Fed snatches the punch bowl away from Wall Street’s party: Morning Brief

This article first appeared in the Morning Brief. Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET. Subscribe

Thursday, January 6, 2021

Rate hikes no longer theoretical, but ‘front and center’

On Wall Street, there’s an old saying that refers to the market’s reaction to Federal Reserve policy that may be negative for stocks, and implies that investors are having the time of their lives.

“Snatching the punch bowl away from the party,” an old trader aphorism that mostly presages higher rates and tighter monetary policy, is the best way to describe Wednesday’s market action after the release of the minutes from the Fed’s last meeting.

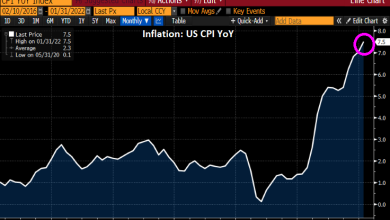

The news confirmed much of the market’s current bias for restrictive monetary policy, and the Fed’s hawkish pivot on surging inflation. But it also crystallized the threat of something that for investors, was once distant — but can no longer be delayed or compartmentalized.

With labor conditions tighter than a drum and prices climbing relentlessly, the era of easy monetary accommodation is nearing its end. Like The Chambers Brothers once sang, “time has come today” – and it’s unlikely to be deterred by Omicron, or much else.

“Elevated inflation is not a new story, but the Fed is an evolving one,” noted Padhraic Garvey, ING’s regional head of research: Now that 2022 is here, the fears of last year — including tapering of bond purchases and higher rates are “front-and-center, which helps to concentrate minds.”

Stocks immediately got the message that the party is wrapping up, with the S&P 500 (^GSPC) having its worst day since November, and the Nasdaq (^IXIC) suffering its worst session since late March.

“There is no question that Fed members are becoming more worried about the higher inflation that they’ve so aggressively tried to stoke,” Peter Boockvar, chief investment officer at Bleakley Advisory Group, said on Wednesday.

Specifically, the veteran market watcher cited the Fed’s concern that inflation was outstripping the ability of lower income earners as a surprise. And perhaps more ominously, businesses appear confident that “they would be able to pass on higher costs of labor and material to customers [an outcome The Morning Brief sounded the horn about last year],” the minutes said.

Not only is the central bank openly musing about higher rates and a quicker end to bond-buying stimulus, policymakers are also entertaining the once unthinkable: a reduction of a balance sheet that’s been swollen since the 2008 financial crisis.

Taken together, it means asset markets that have become “quite spoiled” by Fed liquidity are about to go cold turkey.

“We believe that the dominant theme for the market in 2022 is not Fed rate increases but rather the reduction of liquidity injections that the Fed will complete by the end of the first quarter,” noted Jay Hatfield, CIO of Infrastructure Capital Management.

“The Fed’s unprecedented injection of $120 billion of liquidity into the capital markets per month heavily favored higher risk, speculative investments such as meme stocks, money losing concept stocks and cryptocurrency,” Hatfield added.

As a result, stocks, cryptocurrencies and bonds — which are more of a safe-haven but reacting to inflation expectations – are all selling off simultaneously. That’s prompted some investors to return to another asset once left for dead: gold (GC=F), which is zeroing in on last year’s high above $1,900 per ounce.

“Gold to me is an underrated asset right now,” InTheMoneyStocks president and CFO Gareth Soloway told Yahoo Finance Live on Wednesday.

“I actually have it beating the S&P 500 as well as bitcoin for this year. … Bitcoin and cryptocurrencies are going to see their dot com moment over the next year or two,” he added.

Correction: In Tuesday’s edition, I mistakenly referred to Apple approaching Tesla for a potential tie-up, but it was actually the reverse. Thanks to the eagle-eyed reader who spotted that.

By Javier E. David, editor at Yahoo Finance. Follow him at @Teflongeek

—

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Instagram, YouTube, Facebook, Flipboard, and LinkedIn

Buka akaun dagangan patuh syariah anda di Weltrade.

Source link