Comex Update: Delivery Volume Slows Even as Prices Rise

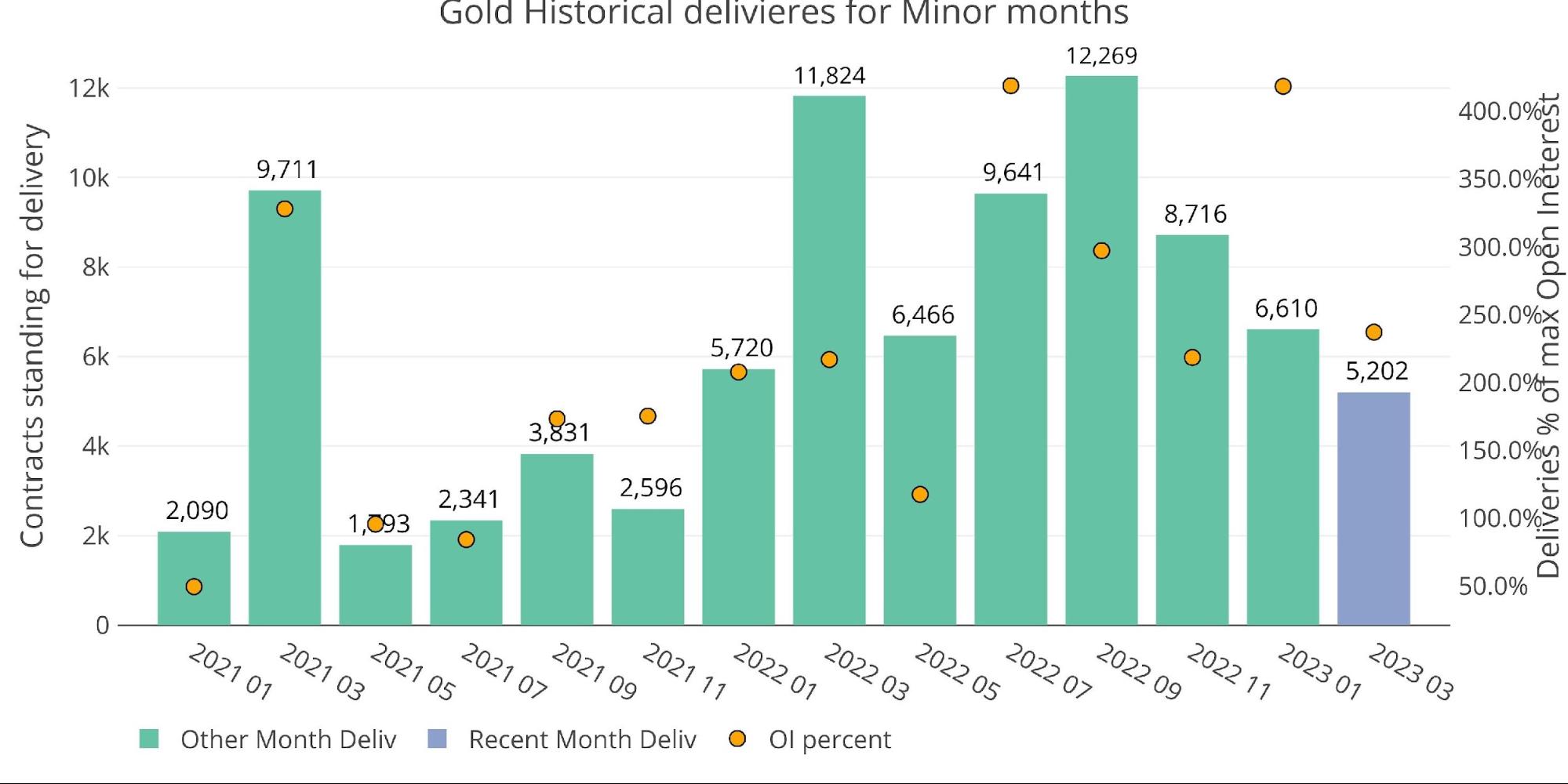

Gold is wrapping up March, which is a minor delivery month. While it was a decent delivery month, it was the smallest minor month since November 2021.

Figure: 1 Recent like-month delivery volume

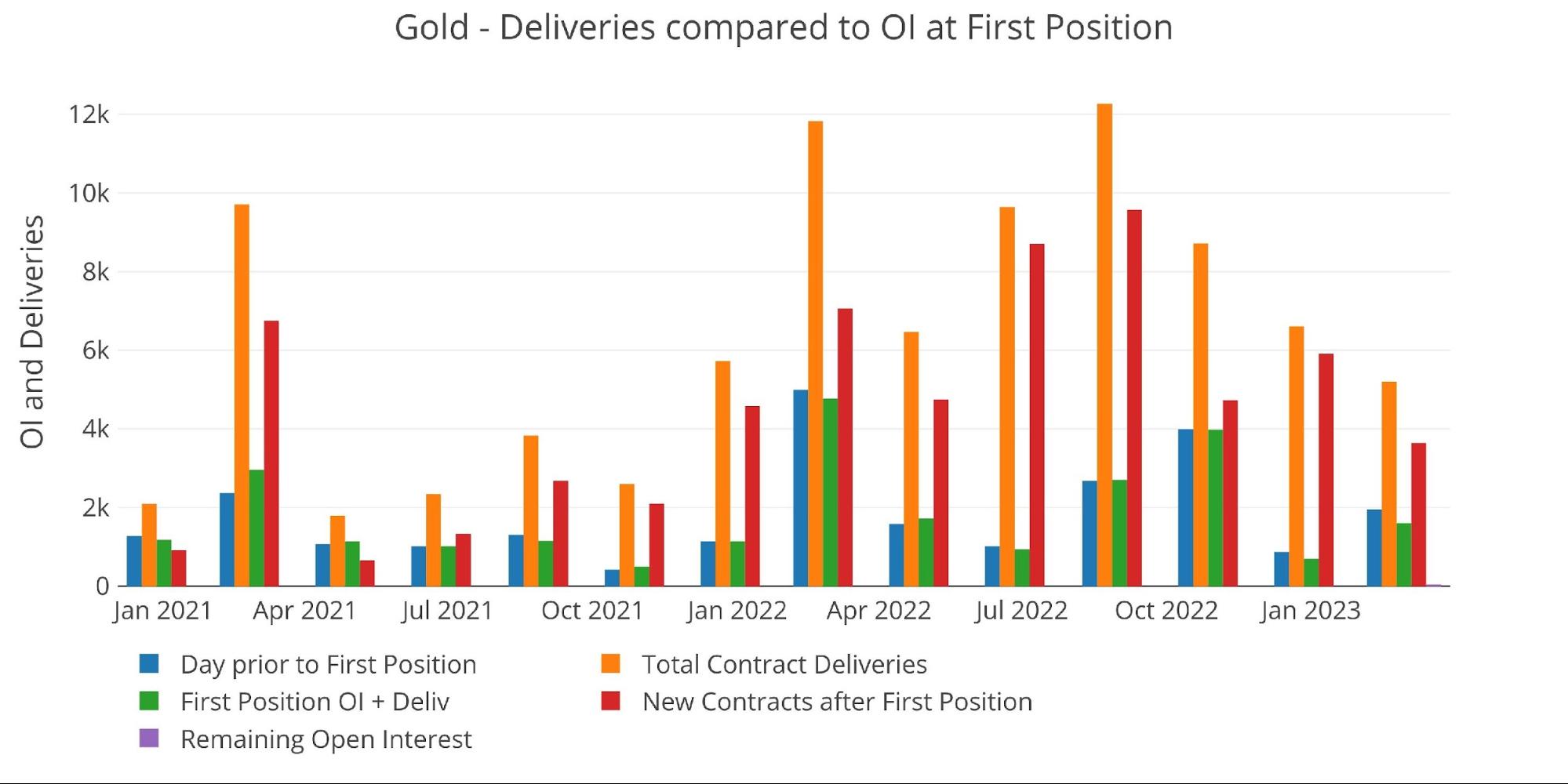

Lower delivery volume has been driven by two factors. First, it had low open interest into the close (green bar) and second, the net new contracts were a bit weaker than previous months (red bar). That said, it should still be noted that 5,202 contracts is still a strong delivery for a minor month historically speaking.

