Services Price Inflation at Highest Level Since 1984

Energy prices have moderated and the price of some goods has dropped in recent months, but the cost of services continues to rise at a red-hot pace and is at the highest level since 1984.

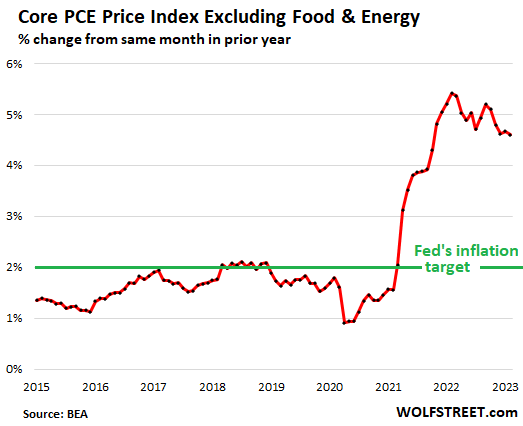

As a result, the core personal consumption expenditures price (PCE) index rose by 4.6% year on year. This is yet another signal that the Federal Reserve is not anywhere close to winning the inflation fight.

The core PCE is the Fed’s favorite inflation number because it understates the rise in prices the most. But even by this measure, the central bank is nowhere near the mythical 2% target.

The headlines trumpeted a “moderation” of the overall PCE with the monthly rate increasing by 0.3%. That was lower than the projected 0.5% rise.

LPL Financial chief economist Jeffery Roach told CNBC, “The inflation trend looks promising for investors. Inflation will likely be below 4% by the end of the year, giving the Federal Reserve some leeway to cut rates by the end of the year if the economy falls into recession.”

It’s difficult to figure out how he came to that conclusion because the headline number hides an unpleasant reality. Despite the sanguine headlines and mainstream assurances, there is no indication that price inflation is going to suddenly go away. I shouldn’t have to say this, but apparently, I do — that core PCE reading remains well above the Fed 2% target.

WolfStreet noted that core CPE is “at nose-bleed levels at well over twice the Fed’s target.”

And if you look at the recent trend, it doesn’t engender much optimism.

Before the most recent 4.6% rise, core PCE increased by 4.7% in January and 4.6% in December, so it has been basically unchanged for three months.

Month on month, core PCE has jumped up and down in the same range since 2021. So, despite the mainstream article that gives the impression prices are dropping based on the PCE, the inflationary cooling has stagnated and it continues to run more than 2% above the Fed target.

Meanwhile, service expenditures are at the highest level since 1984. Two-thirds of consumer spending is on services. The PCE index for services rose by 5.6%. in February, the same as the annual increase charted in January.

Meanwhile, the Fed has started creating more inflation. In just the first two weeks of its bank bailout, the central bank added nearly $400 billion to its balance sheet.

In other words, despite raising interest rates another 25 basis points at its last FOMC meeting, the Fed has effectively waved the white flag and started a controlled retreat in its battle with inflation.

The collapse of Silicon Valley Bank and Signature bank was the first sign of things breaking in this bubble economy. The Federal Reserve and US Treasury rushed in with a bailout scheme that includes a program allowing banks to borrow money using bonds that have been significantly devalued by rate hikes as collateral based on their face value. This seems to have stabilized the banking sector for the time being. But the collapse of these banks reveals the fact that this economy can’t run in a high interest rate environment. It’s only a matter of time before something else breaks.

While the bailout may have bought the Fed some time to carry on the inflation fight theater for another act or two, this bailout scheme was effectively a return to money creation and an end to monetary tightening.

The economist quoted by CNBC is likely correct. The Fed will start cutting interest rates to deal with a recession. But it almost certainly won’t have inflation “under control.” You can call inflation “under control” when the central bank is literally creating inflation.

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Buka akaun dagangan patuh syariah anda di Weltrade.

Source link