Comex Inventory: 17.4 Paper Ounces of Silver for Each Registered Ounce

This analysis focuses on gold and silver within the Comex/CME futures exchange. See the article What is the Comex? for more detail. The charts and tables below specifically analyze the physical stock/inventory data at the Comex to show the physical movement of metal into and out of Comex vaults.

Registered = Warrant assigned and can be used for Comex delivery, Eligible = No warrant attached – owner has not made it available for delivery.

Current Trends

Gold

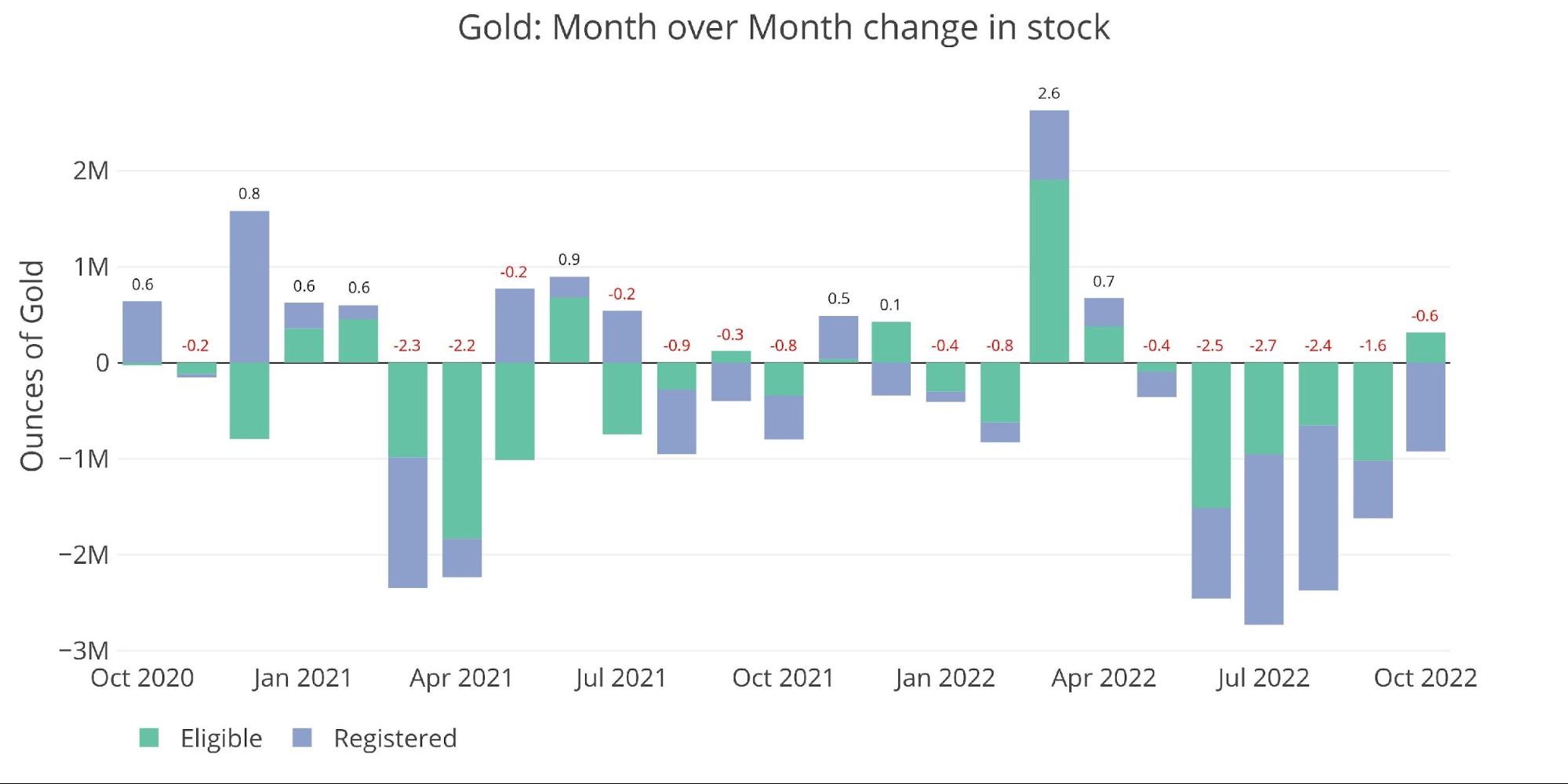

The relentless fall in gold inventories continued again in October. While the overall vault decrease has slowed somewhat, the fall in Registered (925k) has already exceeded the total in September (600k) and will more than likely eclipse June (942k). Registered is the metal available for delivery, so this is an important trend to watch.