Figure: 2 24-month delivery and first notice

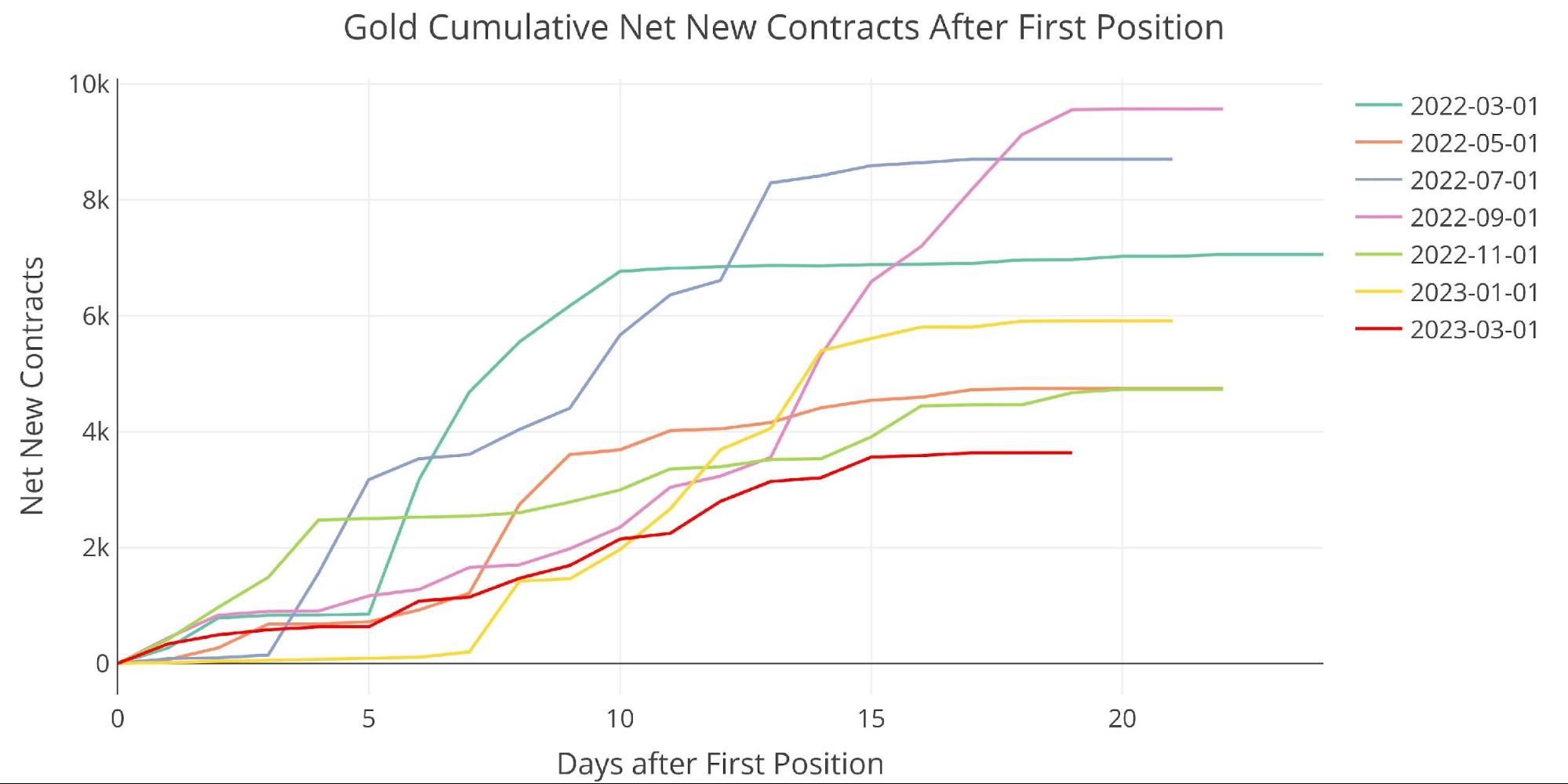

Taking one last look at the net new contracts shows that volume did not respond at all to the banking crisis that has been unfolding the last two weeks as net new contracts slowed and then stopped.

Figure: 3 Cumulative Net New Contracts

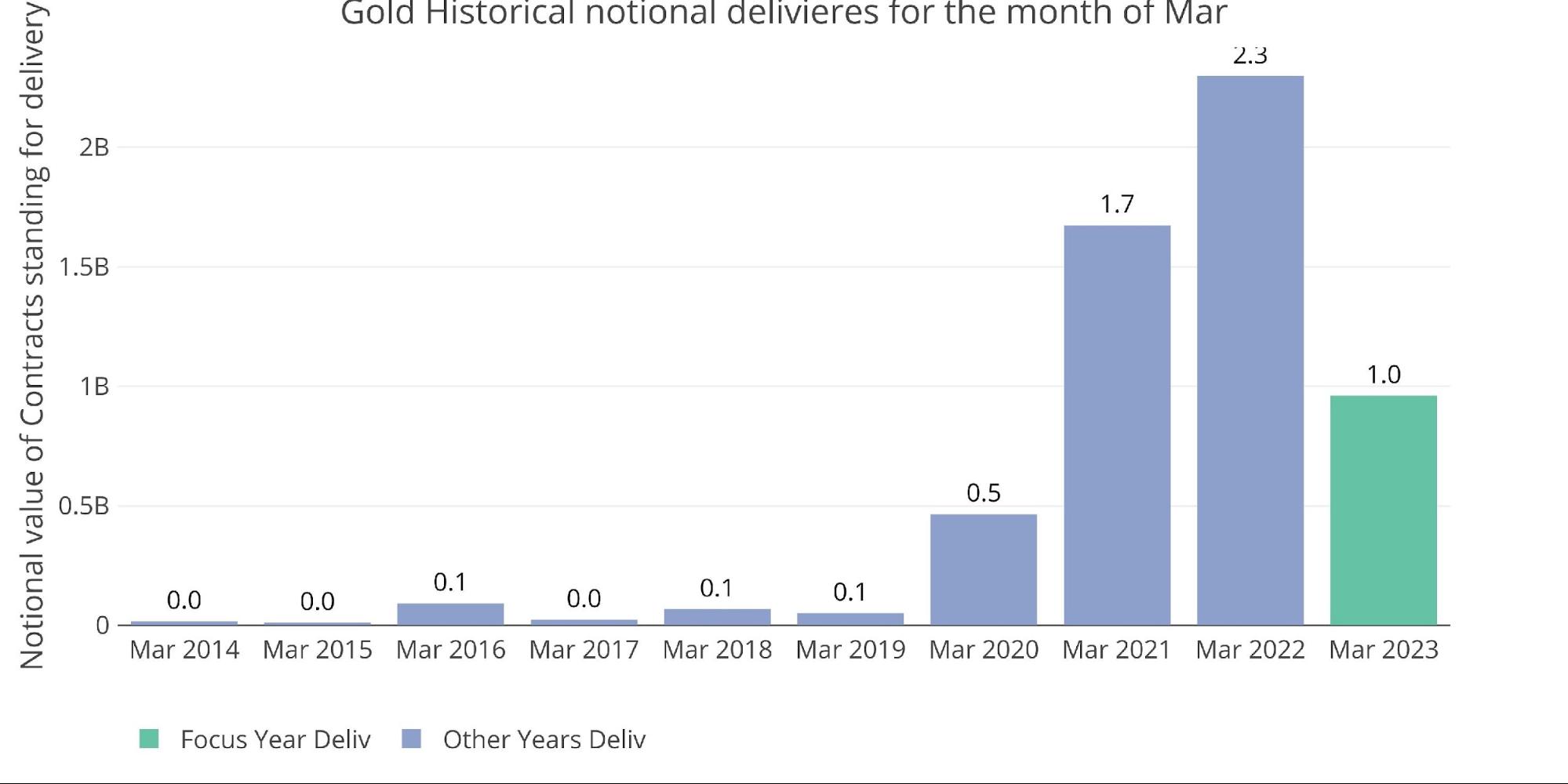

As mentioned previously, from a historical basis, this was a relatively strong March. It is just less than what has been seen in 2021 and 2022. Please note, amounts below are notional dollar amounts.

Figure: 4 Notional Deliveries

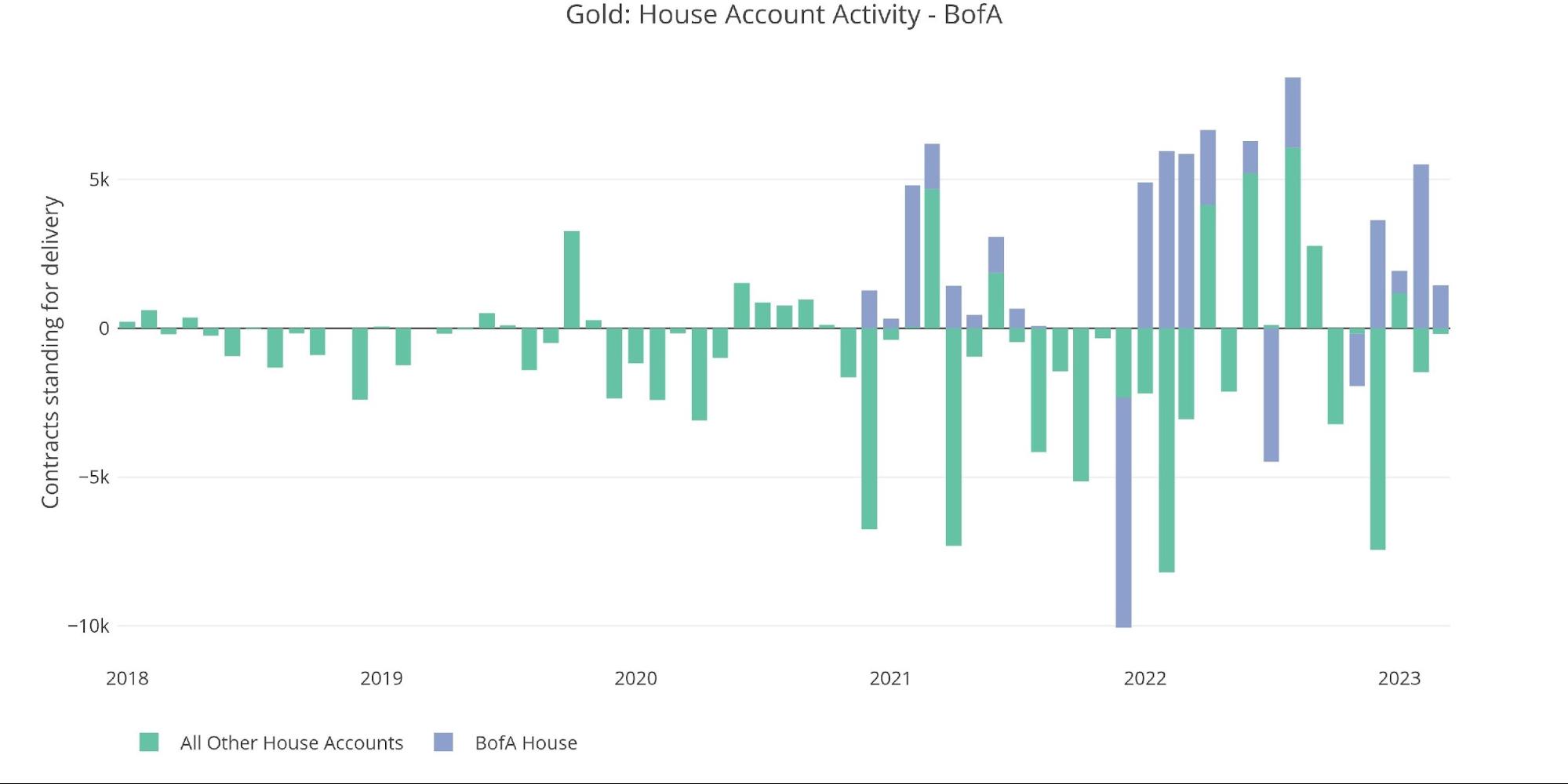

The house accounts were fairly quiet, with only BofA coming in to scoop up some contracts. BofA is most likely taking the opportunity to build up stock it can dump once delivery demand spikes back up.

