Krone Seemingly Ignoring Oil Markets

If you choose to trade this market you just simply use a little bit smaller of a position size then you would in something like the EUR/USD.

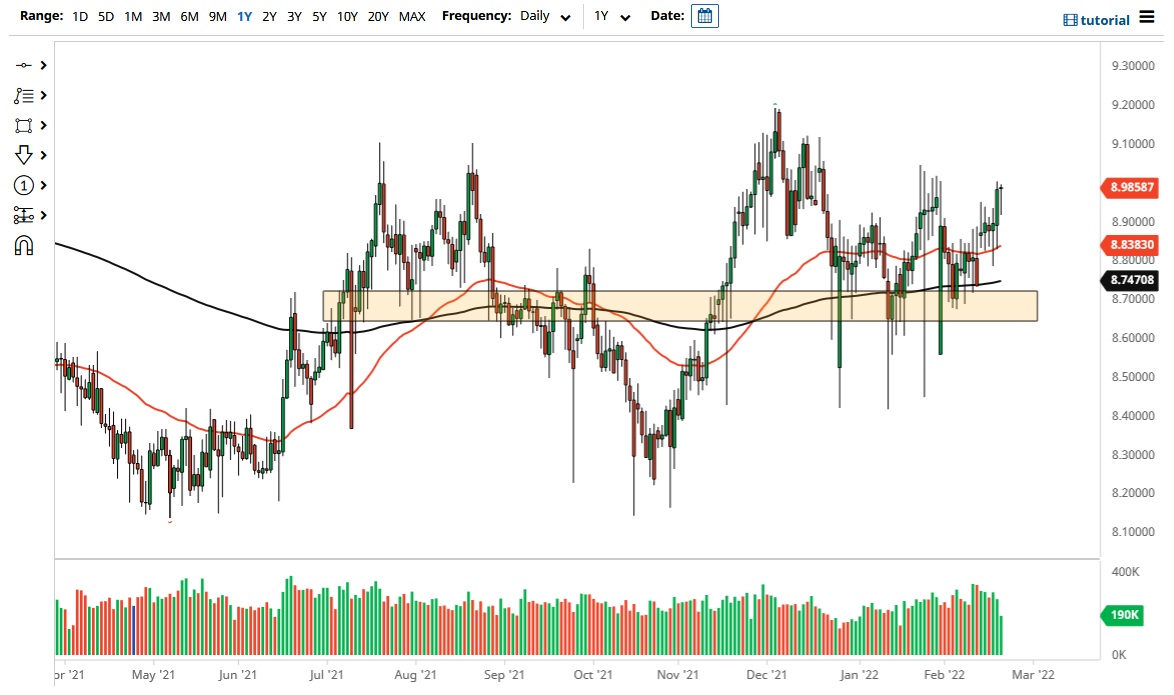

The US dollar initially fell against the Norwegian krone during the Monday session, reaching down towards the 8.91 level before turning around and rally again. By the end of the day, the US dollar was trading just above at 9.00 NOK. This is the same area the market has slammed into multiple times over the last month or so, despite the fact that crude oil continues to find a rather large bid. After all, you would expect a completely different move based upon the fact that it is probably only a matter of time before we see $100 per barrel.

Norway of course is a major exporter of crude oil, so typically the correlation is relatively strong. However, there are a lot of geopolitical concerns out there, and smaller currency sometimes get beaten up by the greenback in that scenario. I think that is part of what you are seeing here, but at the same time inflation in Norway is not grabbing the headlines like it is in the United States for the European Union. With that being the case, and the fact that the Norgesbank seems to be a bit more passive than many other central banks that I follow, I suppose it makes a certain amount of sense that the greenback continues to be stubbornly strong against this particular currency.

If we can break above the 9.05 NOK level, then I think it is possible that the market goes looking towards 9.10 NOK level, followed by the 9.20 NOK level. To the downside, it appears that there is plenty of support near the 8.90 NOK level, and then of course the 50 day EMA which is starting to curl higher at the 8.84 NOK level.

You will notice that there are a lot of long wicks in this chart, and that is because of the nature of the smaller currencies like this. Nonetheless, if you choose to trade this market you just simply use a little bit smaller of a position size then you would in something like the EUR/USD. Because of this, the spread should not scare you, and you should look at this through the prism of a market that likes to trend for long periods of time. It is also worth noting that this 9.00 NOK level is roughly the top of the recent consolidation area, so if we do start falling from here, then you start to trade from a range bound perspective.

Source link