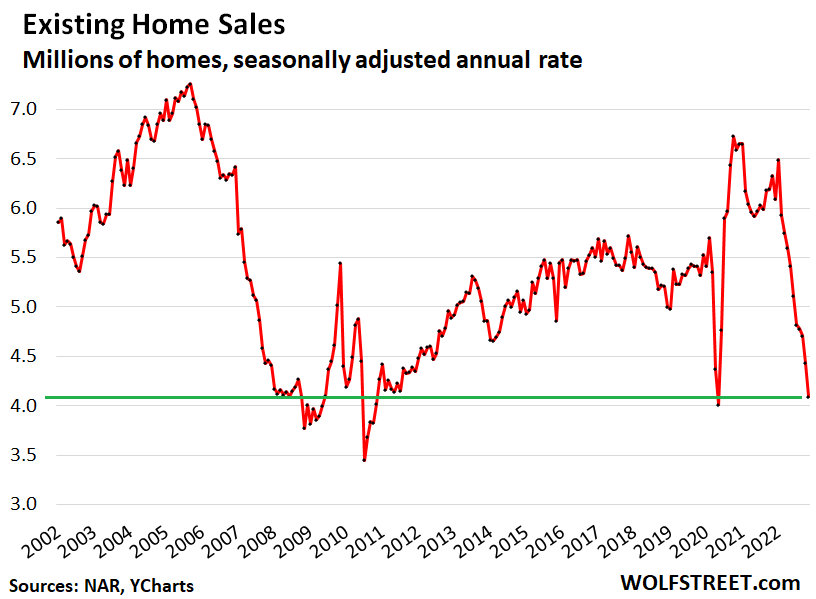

Existing Home Sales Fall for 10th Straight Month as Housing Bubble Continues to Deflate

The US housing bubble continues to lose air at a rapid rate. Existing home sales fell for the 10th straight month in November. This stretch of declining home sales is longer than the housing bust preceding the 2008 financial crisis.

Existing home sales plunged another 7.7% from October to November, according to the latest data from the National Association of Realtors.

Year-on-year, existing home sales have plummeted by 35.4%. It was the 16th straight month of year-over-year decreases. A total of 4.09 million homes were sold over the last 12 months. That’s close to the lockdown low in May 2020 and is approaching levels last seen in 2008-2009.

A National Association of Realtors economist said the residential real estate market was, in essence, “frozen” in November.

The principal factor was the rapid increase in mortgage rates, which hurt housing affordability and reduced incentives for homeowners to list their homes. Plus, available housing inventory remains near historic lows.”

Tight inventory has helped keep home prices from falling dramatically. Total housing inventory fell 6.6% month-on-month but remained 2.7% higher than a year ago. Still, the median price dropped to $370,700 in November. That’s down 10.4% from the June peak. But even with that drop, prices remain 3.5% higher than one year ago.

On average, properties remained on the market for 24 days in November. That was up from 21 days in October and 18 days in November 2021.

As inventory builds and houses stay on the market longer, we will likely see a further decline in home prices in the coming months.

Investors are already pulling out of the market. During the easy-money, low-interest-rate boom created by the Federal Reserve in the wake of the pandemic, investor money poured into the housing market. With mortgage rates now skyrocketing and home values beginning to decline, investors are starting to run away. Investors and second-home buyers accounted for the sale of about 45,640 homes in November. That was down from 75,400 in November 2021. Looking at the bigger picture, investor purchases of single-family homes plummeted by 32.3% in the third quarter compared to the same quarter in 2021

WolfStreet speculates that many people are not listing homes because they remain hopeful that the Federal Reserve will pivot on rate hikes.

They haven’t put their vacant home on the market because they’re still thinking that this too shall pass; and if the home has been on the market for a while and got no nibbles, they’ll pull it off the market, particularly during the holiday period.”

The average 30-year mortgage rate is now around 7.5%. The last time we saw mortgage rates over 6% was right before the housing bubble popped leading to the 2008 financial crisis. Until mid-April of this year, mortgage rates were in the 4% to 5% range.

The Fed blew up this housing bubble when it artificially suppressed interest rates and bought billions of dollars in mortgage-backed securities. Low mortgage rates combined with rapidly rising home prices are a recipe for a housing bubble.

But now the central bank has pricked the bubble by pushing interest rates up.

What the Fed giveth, the Fed taketh away.

Mortgage rates began to fall in late 2018 as the economy tanked and the Federal Reserve ended its post-2008 rate hike cycle. Rates continued to fall as the Fed pivoted back to quantitative easing and then dropped through the floor with the rate cuts and QE infinity in response to the coronavirus. The big spike in mortgage rates we’re seeing today started as the Fed began talking up monetary tightening to tackle raging inflation.

We expect the housing bubble to continue to deflate as we move into 2023. Just how fast the air comes out and the impact on the broader economy remains to be seen.

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Buka akaun dagangan patuh syariah anda di Weltrade.

Source link