GBP/USD Technical Analysis: Regaining Pre-Fed Decision

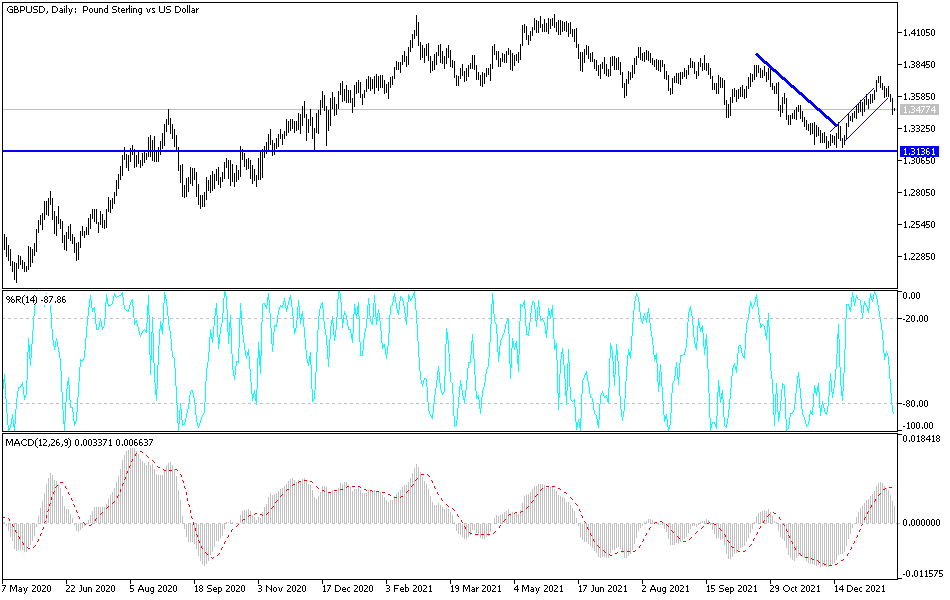

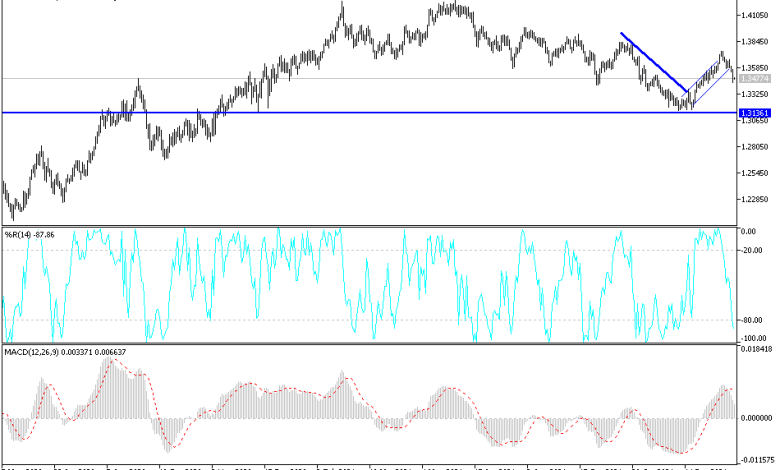

The bears succeeded in pushing the price of the GBP/USD currency pair to breach the most important 1.3500 support. It caused a bullish outlook with losses to the 1.3440 support level, the lowest in three weeks, before settling around the 1.3480 level at the time of writing the analysis. Investors returned to buy the US dollar until the US Federal Reserve announced its monetary policy decisions tomorrow, Wednesday. GBP/USD suffered a setback last week as the greenback found its feet in choppy risk-asset trading, although Sterling remains well supported above the 1.35 resistance and may even try to regain its pre-Fed decision footing.

Sterling was already on the back foot from the dollar’s rally last week when the weak December UK retail sales report pushed GBP/USD below 1.36 on Friday and almost up to the 100-day moving average at 1.3538. Below this area, the 100-day moving average at 1.3543 and the 38.2% Fibonacci retracement of the December-January move at 1.3525 stand as supports. The decline in the pound against the dollar came as it appears that the additional rise in US and global bond yields has exacerbated widespread declines in stock markets, helping the dollar exchange rates to recover from previous losses in what was sometimes choppy trading.

While recent international market volatility could continue, risking sterling in the process, it is likely that the pound-dollar exchange rate losses will be mitigated by the market’s perception that the Bank of England (BoE) is now likely to raise rates once again. Overall, last week’s disclosure of British inflation rising to 5.4% in December maintains the possibility of additional pound-supportive increases in the bank interest rate this year.

According to the technical analysis of the pair: On the daily chart, there was a clear breakout of the bullish channel for the GBP/USD currency pair and stability below the support 1.3500 will support the bears for further launch. The support level is still 1.3330, the most important to change the general trend to a bearish one. Stability is above the resistance 1.3600. I still prefer buying the currency pair from every bearish level. The currency pair will be affected today by the extent to which investors take risks or not, as well as the reaction from the markets’ expectations for the future of raising interest rates, whether from the Bank of England or the Federal Reserve.

Source link