Mastery Trade for XAUUSD 14 th FEB 2023 for Fundamental Analysis and Technical Analysis

Gold : Fundamental Factors

1) The price of gold went up a little bit on Tuesday, but there wasn’t a lot of trading activity because investors were waiting for more information about consumer inflation in the US.

2) The dollar also stabilized because people are worried about inflation going up, which could lead to the Federal Reserve increasing interest rates.

3) The consumer inflation data is expected to show that inflation went down a bit in January, but it is still high. This could cause the Fed to keep talking about being strict with interest rates.

4) Copper prices went down after going up the day before because people are unsure if China’s demand for the metal will recover and if there will be a global recession this year. Copper prices have been changing a lot because of mixed signals about the economy in China and fears of slowing in other countries like the US and Europe

The trend is Uncertain ( Waiting for CPI data to be certain)

Fundamental Range : 1,853.38-1,856.76

Gold : Technical Analysis

Check at Daily Timeframe Support and Resistance for Fibonacci.

Check based on the current timing for the Support and Resistance when you want to go into trade.

Resistance Area : 1863.15,1867.03,1873.30

Support Area : 1850.61,1846.73,1840.46

Pivot point : 1856.88

Confirm with technical indicators and based on your own technical analysis for the trend.

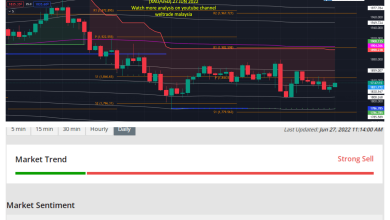

Check investing.com to get more info on what most indicator would display

Check higher timeframe also for more confirmation for entry in Daily timeframe.

The technical indicator display sell in Daily and strong buy in weekly and strong buy in monthly timeframe.

Use linear regression to get confirmation trend at daily as they are not available in investing.com

Linear regression shows upward trend at the daily timeframe .Can check linear regression trend in weekly and monthly for more confirmation.For weekly, it is downtrend and for monthly,it is showing uptrend.

Use Bolinger Band Strategy Tester and RSI Strategy Tester to get more confirmation for the trend and percent profitable.Check at bigger timeframe also such as weekly and monthly.

Ensure that both RSI strategy and Bolinger Band Strategy gives above 50%. for the percent profitable

RSI strategy tester and Bolinger Band Strategy Tester at the daily and weekly has percentage higher than 50% , and monthly has lesser than 50% for the RSI strategy Tester and Bolinger Band Strategy Tester.

Gold : Find buy at the daily chart by using the support point 1, 1850.61 and the take profit will be at the pivot point , 1856.88 (SEE CURRENT MARKET PRICE)

See current market and find the nearest support point for entry and take profit at the pivot point.

Fundamental and Technical analysis must be aligned

For further information, contact me ,Gurmit at +60142584067, I will guide anyone who wants to register with Weltrade. You can register at the link below. Thank you.

https://my.weltrade.com/?r1=ipartner&r2=49989

DISCLAIMER :This analysis is based on Investing.com and Forexfactory.com. You may follow based on your own discreetion.

Can join at our telegram group at Education and Signal , https://t.me/+NfCxZrhbyZIzMGI1

For traders who want to trade on their own can join Weltrade, we provide benefits for traders out there, learn to trade and follow free signals such as free paid signal providers, bookmap gold and tradingview premium live.

Free Bookmap Education t.me/+JetSe33YA0U2ZDk1

Join us at our zoom link, https://us06web.zoom.us/j/87503803695?pwd=UGxmeGpDc3BvK3JFK1NrRjlJQzVldz09 for online learning from 11.30 am to 12.30 am by the Financial Markets Research Center (FMRC) team, with Mr. Gurmit.

Komen anda

Source link