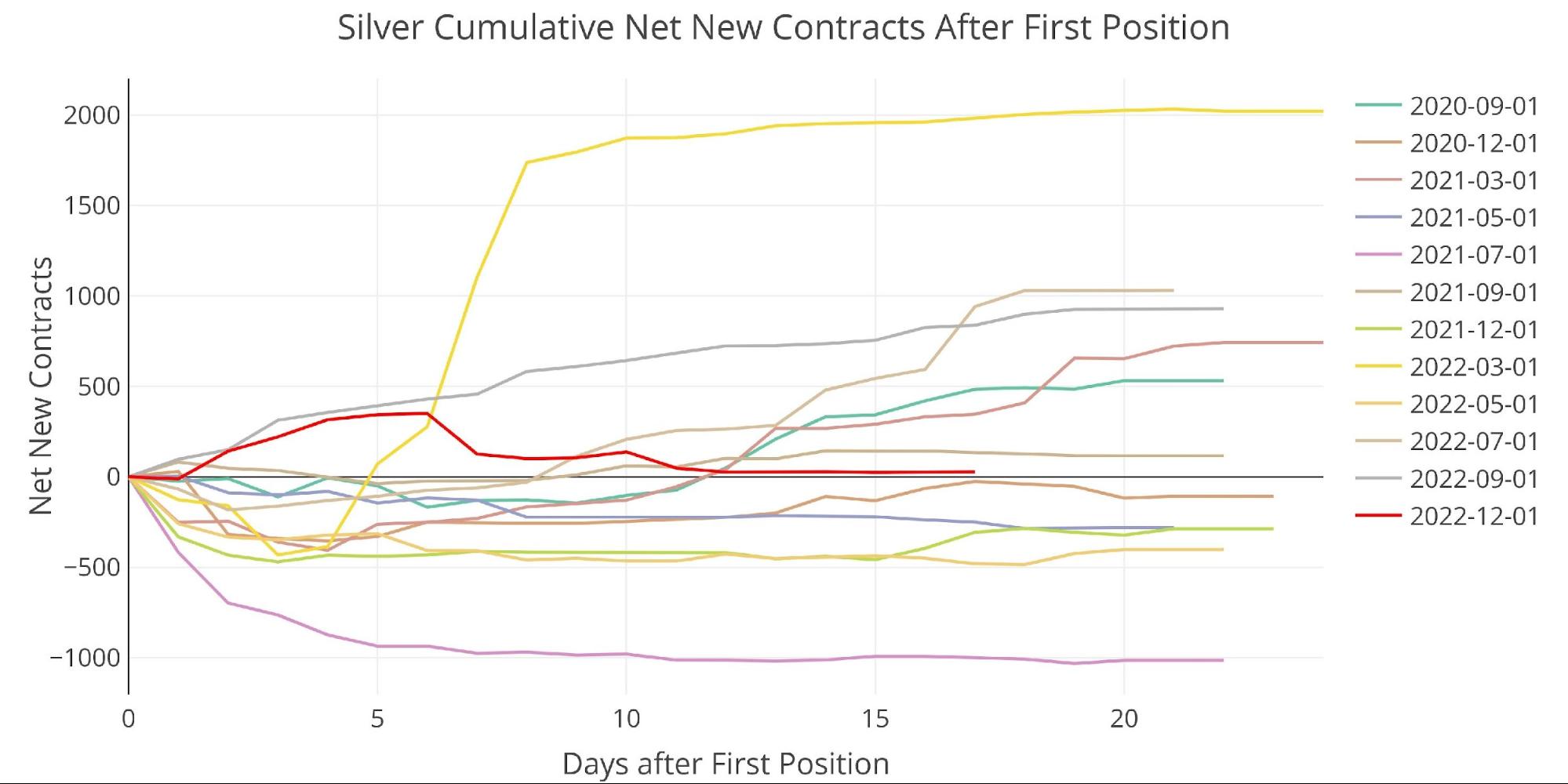

Net new contract activity has been non-existent in December. This is surprising given that March, July, and September all saw pretty strong activity after the delivery period started. What’s even more unusual is that activity started strong and then reversed a few days into the month. Could this be shorts asking to cash settle because they couldn’t find the metal to deliver?

