Chinese Gold Demand Shows Strong Growth Through First Nine Months of 2023

Chinese gold demand was up 7.3% year on year through the first nine months of 2023.

China ranks as the world’s biggest gold market, and Chinese demand has a significant impact on the global gold market.

According to the China Gold Association, China consumed 835.07 tons from January 1 through the end of September.

Demand for gold coins and gold bars surged in China through the first nine months of the year, rising 15.98% from the same period in 2022. Chinese investors bought 222.37 tons of physical gold in the form of bars and coins.

Chinese investors have also put money into gold-backed ETFs. As a result, ETF gold holdings rose by 9.53 tons in the third quarter alone. Total gold holdings in China-based ETFs stand at around 57 tons.

The strong third quarter completely reversed H1’s minor ETF outflows. On the year, collective ETF gold holdings are up by 16% or 8.3 tons.

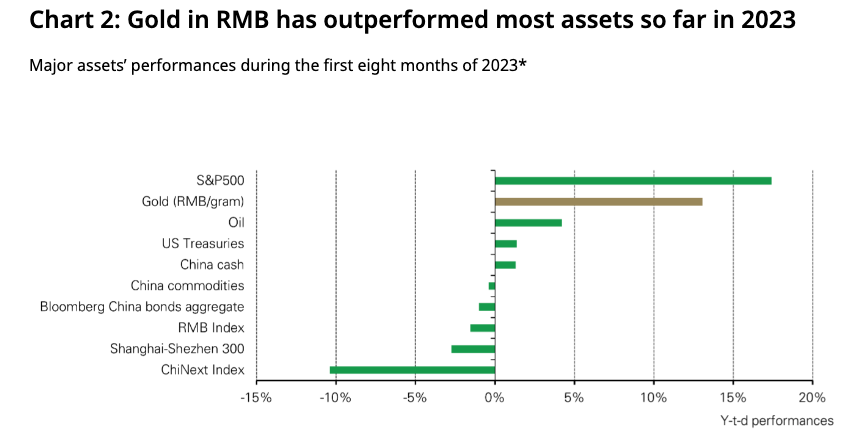

Gold outperformed most other assets in China through August, according to data from the World Gold Council.

Gold jewelry sales were also up from January through September, rising 5.72% to 552.04 tons.

The only decline in gold demand was in the industrial sector with a 5.53% decrease to 60.66 tons.

Demand for gold in China has pushed the Shanghai-London gold price premiums to record highs. In September, the Chinese gold premium averaged $75. That obliterated the old record of $40 set just one month earlier.

According to the World Gold Council, the local gold price in China is normally higher than its international peers. This is primarily due to supply constraints. Prior to the pandemic, over 60% of China’s gold supply came from imports, as domestic production simply could not meet demand. Recent import controls have tightened the gold supply in China, increasing the premium.

Wholesale demand for gold in September indicates the Chinese are not losing their appetite for gold. According to the WGC, gold withdrawals from the Shanghai Gold Exchange registered a seasonal month-on-month rebound of 9 tons. Wholesale gold demand came in at 170 tons in September, slightly above the five-year average of 166 tons. According to the WGC, “The industry’s active stock replenishing ahead of the Golden Week Holiday added to support from key jewelry fairs – which boded well for the jewelry trades – drove the seasonal rise.”

The Chinese central bank also continued to stockpile gold in September, adding another 26 tons to its reserves. It was the 11th straight month of gold purchases for the People’s Bank of China. The Chinese central bank has increased its official reserves by 192 tons since the beginning of the year and 243 tons since it resumed official purchases last November.

Meanwhile, the Chinese have been shedding dollar-denominated assets. Chinese investors sold $21.2 billion in US assets in August alone – primarily US Treasury bonds.

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Buka akaun dagangan patuh syariah anda di Weltrade.

Source link