Jobs Report: Not Strong Enough to Prevent a Soft Pivot

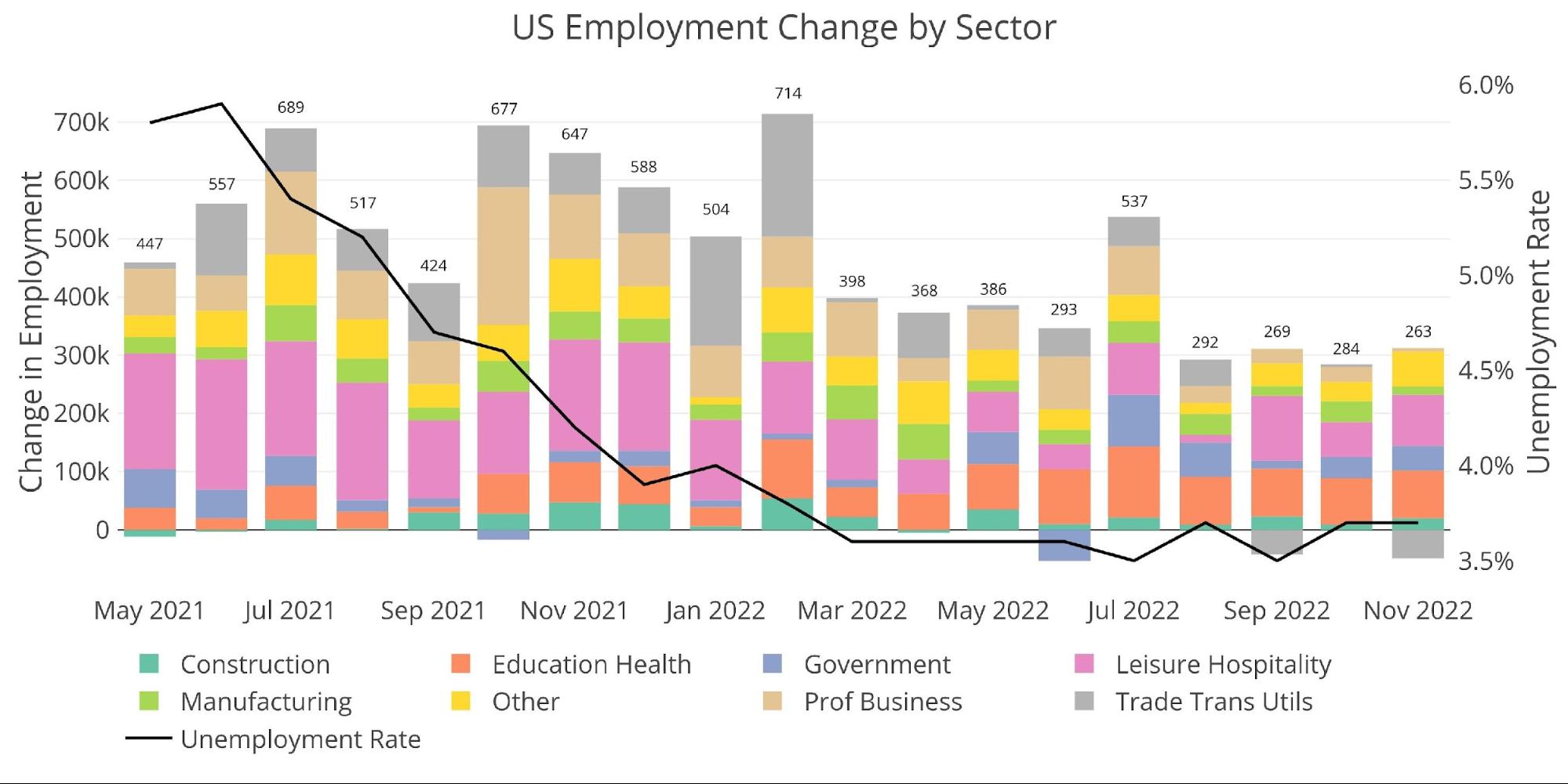

According to the BLS, the economy added 263k jobs in November with a modest revision up in October from 261k to 284k but a revision down in September from 365k to 269k. October was a beat against median expectations of 200k. The employment rate (black line) stayed flat at 3.7% while the labor force participation ticked down from 62.2% to 62.1% This is the weakest labor force participation since December of last year.