Figure: 11 Cumulative Net New Contracts

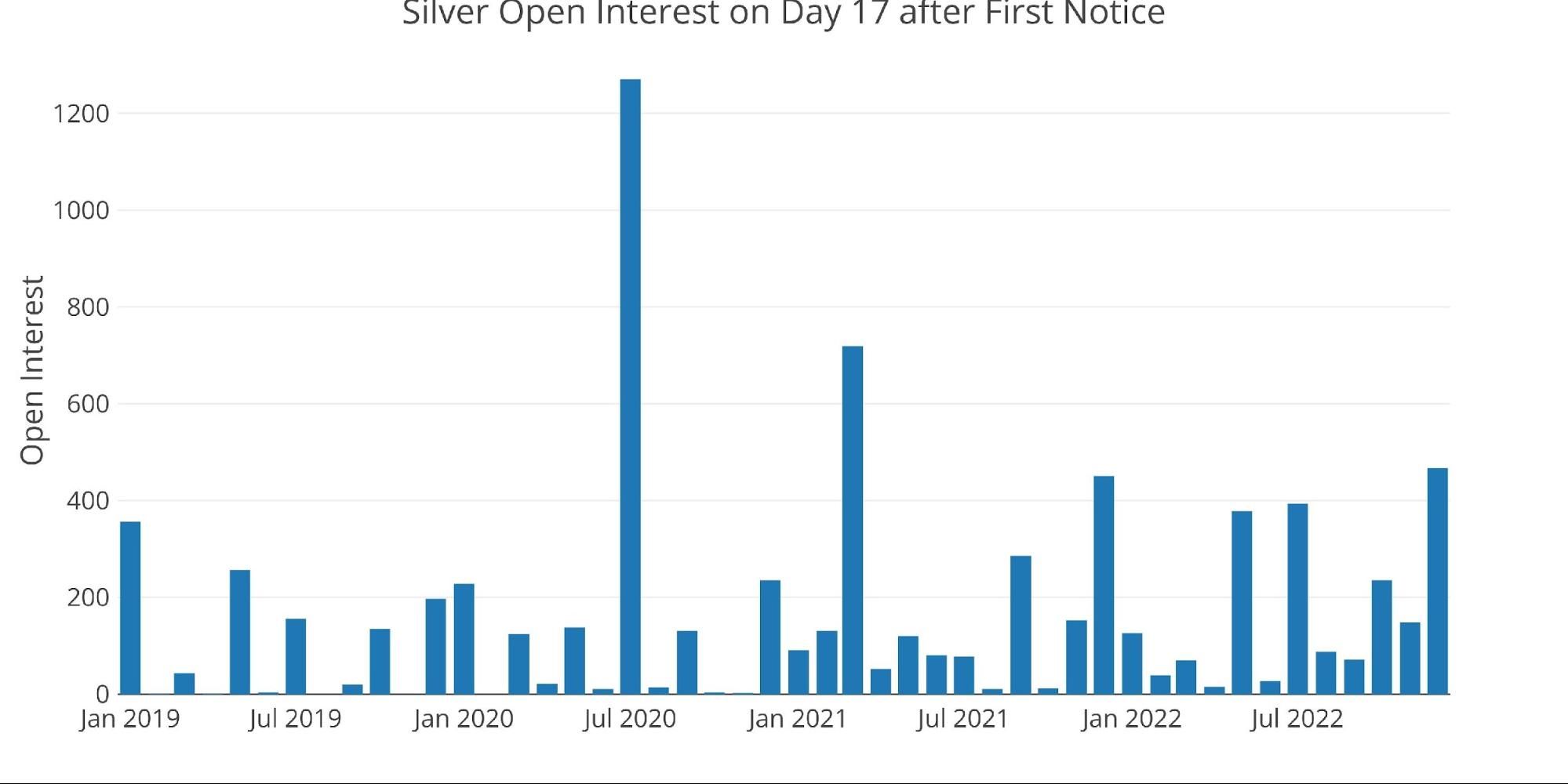

Additionally, there are still 467 long contracts waiting for delivery. This is the largest number this late in the contract since March of 2021 right during the Reddit silver squeeze had 719 contracts open. That month was second only to the massive 1,270 seen in July 2020 when silver was going parabolic.

Bottom line – it is very unusual to see this many contracts still waiting for delivery. Shorts are on the hook to initiate the delivery so they must be scrambling to come up with the physical.

