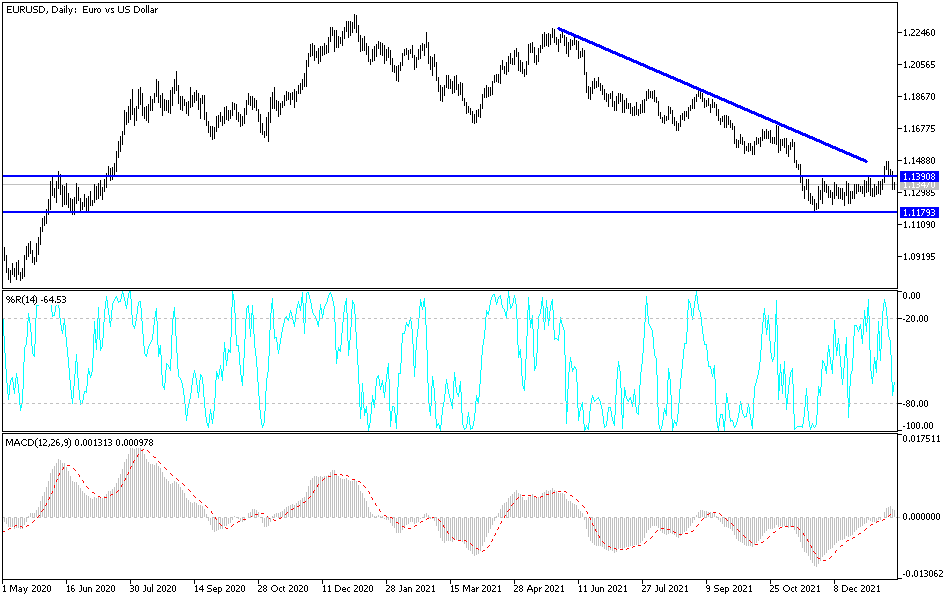

EUR/USD Technical Analysis: Return of Bears Control

In the middle of this week’s trading, the EUR/USD currency pair attempted to recover from the selling operations from the beginning of the week that pushed it towards the 1.1315 support level. The retracement reached the 1.1355 level and is looking for stronger catalysts to rebound higher. The euro weakened against most of the other major currencies amid risk aversion, as US 10-year Treasury yields rose to a two-year high amid growing expectations that the US Federal Reserve would start a tightening cycle in March. Treasuries have fallen across the curve, with the two-year yield hitting the highest level since 2020.

Tech stocks fell on the back of a surge in Treasury yields, which weighed on European stocks. Investors are preparing for the possibility of a more aggressive tightening to contain price pressures. This week, survey results from ZEW – Leibniz Center for European Economic Research showed that German economic confidence improved more than expected to a six-month high in January as the economy is expected to rebound over the coming months. The ZEW Economic Sentiment Index rose to 51.7 in January from 29.9 the previous month. The reading was well above economists’ expectations of 32.0.

The euro fell against the US dollar once again after it climbed higher in the first half of January and boosted confidence among forex analysts who continue to expect an outperformance on the dollar over the coming weeks and months.

The EUR/USD exchange rate traded in a neutral pattern for most of December before climbing higher on January 12th.

The US dollar’s weakness came despite Federal Reserve members directing that US interest rates could rise on four occasions in 2022 while the warning of the need to reverse quantitative easing later in the year has become acute due to high levels of inflation. All of these developments are usually mainly supportive of the dollar, which surprised analysts with its decline even when it was revealed that the inflation rate in the United States reached its highest level since 1982 in December.

Thomas Florey, an expert at UBS, says the euro may eventually rise again against the dollar, but there are several factors that need to evolve before this can happen. He says that global growth, driven by the recovery in emerging markets, would signal a weaker environment for the dollar mainly.

The ECB should feel comfortable about raising rates, something it does not feel comfortable instinctively with the following years of promoting ultra-loose monetary conditions. Accordingly, UBS recently lowered its forecasts for EUR/USD to 1.12 (down from 1.13), 1.10 (down from 1.12), 1.10 (down from 1.11) and 1.10 (unchanged) for each quarter-end period of 2022.

The dollar entered 2022 amid crowded situations with investors and analysts alike waiting for further gains in the currency. As is often the case with crowded trades, any reversal can undo a large position, which appears to have been driving the dollar’s weakness lately.

According to the technical analysis of the pair: So far, the price movement of the EUR/USD is still in a neutral position with a tendency to the downside, especially if it returns to the psychological support level of 1.1300 and below it, and the bears’ control over the trend may increase by moving towards the 1.1280 support levels. It will support expectations to move towards the psychological support 1.1000 as soon as possible. On the other hand, returning to the resistance area of 1.1460, according to the performance on the daily chart, gives the bulls the opportunity to launch again. Today, the euro will be affected by the announcement of the consumer price index in the euro zone. The US dollar will be affected by the announcement of the number of US weekly jobless claims and the reading of the Philadelphia industrial index.

Source link