Atlanta Fed Lowers Q3 GDP Growth Forecast Close to Zero

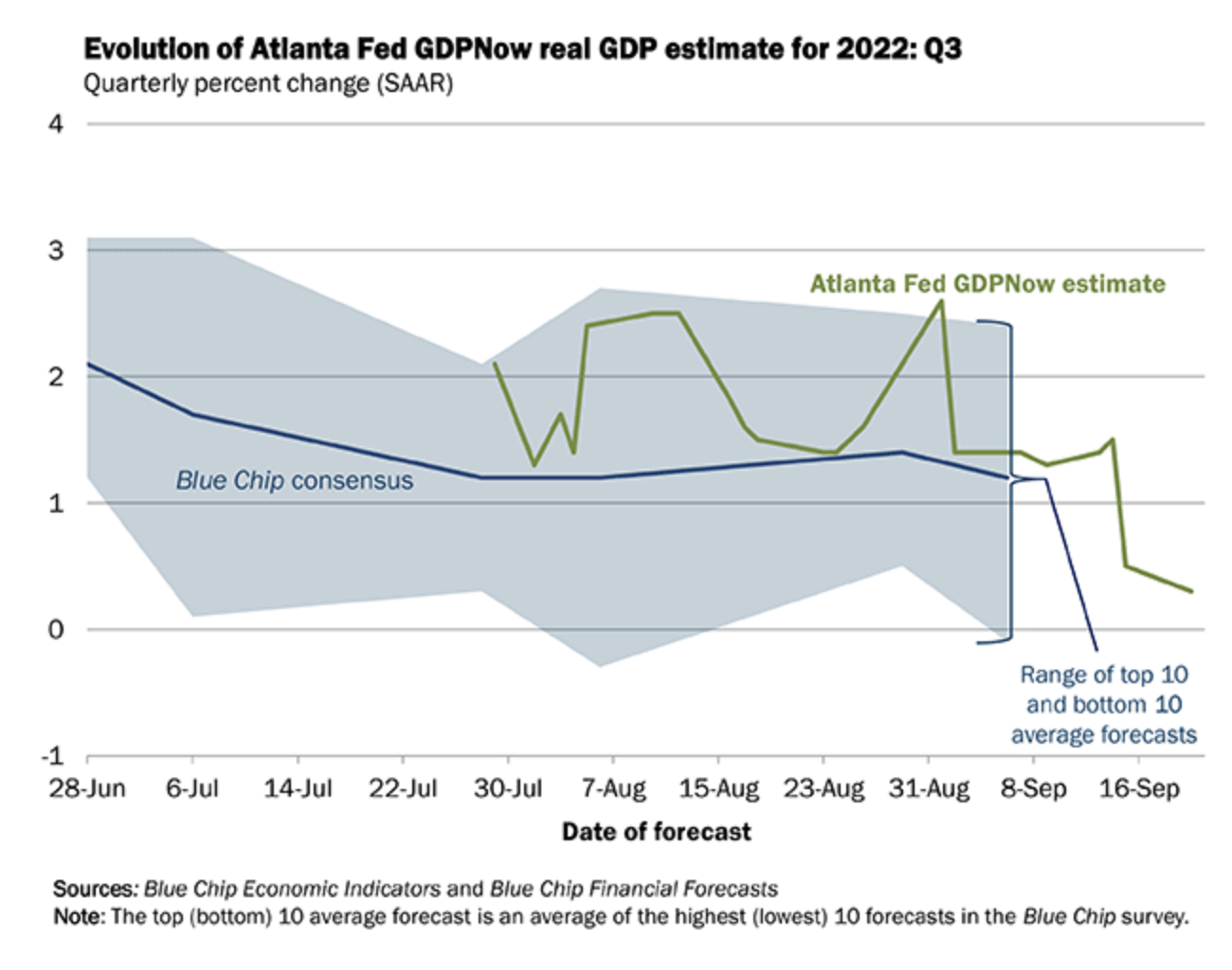

The Atlanta Fed has lowered its GDP estimate for the third quarter to 0.3%, and the trend is downward. That means the economy is teetering on the verge of another quarter of negative GDP growth. Would that be enough to raise recession alarms?

Just five days ago, the Atlanta Fed was projecting 0.5% growth. Last month, it was expecting growth to come in over 2%.

According to the Atlanta Fed, “After this morning’s housing starts report from the US Census Bureau, the nowcast of third-quarter residential investment growth decreased from -20.8 percent to -24.5 percent.”

Residential housing starts increased 12.2% last month. This includes both single and multi-family units. But applications to build declined 10% to an annualized rate of 1.517 million units in August. That was down from 1.685 million in July. Chief economist at Pantheon Macroeconomics told Yahoo Finance, “As a general rule, when starts and permits move in opposite directions, trust the permits numbers, which lead and usually are less noisy.”

That’s apparently the approach the Atlanta Fed took.

In essence, the Atlanta Fed is now projecting virtually no economic growth in Q3. And it may well fall lower before it’s all said and done. This comes on the heels of two straight quarters of negative GDP.

And yet the mainstream continues to insist the economy is “strong.”

By conventional metrics, the economy is already in a recession. But the spinmeisters at the White House and in the mainstream media suddenly decided that old definitions didn’t apply.

As Peter Schiff said in a podcast after the Q2 GDP data came out, “This should be obvious, but people have been in denial about the weakness in the economy. So, as all this weak economic data continues to come out, more and more of the recession deniers are going to have to throw in the towel and accept reality.”

But the Biden administration refused to accept reality. Instead, it tried to alter reality.

The White House propaganda team worked overtime to change the definition of a recession in a very effective gaslighting campaign. Even today, most people in the mainstream are reluctant to admit the economy is in a recession. It remains unclear if a third straight negative GDP print (or virtually no growth) would change anybody’s mind.

GDP isn’t the only thing flashing “recession.” FedEx recently announced office closures and layoffs due to falling demand for shipping.

It’s no wonder that package volume is dropping. Consumers are spending more, but they’re not buying more stuff. They’re just paying more for everything. FedEx exposes the underlying rot in the economy, and it’s going to get worse.

While most people refuse to admit the economy is in a recession, most will at least concede a recession is in the cards. But they insist it will be short and shallow.

The question is: why should it be short and shallow? As Peter Schiff pointed out, the bust needs to be proportional to the boom.

We’ve never had a boom this big. We’ve never had interest rates this low for this long. We’ve never had an economy more screwed up than the one we have right now. We’ve never had bigger asset bubbles, bigger debt bubbles, more misallocations of capital and resources. So, we have more mistakes that we need to fix now than ever before. So, how are we going to do that with a short shallow recession? We’re not. It’s going to be a massive recession.”

Schiff went on to say that the weakness in the economy will ultimately force the Fed to pivot away from its inflation fight.

Layoffs are coming as real spending is going down, and that’s when the Fed ultimately is going to pivot. Once the economy really starts to buckle, the Fed is going to turn.”

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Buka akaun dagangan patuh syariah anda di Weltrade.

Source link