Figure: 12 Delivery Volume After First Notice

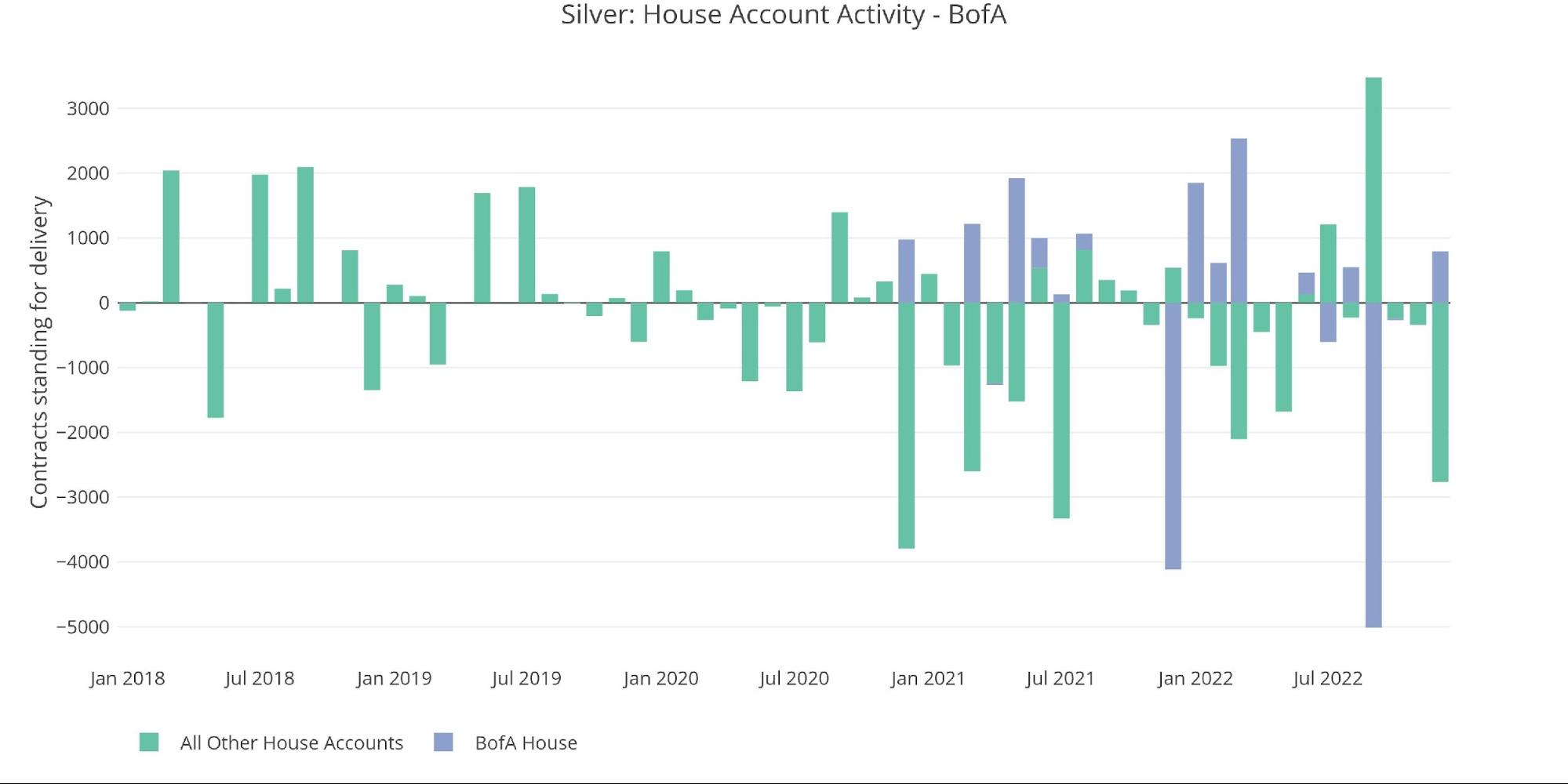

The bank house accounts have done their part, delivering 2,764 contracts (excl. BofA), which is the biggest number since July 2021. BofA is a different animal though. They have been slowly accumulating metal only to deliver a ton of it in a single month. This happened back in September after which BofA has been slow to restock inventory.

Figure: 13 House Account Activity

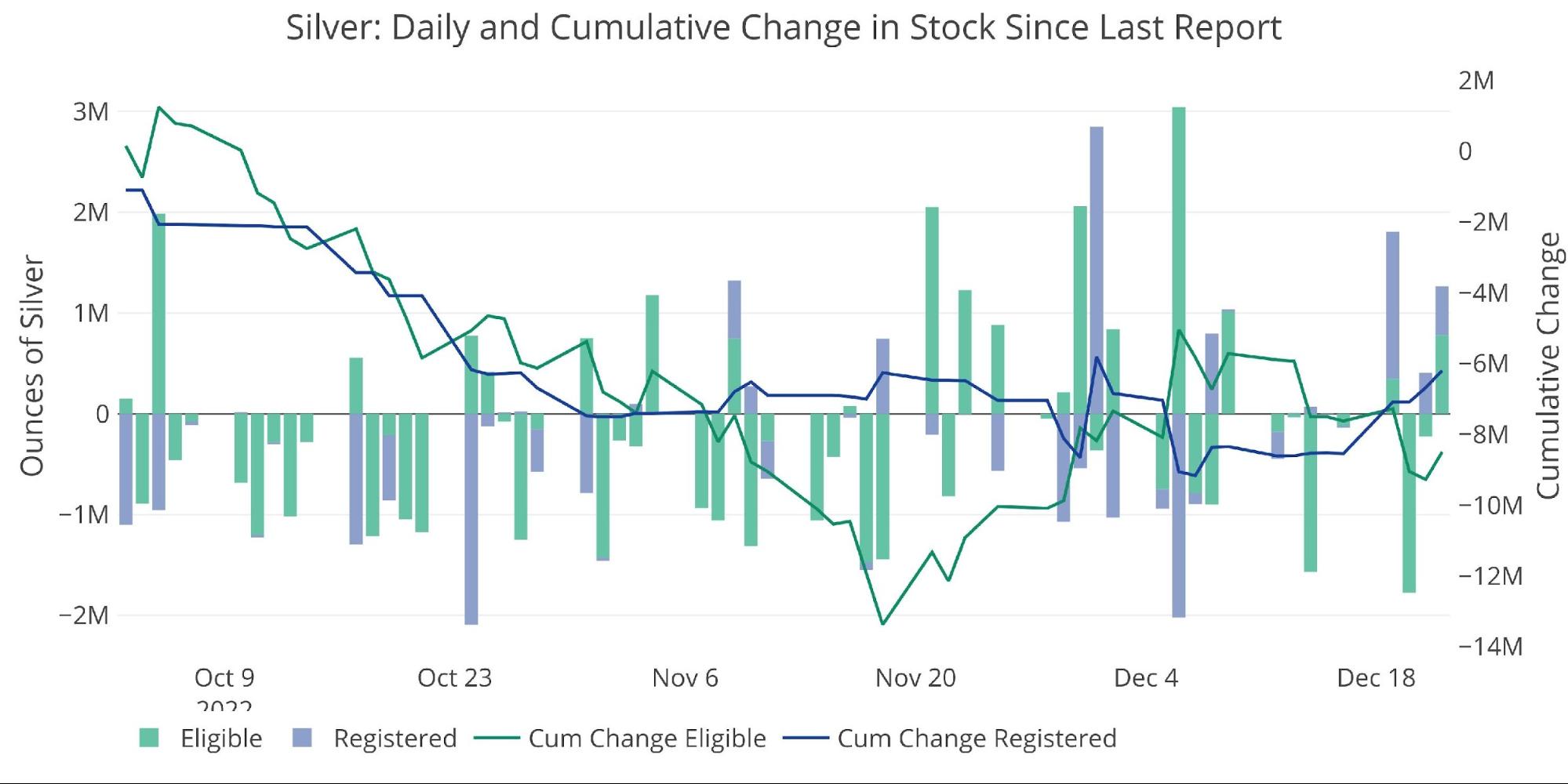

A look at the stock report shows that the consistent outflows of metal have slowed some. The bank vaults have been getting hammered for months, seeing Registered plummet by more than 50m ounces. That has finally slowed as the banks have scrambled to come up with metal to satisfy relentless physical demand. Will supply continue to come online? Will demand continue to drain what supply remains? Time will tell!