Figure: 5 House Account Activity

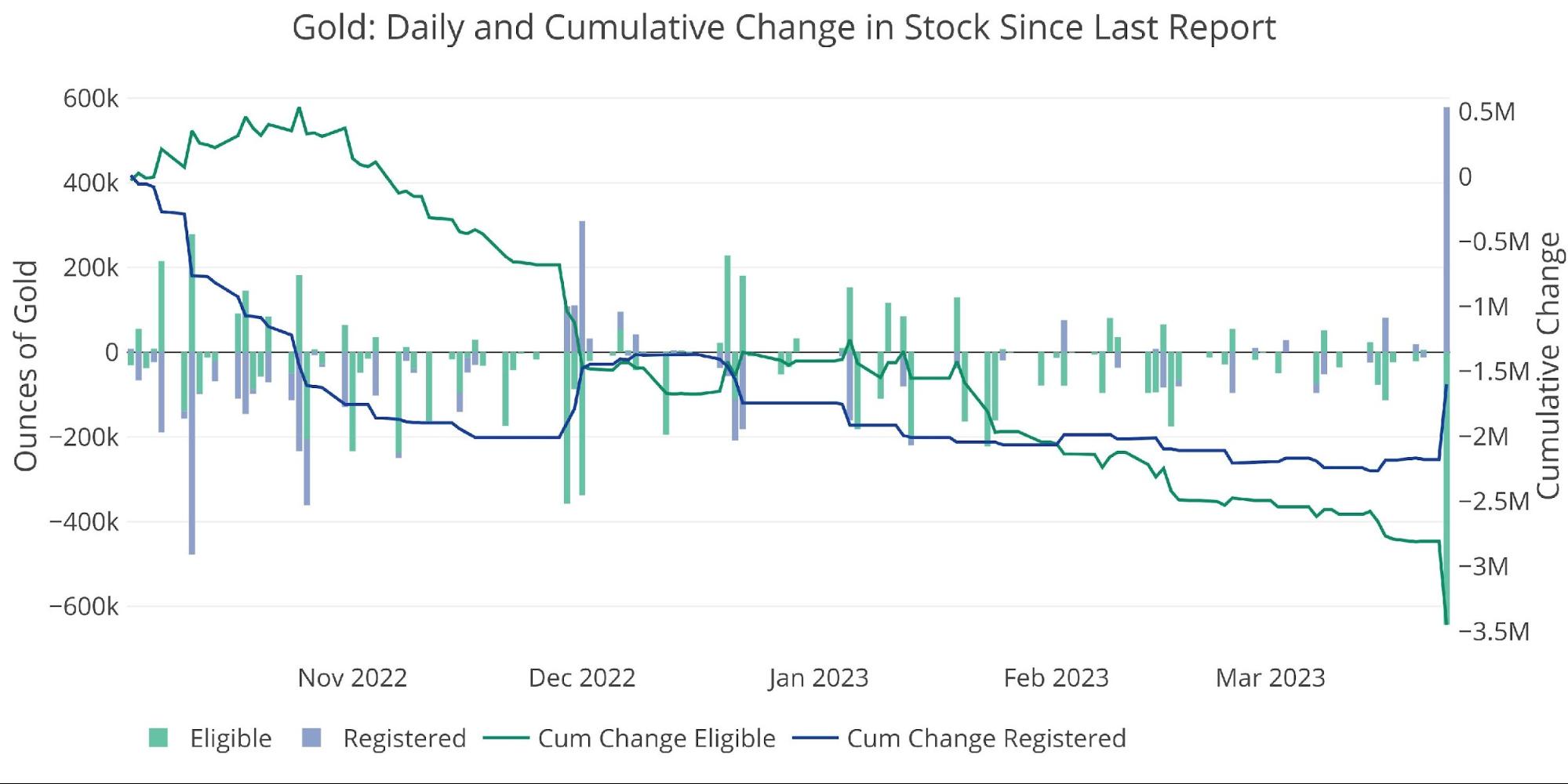

The strangest activity occurred in the actual physical vaults. It seems that in preparation for the upcoming delivery month of April (a major month), JP Morgan has pre-emptively bolstered its Registered position. JP Morgan moved a whopping 578k ounces (~$1.15B) from Eligible to Registered. As discussed previously, this could be a move to improve the optics and try to demonstrate that supply is available to meet delivery demand as the next major month looms for gold.

Figure: 6 Recent Monthly Stock Change

Gold: Next Delivery Month

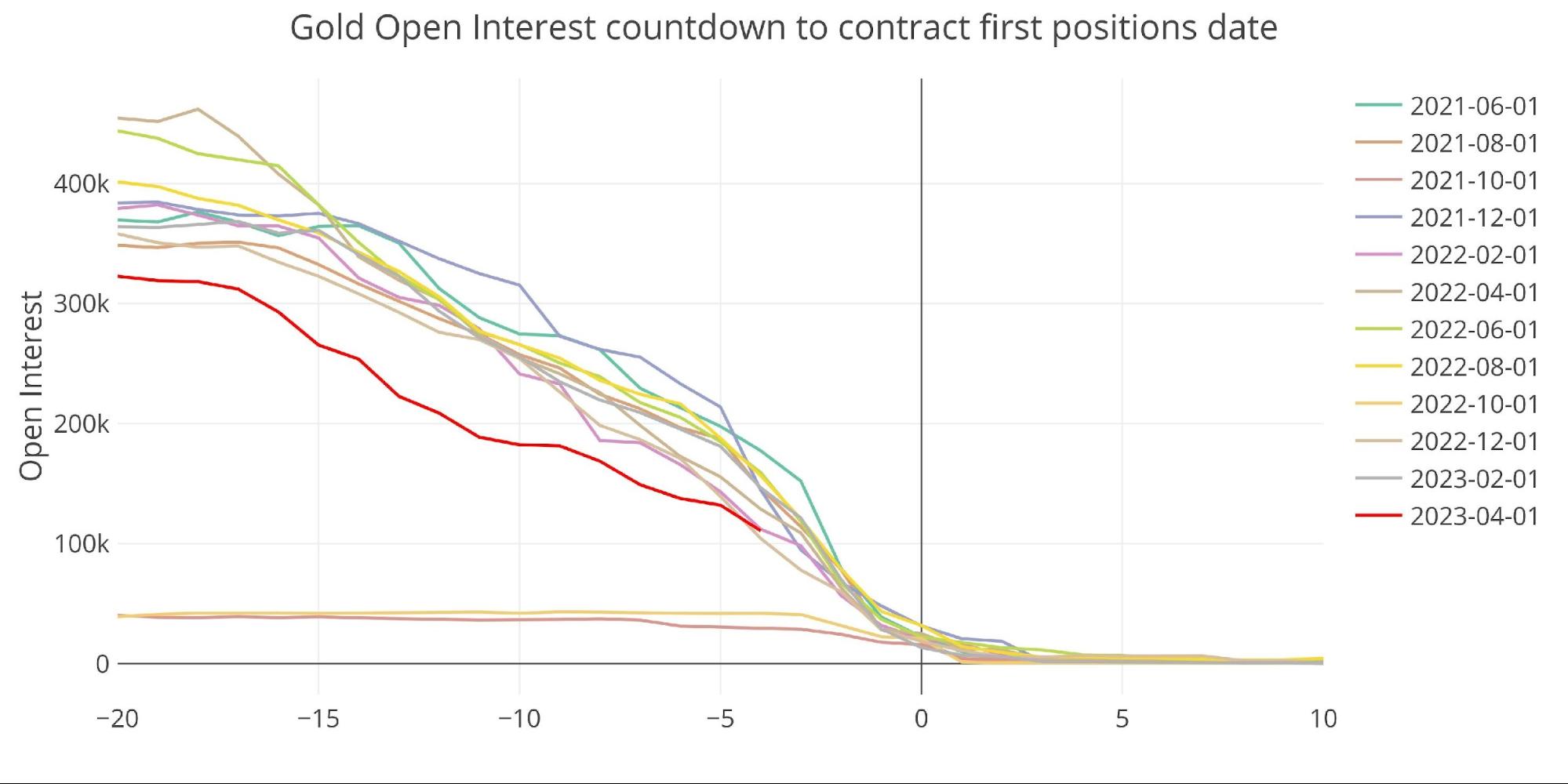

Speaking of the next major month, the chart below shows the April countdown (red line). Gold open interest is actually trailing recent months. As highlighted in the technical analysis, the recent price action in gold has happened despite waning open interest.

Figure: 7 Open Interest Countdown

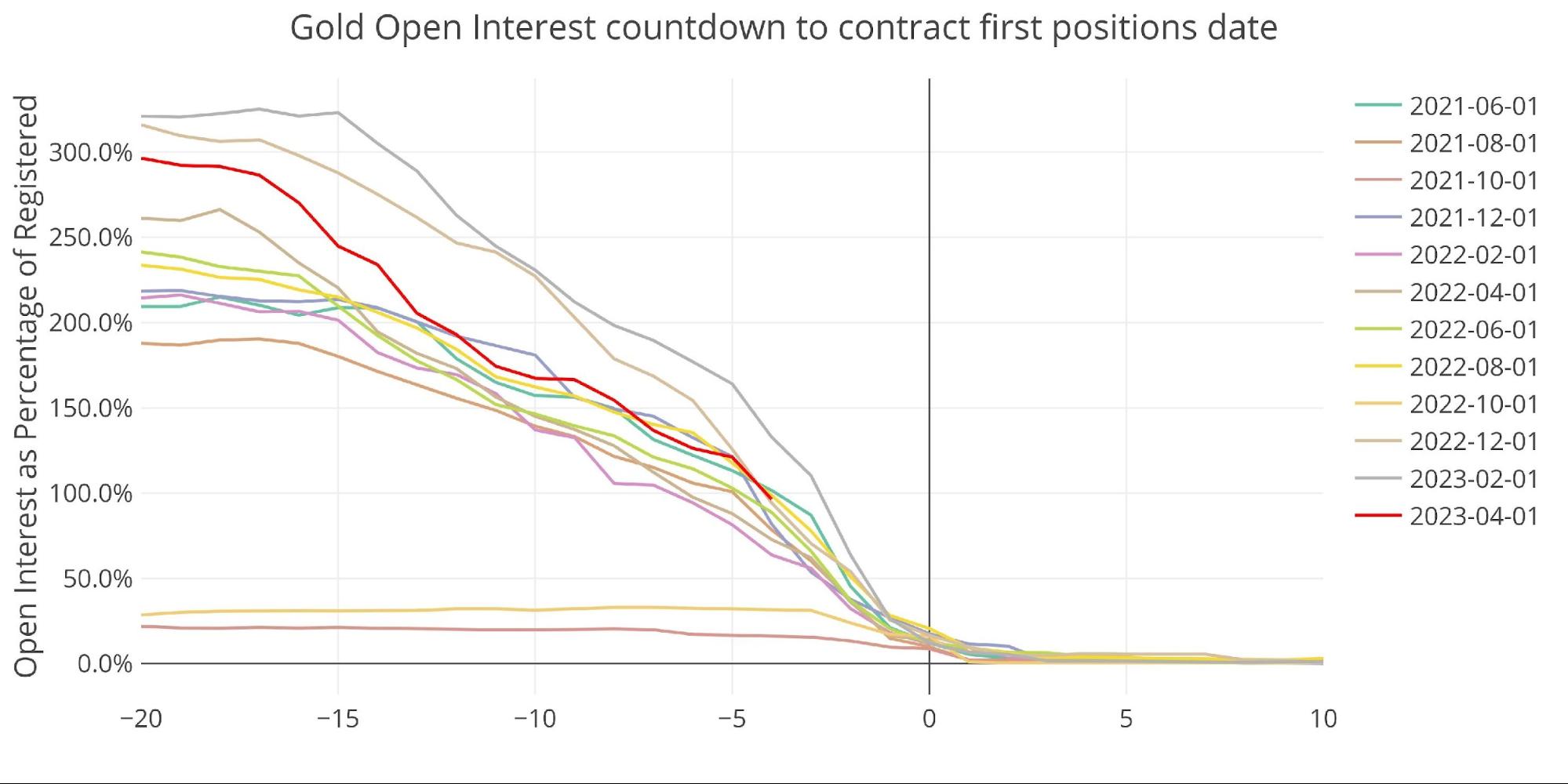

When looked at on a percentage basis relative to Registered, March is more in the middle of the pack. The recent dip is driven by the move from JP to increase holdings of Registered.