The job numbers have stayed surprisingly resilient despite daily announcements by major companies of job cuts and freezes and a weaker than expected ADP report on Wednesday. It’s only a matter of time before this feeds into the BLS job numbers.

Figure: 1 Change by sector

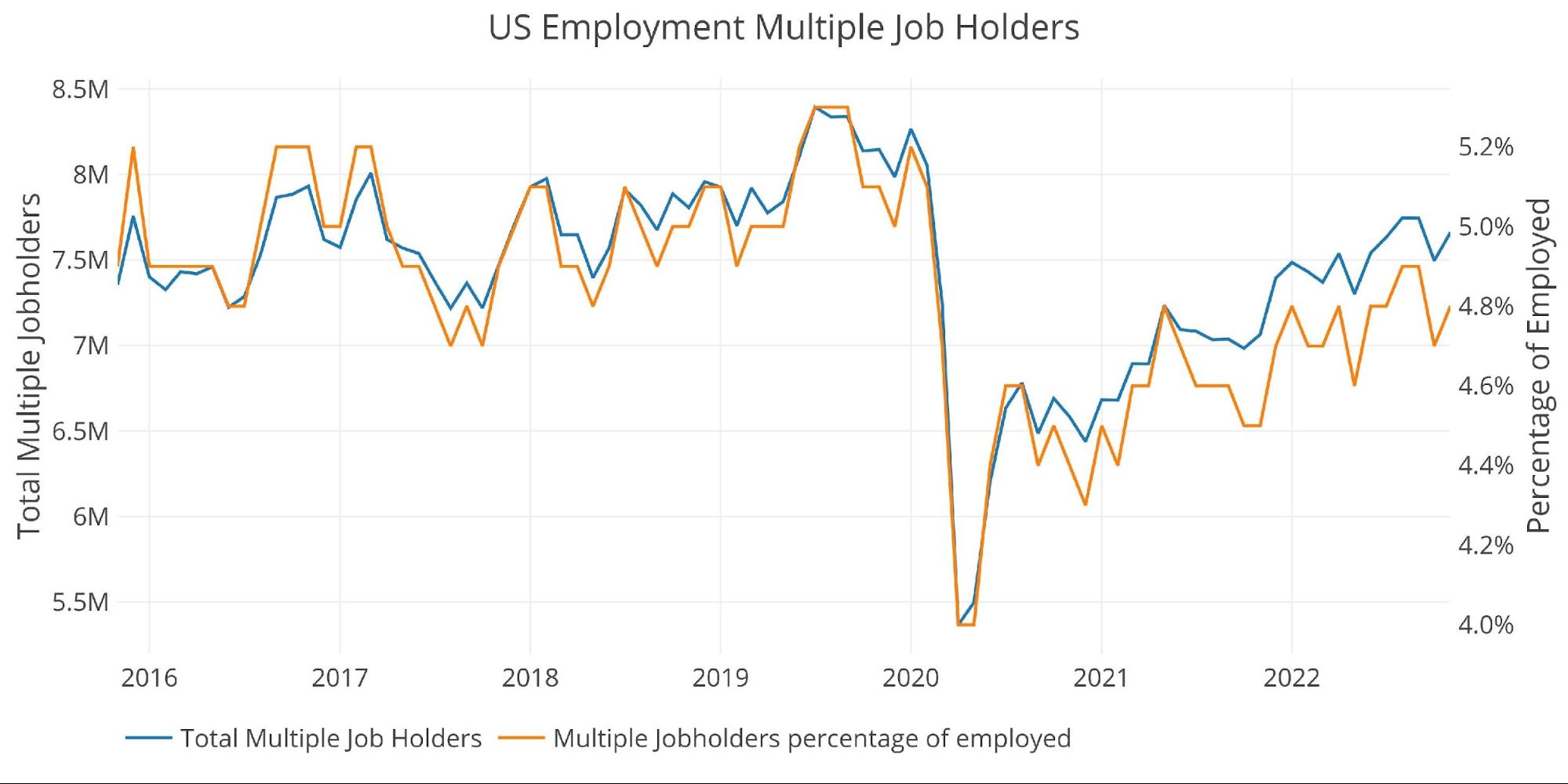

The number of multiple job holders has been steadily increasing in a choppy manner. The current report showed a month-over-month increase, but it is still down from the post-Covid high in September and a half percentage point below the pre-Covid highs.

