Credit Extends Losses With More Rates, Geopolitical Pain Ahead

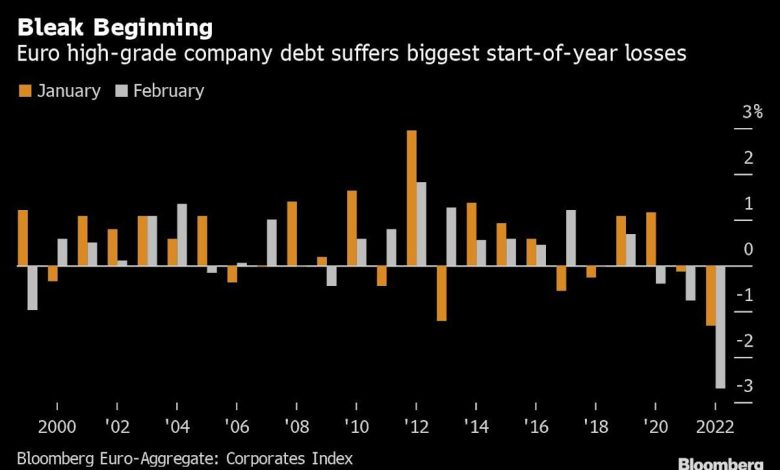

(Bloomberg) — Credit markets suffered the biggest back-to-back monthly losses since the global financial crisis and remain vulnerable amid rising rates, slowing growth and escalating geopolitical risk.

Most Read from Bloomberg

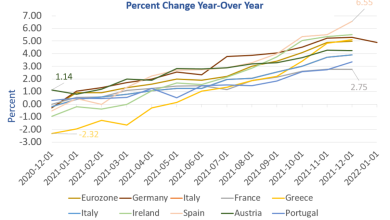

Dollar- and euro-denominated investment-grade company notes have dropped 5.3% and 3.8%, respectively, in 2022. That’s the worst start to a year on record for Europe and the steepest January-February decline since 1980 in the U.S., while sterling bonds tumbled 5.7%, and yen bonds extended a slump.

Investment-grade debt is particularly exposed to rising rates given its higher duration than lower-rated bonds. Federal Reserve officials have stuck to their resolve to raise rates despite uncertainty posed by Russia’s invasion of Ukraine, though traders abandoned wagers on a supersized hike in March amid concerns about the economic impact.

“Things aren’t going to get better,” said Steven Boothe, a portfolio manager for global and U.S. investment-grade bonds at T. Rowe Price Group Inc. “Real growth runs the risk of slowing here rather meaningfully and that to me is the next important risk.”

“Liquidity is getting challenged,” said Boothe, who is looking for opportunities to buy corporate bonds once he gets better visibility on Fed policy, U.S. growth and the Treasury curve. T. Rowe oversaw $1.68 trillion as of the end of December.

DWS North America has gotten more cautious, according to Tom Farina, co-head of credit at the firm. DWS Group oversees over $1 trillion globally.

“Our investment-grade positions are smaller than where they were in fourth-quarter,” Farina said in a telephone interview Tuesday. “We want to get a better sense of where the Fed is going and on inflation before we are willing to jump in.”

“The war is likely to add further inflationary fuel to the fire that is already burning,” said Chris Bowie, a partner at TwentyFour Asset Management in London.

Given that for weeks investors have been speculating about a Fed hike in March, some of the impact of higher borrowing costs may already be priced in.

A precedent here could be the pandemic-related turmoil of March 2020, when high-grade euro-denominated corporate bonds lost nearly 7%. They then rebounded to return 3.7% the following month and more than recovered their initial losses over the rest of that year, Bloomberg index data show.

Investment-grade “credit spreads have already reacted so negatively that to go wider from here, risk would have to increase materially,” said Viktor Hjort, global head of credit strategy at BNP Paribas SA. “We expect some stabilization around these levels in the coming months.”

High-grade U.S. and European borrowers returned to market Tuesday after three days without a deal and higher issuance could well be another drag, since March is typically a heavy month for debt sales. Early projections for March call for $125 billion to $150 billion of U.S. bond issuance, up from about $80 billion last month.

“There is still reason to come to market sooner rather than later, even after the spread backup,” JPMorgan Chase & Co. credit strategists led by Eric Beinstein wrote in a note Monday, referring to U.S. borrowers.

Elsewhere in credit markets:

Americas

American Express Co. is leading a rush of offerings in the U.S. high-grade primary bond market Tuesday as a drop in Treasury yields creates an opportunity to do deals that had been delayed amid volatility.

-

Goodnight Midstream shelved a $400 million leveraged loan due to volatility in the market

-

The junk index posted losses for the second consecutive month and the primary market was on hold with just 16 deals for a little more than $9 billion pricing, the slowest February since 2016

-

U.S. bankruptcy courts saw just one large insolvency in the month of February for the first time since at least 2008, underscoring a record slowdown

-

For deal updates, click here for the New Issue Monitor

-

For more, click here for the Credit Daybook Americas

EMEA

Germany priced a 4 billion-euro tap of existing 2052 notes, while its agricultural development bank Rentenbank also sold bonds

-

They were joined by the Council of Europe Development Bank, which sold sterling-denominated notes

-

Russian borrowers will need to figure out how they’re going to pay about $9 billion over the next three months

-

The International Capital Market Association Executive Committee “resolved, effective immediately, to suspend until further notice the membership of our Russian members and their relevant affiliates”

-

Ukrainian government bonds rose from record low levels even as Russia stepped up its aerial campaign against several cities

-

How sanctions create a risky tangle for Russian bonds: QuickTake

Asia

A plan by Honda Motor Co. to issue dollar green notes stood out in a subdued Tuesday in the primary dollar bond market.

-

One Chinese issuer Huaiyuan County New Urbanization

-

Construction Co. was looking to price a dollar security

-

Chinese high-yield dollar notes rose slightly Tuesday morning, according to credit traders, as the market looked for its first gain in a week

-

But things are getting even more challenging for China’s beleaguered developers, with a slump in home sales deepening just as another wave of bond payments looms

-

KKR & Co.-owned parts supplier Marelli Holdings Co. will file to renegotiate its debts with Mizuho Financial Group Inc. and other lenders via an alternative dispute resolution in Japan, people with people with knowledge of the matter said

-

Surging raw materials prices are often good news for Indonesian credit investors since they typically increase profits of commodity companies. The caveat: Firms must be able to pass on the higher costs

-

Ordinary people from Japan to the U.S. are feeling the effect of the Russian invasion of Ukraine through the bonds they bought in search for yield

(Updates throughout.)

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.

Source link