Figure: 14 Recent Monthly Stock Change

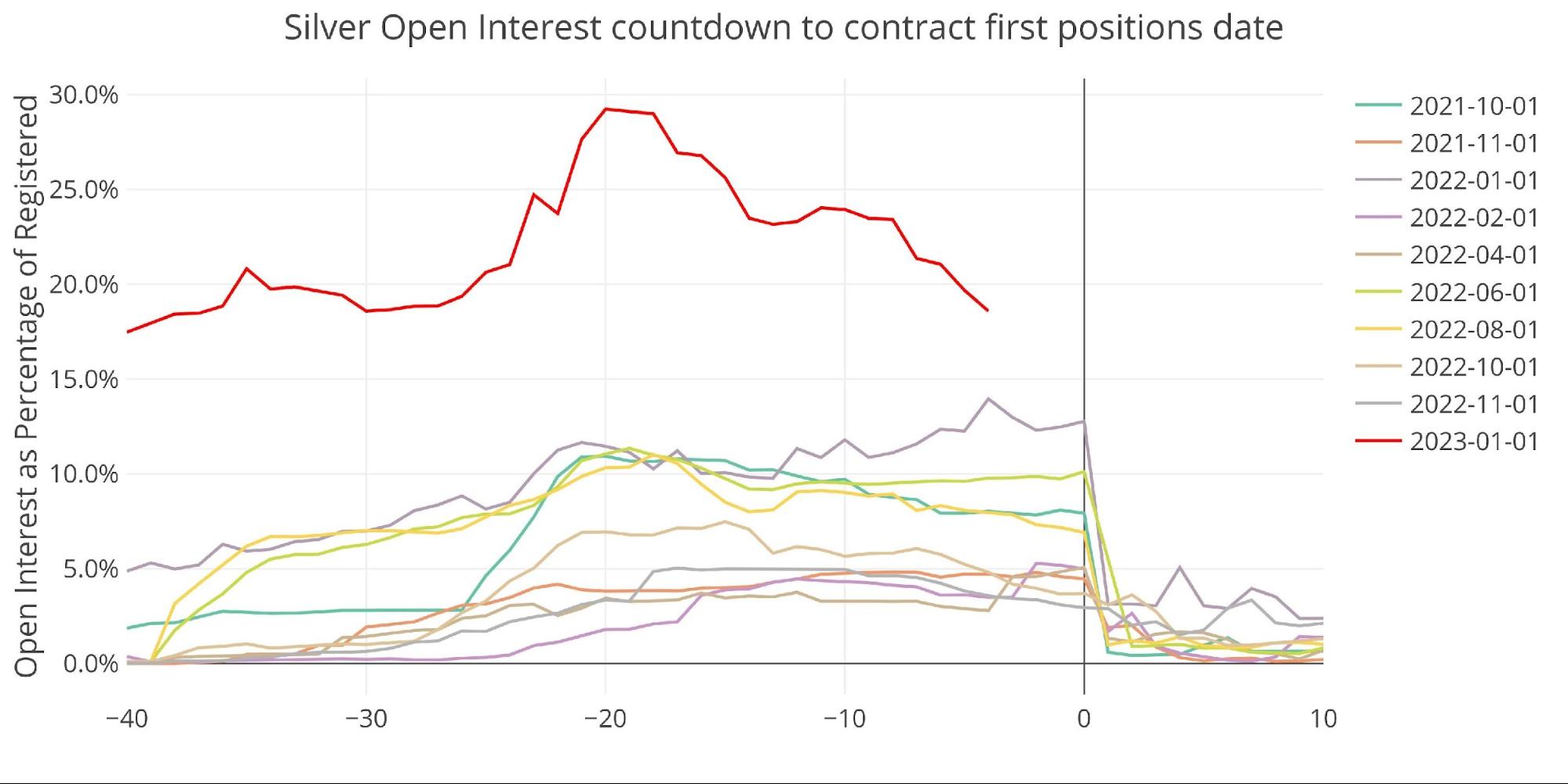

Silver: Next Delivery Month

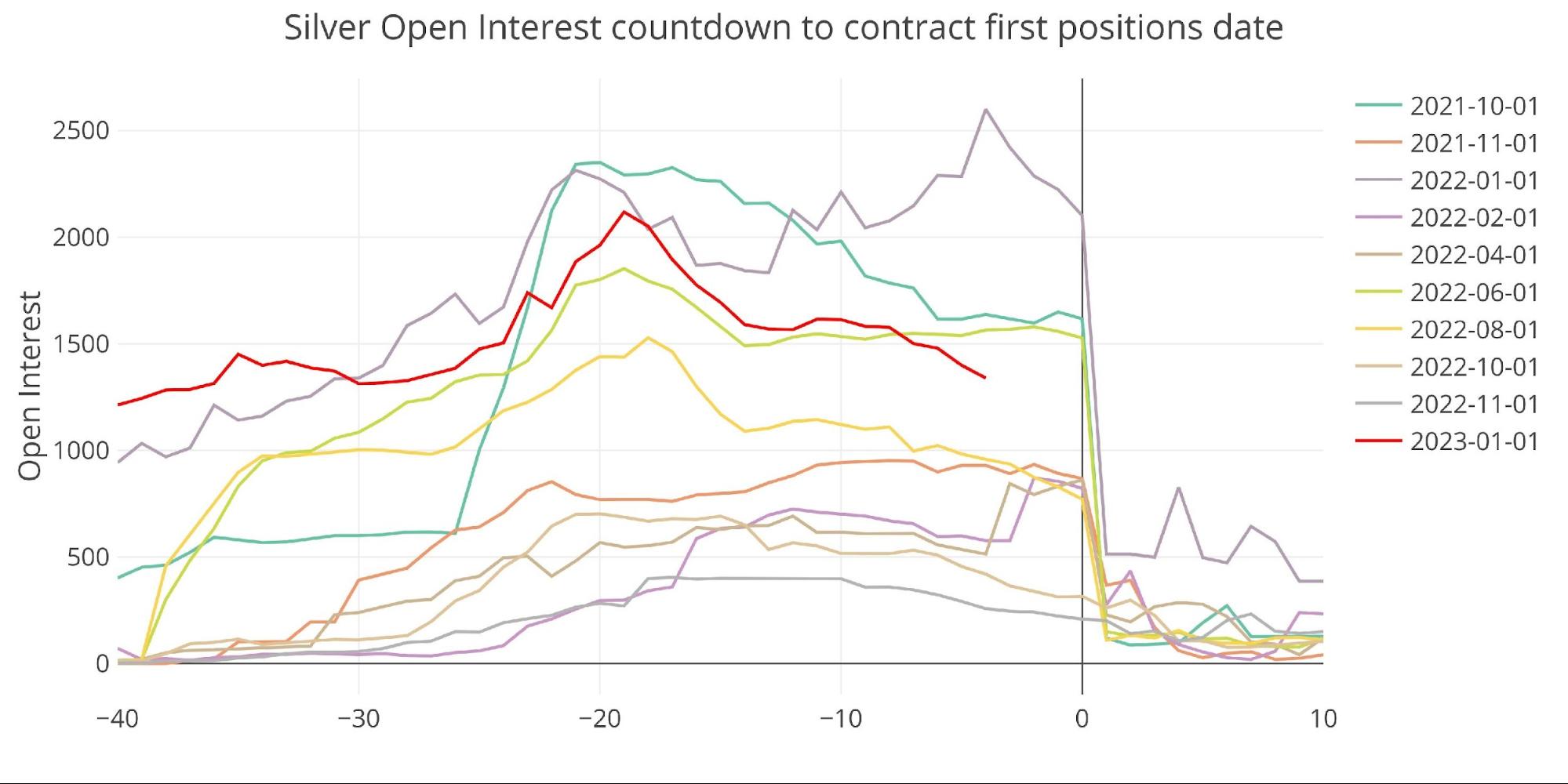

Silver is finally showing some strength for a minor month. From a raw contracts perspective, it is slightly above average.

Figure: 15 Open Interest Countdown

When looking at it as a percentage of registered, we are actually seeing the strongest countdown into close in recent memory.