Figure: 1 Recent Monthly Stock Change

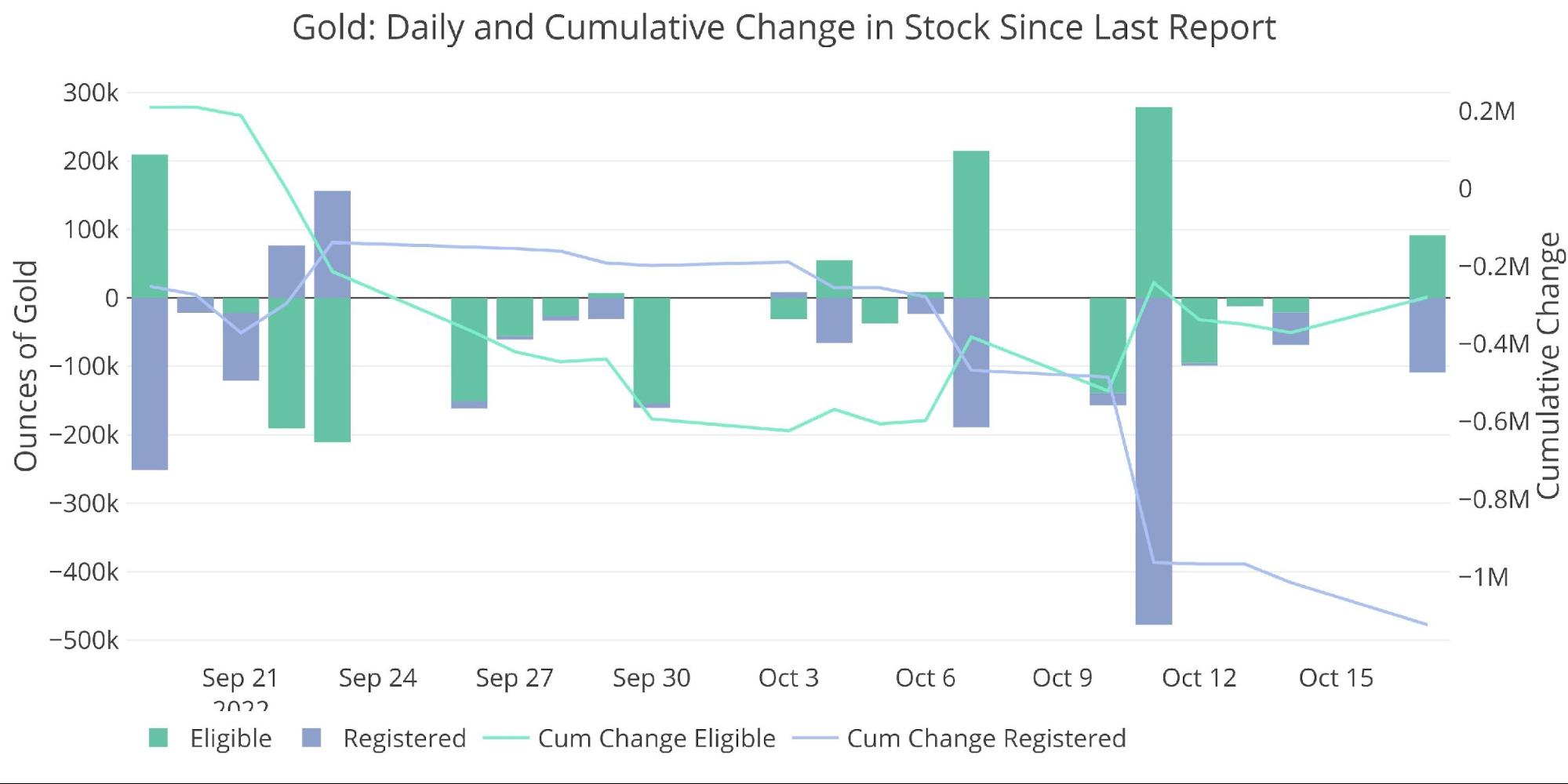

The daily vault moves can be seen below. As shown, hardly a day goes by without a significant move at this point.

