Forecast for XAUUSD 7 OCT 2022 for Fundamental Analysis and Technical Analysis

Gold :Fundamental Factors

1) September US NFP are forecast at 250K compared to 344K in August. As usual, the prior month could be revised, and also affect market outlook.

Since a “normal” NFP is around 200K, any figure above that is likely to support further Fed tightening and weigh on the stock market.

2) The unemployment rate is expected to remain stable at 3.7%. But, that was also the case last month, when analysts were surprised with an increase in the unemployment rate driven by increased labor force participation.With pocketbooks coming under pressure from inflation, it’s not surprising that more people would be out looking for work, which could once again distort the projections.

3) A tight labor market is generally understood to push wages higher, as employers try to attract talent. However, so far this cycle, wage increases have been slower than inflation. Which means that the average real wage has been falling for several months. This could contribute to demand destruction as the average American has less purchasing power. According to the most common economic theory among central bankers and the government, this implies an increased risk of a recession. In fact, because wages aren’t growing as fast as inflation, this could motivate the Fed to be even more aggressive in tightening. As long as wages aren’t significantly outpacing inflation, then the Fed actually likes labor market tightness, because it supports economic growth, according to them.

Gold : Trend is Bearish

Fundamental Range : 1659-1732

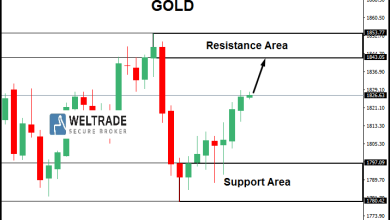

Gold : Technical Analysis

Check at Daily Timeframe Support and Resistance for Fibonacci.

Resistance Area : 1721.97,1726.58,1734.06

Support area :1694.92,1702.40,1707.01

Pivot point : 1714.49

Confirm with technical indicators and based on your own technical analysis

Check investing.com to get more info on what most indicator would display

Check higher timeframe also for more confirmation for entry in Daily timeframe.

The technical indicator display strong buy in Daily and strong sell in weekly and monthly timeframe, where we can entry sell for higher timeframe by following the support area given and vice versa

Use linear regression to get confirmation trend at daily as they are not available in investing.com

Linear regression shows a downward trend.Can check linear regression trend in weekly and monthly for more confirmation.

Use Bolinger Band Strategy Tester and RSI Strategy Tester to get more confirmation.Check at bigger timeframe for percent profitable to get more confirmation.

Percent profitable must be above 50%.

The strategy has contradiction , for RSI strategy tester is more supporting towards the down trend in Daily, and if we follow Bolinger Band Strategy Tester , it is more supporting towards uptrend in Monthly.

Gold : Find Sell at the daily chart by using the resistance points and take profit will be at the pivot point, 1714.69

For further information, contact me ,Gurmit at +60142584067,I will guide anyone that would like to register with Weltrade. Can register at the below link. Thank you.

https://my.weltrade.com/?r1=ipartner&r2=49989

Disclaimer : This analysis is based on Investing.com and Forexfactory.com. You may follow based on your own discreetion.

Can join at our telegram group at https://t.me/weltrade_my

For traders who want to trade on their own can join Weltrade, we provide benefits for traders out there, learn to trade and follow free signals such as free paid signal providers, bookmap gold and tradingview premium live.

Free Bookmap Education t.me/+JetSe33YA0U2ZDk1

Join us at our zoom for online learning from 10.30am to 11.30am by the Financial Markets Research Center (FMRC) team. With Cikgu Hafiz and Cikgu Gurmit

Link: https://us06web.zoom.us/j/81843968428?pwd=VkZ3L2UrcXh2WlZsZHU3ZFFGUmJMQT09

Komen anda

Source link