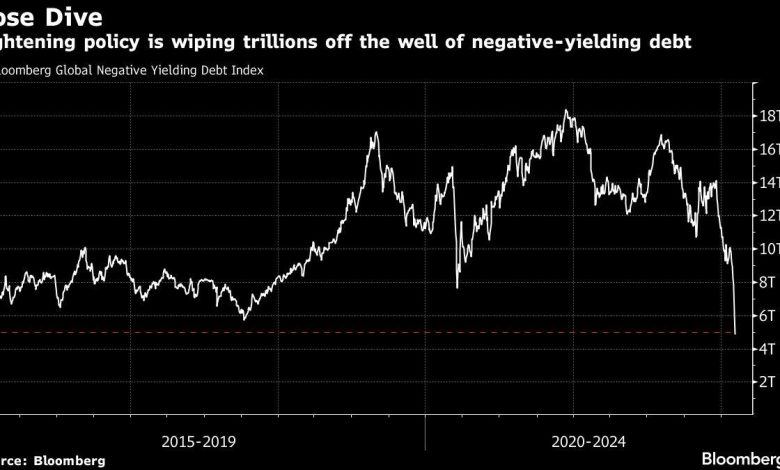

Almost $3 Trillion Wiped From Negative-Yielding Bonds

(Bloomberg) — The global stockpile of negative-yielding bonds has dropped to the lowest level in more than six years — with almost $3 trillion making the leap back into positive-yield territory in just two days last week — in one of the most visible indications yet that the era of easy money is coming to an end.

Most Read from Bloomberg

The pool of subzero bonds — which offer investors a guaranteed loss if held to maturity — now stands at about $4.9 trillion, the lowest since December 2015, according to Bloomberg index data. In Europe, the amount has cratered 80% since a December 2020 peak to the equivalent of $1.9 trillion, the lowest since September 2015; it was zero in 2014.

This shift marks the beginning of the end for a mind-boggling anomaly in modern finance — people paying to lend out money. Negative rates were good for borrowers since it meant they, not investors, would effectively get paid interest. On the flip side, the situation incentivized bond investors to speculate in other assets in their hunt for yield, and prolonged the life of companies that might’ve collapsed otherwise.

“The decline in the universe of negatively yielding bonds has the potential to become self-reinforcing as certain investors such as insurance companies and pension funds, who in previous years extended maturities and went down the rating spectrum to avoid negative yields, are now under less pressure to do so,” strategists led by Nikolaos Panigirtzoglou at JPMorgan Chase & Co. wrote in a note to clients.

Negative-yielding debt is disappearing as central banks worldwide start to withdraw emergency pandemic support to tackle red-hot inflation — reducing demand for bonds, pushing their prices down and their yields up. European Central Bank Governing Council Member Klaas Knot said on Sunday he expects an interest-rate increase as early as the fourth quarter, while U.S. payrolls data on Friday stoked expectations for aggressive moves around the globe.

“As central banks normalize policy, through rate hikes and (more slowly) balance sheet reduction, the drop is set to continue,” said Vincent Chaigneau, head of research at Generali Investments.

In Germany, one of the world’s major bastions of negative rates, 10-year yields posted a 10th straight daily increase, the longest advance in 22 years. They have risen to 23 basis points from minus 18 basis points at the end of 2021.

Underscoring the risk of an abrupt shift in monetary policy, borrowing costs for most-indebted European governments, including Greece and Italy, have surged since the hawkish pivot of the ECB last week. The moves in government bonds are spilling over into corporate credit. Funding costs for euro high-grade borrowers have jumped above 1% for the first time since June 2020.

But JPMorgan’s strategists said a shift away from negative yields and negative policy rates could actually create a “tailwind” for major economies, as “the previous unintended consequences from negative rates abate.” Negative rates have led to mis-allocation of capital, lowered bank profitability, clogged credit creation, and impaired functioning of money markets, the strategists said.

(Corrects characterization of negative-yielding bonds in third paragraph)

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.

Source link