GBP/USD Technical Forecast for 2022

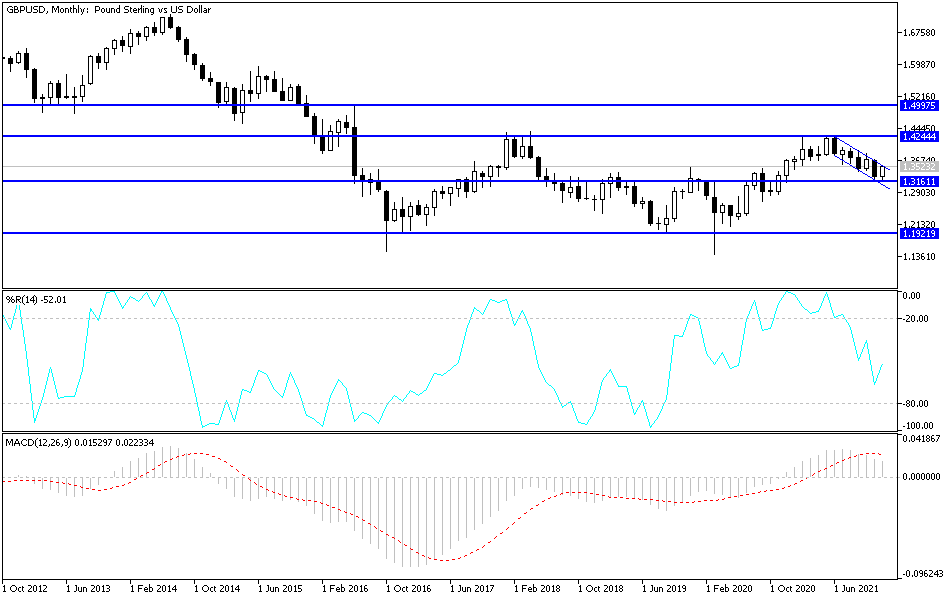

Britain’s progress over the rest of the global economies in the vaccination pace against the pandemic has always been a good reason for the value of the pound to rise strongly against the rest of the other major currencies. The share of the GBP/USD currency pair was the rebound to the higher resistance area 1.4249 since April 2018. Progress continued until the end of the first half of 2021. GBP/USD then returned to retreat timidly in the remainder of the year’s trading, amid the emergence of the new Corona variable, Omicron, which forced the world to re-impose restrictions.

In the last month of the year’s trading, the sterling dollar pair fell to the support area 1.3160 before closing trading stable around the 1.3523 level. The Bank of England was proactive and contrary to expectations, it surprised the markets and raised interest rates. Commenting on this and the forecast, Sean Osborne, chief FX analyst at Scotiabank, said: “The sterling has maintained a decent bullish trend since the days following the BoE’s rate hike in the middle of the month.” “However, markets are still anticipating four 25 basis point hikes by the Bank of England in 2022 that should support the British pound against the euro and the Japanese yen – although gains against the US dollar appear to be more limited with the possibility of a Fed tightening. a similar amount.”

UK labor market figures on December 14 and inflation data from the Office for National Statistics showed CPI rising above 5% for the month of November, which then may have prompted the Bank of England’s decision on December 16 to raise the interest rate from 0.1% to 0.25 %. Doing so will help reduce the rate of inflation. This will take time as we expect inflation to reach around 6% in the spring.

Raising interest rates now will help ensure inflation drops back to our 2% target by the end of 2023, the Bank of England says on its website. This made the Bank of England the first in the Group of Seven major economic central banks to raise interest rates in the wake of the coronavirus crisis.

“The sterling story hasn’t been quite so clear in recent months, but we think investors may have gotten too negative on sterling,” says Michael Cahill, FX analyst at Goldman Sachs. “While sterling will continue to be affected by global sentiment towards risk, and positioning-related flows could overshadow the picture around the end of the year, we believe negative views on sterling are exaggerated,” he added.

For the most part, any further rate increase from the Bank of England would simply reverse the massive bank rate cut from 0.75% announced at the start of the crisis in early 2020, although many analysts expect that process to be Supportive of the pound against a number of major currencies.

GBP/USD Forecast for 2022:

After the Bank of England’s recent decision, expectations are still positive for the future of the GBP/USD currency pair for 2022. The competition in it is a kind of balance between the Bank of England’s recent measures and what the US Federal Reserve will do this year. The psychological resistance 1.4000 is still the key to strength for the performance of the GBP/USD pair in the coming months. Because it moves technical indicators to the upside and increases investors’ optimism towards the pound, which increases buying deals. In the event that the epidemic is contained, and risk appetite increases, it does not rule out moving towards the resistance levels 1.4350 and 1.4660, respectively, according to the monthly chart.

It must be taken into account that sterling gains throughout 2022 may collide with tensions between Britain and the European Union regarding the terms of Brexit and its future, the energy crisis and the political future of the Boris Johnson government. The pandemic in Britain is out of control. On the downside, the psychological support will remain 1.3000 the most important for the selling of sterling dollars. This may open the way to test the stronger descending levels, the most important after that 1.2775 and 1.2230, respectively, and may reach it if the concerns mentioned in the previous lines are realized.

Source link