Figure: 2 Multiple Full-Time Employees

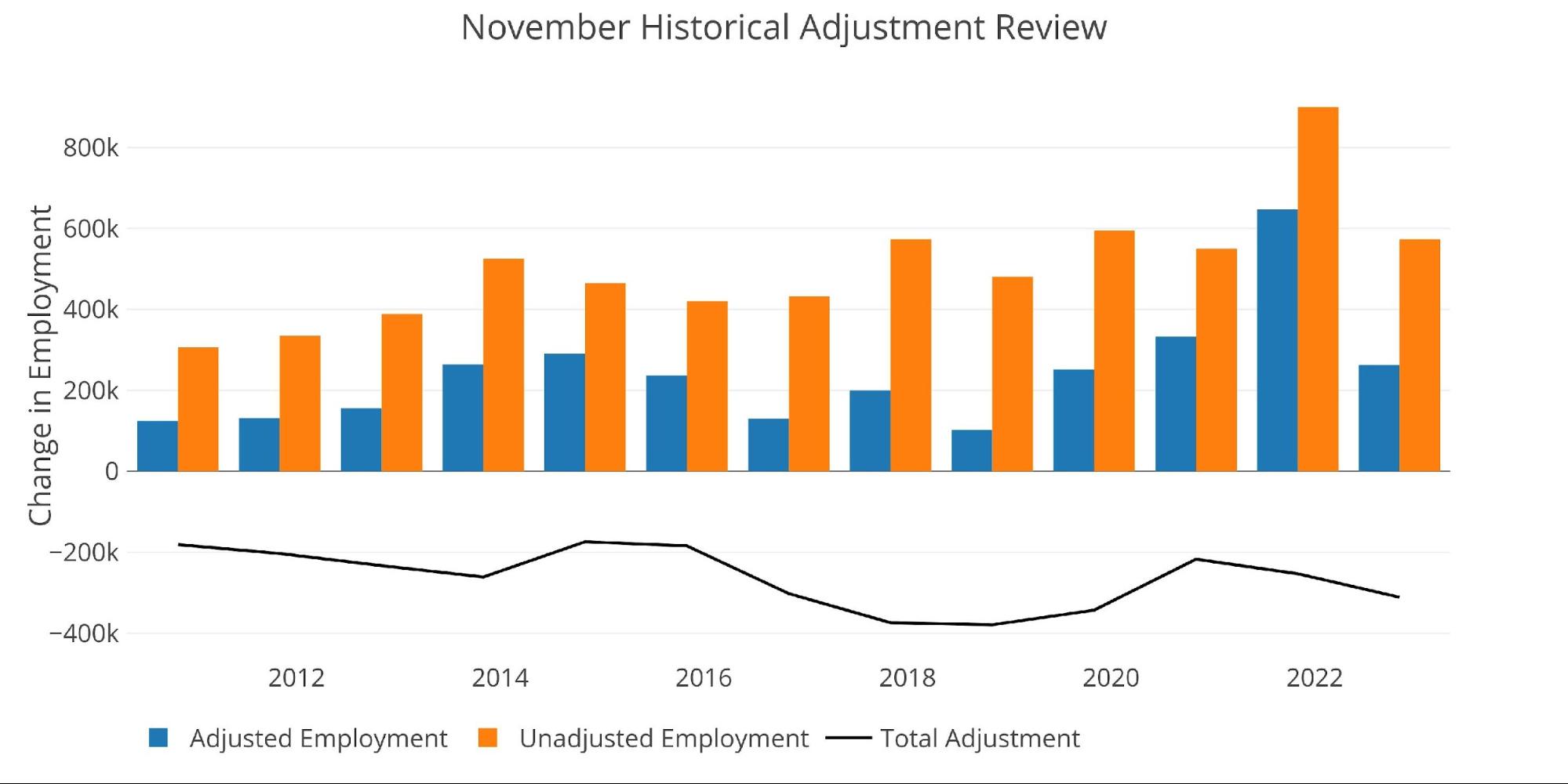

When looking at the unadjusted numbers, November was around middle of the pack.

Figure: 3 Monthly Non-Seasonally Adjusted

November typically sees adjustments down to the raw figure. This November saw an adjustment down of 311k which is the biggest downward adjustment in the last three years.

