USD/JPY Technical Analysis: Important Trading Week

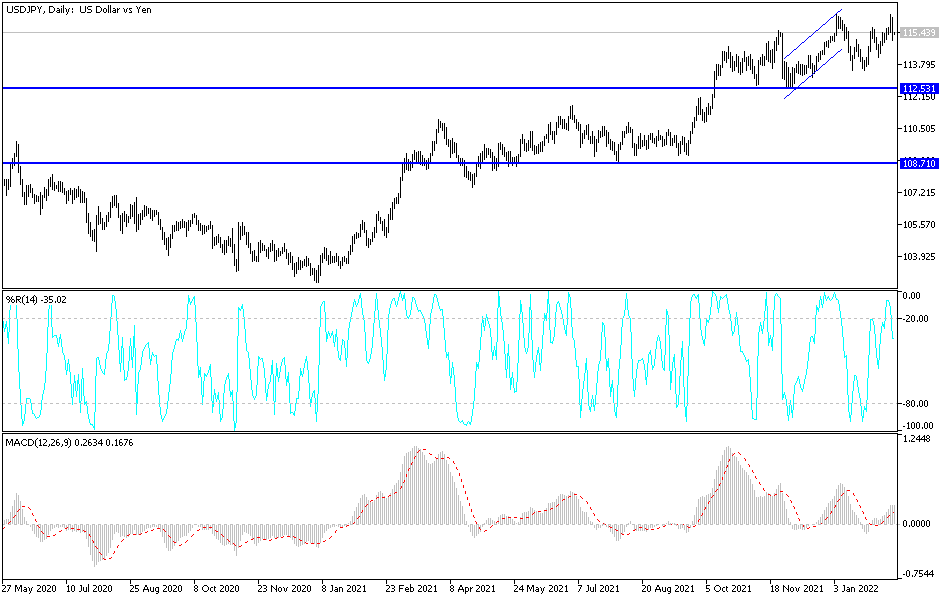

The USD/JPY bulls gained more momentum, especially after the announcement of stronger numbers than all expectations for US inflation. Therefore, the opportunity was better to move towards the resistance level of 116.34, the highest for the currency pair in years. Despite that, we recommended our valued customers sell the currency pair from resistance 116.30, as technical indicators reached overbought levels and amid profit-taking sales. The currency pair moved towards the 115.01 support level at the end of last week, before closing trading stable around the 115.43 level.

US inflation hit a new multi-decade high in January, which could worry Fed policy makers, although many forecasters remain confident that inflation is still likely to start declining around the spring. Monthly and yearly declines in inflation remain likely for the coming months although price growth in the US accelerated to its fastest pace since February 1982 during the opening month of the new year.

Bureau of Labor Statistics data released Thursday suggested overall inflation came in at 7.5% last month and reported the all-important “core inflation” rising to 6%, leaving each measure well above the Fed’s average 2% target.

Overall, the January data did lead St. Louis Fed President James Bullard to call for an immediate and larger-than-usual increase in the federal funds rate, but that will likely be a worrisome disappointment for other Fed policymakers as well. Look for inflation to start rising in the new year before declining over the rest of the year.

One effect of the pandemic and the measures used in attempts to contain the COVID-19 coronavirus has been that US households are spending larger shares of their income on goods of all kinds, from factory-made to field-grown ones. This is the case in the Bureau of Labor Statistics by adapting its consumer price basket to include more of these goods than services.

This is important because it is commodity prices that have caused much of the recent inflation, partly because of supply chain disruptions and because of increased demand. It is also important because commodity prices are widely expected to fall as businesses and households move out of the pandemic and spending on services returns to more typical levels.

According to the technical analysis of the pair: Despite the recent performance at the end of last week’s trading, the price of the USD/JPY currency pair has the opportunity to rise as long as it is stable around and above the psychological resistance 115.00. The bulls are stable at the resistance 115.50, which may revive the pair to stronger upward levels. The closest to it after that is 116.20 and 117.00. Expectations of raising US interest rates may collide this week with the announcement of the content of the minutes of the last meeting of the US Federal Reserve and the statements of a large number of US monetary policy officials.

On the downside, the bears’ control will only be strengthened if the currency pair moves towards the 114.85 and 113.90 support levels, otherwise the general trend will remain to the upside as is the performance on the daily chart below.

Source link