Figure: 8 Countdown Percent

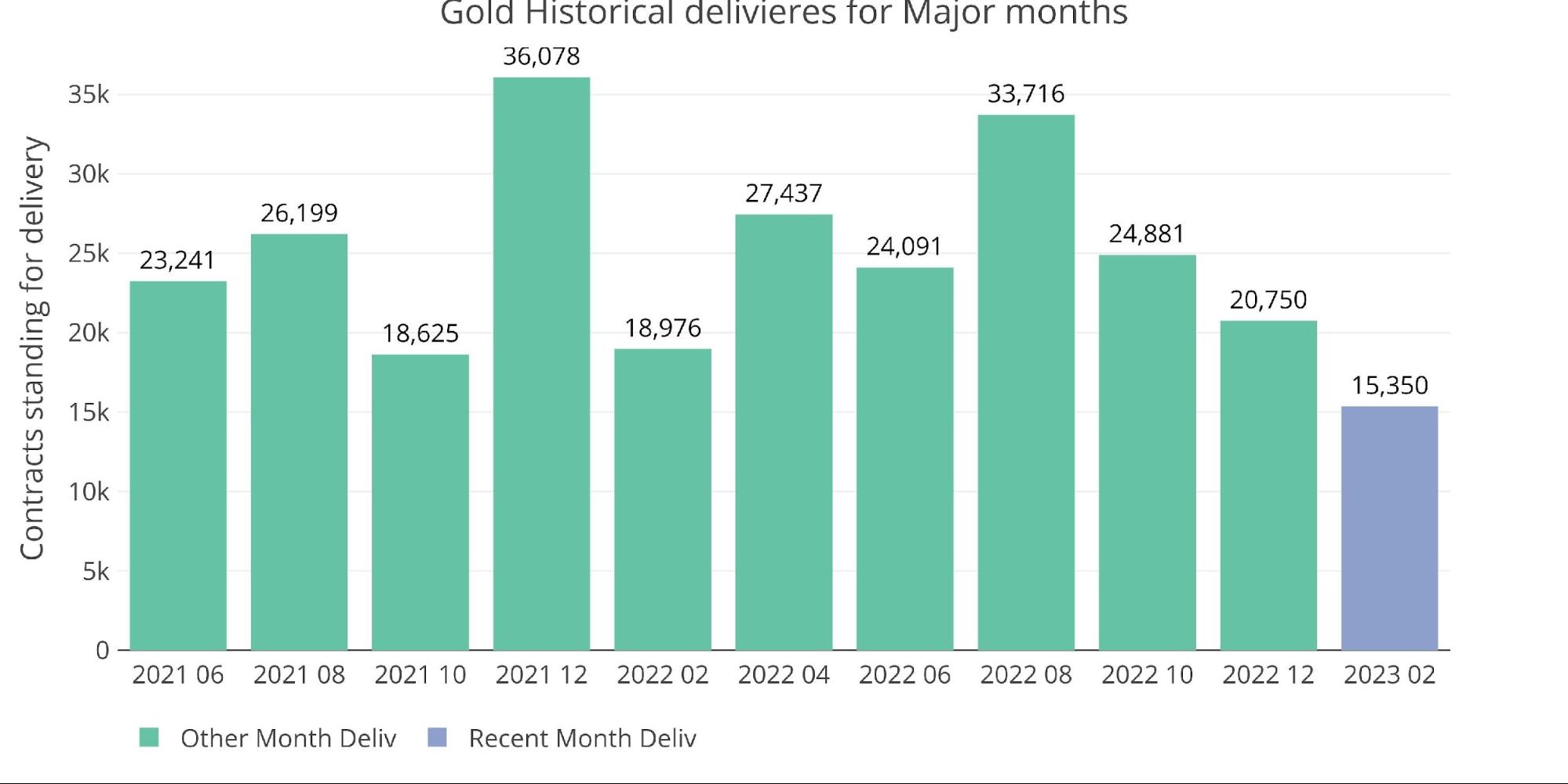

Major months have seen a downward trajectory since August. I have previously theorized that some of this could be a stand-down order while supplies are low but impossible to know for sure. First Position is coming on Thursday which will show the current delivery interest.

Figure: 9 Historical Deliveries

Spreads

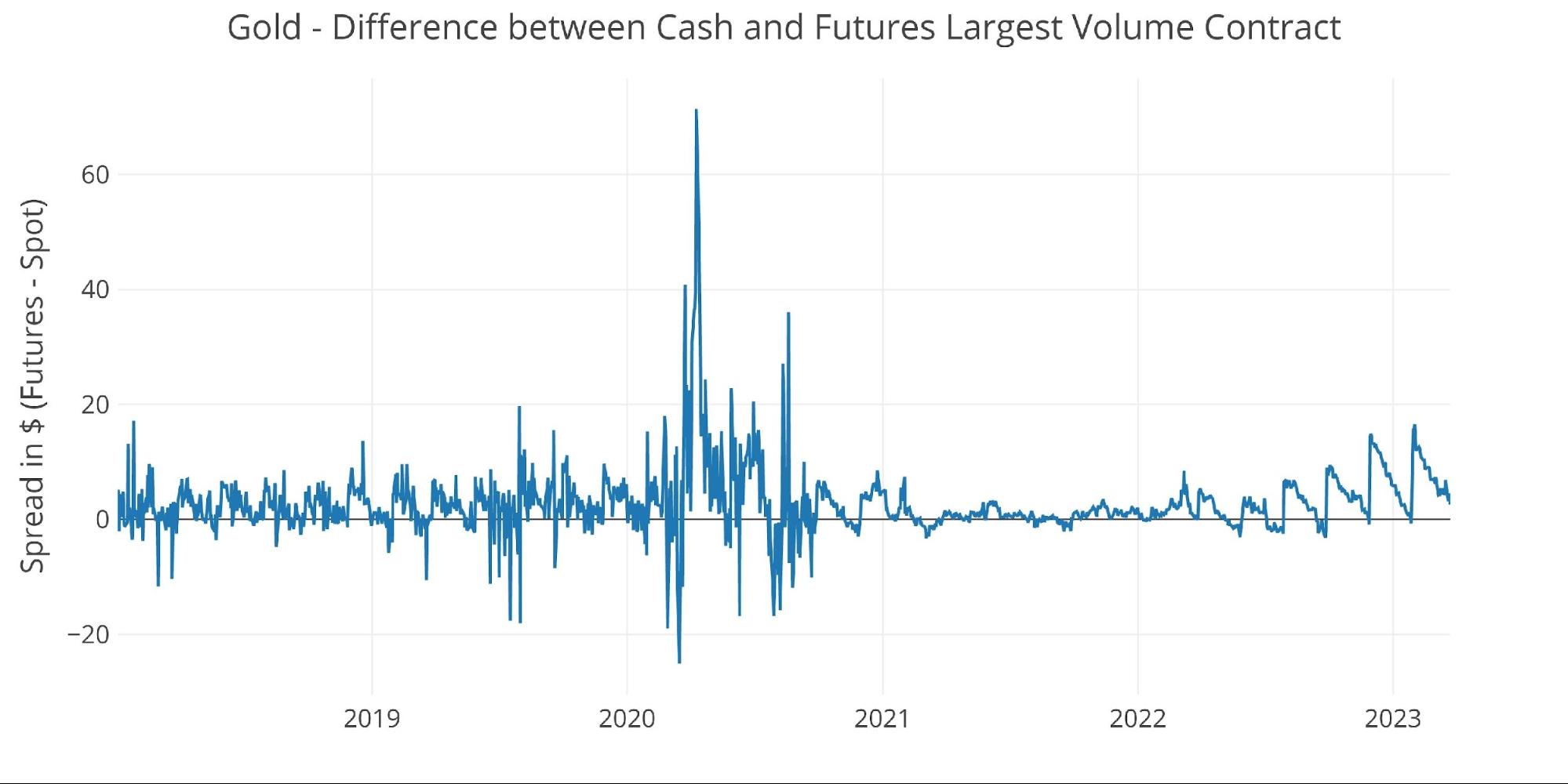

The market remains in strong contango with the highest spreads seen since at least summer 2021.

Figure: 10 Futures Spreads

The spread in the cash market looks like it has become very controlled and tightly managed. This started around October 2020 right after gold reached new all-time highs. The nature of the spread in the cash market looks quite deliberate.