Figure: 4 YoY Adjusted vs Non-Adjusted

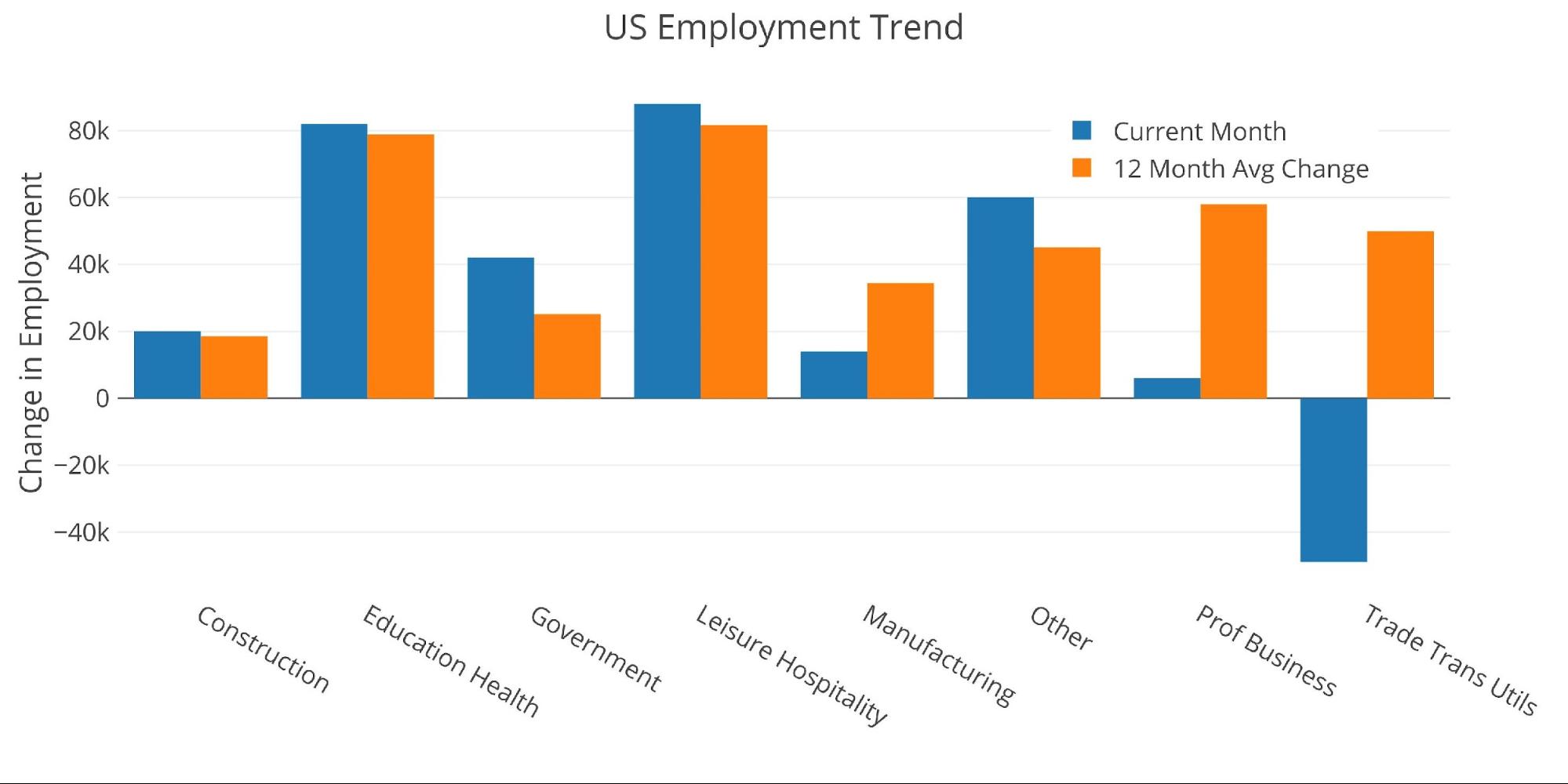

Breaking Down the Adjusted Numbers

Surprisingly, November came in above trend for 5 of the 8 categories shown below. Only Manufacturing, Professional Business, and Trade/Transport/Utils came in below the 12-month trend.

