Hotter Than Expected CPI – A Recurring Theme

“Hotter than expected.”

This seems to be a recurring theme when it comes to price inflation.

The September CPI data gave us another variation on that tune. And it should once again remind us that the Federal Reserve is nowhere near its 2% target.

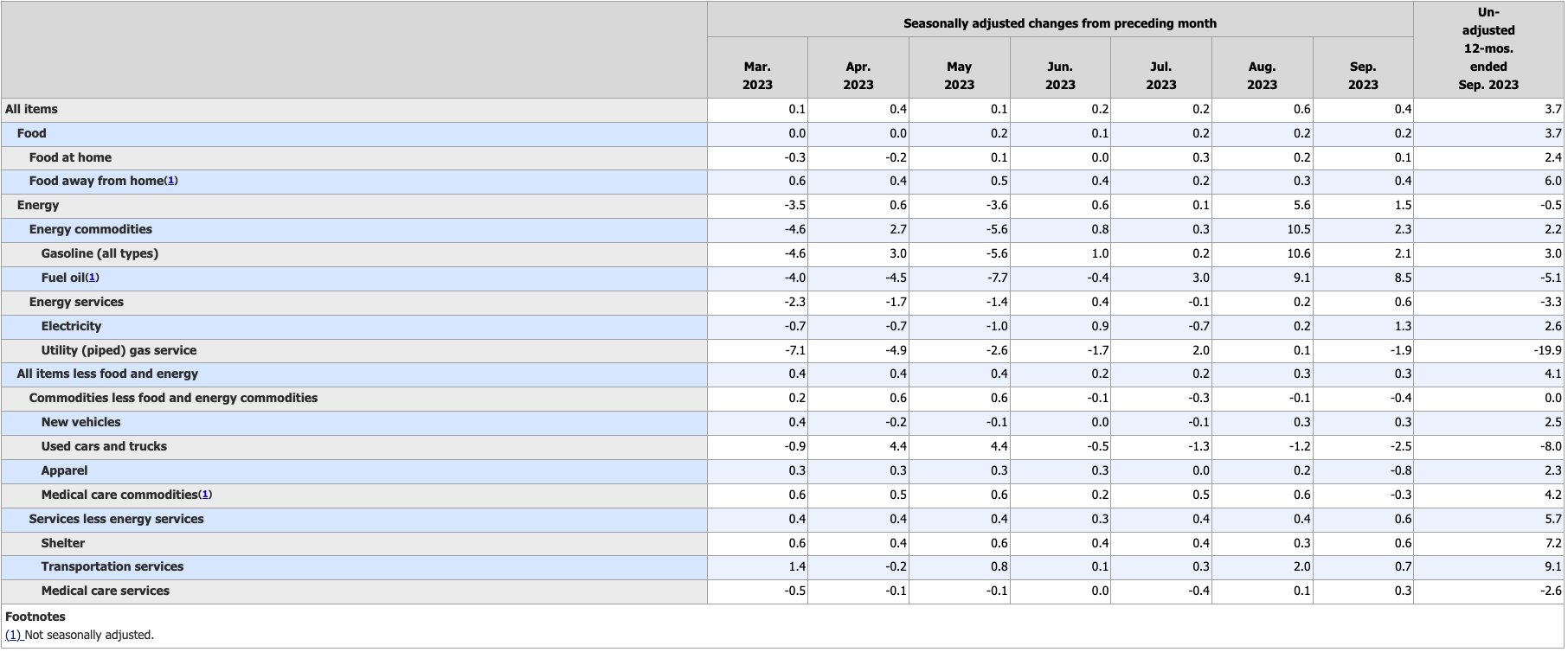

Consumer prices rose 0.4% month-on-month in September, according to the latest data released by the Bureau of Labor Statistics (BLS). The expectation was for a 0.3% increase. The headline annual CPI was up 3.7%, mirroring the rate in August. The expectation was for a slight drop to 3.6%.

CPI jumped despite moderating energy prices. Gasoline prices rose another 2.1% month-on-month, but that pales in comparison to the 10%-plus increase in August.

Even factoring out gasoline and food costs, we continue to see inflationary pressure. (Not that normal people can just “factor out” food and energy.) Core CPI, stripping out more volatile food and energy prices rose 0.3% month-on-month for the second straight month. This is a tick higher than the 0.2% increase in June and July. The annual core CPI was 4.1%, down from 4.3% in August.

The drop in annual core CPI is largely a function of math as large increases in the core CPI last year are rolling out of the calculation. We saw the same thing happen over the summer when the biggest CPI jumps dropped out of the annual calculation and the headline rate plunged.