Figure: 11 Spot vs Futures

Silver: Recent Delivery Month

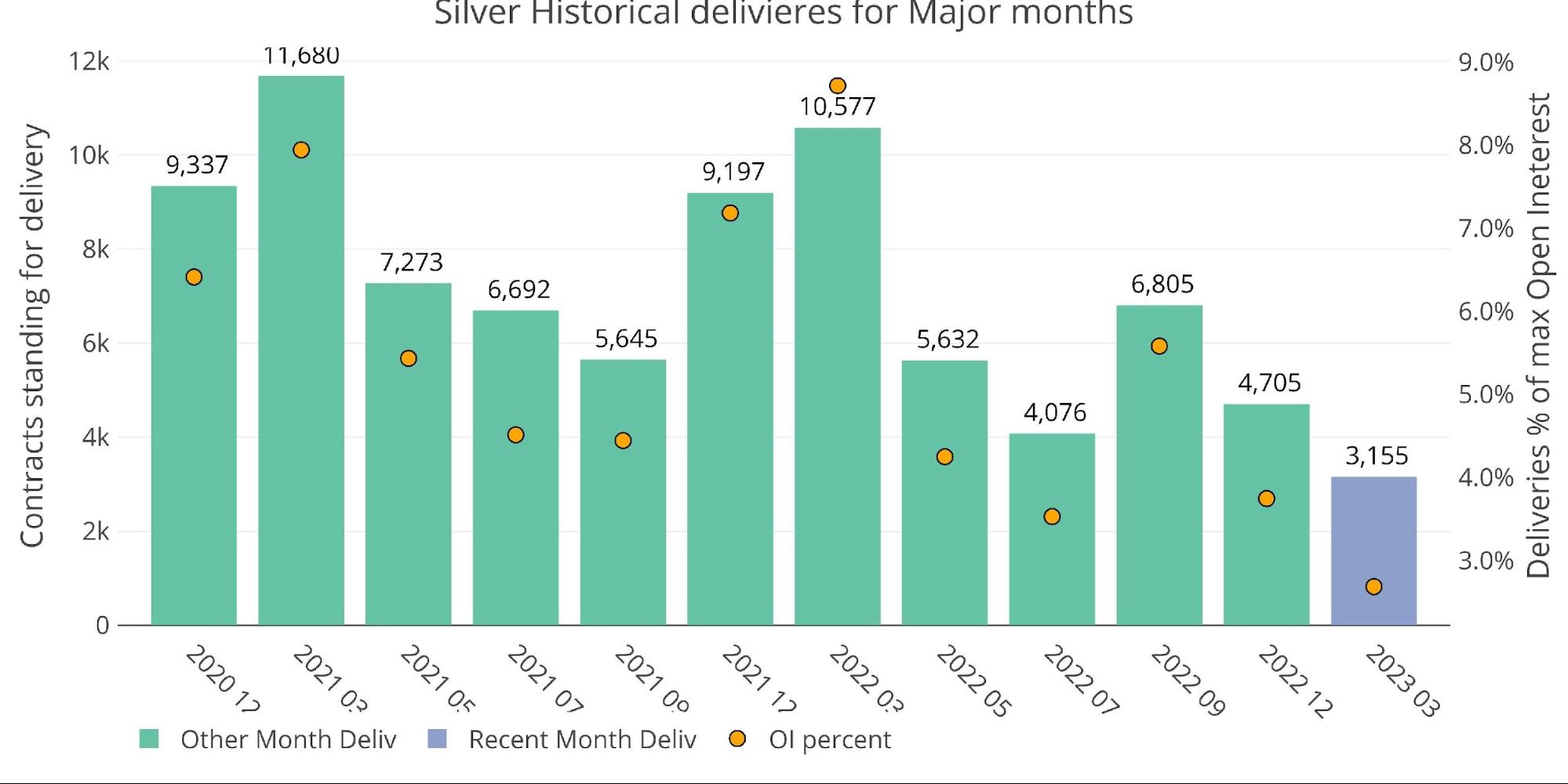

Silver delivery volume continues to decline, with March posting 3,155 contracts delivered. This is the smallest major month going back to July 2017.

Think about that, the economy is on the cusp of a financial crisis and delivery volume is the lowest in 6 years. Again, this could very well be intentional as supply available for delivery has vanished from Comex vaults.

Figure: 12 Recent like-month delivery volume

Similar to gold, this was driven by lackluster open interest into the close (green bar), and almost zero impact from net new contracts. The massive drop into close (difference between blue and green bar), is still clear to see this month. These are contracts that waited until the last day before rolling.

Figure: 13 24-month delivery and first notice

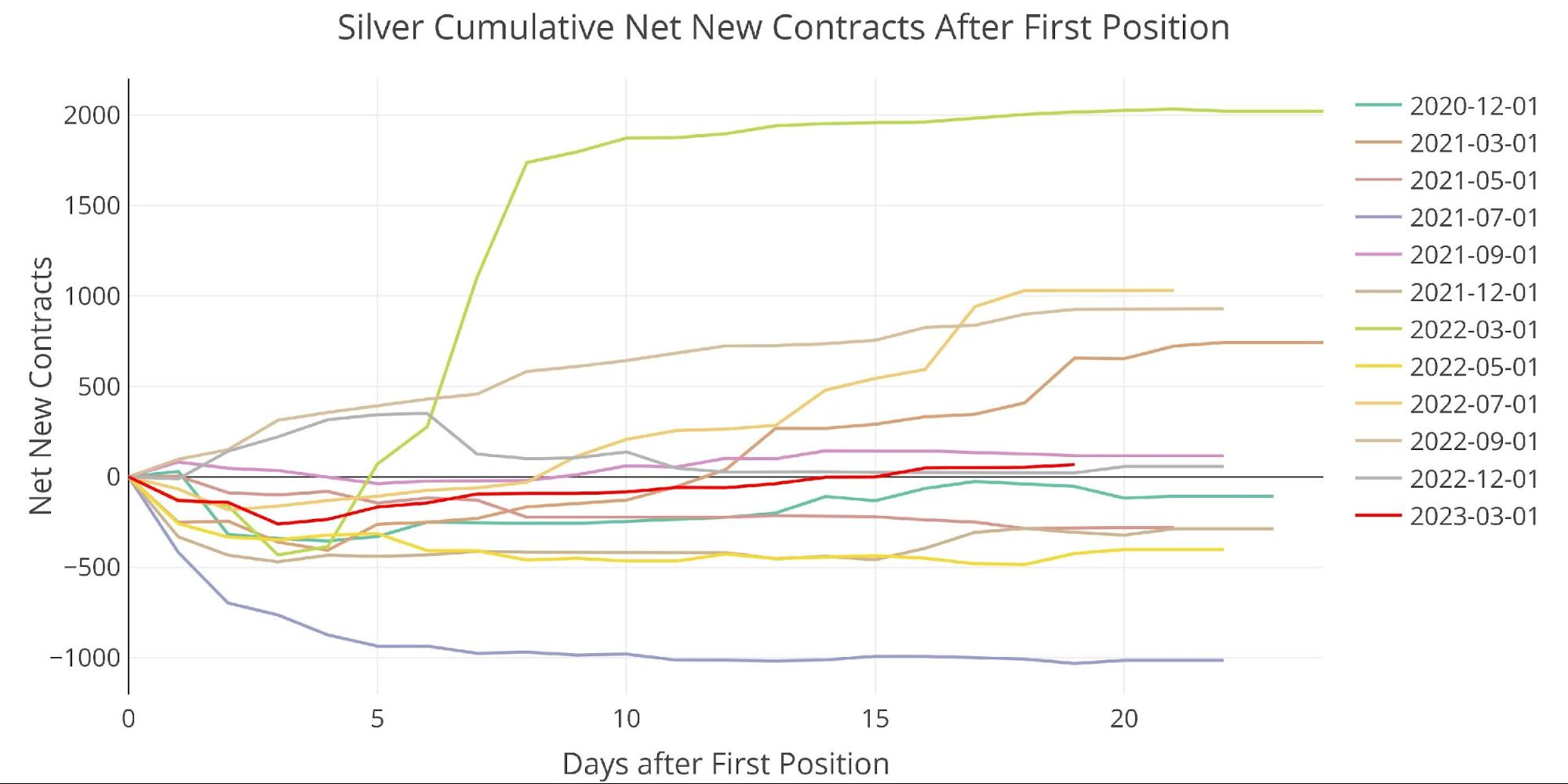

Net new contracts have remained incredibly flat for the month.

Figure: 14 Cumulative Net New Contracts

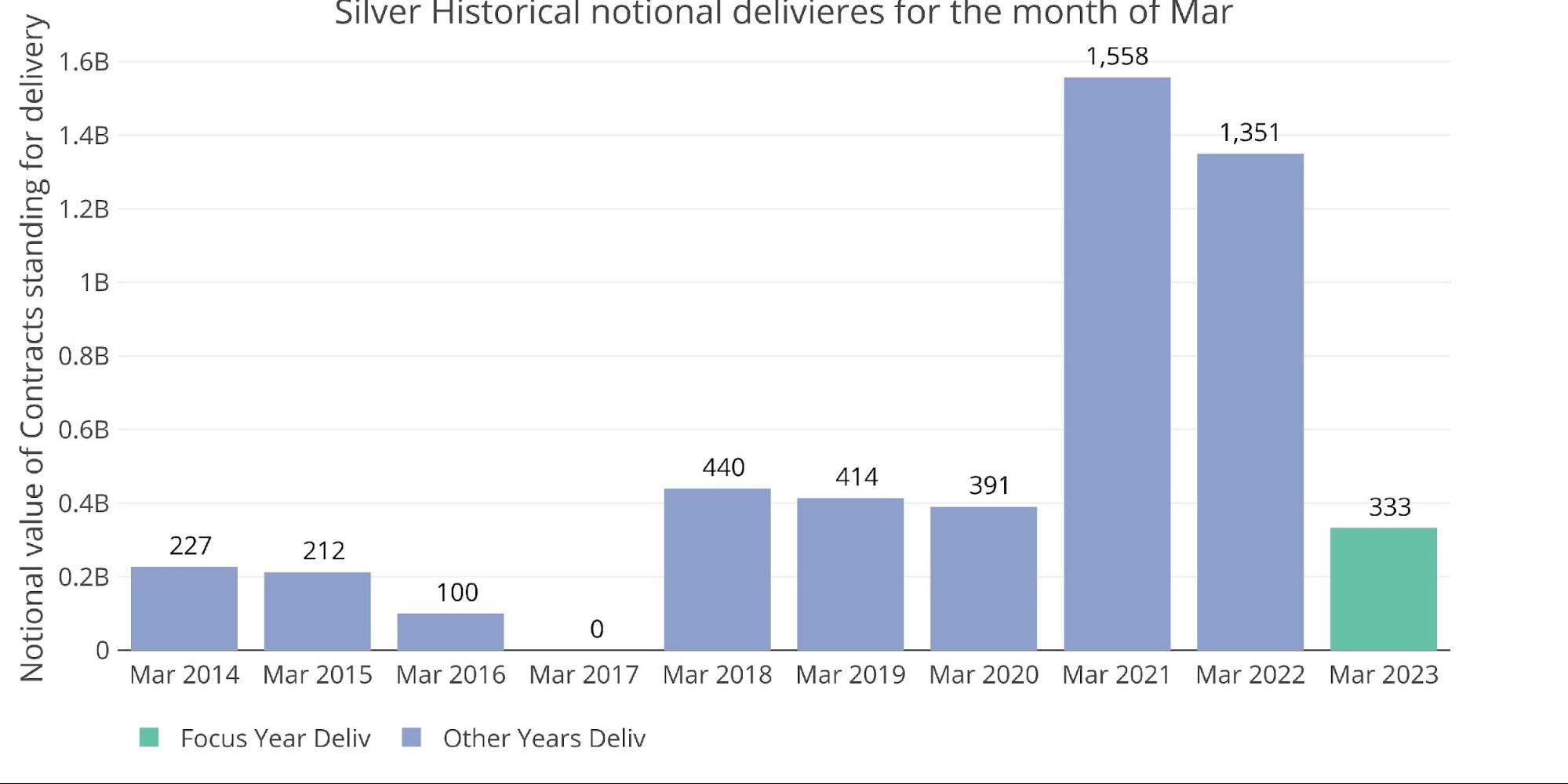

From a notional perspective, March will be the weakest activity since 2017 as noted above. Delivery demand has simply fallen off a cliff.

