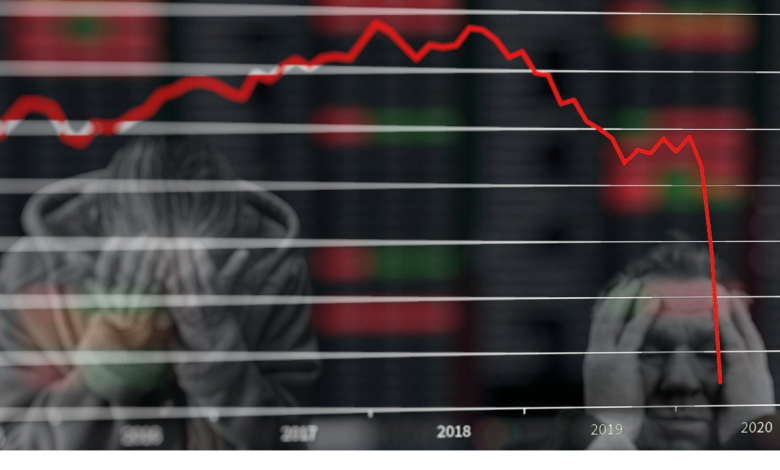

Peter Schiff: The 2023 Financial Crisis Has Begun!

As we start to sort through the fallout of the failure of Silicon Valley Bank and Signature Bank and the government’s reaction to it, the next question is: what’s next?

Government officials and mainstream pundits insist everything is fine now. They say quick government action averted a crisis. But in his podcast, Peter Schiff said this is really just the beginning of the next financial crisis.

This is no longer the 2008 financial crisis. This is the 2023 crisis. It’s been a long time — fifteen years since we had a financial crisis. I’m surprised it’s taken this long for this crisis to begin. But I’m not surprised we are having a crisis.”

Over the weekend, the Federal Reserve and the US Treasury took quick steps to address the failure of the two big banks. Peter called it “the plunge protection team.”

In order to prevent bank runs and shore up the system, they created a mechanism to ensure nobody loses their deposits – even those that weren’t insured by the FDIC. They also set up a loan program that effectively bails out any other banks that might be on shaky ground.

While these actions only kick the can down the road, Peter said the situation would have been much worse had the government not announced this bailout. We would have almost certainly had more bank failures.

Of course, government officials, including President Biden insist this isn’t a bailout.

Nobody wants to admit it’s a bailout because, obviously, the bailouts were not popular, and so they want to distance themselves from that language. But this absolutely is a bailout.”

Government officials can plausibly claim they are not bailing out the failed banks because they are letting the institutions go under. But the bank’s customers are getting bailed out.

They would have lost money. But now they’re not going to lose money. Why? Because the government is going to make up their losses.”

Biden and others also swear taxpayers aren’t on the hook for any of this.

OK, well, then where’s the money going to come from? The man in the moon? Of course, the taxpayers are going to pay. But they may not pay in the form of taxes because nobody has the integrity to actually raise middle-class taxes. But that doesn’t mean the taxpayers are going to get away with this. They’re going to pay for it. It’s just that they’re not going to pay for it with higher taxes. They’re going to pay for it with higher prices.”

Peter is referring to the inflation tax.

On Sunday the Fed announced the Bank Term Funding Program (BTFP). This program will offer loans of up to one year in length to banks, savings associations, credit unions, and other eligible depository institutions pledging US Treasuries, agency debt and mortgage-backed securities, and other qualifying assets as collateral. Banks will be able to borrow against their assets “at par” (face value).

In effect, the plan creates a mechanism for banks to acquire capital they couldn’t otherwise access under normal market conditions. And of course, the Fed will create the money for these loans out of thin air.

In fact, as far as I’m concerned, today marks the return to quantitative easing. So, we are now officially in QE 5. And I expect the Fed’s balance sheet to go up from here.”

Peter said it’s amazing that just a week ago, people were still talking about the Fed slaying inflation while bringing the economy to a “soft landing.” Meanwhile, he was saying the only way the Fed could succeed in getting inflation anywhere near 2% is by creating not just a recession, but a financial crisis.

So, it wasn’t just that we were going to have a recession. We were going to have another financial crisis. And I also said that the financial crisis that the Fed was going to create this time would be worse than the one that it created in 2008. And that’s exactly where we are.”

Peter said this financial crisis is already so much worse that the government effectively raised FDIC protection from $250,000 to infinity.

They just set the precedent. I know they haven’t codified it into law. But they just set the precedent of bailing out the depositors of these two banks.”

And with the wave of a wand, the federal government effectively took on an extra $7 trillion in unfunded liabilities. (The total of uninsured bank deposits.)

Meanwhile, many more banks were going to fail had the government not backstopped them.

Those executives were bailed out because they would have lost their jobs when their banks went under, but now their banks are not going to go under because of the bailout. A lot of stockholders would have lost their money. But now they’re not going to lose their money because of these bailouts. Yes, there are a couple of people who got punished. But all of these other banking executives who made the same mistakes, who have the same overleveraged balance sheets — they’re all going to get bailed out.”

Biden said he was going to find the people responsible for this situation and punish them and hold them accountable. Peter pointed out that one of them is right in his administration.

She’s the secretary of the Treasury, Janet Yellen. The people responsible for this mess are all the chairmen and chair ladies of the Federal Reserve starting with Alan Greenspan right up to Powell.”

Nevertheless, the powers-that-be claim their quick action prevented bank runs and the financial system remains sound. “Your money is safe,” they say.

Peter disagrees.

As a result of these bailouts, the money that people have on deposit at banks is at greater risk than ever. In fact, it’s not just the deposits at these failed banks. But every deposit at every bank is now at risk. And the reason is because of inflation. Massive inflation is going to be created to pay for these bailouts. A return to quantitative easing. Prices are going to go through the roof. That means the purchasing power of bank deposits is going to fall through the floor.”

Peter goes on to explain the dynamics behind the bailouts.

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Buka akaun dagangan patuh syariah anda di Weltrade.

Source link