Gold Up 5.4% Through First Half of 2023

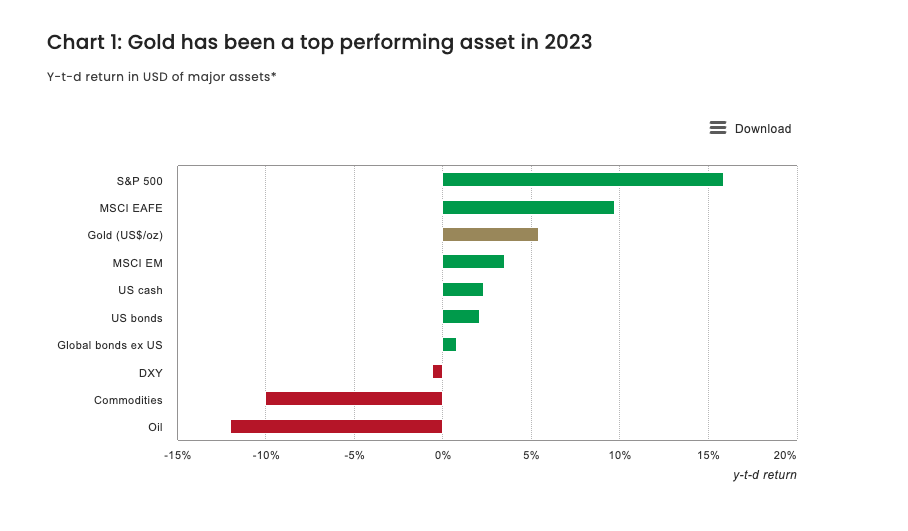

Despite a lackluster June, the price of gold rose 5.4% through the first six months of 2023 and was the second-best performing asset class behind only developed market stocks.

Gold closed at $1,912.25 on June 30.

Gold outperformed emerging market stocks, the US dollar, US bonds, global bonds, commodities and oil. The only asset class that outperformed gold in H1 was developed market stocks thanks to what Peter Schiff called a bear market rally.

Gold enjoyed this healthy gain despite significant headwinds. In fact, the World Gold Council’s Gold Return Attribution Model (GRAM) estimated a 4% drop in the gold price through H1.

The GRAM is a statistical breakdown of the main factors driving monthly changes in the spot gold price based on four drivers that have been shown to reliably explain gold’s price behavior since 2007 — economic expansion, opportunity cost, risk and momentum.

There were several factors pressuring gold through the first half of the year.

Bond yields remained at higher levels through much of the year. This typically creates a drag on gold demand as investors pour money into higher-yielding assets.

Dollar strength has also worked against gold, although the impact has been less significant than in 2022. Dollar strength versus the yen, the Canadian dollar and the Australian dollar was offset somewhat by weakness against the euro.

Both dollar strength and higher bond yields were supported by continued Federal Reserve monetary tightening. Even with a rate hike pause in June, hawkish Fed talk continued to spook markets, support dollar strength and pressure bond yields higher.

Price momentum to the downside and gold ETF outflows also pressured gold, particularly in the last two months of Q2.

Central bank gold buying and risk hedging during the banking meltdown in March supported the price of gold in H1 and offset these headwinds.

Looking ahead, central bank gold buying will likely continue into the foreseeable future. According to the 2023 Central Bank Gold Reserve Survey released by the World Gold Council, 24% of central banks plan to add more gold to their reserves in the next 12 months. Seventy-one percent of central banks surveyed believe the overall level of global reserves will increase in the next 12 months. That was a 10-point increase over last year.

From a macroeconomic standpoint, the mainstream seems to be expecting one or two more rate hikes followed by an extended “hold” period. According to the World Gold Council, “As monetary policy likely transitions from tightening to on-hold, market consensus is for a mild contraction in the US this year, and slow growth in developed markets.”

Should this scenario play out, our analysis suggests that gold will remain supported in 2023, especially given its robust performance in H1. But it may not break out significantly from the range we have seen so far this year.”

In my view, the mainstream is underestimating the extent of the looming economic downturn and the potential for a big breakout for gold.

And even though the Federal Reserve and the US government managed to paper over the banking crisis with a big bailout, it’s only a matter of time before something else breaks in the economy. The economy is addicted to easy money and the Fed has taken that away. The economy isn’t built to function in a high-interest-rate environment. Even Fed economists are warning of a looming catastrophe. According to a recently published note, an unprecedented number of distressed companies could collapse due to the recent increase in interest rates.

These factors should not only support the price of gold through the second half of 2023, a deep recession and loose monetary policy by the Fed in response could pave the way for a significant run-up.

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Buka akaun dagangan patuh syariah anda di Weltrade.

Source link