GBP/USD Technical Analysis: Waiting for Inflation Report

Today is an important day for the GBP pairs in the Forex market. The inflation report will be announced from the Bank of England, along with comments from monetary policy officials of the bank about what is contained in the report. This will be important for the expectations of raising interest rates, which has supported the gains of the pound a lot in the recent period. The recent rebound gains for the GBP/USD currency pair extended to the 1.3642 resistance level before settling around the 1.3592 level at the time of writing, recovering from the 1.3538 support recorded yesterday as well.

Britain printed a budget surplus of £2.9 billion in January 2022 backed by increased tax revenue with central government revenue of £91.6 billion in January 2022, £8.6 billion more than in January 2021. However, the surplus was less than what the market had been expecting. At £3.5 billion, economists say the recent fiscal improvements will surely be swallowed up by the rising cost of debt repayment over the coming months.

The Office for National Statistics said most of January’s surplus was driven by a jump in self-assessed income tax revenue of £18.4 billion, an increase of £2.0 billion. Commenting on this, Philip Shaw, Economist at Investec says, “The fact that borrowing was negative this time exaggerates the improvement in the financial position – and January tends to be a boom month for revenue thanks to the strength of the PAYE income tax payments. However, this was the first repayment since the beginning of the epidemic for two years in the past and the general situation is developing positively.”

But Britain’s finance minister, Rishi Sunak, is worrying that the inevitable rise in debt repayment costs after rising inflation. Debt interest payments were 6.1 billion pounds in January, an increase of 4.5 billion pounds.

Capital Economics expects repayment burdens to rise “for some time now” as they expect RPI inflation to continue to climb to a peak of 9.9% in April 2022 and average 1.1 percentage points higher than the Office of the Balance Sheet forecast in 2022/23 and 3.2 parts. above in 2023/24.

The British government borrowed a total of £138.5 billion in the fiscal year to January 2022 which was the second highest fiscal year-to-January borrowing since monthly records began in 1993. But it is encouraging that borrowing is now nearly half of what it was a year ago ( 140.2 billion pounds less). Public sector net debt excluding public sector banks (PSND ex) was £2317.6 billion at the end of January 2022 representing about 94.9% of GDP, levels not seen since the early 1960s.

Looking at the ten months of the 2021/22 fiscal year, government spending decreased by 4.9% compared to the corresponding period of the previous year with revenue increasing by 15.6%. However, it looks almost certain that Sunak will continue to raise taxes in April when National Insurance contributions from both employers and employees take effect.

Accordingly, Capital Economics says that the current deficit in borrowing will decrease in 2022/23 as higher inflation and interest rates could cause borrowing to exceed the balance sheet office’s forecast by £30 billion.

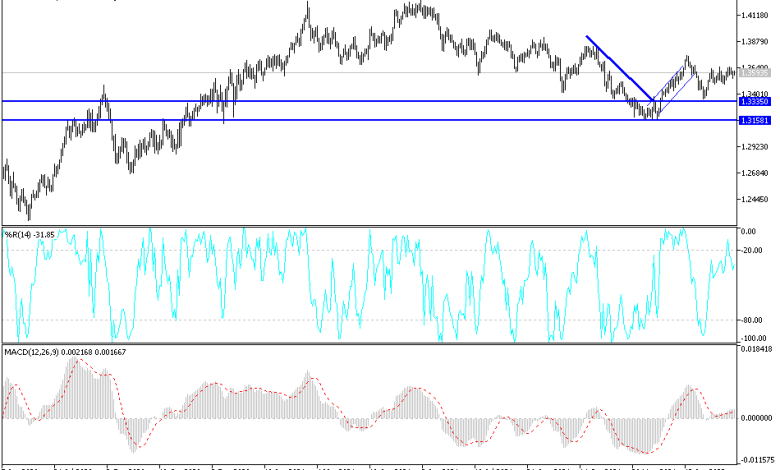

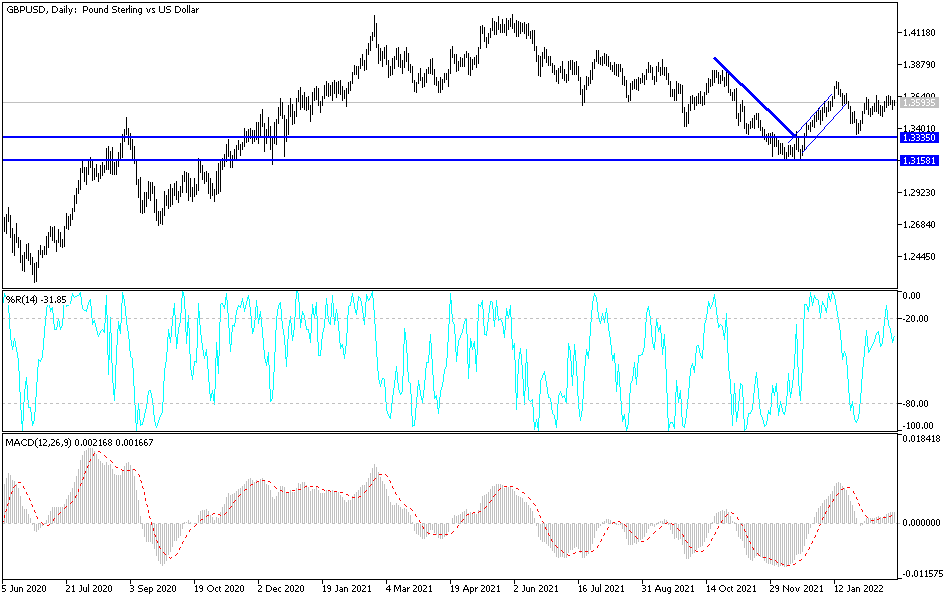

According to the technical analysis of the pair: The relatively continuous balance of the GBP/USD currency pair stems mainly from the expectations of raising interest rates for both the Bank of England and the US Federal Reserve, but this is punctuated by risk appetite in light of the Russian crisis that has emerged. According to the performance on the daily chart, the GBP/USD price still has a chance to rise and settle above the resistance 1.3660 that supports the bulls to launch strongly higher.

I think that the selling of the pair may be an opportunity to think about buying again, and the most suitable areas for the moment are 1.3520, 1.3420 and 1.3300, respectively.

Source link