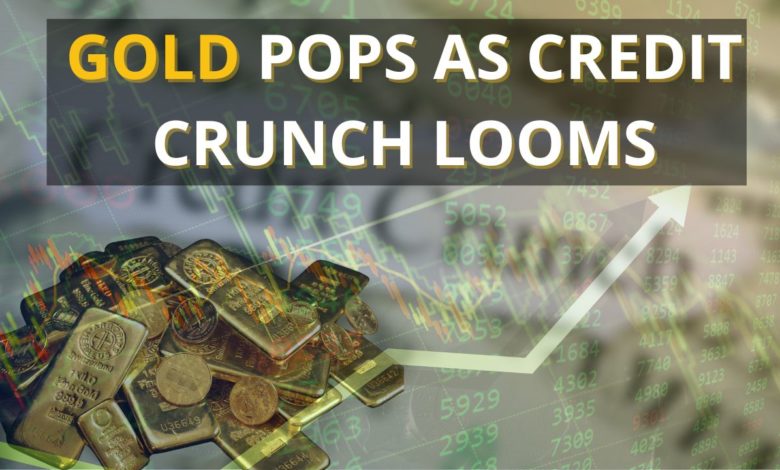

Gold Pops as Credit Crunch Looms

The double figure pop up in gold on Tuesday was more to do with weakening of the US dollar, than rampant gold demand itself. The significant drop in the fiat currency was largely thanks to the release of October’s CPI report. Echoing that of the previous month, the report showed weaker growth and lower than expected inflation. This has left some calling for the Fed to not only pause its rate hikes but also to do so earlier than expected. The very modest drop in the gold price yesterday was thanks to a small recovery in the US Dollar, the fact that gold barely dropped in price just shows how much support it continues to pull in from CPI and PPI reports.

US avoids Shutdown…again…

In news that will come as no surprise to anyone, the US government has ‘narrowly’ avoided a shutdown after the Senate passed a bill yesterday in a ‘race against the clock’ to pull a deal together. We could bore you with the minutiae of the deal but that would then set a precedent to explain the deal every time this happens, and it happens a lot so…we’re not going to start something we’re not going to finish.

Christmas Credit Crunch

As ever it makes sense to look at what is happening behind the official data releases that are much hyped by central banks and advisers. We are of course referring to the Federal Reserve SLOOS report (Senior Loans Officer Opinion Survey) which indicated that there is an ongoing tightening in lending standards. Great! You may cry, they should be more responsible! Yes, absolutely…perhaps. But the US economy (like all major economies) is one built on the back of credit. If these cautious lending practices turn out to mean a drop in actual lending, then that could point to a credit crunch and so a recession. Quite the bookend to a year that started with tumultuous activity in the banking sector.

The UK isn’t inflating as fast as it was, but it’s also not doing anything at all…

In the UK there was apparently cause for celebration when inflation figures for October showed that the growth in prices was starting to slow down. This preceded the growth figures which showed that whilst things were better than the 0.1% predicted slowdown in the economy, the UK is looking at a protracted period of stagnation and a near horizontal growth line.

Currency Wars – done and dusted?

Of course, the big news in the US has been the meeting between President Biden and Xi Jinping (standby for the fallout from the former calling the latter a ‘dictator’ immediately after said meeting). For many years the two countries of which the men preside over were the biggest players in Currency Wars. A term that dominated economic news prior to the pandemic. The term draws fewer headlines. Currency wars, as long as fiat rules, will always exist but we are in a very clear ‘lull’ in the long and protracted battle that has raged between the US and China for many years.

At the moment there is a general sense that there is no immediate threat to the US Dollar. It is still the reserve currency of choice, and China still chooses to hold its own reserves in dollars. Whether due to the timing of the report or just a shift in outlook, the Treasury’s bi-annual currency report did not reference China as a ‘currency manipulator’ of which it has done previously.

This is not to say that we can label past accusations of currency manipulation by the Americans towards China as contretemps of times gone by. Instead we would suggest that right now it isn’t front and centre of currency management. China has always been one to take its time with any policy. It has placed heavy focus and significant resources on shoring up its reserves with gold and stabilising the renminbi rather than weakening it against competitor currencies. Given how weak China’s economic growth has been this past year, and Trump’s possible re-election, we suggest that both countries will return to the battlefield as economic growth becomes a major focus for each of them.

GOLD PRICES ( AM/ PM LBMA FIX– USD, GBP & EUR )

| USD $ AM |

USD $ PM |

GBP £ AM |

GBP £ PM |

EUR € AM |

EUR € PM |

|

|---|---|---|---|---|---|---|

| 15-11-2023 | 1973.40 | 1958.20 | 1583.65 | 1578.11 | 1818.29 | 1807.22 |

| 14-11-2023 | 1946.55 | 1969.05 | 1583.13 | 1580.36 | 1814.57 | 1817.63 |

| 13-11-2023 | 1937.45 | 1931.15 | 1582.70 | 1577.36 | 1812.29 | 1808.14 |

| 10-11-2023 | 1953.45 | 1941.65 | 1599.29 | 1591.57 | 1830.38 | 1819.91 |

| 09-11-2023 | 1946.75 | 1957.45 | 1584.27 | 1593.17 | 1821.18 | 1825.71 |

| 08-11-2023 | 1960.10 | 1959.35 | 1599.64 | 1595.89 | 1837.99 | 1833.36 |

| 07-11-2023 | 1967.80 | 1960.70 | 1598.44 | 1594.44 | 1839.70 | 1836.39 |

| 06-11-2023 | 1987.10 | 1984.60 | 1600.41 | 1601.57 | 1848.20 | 1847.86 |

| 03-11-2023 | 1988.50 | 1994.45 | 1627.59 | 1615.90 | 1868.20 | 1860.42 |

| 02-11-2023 | 1986.70 | 1983.60 | 1629.49 | 1628.54 | 1869.48 | 1864.58 |

| 01-11-2023 | 1982.50 | 1986.35 | 1633.38 | 1634.17 | 1879.61 | 1881.47 |

Buy gold coins and bars and store them in the safest vaults in Switzerland, London or Singapore with GoldCore.

Learn why Switzerland remains a safe-haven jurisdiction for owning precious metals. Access Our Most Popular Guide, the Essential Guide to Storing Gold in Switzerland here

Receive Our Award Winning Market Updates In Your Inbox – Sign Up Here

Source link