LME to Nearly Double Its Default Fund After Nickel Squeeze

(Bloomberg) — The London Metal Exchange told members it will nearly double the size of its clearinghouse default fund as the exchange grapples with the fallout from an unprecedented short squeeze that roiled metals markets this month.

Most Read from Bloomberg

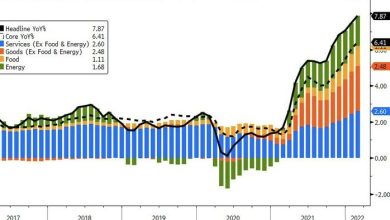

The default fund is expected to increase to $2.075 billion from $1.1 billion in April as a result of the exchange’s monthly stress-testing exercise, an LME spokesperson said on Friday. The move comes after a record spike in nickel prices earlier this month and wild swings in recent sessions that have put the metal on course for a 49% monthly gain, the biggest increase since 1988.

The fund is mostly paid for by LME members, and the increase will add to financial strains on brokers, traders and banks that have already been hit with surging margin calls due to the dramatic prices moves in metals and other commodities since Russia’s invasion of Ukraine. The fund is used to cover the losses if one or more of its members defaults on their obligations to the LME.

When nickel prices spiked 250% in two days earlier this month, several brokers on the LME were brought to the brink of failure before the exchange intervened to close the market and cancel several hours of trades at the highest prices. The bourse has said the spike posed a systemic risk to its market.

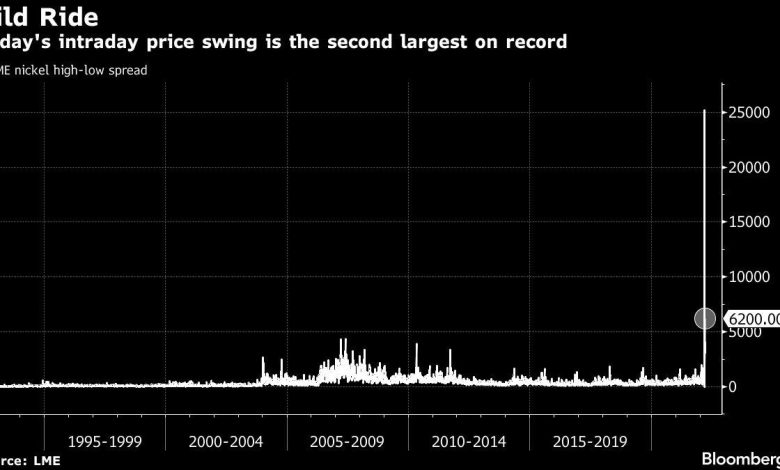

Nickel initially plunged when the market reopened, but surged by the 15% exchange limit on both Wednesday and Thursday and traded in wild swings on Friday. Prices were down 2.7% at $36,245 a ton as of 1:20 p.m. in London, having traded in a $6,200 range through the morning — the second-largest intraday move on record if the canceled trades this month are excluded. In Shanghai, nickel futures fell 6.6% in evening trading, to the equivalent of about $34,317 a ton when VAT is excluded.

The LME’s handling of the crisis has sparked fury among investors and traders, and a sharp decline in trading activity as they exit the market is amplifying the risk of further price swings. On Thursday, the Bank of England, which regulates the LME’s clearinghouse, highlighted the price spike as an example of the “significant stress in a range of commodity markets” as margin calls against exchange contracts and over-the-counter derivatives rise.

The monthly reset of the fund “is a standard process to calibrate against observed hypothetical stress testing losses over the past six months,” the LME said in a statement. The increase in April is “due to increases in prices of all LME metals over the past month.”

Members’ contributions to the default fund, which are calculated monthly and based on relative initial margins, will be due on April 4, people familiar with the matter said earlier. The LME will also increase initial margins on nickel contracts to $6,144 a ton from March 29, a 28% increase, it said in a separate notice on Thursday.

(Updates with confirmation from the LME.)

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.

Source link