Figure: 15 Notional Deliveries

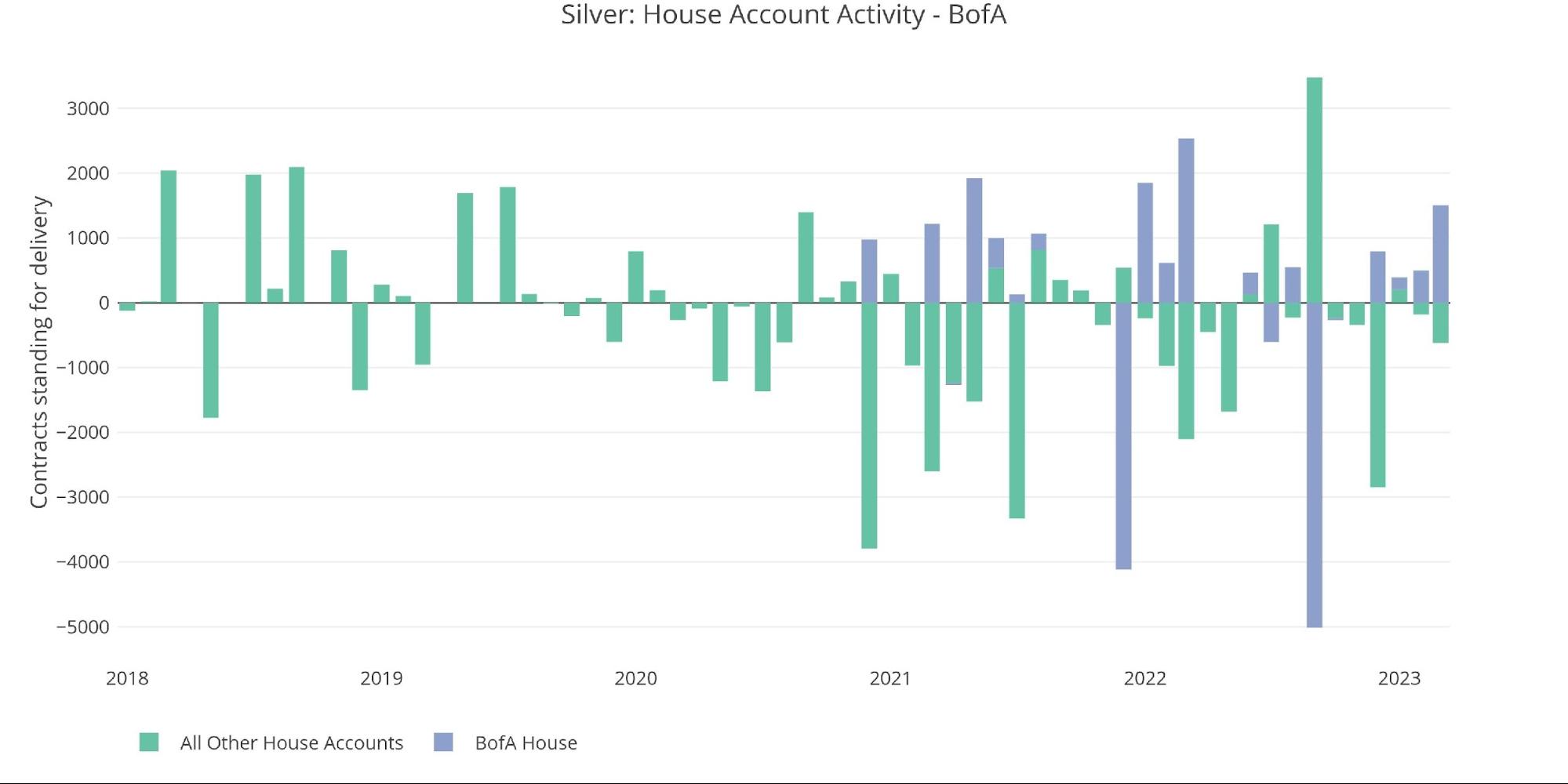

The bank house account activity shows that BofA was not sitting on its hands, however. BofA came in to take delivery of 1,503 contracts. This is the biggest month by BofA since March 2022, right after the war in Ukraine started. BofA is still working to replenish its inventory after the massive sell-out that happened in September 2022.

From a pricing perspective, BofA has been getting killed… buying high and selling low. But they seem much more concerned with being able to backstop the market in times of surging demand. BofA is definitely using the lower activity to accumulate metal.

Figure: 16 House Account Activity

Registered did see some major restocking in preparation for the delivery month, but parties taking delivery have already undone half the move. 7M ounces moved from Eligible to Registered over two days, but there has been a steady drift out of Registered since.

Figure: 17 Recent Monthly Stock Change

Silver: Next Delivery Month

April is a minor delivery month in silver and barely has a pulse.

Figure: 18 Open Interest Countdown

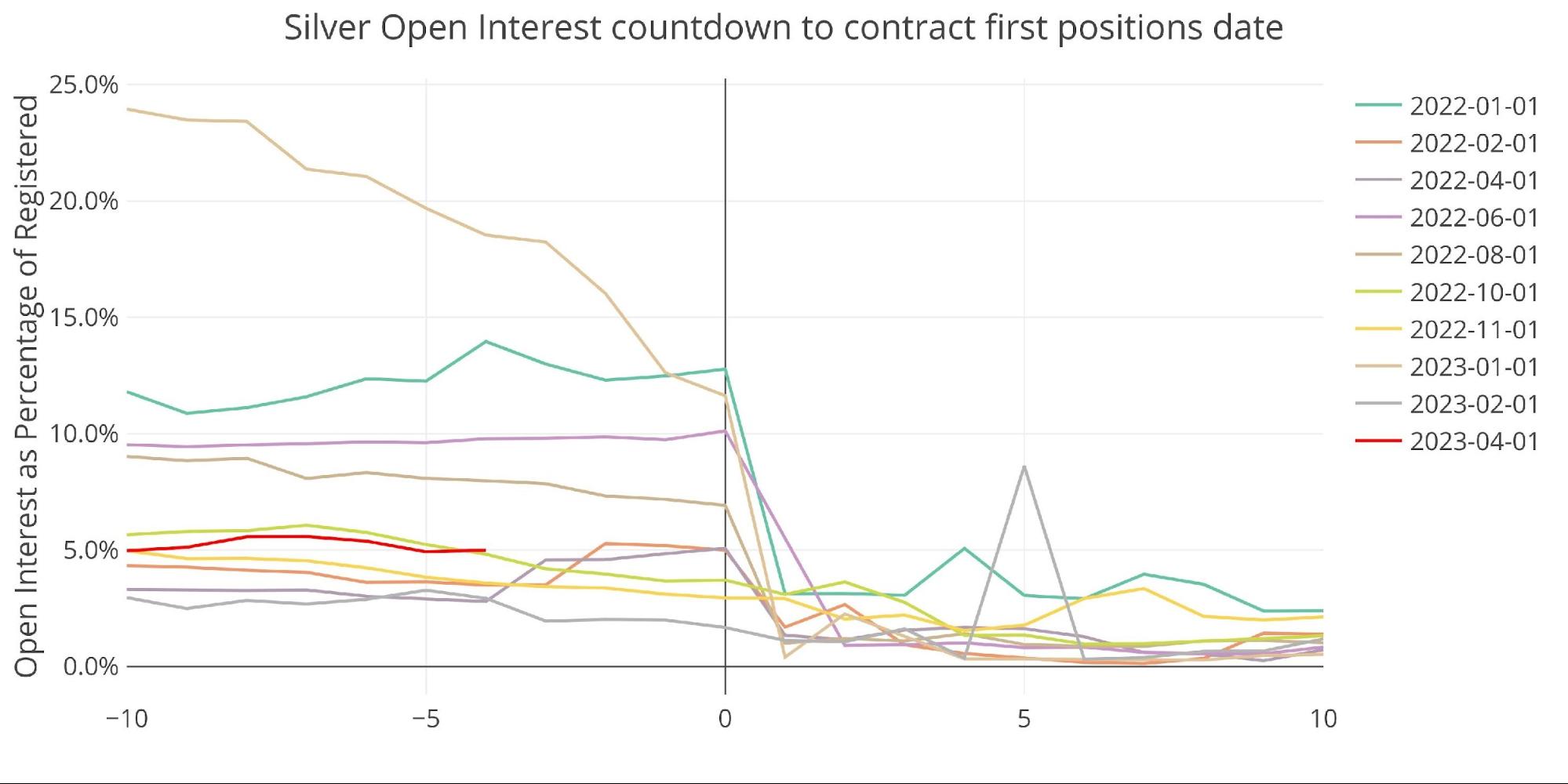

When viewed as a percentage of registered, silver is still well below trend compared to recent months.

