AUD/USD May Rise on Rosy Chinese PMI Data but Omicron Fears Linger

Australian Dollar, AUD/USD, China PMIs, Omicron, New Year – Talking Points

- Chinese PMIs increase for December, reflecting elevated economic activity

- Australian Dollar remains slightly lower after late-day Wall Street selloff

- AUD/USD battles the falling 50-day Simple Moving Average in APAC hours

Friday’s Asia-Pacific Forecast

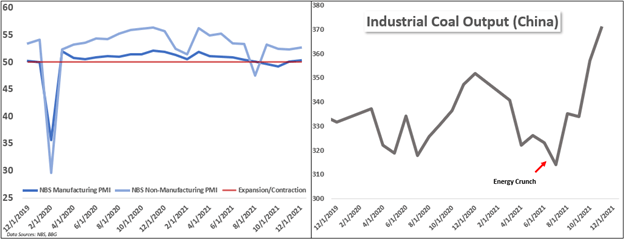

The Australian Dollar may see some upward movement versus the US Dollar after China’s manufacturing and services sectors expanded at a faster rate in December, according to the National Bureau of Statistics (NBS). The non-manufacturing purchasing managers index (PMI) increased from 52.3 to 52.7, and manufacturing PMI increased from 50.1 to 50.3. That was above the Bloomberg consensus figures of 52.0 and 50.0, respectively.

The upbeat figures are an encouraging sign for the Chinese economy, which also has an outsized impact on global GDP growth. A pullback in energy prices likely helped fuel sentiment among PMI survey participants following an energy crunch in October. China’s industrial coal output increased sharply in November as numerous blast furnaces used to produce metals were put back online. A series of actions from the People’s Bank of China (PBOC) likely spurred increased economic activity as well.

Market sentiment broke down late in the New York trading session overnight. The benchmark S&P 500 index closed 0.30% in the red after a late-day selloff, and the tech-heavy Nasdaq 100 index shed 0.38%. New York City shattered its previous daily record for Covid cases at 74,207. The United States saw sharp case increases across the country as Omicron continues to spread like wildfire.

A record increase in Covid-19 cases in New South Wales (NSW) – Australia’s most populated state – is causing concern among policymakers. That is despite NSW boasting a vaccination rate of over 90%, with cases through the last 24 hours soaring by 21,151, according to NSW Health. Victoria – Australia’s second most populated state and home to Melbourne – also reported a record 5,919 increase in Covid-19 cases. That increase coincided with hospitalizations increasing from 395 to 428, although those in intensive care fell. Victoria also has a +90% vaccination rate.

Elsewhere, South Korea reported a 3.7% rise in inflation for December on a year-over-year basis. That was slightly above the consensus analysts’ estimate of 3.6%, according to the DailyFX Economic Calendar. Later today, India will report its current account balance for the third quarter along with external debt. Singapore’s November bank lending data and the Philippines retail price index (Oct) will cross the wires. Trading volumes will likely be lighter than usual today, given it is New Year’s Eve. Markets in Tokyo are closed today.

AUD/USD Technical Forecast

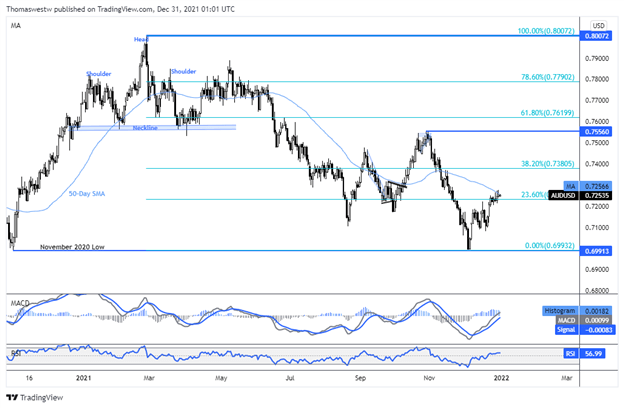

AUD/USD is nearly unchanged in early APAC trading after prices hit a fresh intraday high overnight before trimming gains. The falling 50-day Simple Moving Average (SMA) is providing a level of resistance. A move lower may see support from the 23.6% Fibonacci retracement level after prices struggled to breach the level over the last week. If prices pierce the 50-day SMA, a move up to the 38.2% Fib level may be on the cards.

AUD/USD Daily Chart

Chart created with TradingView

— Written by Thomas Westwater, Analyst for DailyFX.com

To contact Thomas, use the comments section below or @FxWestwater on Twitter

Buka akaun dagangan patuh syariah anda di Weltrade.

Source link