October CPI Cools; Does This Really Mean the Fed Won the War?

For the first time in several months, the Consumer Price Index (CPI) came in cooler than expected in October, supercharging expectations that the Federal Reserve can relent on its inflation fight.

But is the optimism premature?

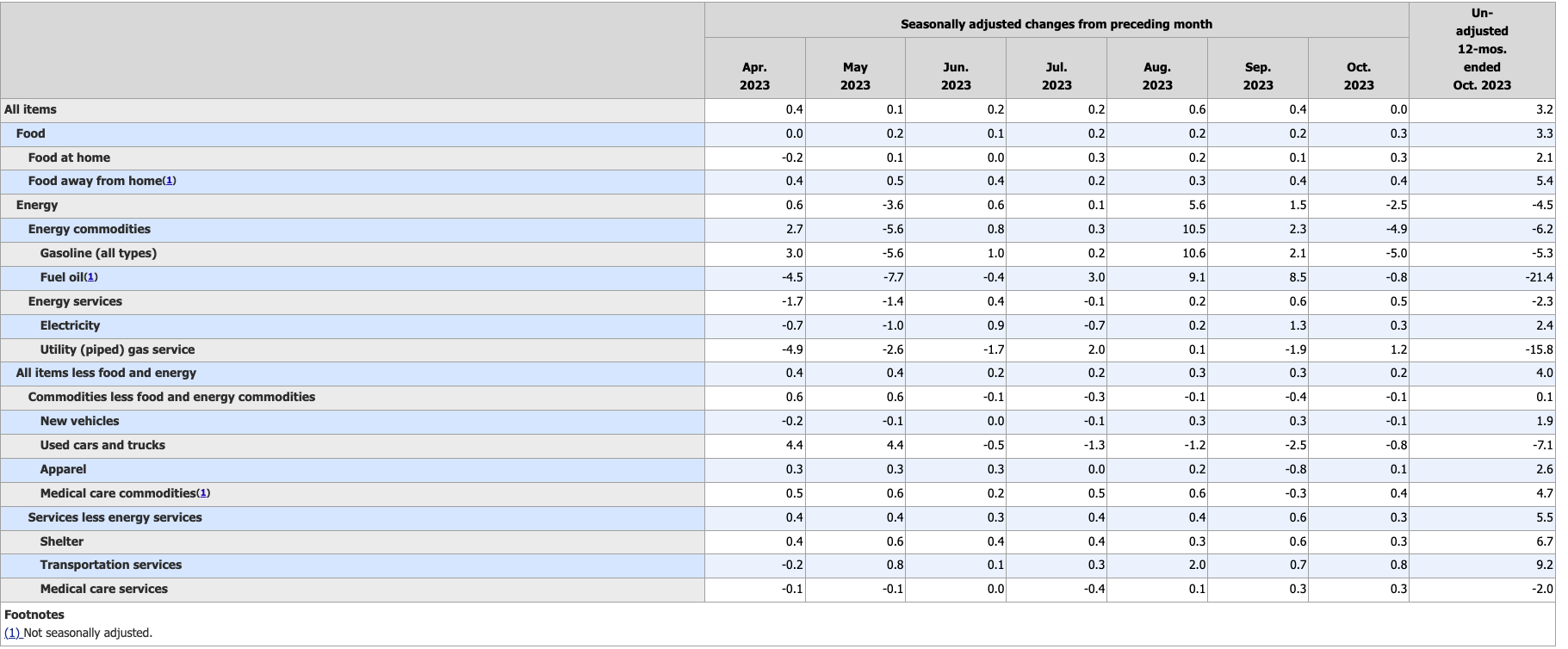

Consumer prices were flat month-on-month in October, according to the latest data from the Bureau of Labor Statistics. This was below the expectation for a 0.1% increase.

On an annual basis, prices rose 3.2%. That was down from a 3.7% reading in September and lower than the 3.3% forecast.

Factoring out gasoline and food costs, we continue to see inflationary pressure. (Not that normal people can just “factor out” food and energy.) Core CPI, stripping out more volatile food and energy prices rose 0.2% month-on-month. It was a tick lower than the 0.3% increase in September but in line with June and July’s data. The annual core CPI was 4.0%, down slightly from 4.1% in August.