Figure: 2 Recent Monthly Stock Change

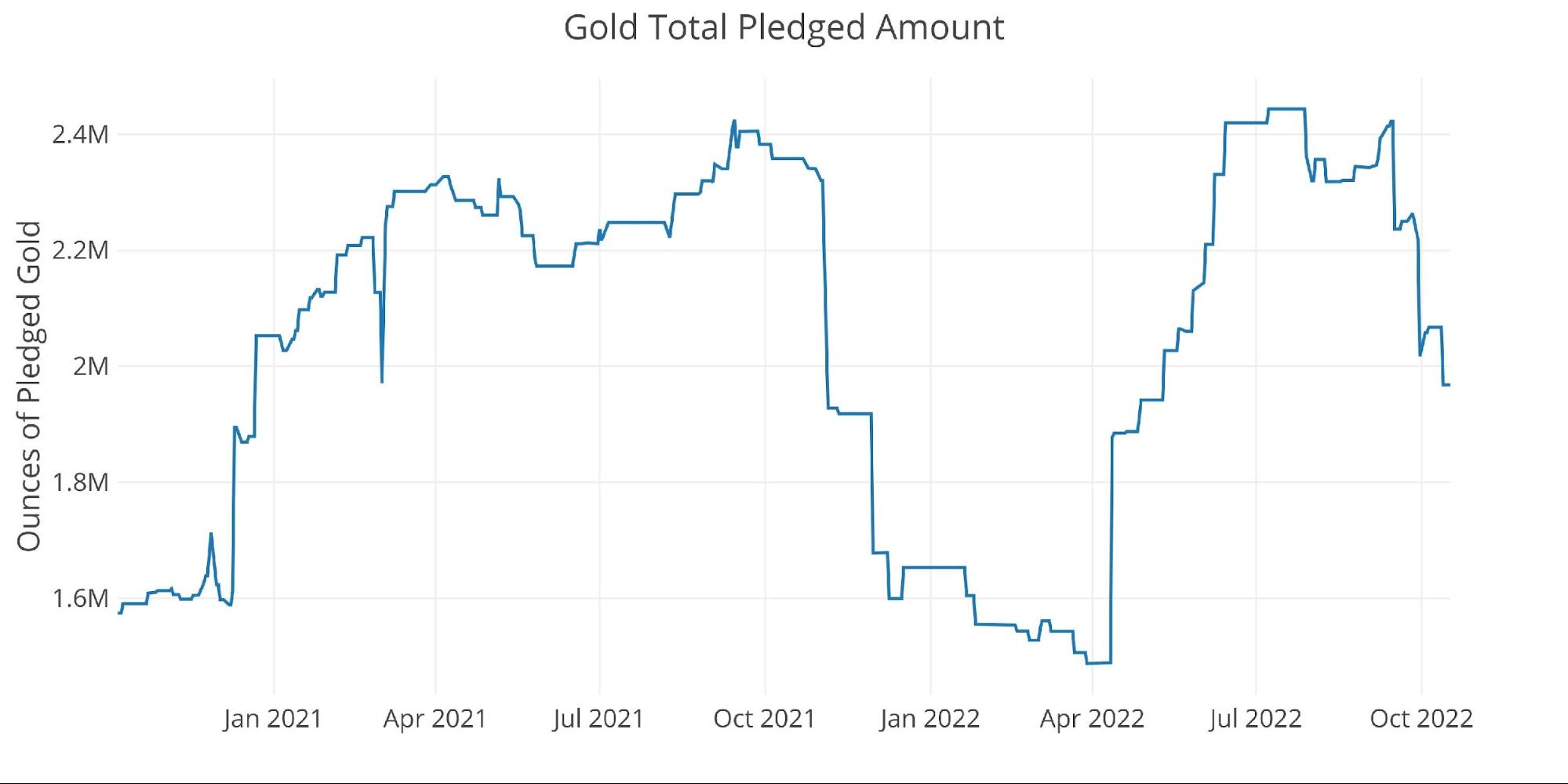

The current fall in Registered is also impacting the Pledged category. Pledged is a subset of Registered but is actually not available for delivery because it has been pledged as collateral. The biggest falls have come from Brinks, HSBC, and Manfra who have reduced Pledged by a combined 464k ounces over the last month.