Figure: 5 Current vs TTM

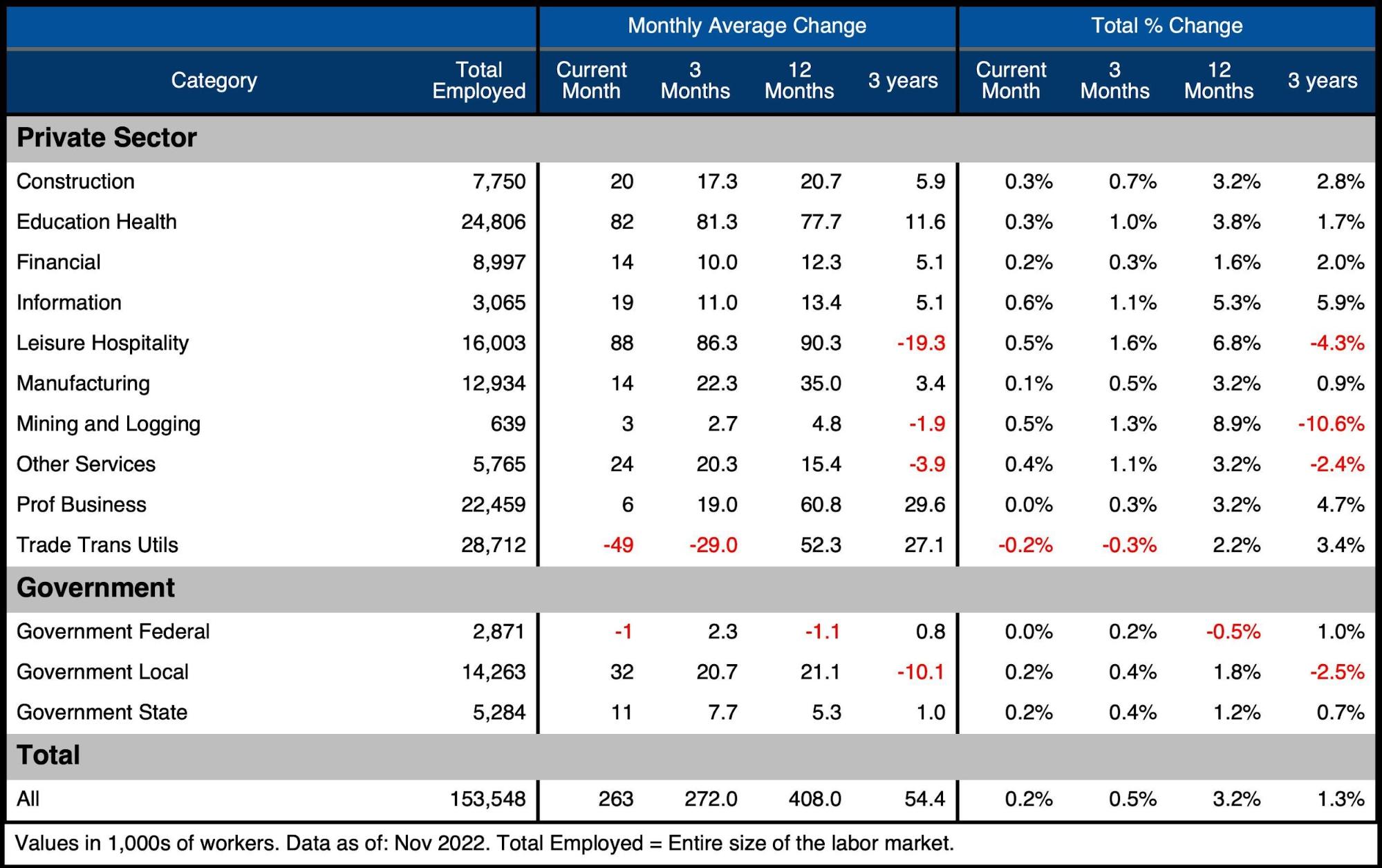

The table below shows a detailed breakdown of the numbers. Despite 5 of 8 categories above trend, the aggregate number of 263k is below the three-month average (272k) and the 12-month average (408k).

Key takeaways:

-

- Excluding government, 7 of 10 categories were above the 3-month average

- Despite a glut of new home supply, Construction saw a strong increase

- Leisure and Hospitality was also quite strong at 88k, coming in close to the 12-month average of 90k

