Drop to 1.300 Can’t Be Ruled Out

The pair will likely continue with the bearish trend today as investors reflect on the hawkish statement by Jerome Powell.

Bearish View

- Set a sell-stop at 1.3120 and a take-profit at 1.300.

- Add a stop-loss at 1.3200.

- Timeline: 1 day

Bullish View

- Buy the GBP/USD pair and set a take-profit at 1.3300.

- Add a stop-loss at 1.3150.

The GBP/USD pair held steady in the overnight session as investors refocused on the upcoming UK inflation data scheduled for Wednesday. They are also assessing the interest rate decisions by the Bank of England and Federal Reserve. It is trading at 1.3134, which is slightly below the overnight high of 1.3214.

Fed and BOE

There were no major economic data from the US and UK on Monday and the same trend will continue on Tuesday. Therefore, analysts and investors will continue assessing last week’s decisions by the Federal Reserve and the Bank of England.

On Wednesday, the Fed decided to deliver its first interest rate hike since 2018 in a bid to deal with the rising inflation. It increased rates by 0.25% and signaled that it will hike in the remaining six meetings of the year. The Fed anticipates that it will have three rate hikes in 2023.

In a statement on Monday, Jerome Powell reiterated his view that higher interest rates are necessary considering that the labor market has tightened while inflation has surged. He expects that inflation will keep rising in the coming months because of the ongoing crisis in Ukraine.

Meanwhile, the BOE also decided to hike interest rates on Thursday last week. Like the Fed, the bank decided to hike interest rates by another 25 basis points. It was the third time that the bank has raised interest rates in the past few months.

With no economic data expected from the UK on Tuesday, investors will be waiting for the upcoming consumer inflation numbers scheduled for Thursday. Analysts expect these numbers to show that prices continued rising in February.

Sadly, the situation will continue worsening as the crisis in Ukraine pushes prices of most items like commodities and fertilizers higher.

GBP/USD Forecast

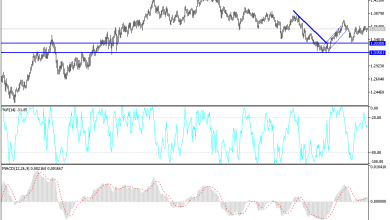

The four-hour chart shows that the GBP/USD pair has been in a strong bullish trend in the past few days. On Monday, it managed to move above the key resistance level at 1.3200. It then retreated and moved below the 23.6% Fibonacci retracement level.

The pair has moved slightly below the 25-day moving average while the MACD has formed a bearish crossover pattern. Therefore, the pair will likely continue with the bearish trend today as investors reflect on the hawkish statement by Jerome Powell. If this happens, the next key support will be at 1.3000.

Source link