The End of Japan’s Negative Interest Rates: What It Means for Gold

The Bank of Japan’s historic move to end the country’s negative interest rate policy after nearly two decades triggered a jolt upward to new all-time highs for gold against the yen. But what are the implications for gold in the medium and longer term? The answer is far from simple.

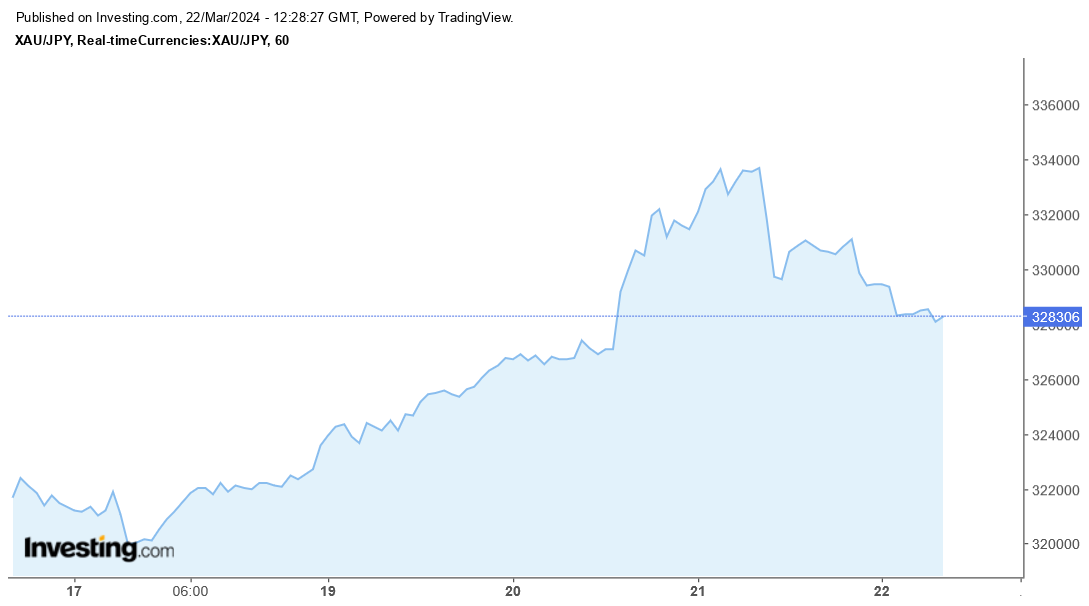

The yen initially rose against gold amidst speculation that the BoJ would increase interest rates for the first time since the 2007 global financial crisis, but as the predictions of a rate hike materialized, gold hit a new record. The price has stabilized (for now) and the yen’s overall reaction has been surprisingly muted as markets digest the official news, marking a historic shift as most central banks prepare to lower their interest rates as they’ve declared victory over increased inflation worldwide.

Gold vs Yen Since Tuesday’s BoJ Decision

The BoJ announced it will now hold short-term rates at a still-accommodative 0% to 0.1% and is getting rid of its yield curve control program and ETF purchases (which had been providing the BoJ with a source of dividend revenue). Despite this, the Nikkei index, which measures the performance of the Tokyo Stock Exchange, reached new all-time highs just a day ago. Strong overseas interest in long-term Japanese bonds has also continued, with $14.26 billion USD pouring in last week.

The rate hike decision signals confidence in the next era for the Japanese economy, which for decades has remained relatively stagnant. Generally, more confidence in broader markets means less demand for gold (especially when compared to recent gold-buying frenzies), but this interest rate hike is unique because other central banks are now preparing to move in the opposite direction, having claimed to have defeated high inflation.