Figure: 6 Labor Market Detail

Revisions

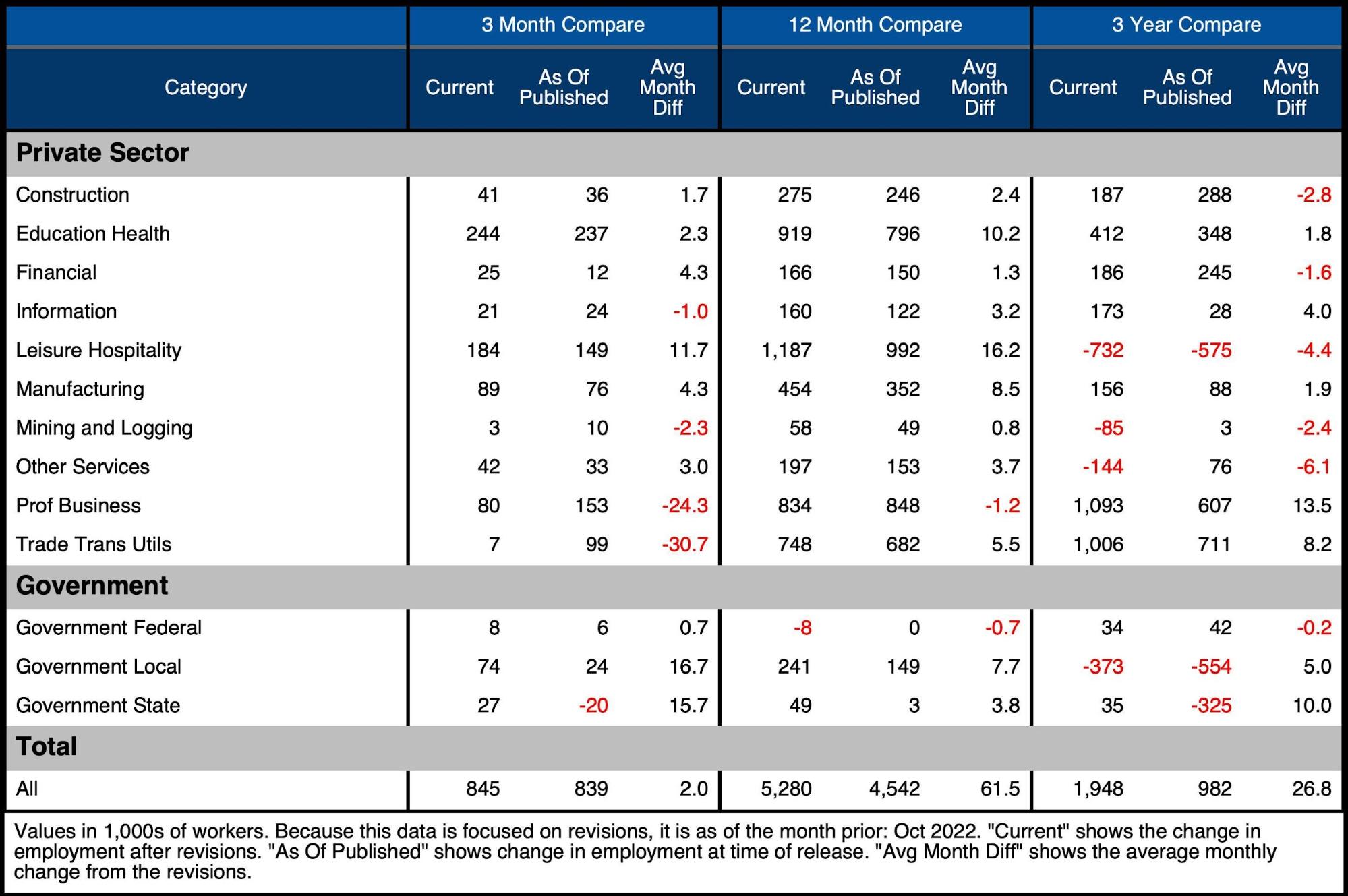

While the headline number gets all the attention, the number is typically revised several times. Revisions over the last three months were slightly net positive (+2k) while revisions over the last 12 months averaged +61.5k.

Over the last three months, government job revisions were positive by 33.1k. Without the Government job revisions, the three-month revisions would have been negative by 31.1k.