Figure: 16 Countdown Percent

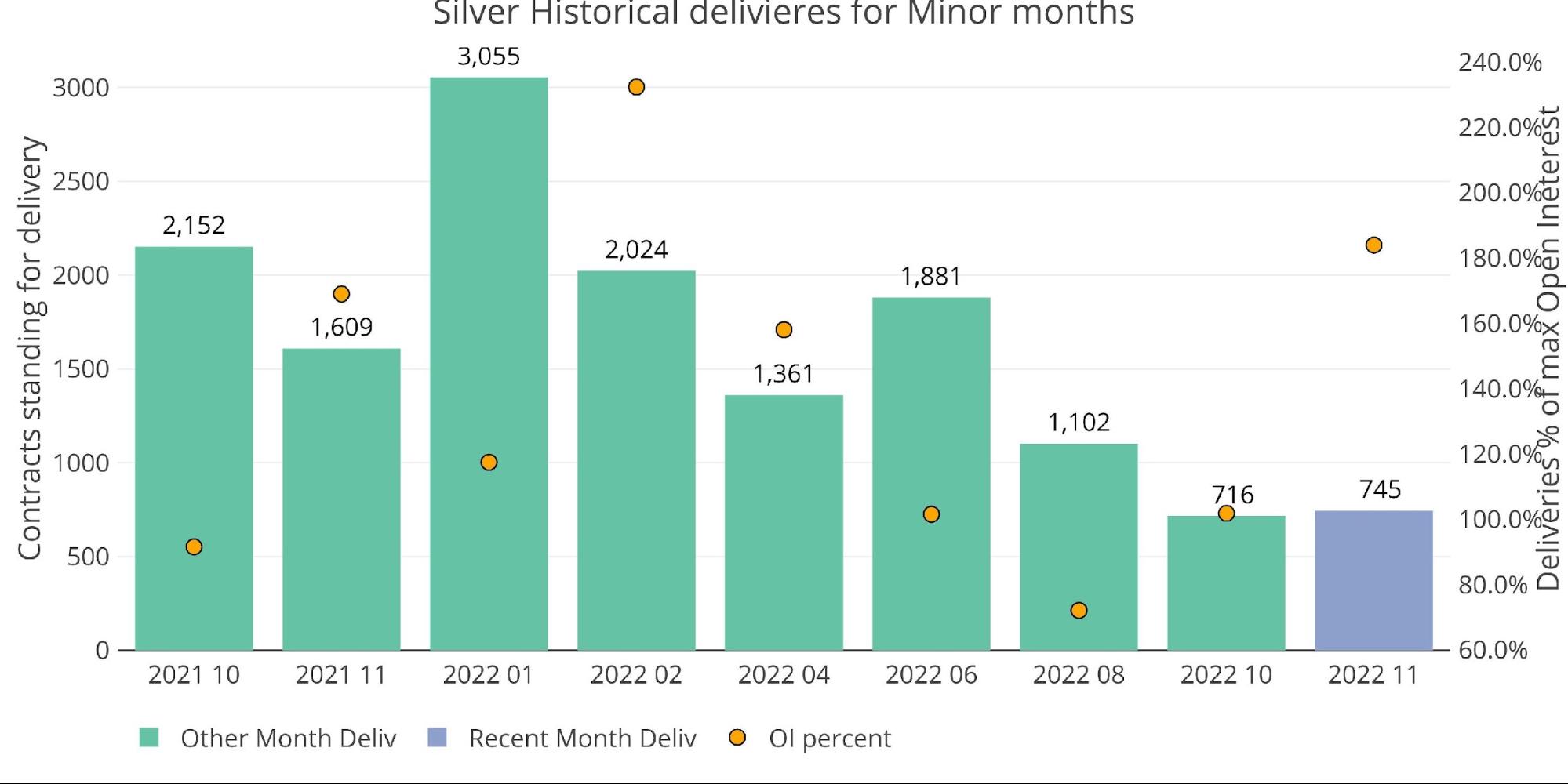

Delivery volume in minor months has been extremely weak. Is it possible January reverses the trend? Last year, January had over 3k contracts deliver. It would take a good deal of mid-month activity to get to that number. My guess is it won’t happen because it can’t happen. There isn’t enough supply available!

