Natural Gas Technical Analysis: Trying to Recover

Our expectations indicate a rise in natural gas during its upcoming trading.

Spot natural gas prices (CFDS ON NATURAL GAS) rose during the recent trading at the intraday levels, to achieve slight daily gains until the moment of writing this report, by 2.05%. It settled at the price of $4.688 per million British thermal units, after declining yesterday and for the third day in a row by It reached -1.20%.

Natural gas prices remained in a narrow range on Wednesday, swinging between modest gains and losses as traders weighed global supply concerns amid the war in Ukraine against the prospect of fading domestic demand as spring weather approaches sharply.

Nymex gas futures for April were down about a tenth of a cent on the day and closed at $4.526 per million British thermal units. to settle at $4,561.

“The outlook continues to move in the warmer direction,” Weather On Demand Services said Wednesday. Bespoke added that the forecast for the next two weeks is “warmer than usual, in stark contrast to the forecast we saw for the middle of the month just one week ago.” “Change in weather is the main bearish factor over the past few days, thanks to the possibility of the cold fading out completely in the middle of the month.”

Last week, futures jumped 12% on expectations of more cold weather and escalating tensions over the Russian invasion of Ukraine. The war has fueled spikes in oil and natural gas prices in Europe, on fears that Russian crude and gas supplies to Europe will be halted amid the winter cold, and US futures have followed suit.

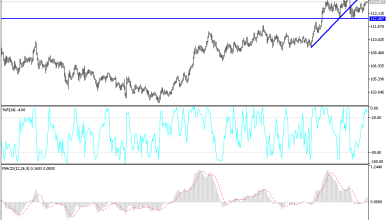

Technically, the main bullish trend is dominating the movement of natural gas in the medium term and moving along a trend line, as shown in the attached chart for a (daily) period, supported by its continuous trading above its simple moving average for the previous 50 days.

It retreated in its recent trading following the stability of the important resistance level 4.954, to try to search for a bullish bottom that might gain the positive momentum needed to regain its recovery, and tried to discharge its overbought, which was evident at the time on the relative strength indicators.

Therefore, our expectations indicate a rise in natural gas during its upcoming trading, to target again the resistance level 4.954 in preparation to attack it, and this positive scenario will remain as long as the support level 4.214 remains intact.

Source link