Will the BoE Say Anything New?

More aggressive expectations for the future of raising interest rates from the Bank of England continue to support the strength of the GBP against the other major currencies. Since the beginning of this week’s trading, the price of the GBP/USD is recovering stable around the resistance level 1.3589 after it fell to the support level 1.3490 after strongly positive numbers for US jobs. The British pound was one of the strongest performers of the major currencies in the run-up to the Bank of England policy decision on February 03, as investors braced for another 25 basis point hike.

Moreover, inflation figures will continue to rise in the coming months which will force the Bank of England to continue tightening monetary policy. Money market pricing indicates that there are more than 100 basis points for raising interest rates between now and next March, while some economists see the “final” interest rate in the UK ending at 2.0%.

Moreover, once the bank’s interest rate reaches 1.0%, the Bank of England is expected to start selling the bonds it acquired under the quantitative easing program, further tightening financial conditions.

On the other hand, in a supportive development for the pound. British Prime Minister Boris Johnson said laws requiring people in England with COVID-19 to self-isolate could be lifted by the end of the month, bringing an end to all domestic restrictions related to the coronavirus. “Provided that current encouraging trends in the data continue, I expect we will be able to end recent domestic restrictions – including legal requirements for self-isolation if a positive test result – a full month in advance,” Johnson said.

People who test positive are now required to isolate for a full five days. This rule will expire on March 24. Johnson added that he plans to present his plan to live with the virus when Parliament returns from a short break on February 21.

Officials said the British government plans to switch from legal restrictions to advisory measures and treat the coronavirus like the flu as it becomes a pandemic in the country. The UK has seen a decrease in the number of new infections and hospitalizations of COVID-19 patients since early January, when the transmissible omicron variant drove the number of daily cases to more than 200,000.

The current infections average about 64,000 per day – the lowest recorded since mid-December – with 314 deaths reported on Tuesday.

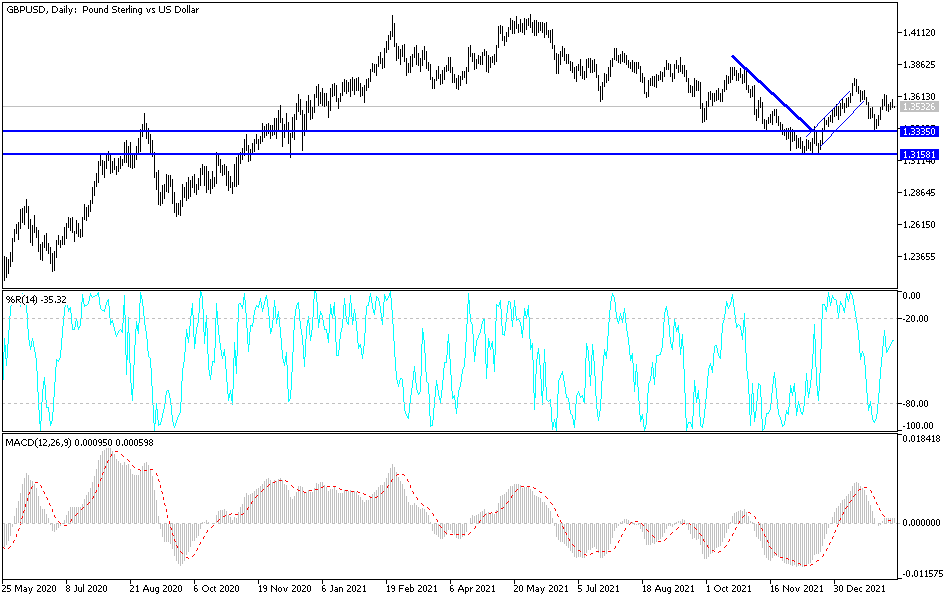

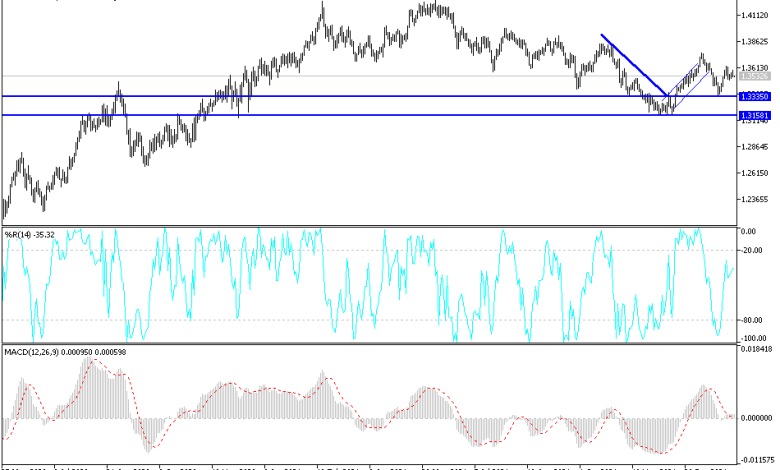

According to the technical analysis of the pair: The price movement of the GBP/USD currency pair today depends on the reaction to the Bank of England Governor’s statements and the reaction from the results of the US data, the consumer price index and the weekly jobless claims. So far, the general trend still tends to rise as long as it is stable above the 1.3500 resistance, and the bulls will gain more control by moving towards the resistance levels 1.3660 and 1.3750, respectively. On the other hand, there will be no reversal of the general trend without the currency pair moving towards the support levels 1.3445 and 1.3370, respectively.

I still prefer buying the GBP/USD from every bearish level.

Source link