Figure: 19 Countdown Percent

Spreads

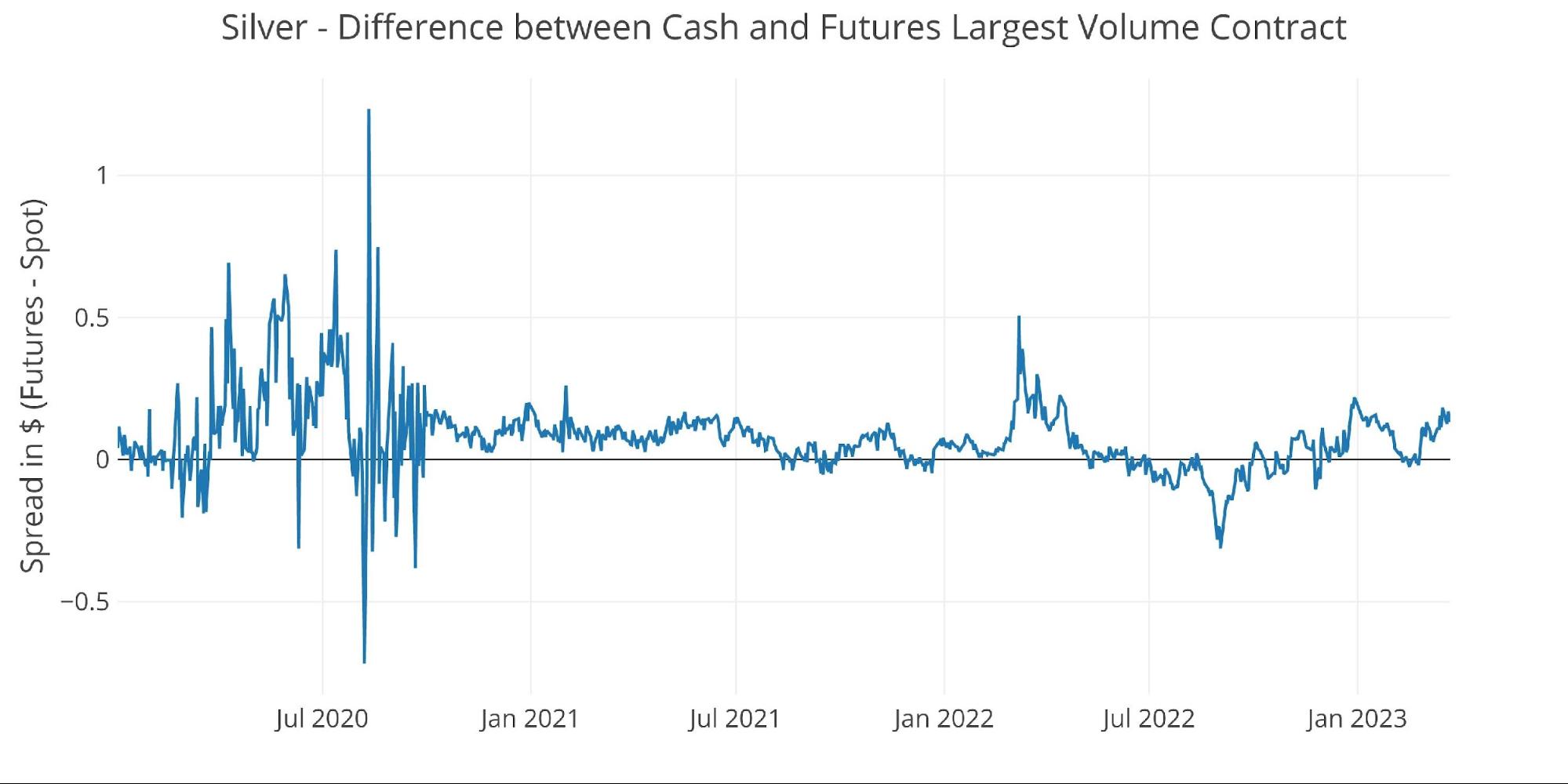

the cash market is back in contango after another brief dip into backwardation.

Figure: 20 Spot vs Futures

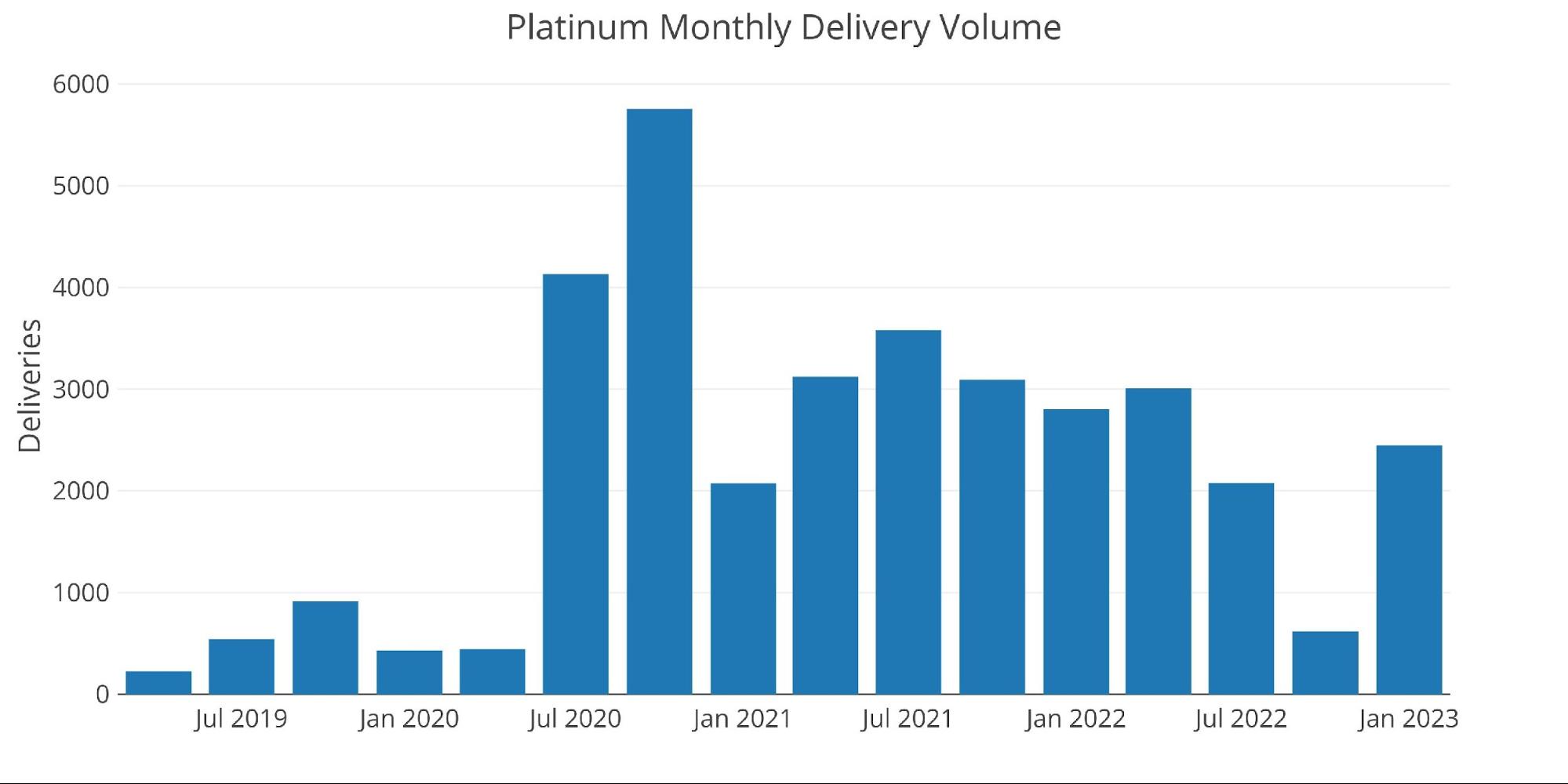

Platinum

Platinum has been a thorn in the side of the Comex for the last two delivery months. For October, they drove deliveries lower and then were able to bring deliveries down in January. The Comex seems to be prepared this month…

Figure: 21 Platinum Delivery Volume

First, they have increased the amount of Registered available before the delivery starts. Not only were they moving metal from Eligible to Registered but they even brought in new supply. These moves have come at the expense of Eligible which has the lowest inventory in some time.

Figure: 22 Platinum Inventory

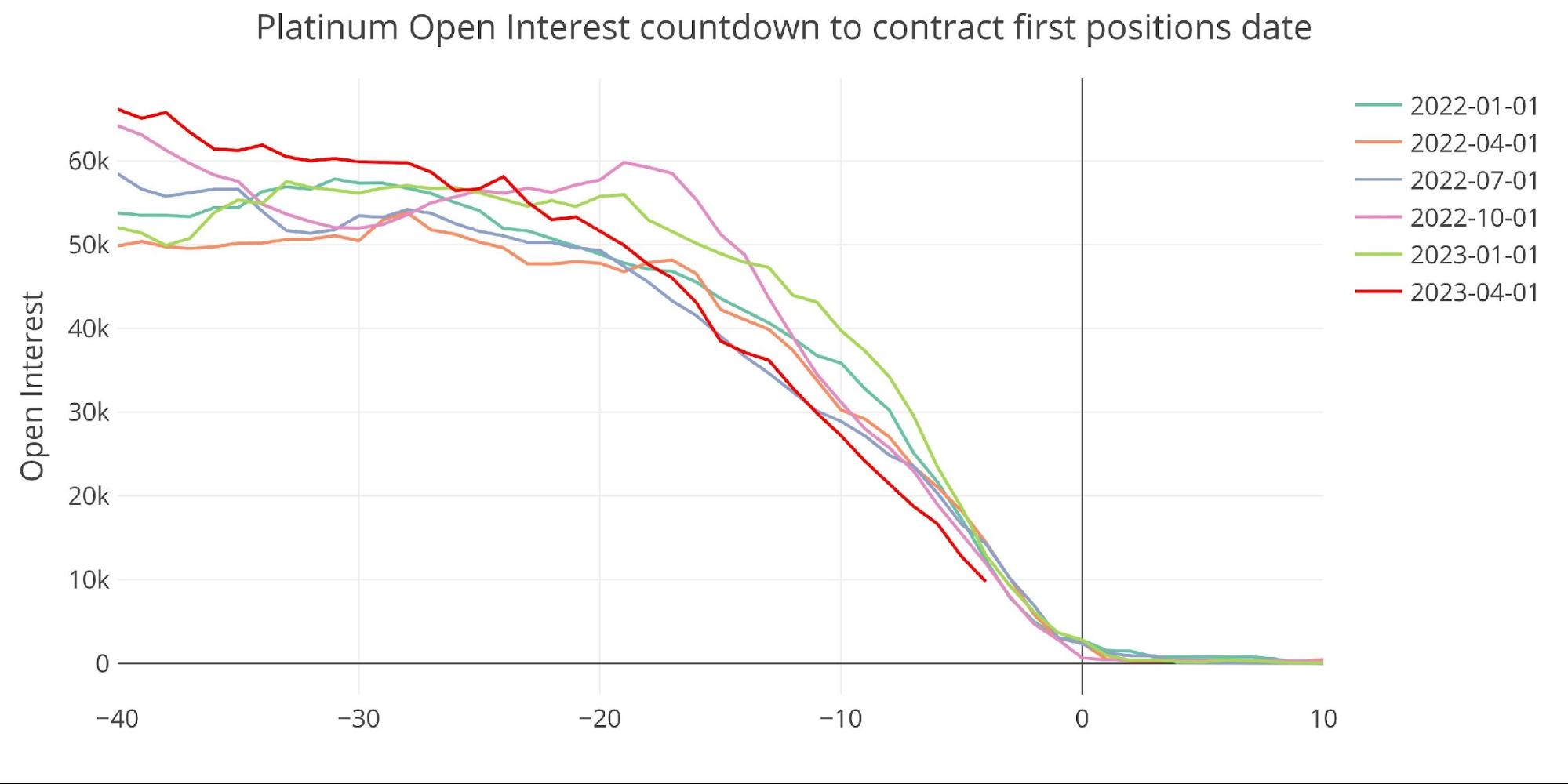

The open interest is also being managed lower, going from one of the biggest months to one of the smallest months with 4 days to go.