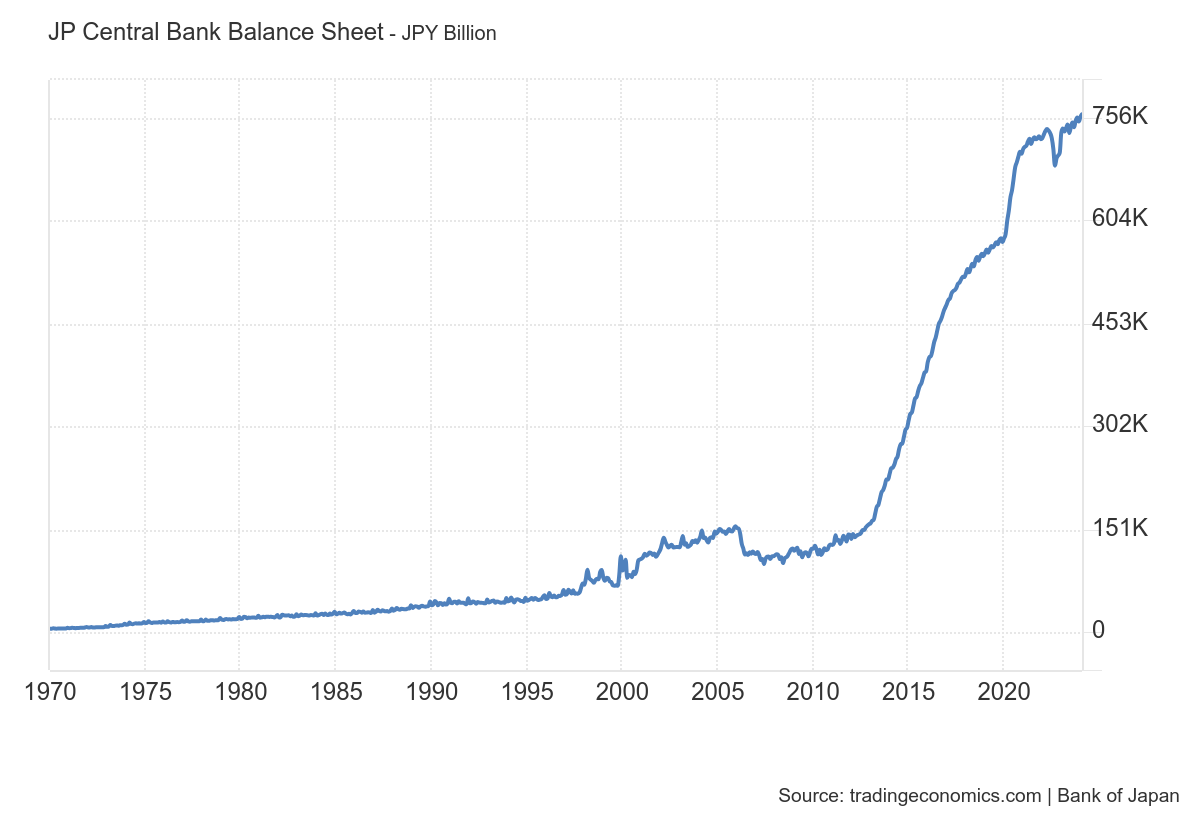

In the US, the national debt has expanded rapidly with higher rates resulting in a higher proportion of the debt constituting interest payments. Similarly, higher rates in Japan will mean a higher cost to service the country’s debt. Meanwhile, after its asset buying program to simulate the economy, in 2018 the BoJ’s assets had already surpassed the country’s nominal GDP.

BoJ’s Balance Sheet Since 1970

Interest rates below 0% in Japan were meant to stimulate banks to make loans to consumers instead of keeping their capital at the BoJ. But if they can get paid more for lending at higher rates to businesses, and convince enough consumers to pay more to borrow, it could lead to more inflation than the BoJ is ready for. It could also mean trouble for smaller businesses that can’t any longer afford to borrow.

While the BoJ wants higher inflation, Japanese consumers have already seen price increases recently, and central banks have a history of missing their mark and backing themselves into a corner in an attempt to reverse it. And as Japan’s economy has been under negative interest rate policy for so long, and inflation increased last year, it would be easy to lose the plot even with a very slow uptick. As Moody’s Stefan Angrick told the Gold Coast Bulletin:

“It wouldn’t take much to do further damage…The BoJ is treading on thin ice.”

If the Japanese consumer sees prices rise too much from increased borrowing and spending, the relative strength of gold is likely to continue increasing. That’s doubly true in the broader context of most central banks preparing to lower rates even as inflationary pressure remains, despite their previous declarations that their policies had tamed it.

Consumer Price Inflation in Japan Since 1996

As the BoJ’s governor Ueda has made it extremely clear that monetary policy will remain accommodative, and a higher inflation target still hasn’t been met, the yen’s exchange rate isn’t poised to dramatically strengthen against gold anytime soon.

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Buka akaun dagangan patuh syariah anda di Weltrade.

Source link