Figure: 17 Historical Deliveries

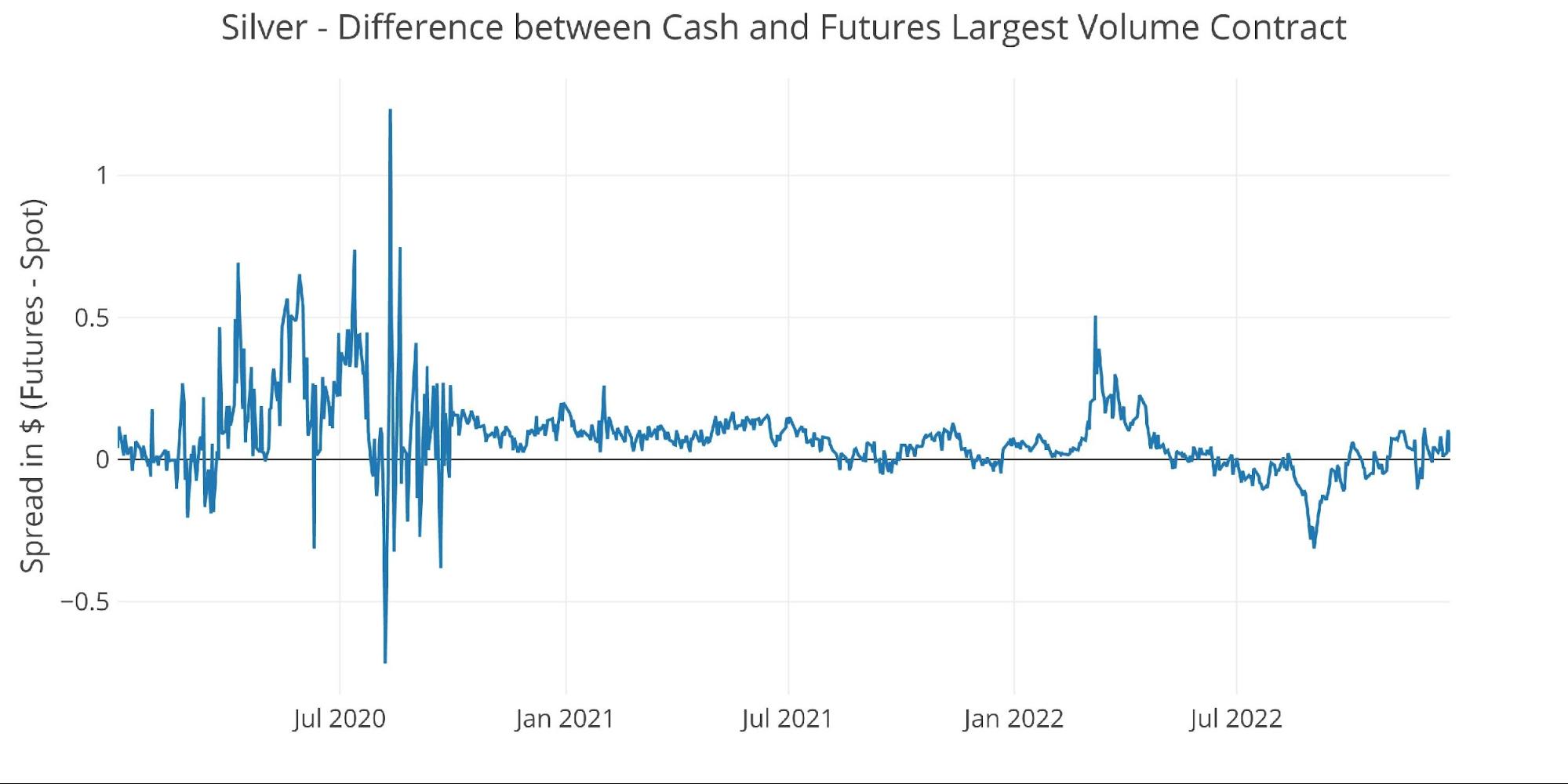

Spreads

The silver spot market has finally crawled out of backwardation after spending several months with cash prices higher than futures.