Looking at the monthly increases so far in 2023 reveals that core CPI remains sticky. It rose by 0.4% in January, 0.5% in February, 0.4% in March, 0.4% in April, 0.4% in May, 0.2% in June and July, 0.3% in August and September, and 0.2% in October. That averages to 0.33% per month or 4.0% annually – still more than double the Fed’s 2% target.

To put the monthly core CPI increase in perspective, you would need to average just under 0.17% to hit the 2% annual target.

Keep in mind, inflation is worse than the government data suggest. This CPI uses a formula that understates the actual rise in prices. Based on the formula used in the 1970s, CPI is closer to double the official numbers.

Even accepting the government data, every number remains well above the Fed’s 2% target.

Price inflation continues to eat away at workers’ paychecks. Inflation-adjusted average hourly earnings increased modestly by 0.2% on a monthly basis in October. But on the year, real average hourly earnings have increased by just 0.8%, according to a separate Labor Department release. When you consider the government numbers understate increasing prices, it’s clear workers are rapidly losing ground to skyrocketing prices.

Looking more deeply at the data, a big drop in energy prices drove overall CPI lower. In aggregate, energy prices declined by 2.5% month-on-month, with gasoline prices dropping by 5%. But food prices continued to tick up, rising by 0.3% from last month. Shelter prices also continued their relentless march upward, increasing by 0.3% month-on-month and 6.7% on an annual basis.

Services (minus energy services) CPI charted a 0.3% increase on a monthly basis with the annual rise coming in at 5.5%. Service prices are considered a leading indicator of future price inflation.

REACTION

Stocks rallied on the news, along with bonds (with falling yields). Gold also charted a big gain in the hours after the BLS report as the CPI data reinforced the belief that the Fed can now end its inflation fight. Even before the CPI data release markets were pricing in 75 basis points of rate decreases in 2024.

One portfolio manager told CNBC, “The Fed looks smart for effectively ending its tightening cycle as inflation continues to slow. Yields are down significantly as the last of investors not convinced the Fed is done are likely throwing in the towel.”

An economist chimed in calling the October report “a game changer.

We’re having a day of rational exuberance, because the data clearly show what we’ve been waiting for for a long time, which is a crack in the shelter component.”

In a podcast before the CPI data came out, Peter Schiff said investor optimism was at odds with reality and price inflation isn’t dead and in the grave.

Prices are going to keep on rising because the budget budget deficits are skyrocketing. The money printing is going to continue. The inflation burden is going to be heavier, and heavier, and heavier. And this consumer, who has already been shot up, is going to get shot some more.”

After the October CPI data came out, he warned not to get too caught up in the hype.

Don’t be fooled by Oct.’s flat #CPI. It’s just one month and it was only .1% lower than expectations. YoY headline is still 3.2% and core is still 4%. The #inflation numbers have been bottoming and future CPI numbers will be much hotter, even as the economy cools. #Stagflation!

— Peter Schiff (@PeterSchiff) November 14, 2023

Ironically, an end to rate increases, subsequent rate cuts, and loosening monetary policy will eventually lead to more price inflation. In other words, as soon as the Fed declares victory, inflation wins.

How?

Because rising prices are a symptom of monetary inflation. And monetary inflation is exactly what we will get when the central bank reverts to a looser monetary policy.

In fact, Jim Grant pointed out that the Chicago Fed’s Financial Conditions Index reveals financial conditions are looser than average even after the Fed’s “short of zero to 60 in six seconds of rate increases.”

Schiff noted that any indication of victory over price inflation would produce a sharp decline in the dollar’s exchange rate.

If the Fed ever declares victory in the war, the dollar will collapse. A weakening dollar will put renewed upward pressure on producer and consumer prices.”

He also pointed out that contrary to popular belief, a slowing economy will exacerbate inflationary pressure.

As the economy slows budget deficits will rise and the dollar will fall. These developments will lead to even more inflation, which will push both long-term bond yields and consumer prices much higher.”

While the October CPI data may reflect a slowdown in rising prices and create a sense of optimism, it seems a bit premature to think that price inflation is a thing of the past.

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Buka akaun dagangan patuh syariah anda di Weltrade.

Source link