CED Report Outlines Dangers of Proliferating US Debt

NEW YORK, March 15, 2022 /PRNewswire/ — The US debt is at a precarious new level, quickly approaching historic highs not seen since the end of World War II. Then, combat troops were returning home to a decade of economic prosperity and post-war production. Now, the nation has faced three costly crises in the last 15 years— the financial crisis, the pandemic, and the war in Ukraine. These events demonstrate that this nation must be fiscally prepared to be a true world leader. It must not continue to teeter over the edge of financial stability.

Today, the Committee for Economic Development, the public policy center of The Conference Board (CED), issued a new Solutions Brief, Dealing with Fiscal Debt: A Policy Road Map. As detailed in the report—the latest in a series of Solutions Briefs on Sustaining Capitalism—the nation’s debt is currently about 100 percent of gross domestic product, approximately three times higher than it was in 2000.

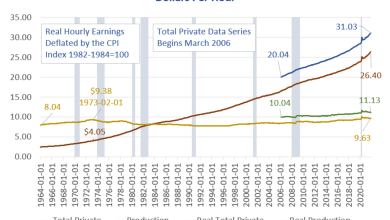

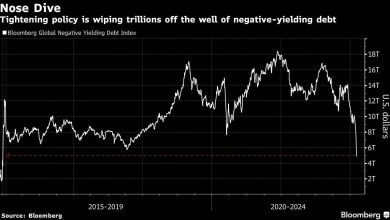

What’s more, the expanding public debt will quickly put a damper on private sector growth. The more credit the federal government demands from financial markets, the less financing there will be available for private enterprise and innovation. Smaller businesses will struggle to borrow through intermediaries using shorter-term loans with higher interest rates. Instead, investors will focus on the safe, slower-growth part of the business sector—to the detriment of economic dynamism and innovation, US world leadership, and longer-term growth of living standards.

“Without immediate action to drive down the spiraling costs incurred by the federal government, we are steering the nation’s economy into uncharted waters,” warned Dr. Lori Esposito Murray, President of CED. “Any meaningful, truly impactful solutions must begin now, with cooperation from the private sector and policymakers on both sides of the aisle, to turn the tide. Leaving the nation’s daunting fiscal situation on the backburner risks crippling the economy beyond repair. Mustering the political will to prevent that—and put the nation on a course to prosperity—is imperative.”

Key insights from the Solutions Brief include:

In the coming decade, the US debt will surpass historic highs:

- Today, the federal debt is about 100 percent of GDP. In the next decade, the debt burden will surpass historic highs not seen since the end of World War II.

- By 2051, this figure is expected to double, topping 200 percent of US GDP.

Debt service will soon become the fastest-growing component of the federal budget:

- By 2051, the government’s debt obligations will have grown so large that predicted revenue will not be enough to pay for just debt service, Social Security, and Medicare.

- The resulting deficits will be so large that they will be averted only by a combination of painful cuts in defense and domestic appropriated programs, Medicare and Social Security—and increases in taxes and other sources of revenue.

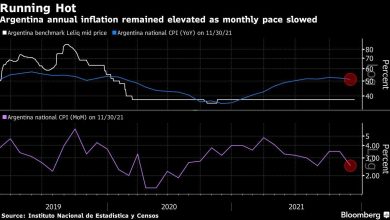

- If federal interest rates should rise even slightly higher, the economic impact could be catastrophic. CBO calculations show that if the interest rate on the outstanding debt increases by 0.05 percent per year, the debt held by the public would reach 260 percent of GDP, rather than the 202 percent in their baseline projections.

As the debt grows, the US labor force will decline:

- As Baby Boomers retire and birth rates slow, the US labor force is expected to decrease from its peak growth rates in the second half of the 20th century.

- Increased immigration would help offset the drop in US labor. However, to bring the US labor force growth to the two-percent figure seen in the 1950s-1980s, the number of immigrant workers entering the US would need to quintuple. Thus, economic growth faster than projected over the long-term budget can only be achieved through historically rapid productivity growth—and this is unlikely.

Key recommendations from the Solutions Brief include:

In its new Solutions Brief, CED offers six steps to halt the nation’s slide into deepening debt and meet budget priorities. They include:

- Facing the Issue: The nation cannot right its fiscal ship without policy leaders from both parties who recognize the peril and are willing to work together in the nation’s interest. Responsibility for difficult decisions must be shared, and fiscal responsibility must again have a role in budget deliberations. Policymakers must set priorities and ensure there is revenue to meet those priorities—not through smoke and mirrors or budget gimmicks.

- Health Care: Health care is the largest and fastest-growing non-debt-service part of the budget. Medicare, more than any other federal activity, drives up the annual deficits and the accumulated debt, and debt-service cost increases as a result. At the same time, the broader private health care system for the working-age population and their dependents strains the finances of businesses and households alike.

- Social Security: The cost of Social Security is also growing, largely due to the aging population. After strengthening the safety net for intermittent workers with interrupted employment histories, Social Security’s costs should be reined in with gradual reductions in benefits for the most-affluent workers, and broader coverage of the payroll tax for workers with higher wages and with generous fringe benefits that are currently not taxed.

- Annual Appropriations and Smaller Entitlement Programs: Congress must take the appropriations process seriously. Whether the process continues to occur annually or is extended to a two-year cycle, policymakers must commit to carefully evaluating budgets and appropriation requests. Legislators must also carefully complete a budget resolution each year, using reconciliation the way it was originally intended—for deficit reduction.

- Revenues: Any long-term solution to the debt crisis will require greater revenues. The nation’s tax policy needs fundamental reform. If income tax reform does not yield sufficient revenues, policymakers should consider additional sources consistent with sound reform principles and with continuing budget discipline. The social insurance payroll taxes must also contribute part of the funds needed to make Social Security and Medicare financially sustainable.

- Segregate and Solve the Pandemic’s Damage: The federal response to COVID-19 cost roughly $6.5 trillion. This pandemic-related portion of the debt should be segmented out and financed with long-term fixed-rate Treasury bonds. By taking immediate actions to pay off this one-time cost, policymakers will demonstrate the nation’s determination to restore fiscal responsibility.

The new Solutions Brief, Dealing with Fiscal Debt: A Policy Road Map, can be accessed here.

About CED

The Committee for Economic Development (CED) is the public policy center of The Conference Board. The nonprofit, nonpartisan, business-led organization delivers well-researched analysis and reasoned solutions in the nation’s interest. CED Trustees are chief executive officers and key executives of leading US companies who bring their unique experience to address today’s pressing policy issues. Collectively they represent 30+ industries, over a trillion dollars in revenue, and over 4 million employees. www.ced.org

About The Conference Board

The Conference Board is the member-driven think tank that delivers trusted insights for what’s ahead. Founded in 1916, we are a non-partisan, not-for-profit entity holding 501 (c) (3) tax-exempt status in the United States. www.conference-board.org

SOURCE Committee for Economic Development of The Conference Board (CED)

Source link