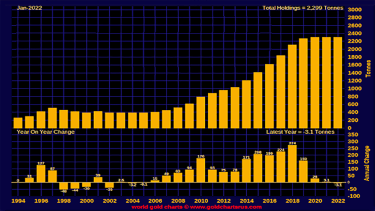

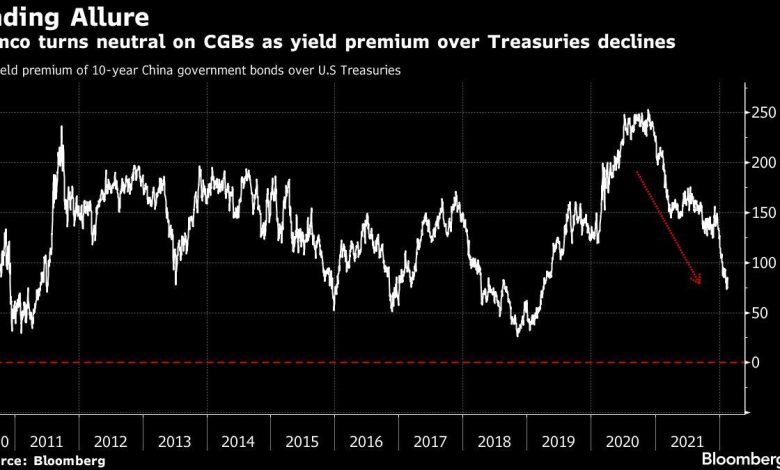

Pimco Sours on Chinese Debt as Rising U.S. Yields Erode Appeal

(Bloomberg) — Pacific Investment Management Co. lowered its recommendation on Chinese sovereign debt to neutral from overweight as policy divergence with the U.S. diminishes its yield advantage.

Most Read from Bloomberg

The investment giant had an overweight call on the securities for most of last year when inflows to the nation’s bonds hit a record high.

“We have turned more neutral on China duration given how much the U.S. rates market has repriced while the China market has outperformed,” said Hong Kong-based Asia portfolio manager Stephen Chang, adding that the bonds are unappealing even on a currency-hedged basis.

The yield premium on China’s 10-year government bonds over Treasuries slumped to the lowest since 2019 last week as surging U.S. inflation prompted traders to ramp up bets for aggressive Federal Reserve rate hikes. Meanwhile, China’s slowing inflation gives its central bank more room to ease after it pumped in liquidity to support an economy battered by Covid curbs and a property slowdown.

Global demand for Chinese debt is already declining this year. Foreign institutional investors bought a net 66.3 billion yuan ($10.4 billion) of Chinese securities in the interbank market last month, compared to 69.8 billion yuan of purchases in December, according to Bloomberg calculations based on Chinabond and Shanghai Clearing House data.

Strategists from Societe Generale SA and Barclays Plc are forecasting further moderation in foreign purchases after funds boosted allocations following the inclusion of the nation’s debt in a global bond index in October.

Sweet Spot

Still, expectations for more monetary easing means foreign funds aren’t completely giving up on Chinese debt. Pimco’s Chang favors seven-year government bonds and policy bank notes due to the flatness of the seven-to-10 year part of the curve.

PineBridge Investments echoes his view.

“The seven-year part of government bond curve is the sweet spot, given our view in near-term monetary policy,” said Arthur Lau, head of Asia ex-Japan fixed income in Hong Kong. “Short-end has rallied, because rates have dropped to reflect the easing cycle in China, while the long-end seven-to-10 years part of the curve has not reacted to such a move.”

While the People’s Bank of China refrained from cutting interest rates this week, market watchers expect reductions in coming months. This could present a buying opportunity in the medium term, according to Lau who sees 10-year yields falling to 2.2%-2.5%. The benchmark was at 2.78% on Thursday.

For Western Asset Management, China bonds are attractive from a diversification perspective. “They won’t repeat last year’s performance, but they will still outperform,” said Desmond Soon portfolio manager and head of Asia ex-Japan investment at Western Asset Management in Singapore, referring to Chinese government bonds. “This is the second largest bond market in the world with only 10% of foreign ownership,” he said.

Fidelity International expects global investors to continue exploring Chinese government and policy bank bonds. They provided healthy liquidity even during the peak of the pandemic in March 2020, said Vanessa Chan, Asia fixed-income investment director at the fund.

Other investors continue to be cautious. Chinese government bond yields are at the low end of their range, Brad Gibson, co-head of Asia Pacific fixed income at AllianceBernstein, said in a Bloomberg Television interview.

Five-year yields at 2.35% “are fully pricing in another series of small interest-rate cuts,” he said.

(Adds tout after ninth paragraph.)

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.

Source link