Back to Budget Deficits Despite Surging Government Revenue

After running a budget surplus in April thanks to an influx of tax-day tax receipts, the federal government reverted back to running a deficit in May.

The budget deficit was $66.22 billion last month. That raises the current fiscal year deficit to $426.2 billion with four months left to go.

A large influx of money into the Treasury continues to paper over the federal government’s spending problem.

The federal government took in $389 billion last month. This was far below the big influx of cash the Treasury reported in April as Americans paid their 2021 income tax bills. But May still ranked as the fourth-largest revenue month of this fiscal year. Government receipts for the fiscal year are up 29% from 2021 at roughly $3.4 trillion.

Unfortunately for Uncle Sam, the CBO expects this revenue surge to wane.

Individual income tax receipts are projected to decline as a share of GDP over the next few years because of the expected dissipation of some of the factors that caused their recent surge. For example, realizations of capital gains (profits from selling assets that have appreciated) are projected to decline from the high levels of the past two years to a more typical level relative to GDP. Subsequently, from 2025 to 2027, individual income tax receipts are projected to rise sharply because of changes to tax rules set to occur at the end of calendar year 2025. After 2027, those receipts remain at or slightly below the 2027 level relative to GDP.”

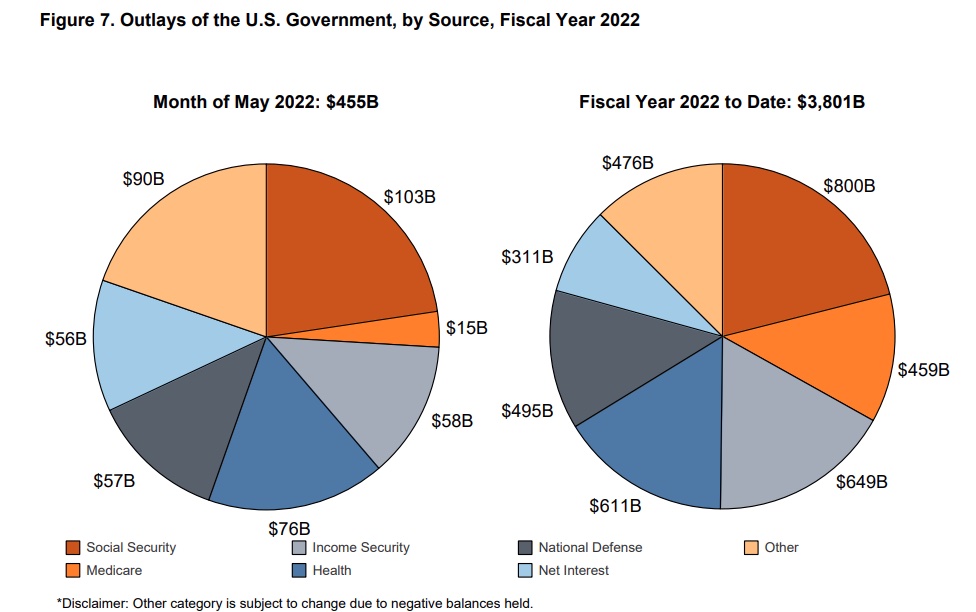

Meanwhile, the federal government continues to spend money hand-over-fist. Uncle Sam spent $455.2 billion in May. This brought total spending for fiscal 2022 to just over $3.8 trillion.

Mainstream financial news reports keep telling us that spending is dropping with the end of many pandemic-era programs. This is true. Stimulus and other programs ballooned spending over the last two years. But if you strip out the pandemic programs and look at baseline outlays, it’s clear that the federal government is nowhere near getting its spending problem under control. May spending this year eclipses all years before 2020.

Meanwhile, President Joe Biden wants to keep spending, and he wants to spend more. His budget raises spending on everything from domestic programs to the Pentagon.

The bottom line is the Treasury can’t depend on record revenues every month to push the deficit lower.

The CBO projects a $1 trillion deficit in fiscal 2022, down significantly from the massive deficits the government ran in 2020 and 2021. This sounds like a great accomplishment until you put the numbers in context. Prior to the pandemic, the US government had only run deficits over $1 trillion four times — all in the aftermath of the 2008 financial crisis. Trump almost hit the $1 trillion mark in 2019 and was on pace to run a trillion-dollar deficit prior to the pandemic. The economic catastrophe caused by the government’s response to COVID-19 gave policymakers an excuse to spend with no questions asked. Now it appears the government is settling back into the status-quo – running ’08 financial crisis-like deficits every year.

And if the economy spins into a recession as the Fed tightens monetary policy to fight raging inflation, you can expect revenue to tank, meaning even bigger budget shortfalls.

The national debt currently stands at $30.4 trillion.

According to the National Debt Clock, the debt to GDP ratio is 129.37%. Despite the lack of concern in the mainstream, debt has consequences. More government debt means less economic growth. Studies have shown that a debt to GDP ratio of over 90% retards economic growth by about 30%. This throws cold water on the conventional “spend now, worry about the debt later” mantra, along with the frequent claim that “we can grow ourselves out of the debt” now popular on both sides of the aisle in DC.

To put the debt into perspective, every American citizen would have to write a check for $91,607 in order to pay off the national debt.

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Buka akaun dagangan patuh syariah anda di Weltrade.

Source link