Figure: 18 Spot vs Futures

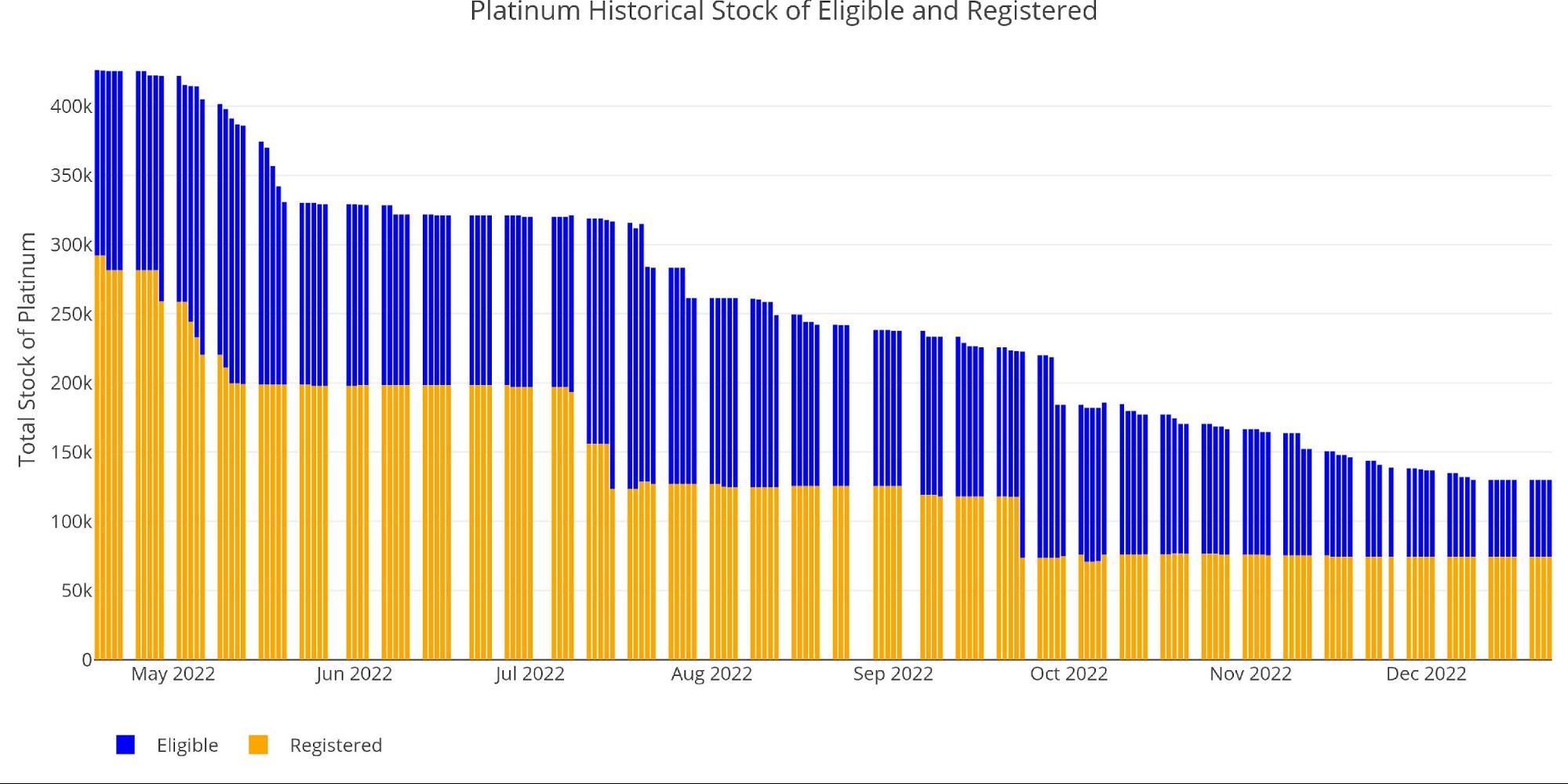

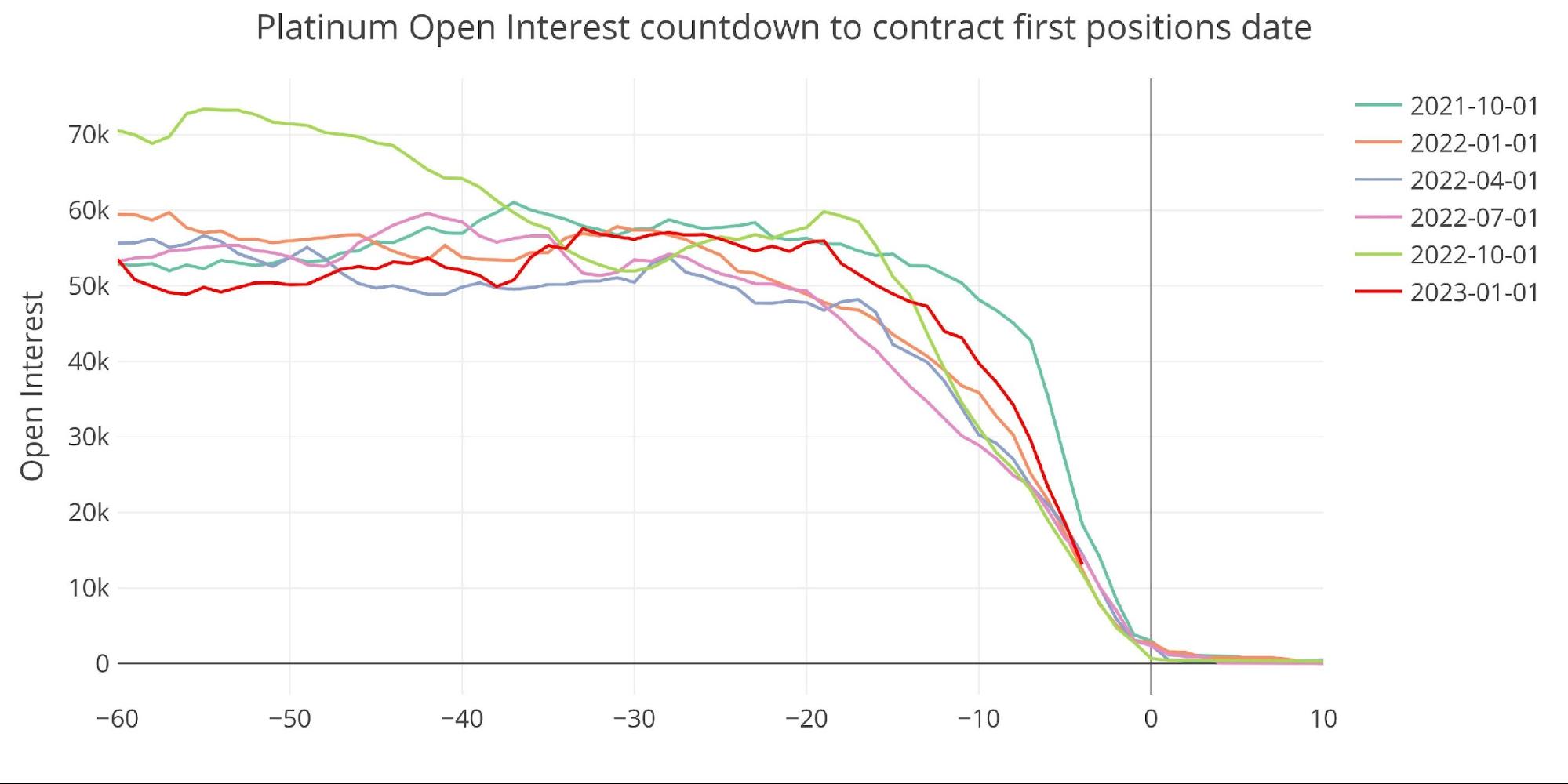

Platinum

Things in platinum could get very interesting. Platinum only has 4 major months a year (Jan, Apr, Jul, Oct). We covered the dramatic and unprecedented fall in Platinum open interest back in the October contract. This led to the smallest delivery volume since April 2020. Unfortunately, the shorts only delayed their problem.

