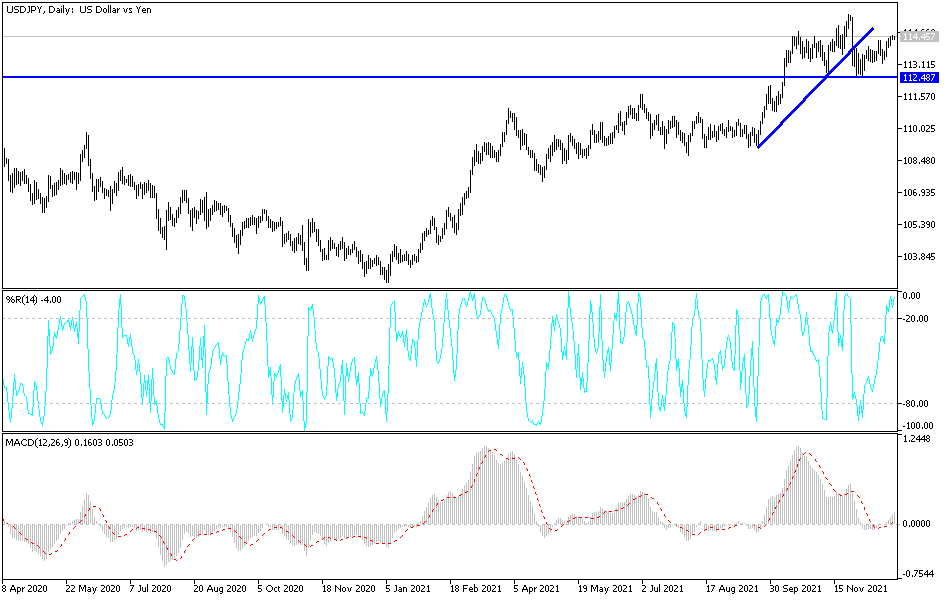

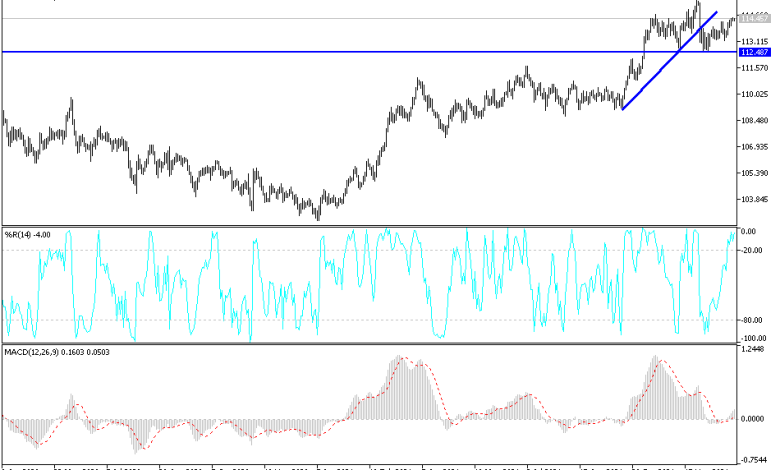

USD/JPY Technical Analysis: Bullish Stability

Like last week, the USD/JPY is stable around the 114.47 resistance level, near its highest in more than a month. This comes amid a wave of risk appetite and abandonment of the Japanese yen as a safe haven due to optimism in the markets about omicron, in addition to increasing expectations that the date of the US interest rate hike will be sooner than previously thought. Most recently, we noted stagnant US consumer spending, adjusted for inflation, in November as the fastest price gains in nearly four decades eroded purchasing power. Commerce Department figures last week showed that purchases of goods and services, adjusted for higher prices, were little changed after rising 0.7 percent in October. So-called nominal spending, unadjusted for inflation, rose 0.6 percent, matching the average estimate of economists.

The yen is a popular asset during turbulent times.

There is a series of cross-currents underlying the spending figures. Many Americans, amid headlines about crowded supply chains, began holiday shopping earlier than usual this year, which helped explain the strong progress the previous month. But at the same time, consumers are also facing the fastest inflation in decades. With each trip to the grocery store and gas pump eating up a little of their paycheck, people have less left for discretionary purchases. And the new omicron variant for COVID-19 threatens to curb the initial rebound in services expenses.

The report showed that Americans are spending more on necessities amid rising prices. Money spent on housing and utilities increased last month, as did spending on gasoline and food. The data showed that inflation-adjusted spending on services rose 0.5 percent, the most in three months, while spending on goods fell 0.8 percent, the first decline since July.

The S&P 500 has advanced, and is trading near its all-time high. Treasuries fell, while the dollar rose.

In the eyes of economists and analysts, a flat reading of real consumer spending in November – even before Omicron hits – suggests that inflation may start to affect consumer resilience through the end of the year. The increase in services was widespread, which is a positive sign.

According to official figures, the personal consumption expenditures price measure, which is used by the US Federal Reserve to achieve the 2 percent inflation target, rose 0.6 percent from the previous month and 5.7 percent from November 2020, the highest reading since 1982. It was these numbers that are in line with economists’ expectations. It was followed by an annual increase in the Department of Labor’s Consumer Price Index which was also the fastest since 1982.

The data comes on the heels of a hawkish approach by Fed officials, who have come under pressure to take action against rising rates. The US central bank recently announced that it will accelerate the end of its asset purchase program, and new interest rate expectations indicate that policy makers favor raising borrowing costs by three-quarters of a percentage point next year.

Technical Analysis

As I mentioned before, stability above the 114.20 resistance will continue to support a bullish performance and a move to higher resistance levels, namely 114.75, 115.20 and 116.00. These support the indicators’ movement towards strong overbought levels. On the other hand, the bears have hope if the bears return to the support area 113.50.

Source link