Figure: 7 Revisions

Historical Perspective

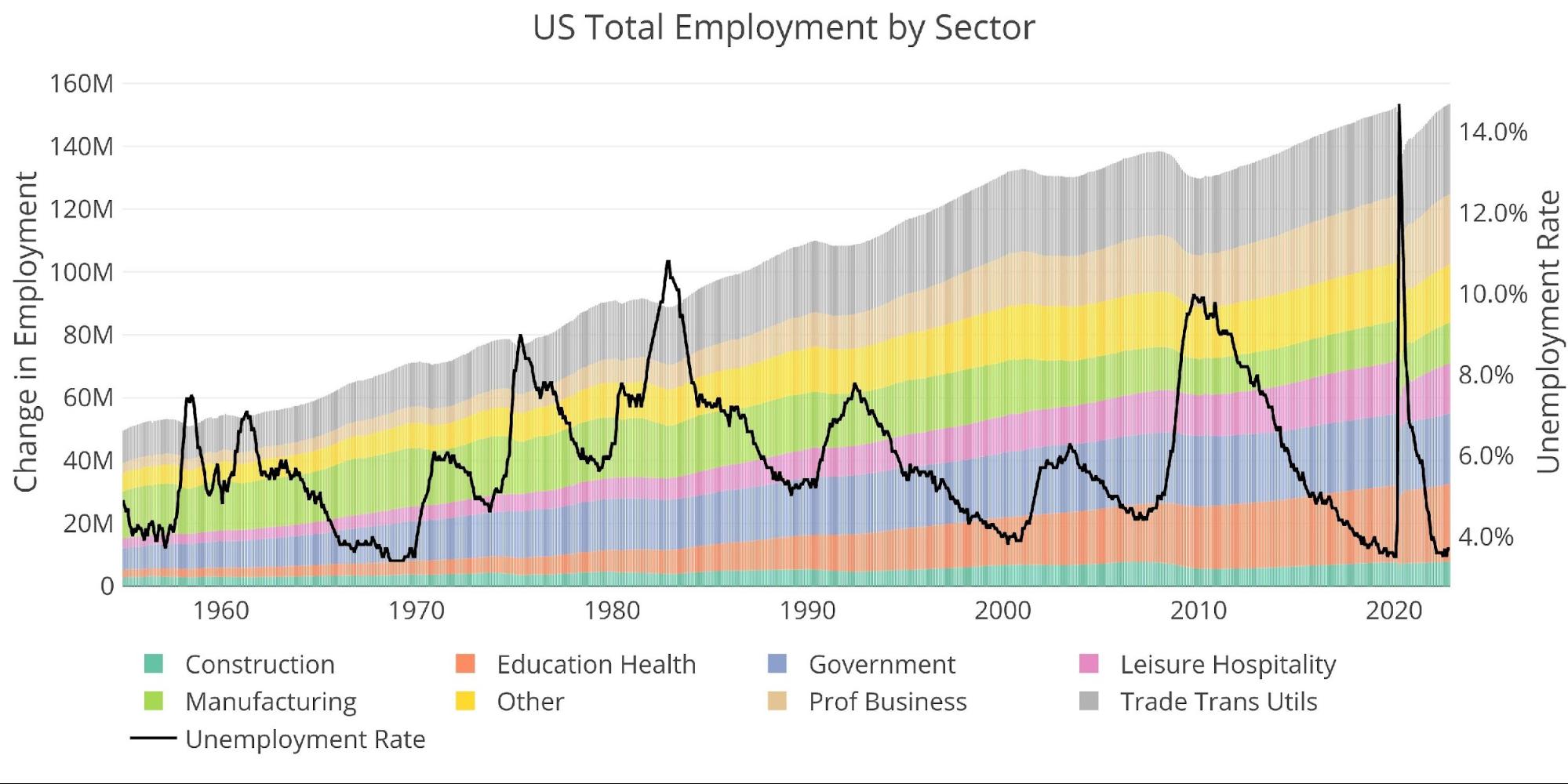

The chart below shows data going back to 1955. The Covid recession can be seen as the greatest job market loss ever.

The current unemployment rate stayed flat at 3.7%.