Figure: 23 Open Interest Countdown

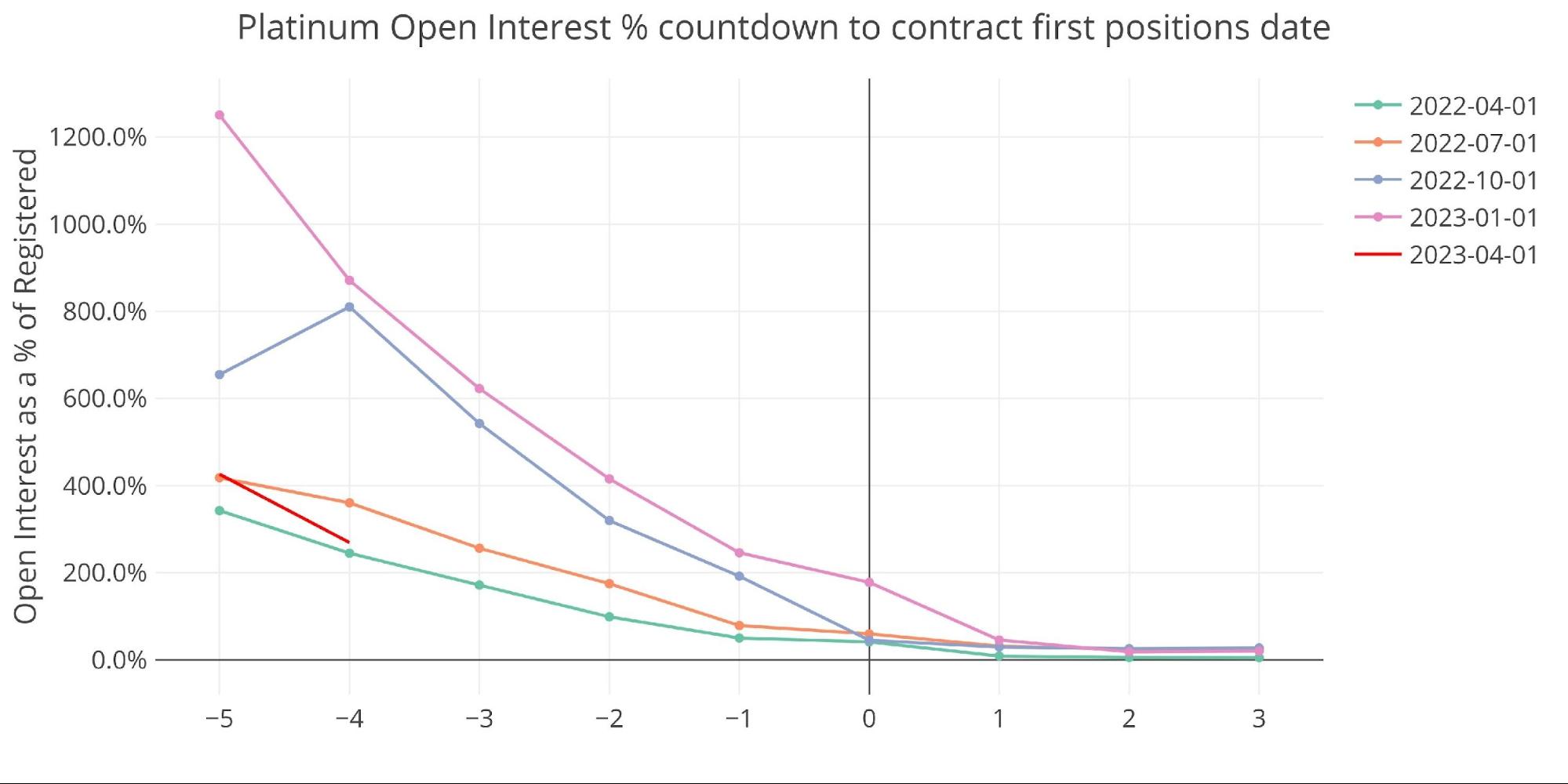

As shown, the increase in Registered combined with the drop in open interest puts current open interest at 270% of available Registered. This gives the Comex plenty of time to see more contracts roll and get below the 100% mark.

Figure: 24 Countdown Percent

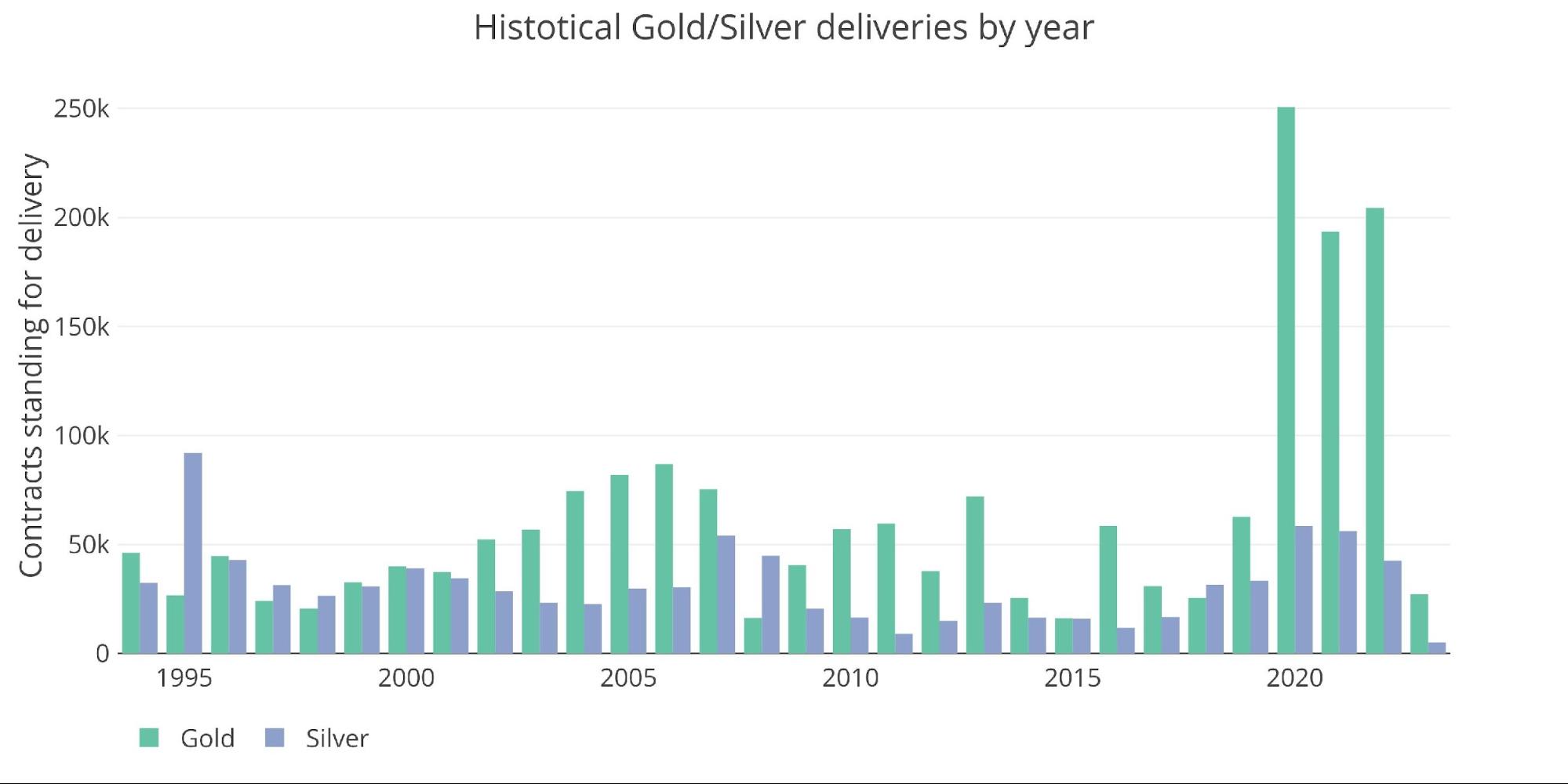

Wrapping up

So, what’s going on? Has physical demand for precious metals dried up? Why have delivery volumes suddenly slowed along with falling open interest? It seems strange this would happen despite a potential financial crisis looming over the economy that has pushed up gold prices to the highest in a year and caused people to start draining supplies of coins and bars.

I guess that this is by design. The Comex has been under stress for months now and supplies were getting dangerously low. My guess is there is a stand-down order among the big players to improve the optics of the system. As recent bank runs show, a loss of confidence can cause things to unravel quickly. The Comex cannot afford a loss of confidence. If it saw a bank run, supplies would be wiped out in a day and then expose the Comex. This would create true price discovery in the physical market and blast prices much higher.

I don’t think this is simply a return to pre-Covid activity. There is more going on here, and we should know more in the coming months.

Figure: 25 Annual Deliveries

Data Source: https://www.cmegroup.com/

Data Updated: Nightly around 11 PM Eastern

Last Updated: Mar 24, 2023

Gold and Silver interactive charts and graphs can be found on the Exploring Finance dashboard: https://exploringfinance.shinyapps.io/goldsilver/

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Buka akaun dagangan patuh syariah anda di Weltrade.

Source link