New year new inflation theme: what if inflation surprises to the downside?

See TME’s daily newsletter email below. For the 24/7 market intelligence feed and thematic trading emails, sign up for ZH premium here.

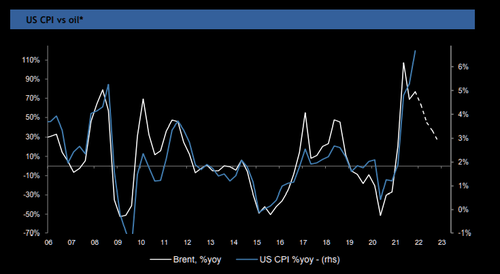

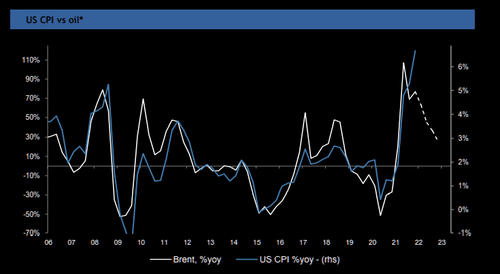

Headline inflation rates are likely to peak out…

With respect to inflation, while it is likely to remain elevated for longer, J.P. Morgan economists project that it will peak in 1H. Base effects are becoming more challenging for inflation to stay elevated. Even assuming oil price at $100 through this year, headline CPI in the US is likely to move down.

Source: JPM

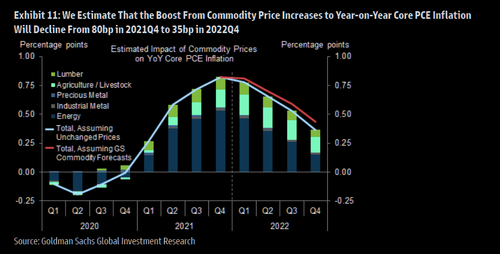

The waning boost from commodity prices on inflation

GS expect the boost from commodity prices to year-on-year core PCE inflation to decline from a peak of 80bp in 2021Q4, to 35bp by 2022Q4.

Source: Goldman

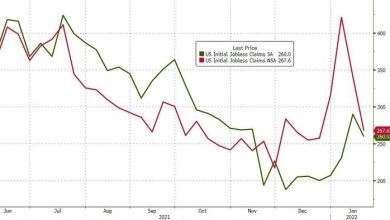

Little evidence of wage growth to accelerate further

“Forward-looking wage signals provide little indication that workers and employers expect wage growth to accelerate further in 2022, and are broadly consistent with our forecast that wages will grow at around a 4% pace. This pace would be stronger than the roughly 3% peak reached at the end of the last cycle, but still compatible with the Fed’s inflation goal”.

Source: Goldman

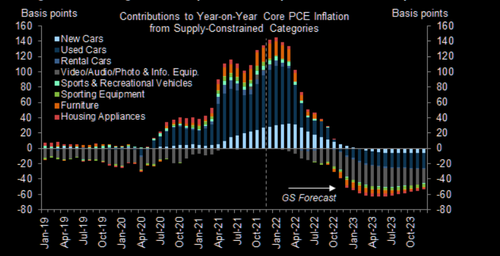

Another inflation contributor coming down…

GS estimate that the contribution to YOY inflation from “Supply-Constrained Categories” will swing from +135bp now, to +145bp in January 2022 and -50bp at end-2022.

Source: Department of Commerce / GS

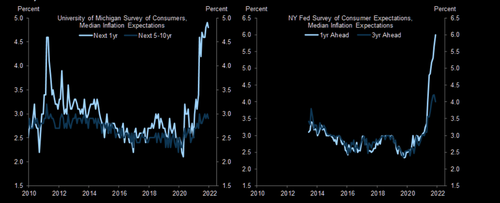

But the household expectations are high…

Long-term household “Inflation Expectations” are near multi-year highs in both the UMich (+2.9%, next 5-10yr) and NY Fed surveys (+4.0%, 3yr ahead).

Source: University of Michigan, Federal Reserve

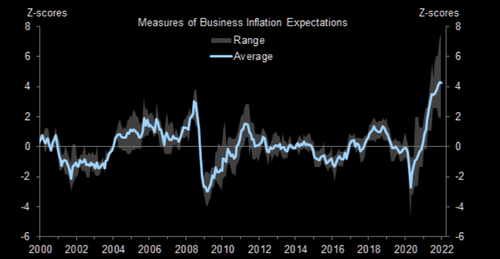

And business expectations are high…

Business inflation expectations have increased to the highest level in at least two decades.

Source: Goldman

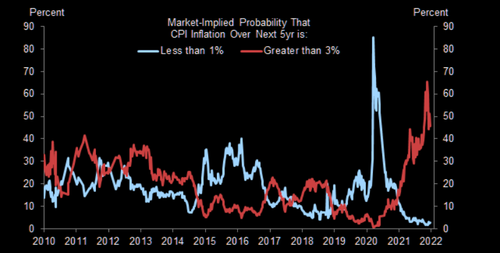

Market pricing of inflation

Market pricing implies a 46% chance of headline CPI inflation exceeding 3% over the next 5 years.

Source: FED

Source link