GBP/USD Technical Analysis: Factors for Strong Gains

We mentioned before that the sterling pound may remain supported in the future by the expectations of raising interest rates, and that the recent decline may be an opportunity to buy. In the case of the GBP/USD currency pair, it fell at the beginning of this week’s trading to the level of 1.3490, before recovering at 1.3560 at the time of writing the analysis. The shift in investor and market sentiment will be after the US inflation figures are announced tomorrow.

Overall, sterling should be “bolstered” in the short term by expectations of a UK rate hike, say analysts at two of Britain’s most popular banks, although they differ on how much strength the euro could get after the central bank pivot.

The pound rose to a two-year high against the euro last week after the Bank of England raised interest rates by 25 basis points, although those gains were quickly eroded by cautious guidance on the UK’s economic outlook given by Bank of England Governor Andrew Billy.

The decision caused price markets to price an additional 16 basis points of tightening over the next 12 months, after the bank revealed the Monetary Policy Committee was just one vote away from raising rates by a more substantial 50 basis points, according to Barclays.

Barclays now expects the British central bank to raise 25 basis points back-to-back in March and May, before stopping with the bank rate at 1%. However, Daly cautioned that sterling has “come a long way since the start of the fourth quarter of 2021” and as such, the extent of sterling’s recent rally and the negative economic backdrop against which the Bank of England is tightening, means that sterling’s gains are likely to be limited. ”

Barclays expected the pound to rise against the dollar, targeting 1.37 by mid-2022, but they expected a weak performance against the euro, keeping the EUR/GBP target in mid-2022 at 0.86.

For his part, Paul Robson, FX Analyst at NatWest Markets, says that sterling is more than monetary policy, and this should provide protection against the Bank of England story being outdated. NatWest describes the bank’s February decision as a “tight hike” and sees additional upside risks as early as March. Economists believe the guidance indicates a front loading of tightening to limit the breadth of the policy cycle. A concern for some participants in the forex foreign exchange market is that the bank’s rally cycle is now fully accounted for, and “in the price” of the currency, and therefore if any disappointment against expectations may lead to weakness.

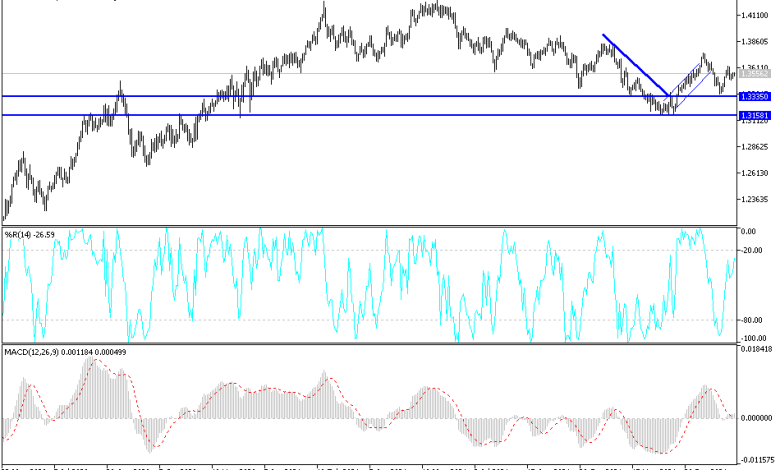

According to the technical analysis of the pair: On the daily chart below, the price of the GBP/USD currency pair is still moving within an ascending channel that was formed recently. The bulls need momentum to move towards stronger ascending levels, and the closest ones are currently 1.3585, 1.3660 and 1.3720, respectively. As mentioned above, the downward movement of the currency pair may be an opportunity to think about the return of buying. The currency pair may abandon the upward path if it moves towards the support level 1.3430 and 1.3350, respectively.

The currency pair is not awaiting any important and influential data today, and the statements of monetary policy officials for both the Bank of England and the US Federal Reserve will have the greatest impact.

Source link