Looking at the monthly increases so far in 2023 reveals that core CPI remains sticky. It rose by 0.4% in January, 0.5% in February, 0.4% in March, 0.4% in April, 0.4% in May, 0.2% in June and July, and 0.3% in August and September. That averages to 0.34% per month or 4.1% annually – still more than double the Fed’s 2% target. And if you annualized the last two months, core CPI would remain elevated at 3.6% — also not 2%.

To put the monthly core CPI increase in perspective, you would need to average just under 0.17% to hit the 2% annual target.

Keep in mind, inflation is worse than the government data suggest. This CPI uses a formula that understates the actual rise in prices. Based on the formula used in the 1970s, CPI is closer to double the official numbers.

Looking more deeply into the data, shelter costs were a big factor in the overall CPI increase, rising 0.6% for the month and 7.2% year-on-year. The big month-on-month rise in shelter costs broke a trend of moderating prices that had been in place since May.

Services (minus energy services) CPI also charted a big jump, up 0.6% on a monthly basis. Service prices are considered a leading indicator of future price inflation.

Food prices continued to increase at a steady clip, rising 0.2% for the third month in a row.

On the positive side, the price of used vehicles continued to plunge. Apparel and medical service commodities also recorded falling prices.

Peter Schiff summed up the latest CPI data in a post on X.

Today’s .4% rise in Sept. #CPI, including a .3% rise in core, further confirms that the #Fed is no where near achieving its 2% annualized #inflation target. YoY headline CPI is 3.7% and YoY core is 4.1%. When will investors finally figure out that the inflation war has been lost?

— Peter Schiff (@PeterSchiff) October 12, 2023

Price inflation continued to squeeze American’s wallets last month with real average hourly earnings dropping -0.2%.

MORE BAD NEWS

There was more bad news on the inflation front with producer prices rising 0.5% in September, according to BLS data released Wednesday. That pushed the annual PPI up to 2.2%, the highest level since April.

The consensus projection was a 0.3% increase.

Over the last 12 months, the increase in producer prices had slowed to as low as 0.2% in June, but PPI has been on the rise since.

Core PPI was up 0.3%, versus the forecast for a 0.2% gain.

Prices for final demand goods surged 0.9% on the month. This was primarily driven by a 5.4% increase in gas prices. But food prices also charted a significant gain of 0.9%.

Prices for final demand services increased 0.3%.

Producer prices are generally considered a leading indicator of future hikes in consumer prices since consumer prices typically lag behind producer prices. As Peter Schiff put it in a podcast, “Before businesses can pass on their higher costs, to their customers, they have to experience those higher costs themselves.”

In other words, a spike in producer prices may spill over into CPI down the road, meaning consumers could see more price hikes in the months ahead as businesses pass on at least some of their costs to customers.

As one economist told CNBC, the PPI report “suggests we haven’t seen the end of sticky inflation — and high interest rates.”

THE FED IS IN A CORNER

Sticky price inflation has the Federal Reserve backed into a corner. Although they haven’t said so publicly, the central bankers would almost certainly like to ease off the interest rate gas pedal. They know that the economy is riddled with debt and can’t function in a high interest rate environment. On the other hand, the Fed can’t plausibly loosen monetary policy with price inflation more than double the mythical 2% target.

Nevertheless, the markets remain sanguine and seem to believe the Fed is finished hiking — if not very close. They also believe the central bank will start cutting rates in the near future — and there won’t be a recession.

As Peter Schiff said after the August CPI came in hotter than expected, the mainstream just doesn’t seem to get it.

I think the more important aspect of the inflation data was how few people seem to comprehend what it means. Most of the talk I hear by the talking heads on the financial media is that everything is great. The inflation threat is pretty much behind us. Yeah, there are a few more bumps in the road, but we’re on the road to 2%. No problem. We’ll be there. The Fed is going to be cutting interest rates by next year, so these high rates aren’t really a problem. It’s just a temporary nuisance until we get back to low rates.”

It remains to be seen whether or not another “hotter than expected” CPI report will dampen the enthusiasm of those have have remained wildly optimistic that the Fed is close to winning the inflation fight. But at some point, they will have to face reality.

Last month, Schiff said the inflation fight was over — and inflation won.

It’s obvious to anybody who opens their eyes that inflation is not topped out and coming down. It’s bottom out and going up. And the people who are blind to this, who are asleep, they are in for a rude awakening. That is a lot of investors.”

Not much has changed.

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Buka akaun dagangan patuh syariah anda di Weltrade.

Source link