Fed Economists Warn of Looming Disaster Due to High Interest rates

A note recently published by two Federal Reserve economists reveals a looming catastrophe.

The Fed’s interest rate hikes have already precipitated a financial crisis. The central bank managed to paper over that problem and get it out of the headlines with a bailout program. But it didn’t solve the problems. Banks continue to tap into the bailout loans as they struggle in this high-interest-rate environment.

And there are even bigger problems on the horizon.

As Peter Schiff put it, the Fed has screwed up everything that is a function of interest rates. With more than a decade of easy money, the central bank created an economy that depends on artificially low interest rates and periodic quantitative easing. It simply can’t function in a high-interest-rate environment. I have been saying that it’s only a matter of time before something else breaks.

It appears that economists at the Federal Reserve know this too.

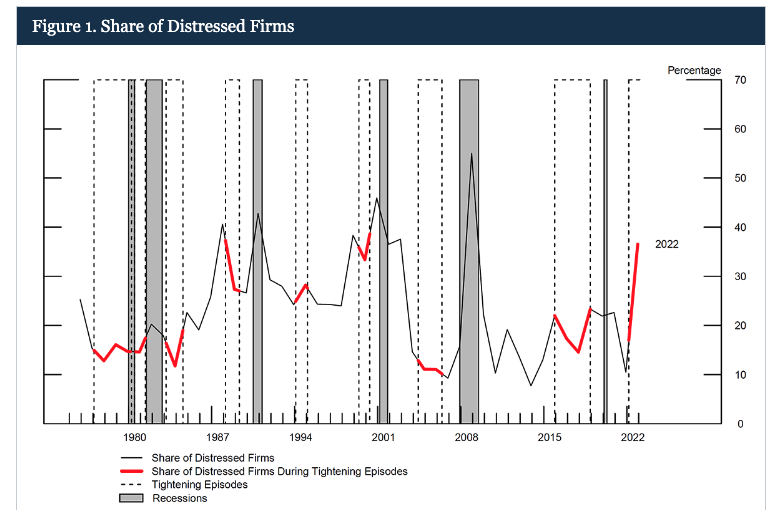

In a note, Ander Perez-Orive and Yannick Timmer reveal that an unprecedented number of distressed companies could collapse due to the recent increase in interest rates.

According to their analysis, more than one-third (37%) of non-financial US companies are in financial distress.

The share of nonfinancial firms in financial distress has reached a level that is higher than during most previous tightening episodes since the 1970s.”

Distressed means close to default.

What does this mean for the economy?

Our results suggest that in the current environment characterized by a high share of firms in distress, a restrictive monetary policy stance may contribute to a marked slowdown in investment and employment in the near term.”

In other words, a deep recession.

To put this situation into perspective, consider the fact that there are more significantly distressed firms today than there were when the Fed tightened monetary policy prior to the financial crisis and the Great Recession.

The paper concludes that the high number of over-leveraged firms in distress “is likely to have effects on investment, employment, and aggregate activity that are stronger than in most tightening episodes since the late 1970s.”

In other words, the impacts of this tightening cycle could be worse than the Great Recession.

This is a problem of the Fed’s own creation.

More than a decade of artificially low-interest rates coupled with massive stimulus injected into the economy during the pandemic incentivized companies to load up on low-interest debt. That was fine and dandy as long as rates were near zero. But with interest rates now pushed up to over 5%, many companies can’t service their massive debt loads. Many will undoubtedly go under.

According to the Fed paper, this will likely have “substantial effects on investment and employment.”

The paper also notes the typical lag between a change in monetary policy and its impact on the economy, noting we may not start seeing a wave of defaults until next year.

This shouldn’t come as a shock. The Fed has addicted the economy to easy money. When you take an addict’s drug away, he goes into withdrawal. The economy already has the shakes. It’s just a matter of time before it goes into full DTs.

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Buka akaun dagangan patuh syariah anda di Weltrade.

Source link