Figure: 19 Platinum Delivery Volume

Supplies of Comex inventory have fallen continuously similar to silver. Registered now sits at 74k ounces which is only about 1500 contracts.

Figure: 20 Platinum Inventory

With 4 days to go, there are over 100k contracts open for January.

Figure: 21 Open Interest Countdown

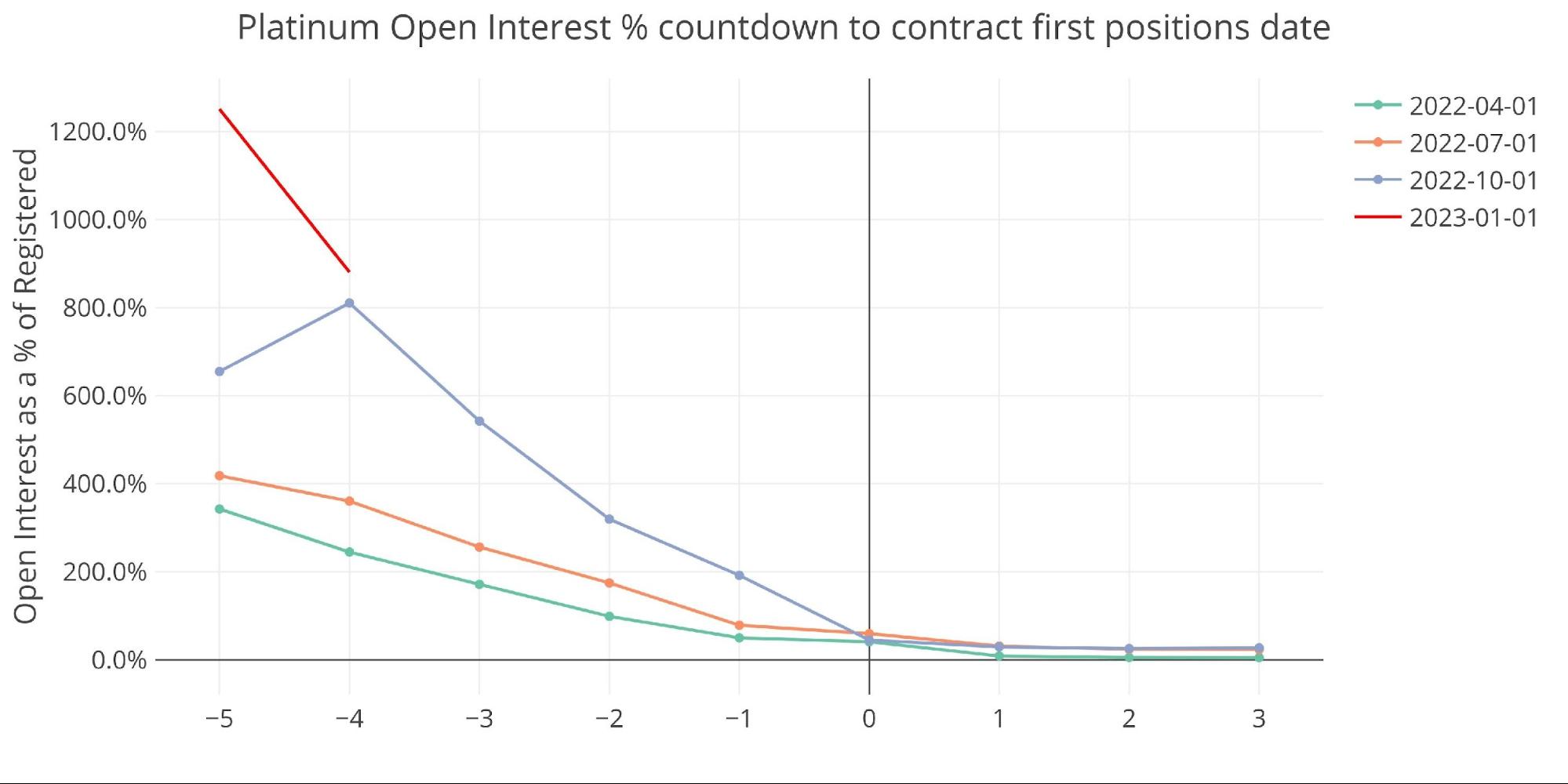

When shown as a percentage of Registered, you can see that current OI is 880% of Registered supplies. This is even higher than October at the same point (810%). Back in October, there was almost 200% open with one day to go before a massive drop in open interest on the final day that brought open interest to 45%.

Figure: 22 Palladium Countdown Percent

Can the shorts pull another rabbit out of their vault? What if the longs decide not to roll or cash settle? Could this create a squeeze in the platinum market that cascades through the precious metals market?

It’s possible but I am not fully convinced. The stakes are way too high and the Platinum is just too small a market. That said, it’s not impossible and either way, the data will reveal how the Comex is dealing with inventory constraints against strong demand.

Wrapping up

As we head towards January delivery, silver is showing strength again while interest in gold seems to be waning some. My eyes are on the platinum market though. The price of platinum is back above $1,000 and up more than 4% today (as of publishing). Stay tuned to see what happens next week during the holidays. Things could get interesting!

Figure: 23 Annual Deliveries

Data Source: https://www.cmegroup.com/

Data Updated: Nightly around 11 PM Eastern

Last Updated: Dec 22, 2022

Gold and Silver interactive charts and graphs can be found on the Exploring Finance dashboard: https://exploringfinance.shinyapps.io/goldsilver/

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Buka akaun dagangan patuh syariah anda di Weltrade.

Source link