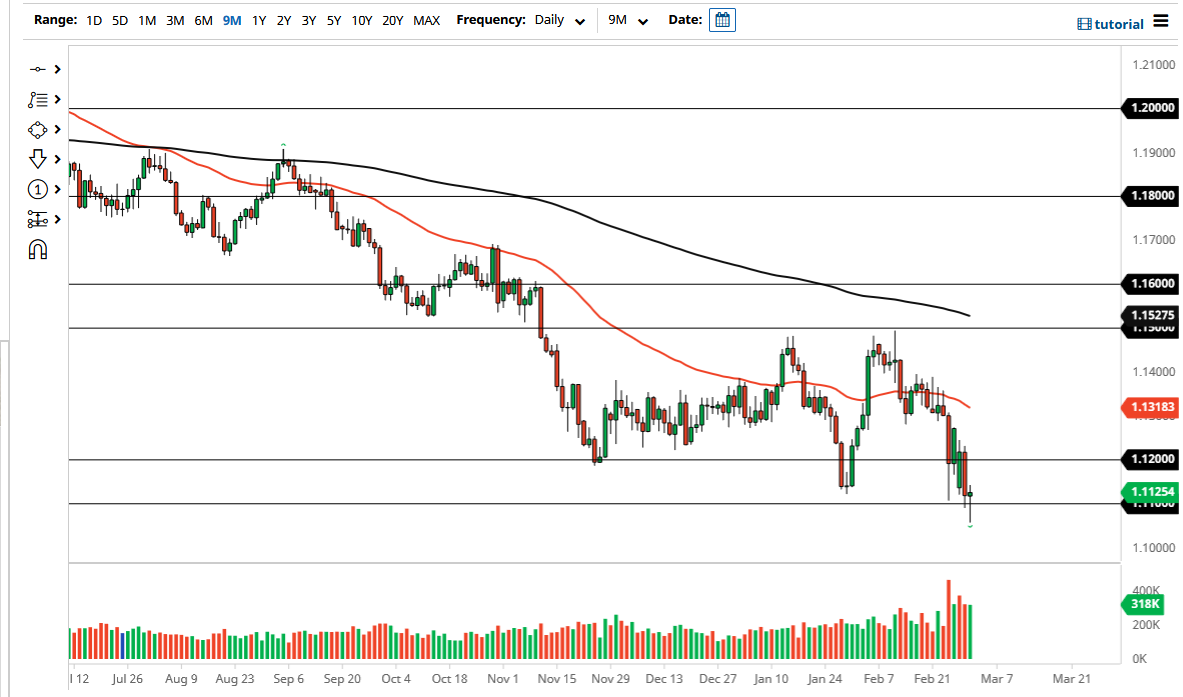

Is the Euro Ready to Turn Around?

We very well could see further selling, but a little bit of a pop higher could be in the cards for the short term.

The euro initially sliced well below the 1.10 level, as there was a major “risk-off” type of situation. By breaking down below that level, it showed just how precarious the situation is for the euro. After all, we have a shooting war in Ukraine, which is right on the doorstep of the European Union. This could continue to be a great barometer for risk appetite overall, as the US dollar is considered to be a safety currency.

The market forming a hammer is of course a very bullish sign, but at this point, I think it is more or less going to be a situation where we would see the euro rally, but this rally will only be a relief rally. After all, the European Union has a whole plethora of issues beyond just the Ukraine situation. Inflation in the European Union continues to be rather hot, but it looks as if the growth of the European Union is slowing down also. In other words, we could be talking about potential “stagflation.”

That being said, if we break down below the bottom of the hammer, it could very well send this market much lower, perhaps reaching down to the 1.10 level underneath. The 1.10 level is a large, round, psychologically significant figure that a lot of people will pay attention to and would offer a certain amount of headline noise to the market.

On the upside, if we were to break above the top of the hammer, it could send this market looking towards 1.12 level. That is where we broke out from and has been an area of interest multiple times. Keep in mind that the interest rate differential most certainly favors the US dollar, and probably will for the foreseeable future. However, we did get a little bit of a reprieve when it comes to risk appetite due to the continued talks between the Russians and the Ukrainians. In fact, they have even mentioned the possibility of a cease-fire, something that will help with risk appetite.

We are in a downtrend, and we did pop below the bottom of the overall consolidation area. This does suggest that we very well could see further selling, but a little bit of a pop higher could be in the cards for the short term.

Source link