Figure: 8 Historical Labor Market

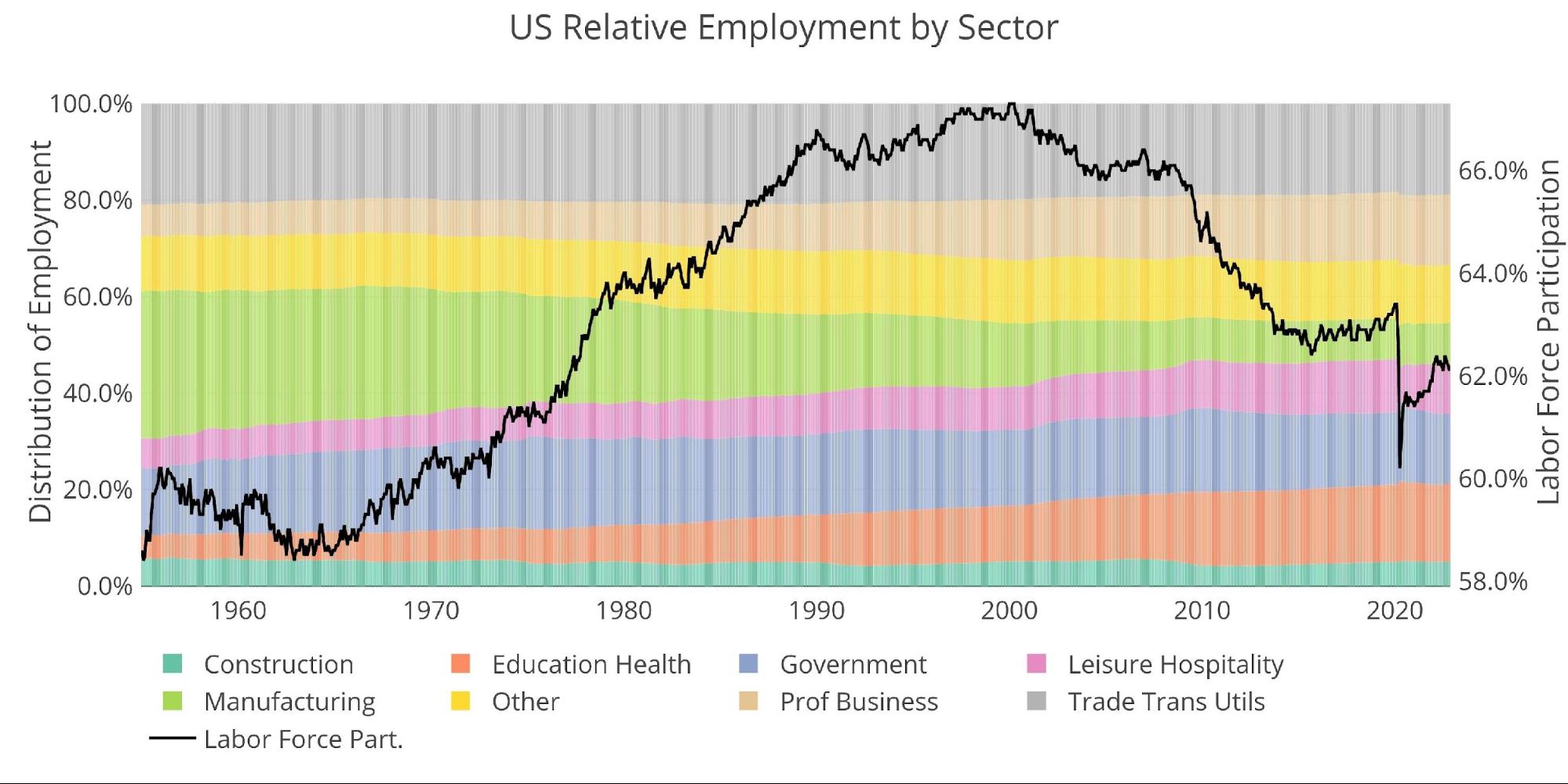

The labor force participation decreased for the third month in a row, falling from 62.4% in August to 62.1%. It still sits more than a full percentage point below the pre-Covid levels of 63.4% and well below the 66% pre-Financial Crisis.

Figure: 9 Labor Market Distribution

What it means for Gold and Silver

The current job numbers surprised to the upside which has put pressure on gold and silver this morning. Gold is fighting at the $1800 mark as of publishing. That said, both silver and gold are still positive for the week after Jay Powell began to introduce the soft pivot.

What many market participants are failing to consider is the possibility of a hard and dramatic pivot by the Fed. The Fed has moved way too aggressively to not have already broken something. FTX was simply a preview of what is to come in the broader market. Something will give shortly and the Fed will be forced to rescue the market or face massive repercussions.

While traders are still not seeing the high probability of such an event, there are players in the gold and silver market who are. This would explain the massive drawdown in inventories seen over the last several months on the Comex. In fact, the drawdowns have been so significant that major market participants are possibly stepping back to not risk putting it under strain. It’s only a matter of time.

Data Source: https://fred.stlouisfed.org/series/PAYEMS and also series CIVPART

Data Updated: Monthly on first Friday of the month

Last Updated: Nov 2022

Interactive charts and graphs can always be found on the Exploring Finance dashboard: https://exploringfinance.shinyapps.io/USDebt/

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Buka akaun dagangan patuh syariah anda di Weltrade.

Source link