Figure: 3 Gold Pledged Holdings

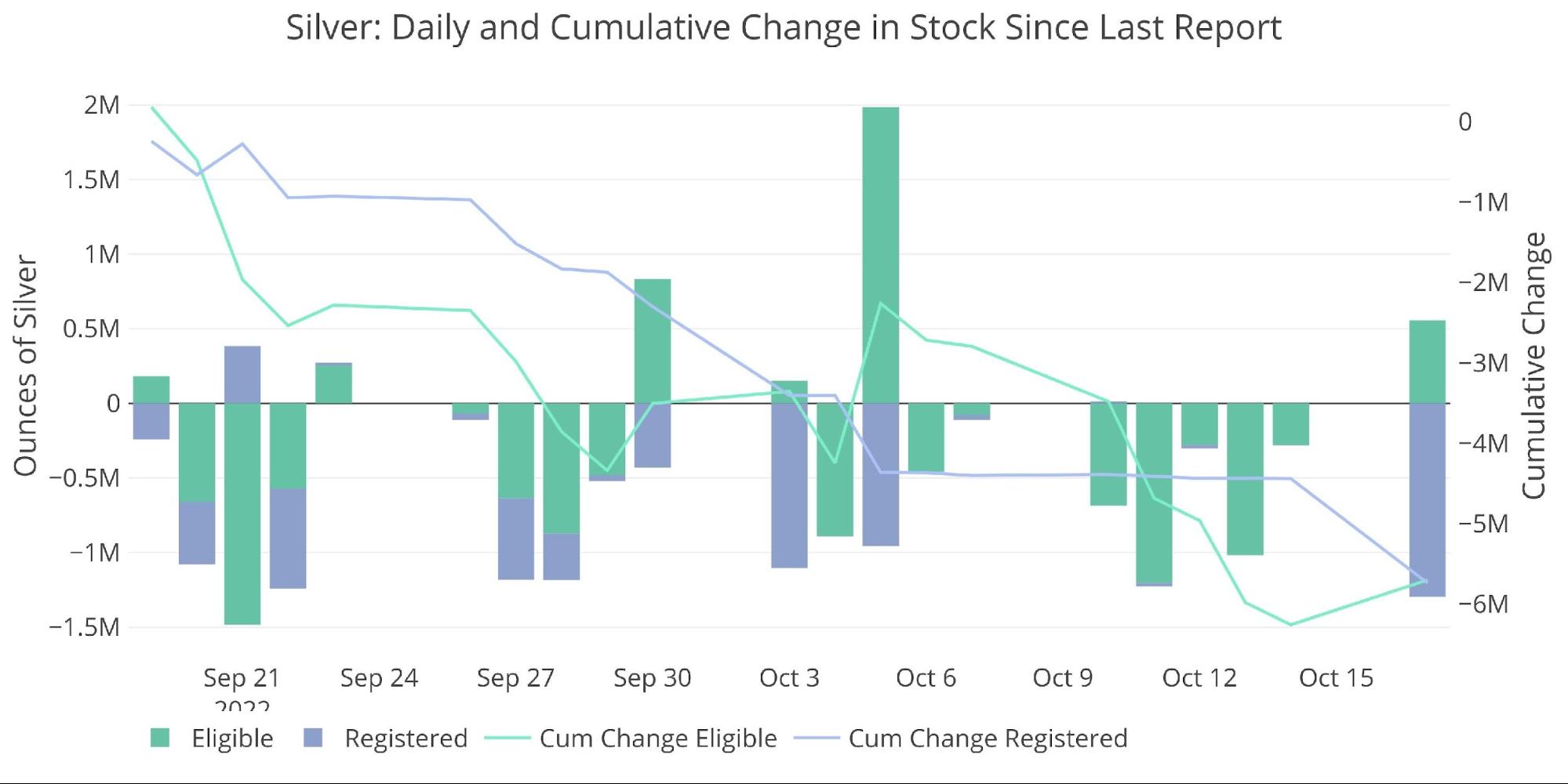

Silver

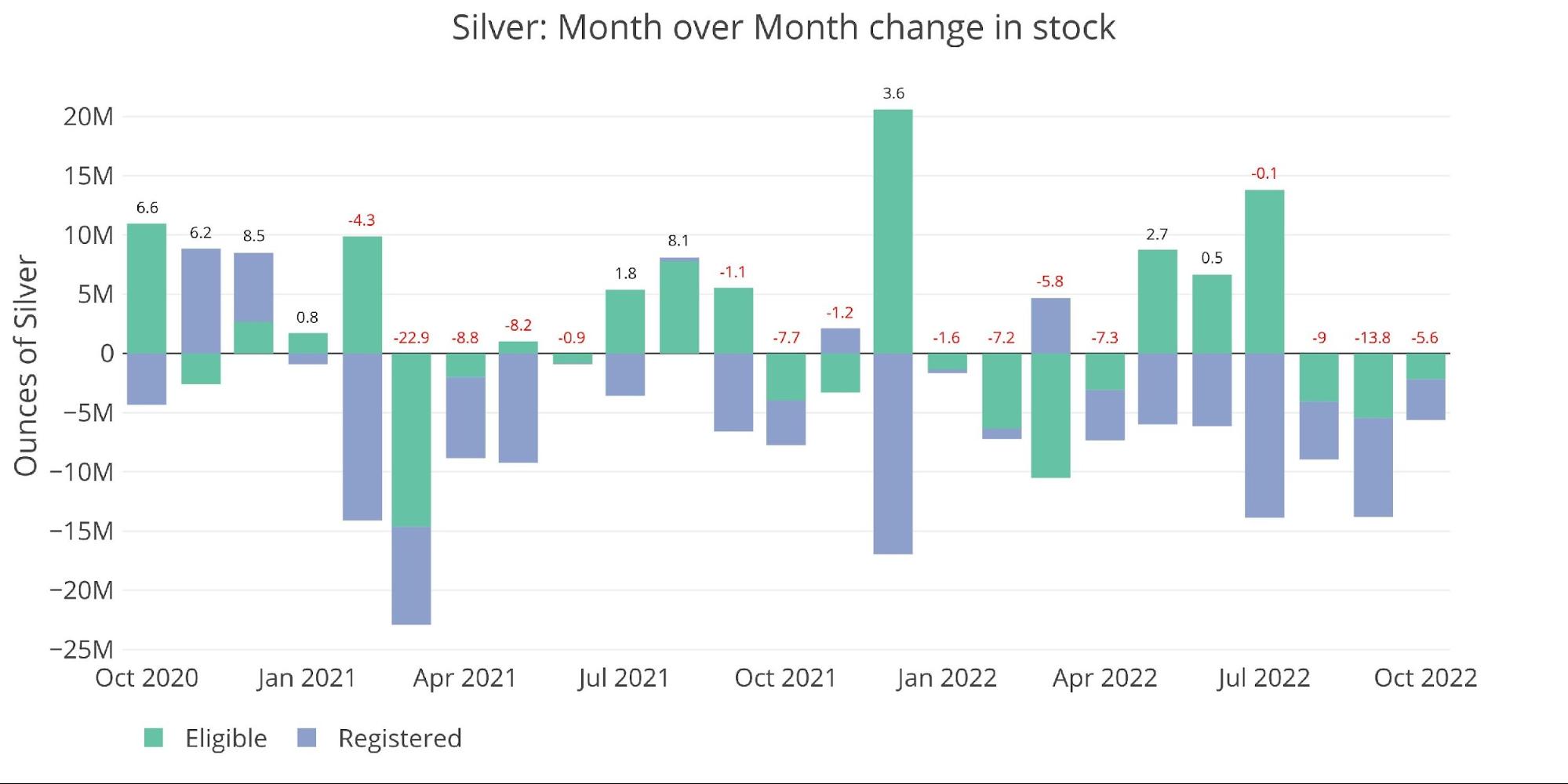

The story in silver is in the Registered category which just fell below 40M ounces for the first time since October 2017 (see Figure 7). This means there are less than 8,000 contracts of Registered metal available for delivery. The next major silver month is December. For reference, last December saw 9.2k contracts delivered with 10.5k standing for delivery as recently as March.

Figure: 4 Recent Monthly Stock Change

There is not enough Registered silver to handle a large delivery month. This is probably why silver is seeing the smallest delivery month in years. There must be cash settlement going on behind the scenes. This is further evidenced by Bank house accounts which have completely left the delivery market! So far, bank house accounts have delivered 4 total contracts of silver. For reference, in September they were responsible for a total of 8,500 contracts (combined long and short) and 750 contracts in August (the last minor delivery month). This can be seen in the chart below. The bar for October is not even visible!

Why would banks immediately cease activity? It could very well be that supplies are so tight that they have no other option.

Figure: 5 House Account Activity

Another strange occurrence was the flat line in Registered decline that just ended. For months, Registered silver saw significant declines almost daily. There might have been 1-2 days with little activity but then the withdrawals would resume.

All of a sudden, right before Registered dipped below 40M in total ounces, the declines stopped. For 7 business days, the ounces in Registered barely moved until yesterday’s report showed that Friday saw 1.3M ounces leave.

Figure: 6 Recent Monthly Stock Change

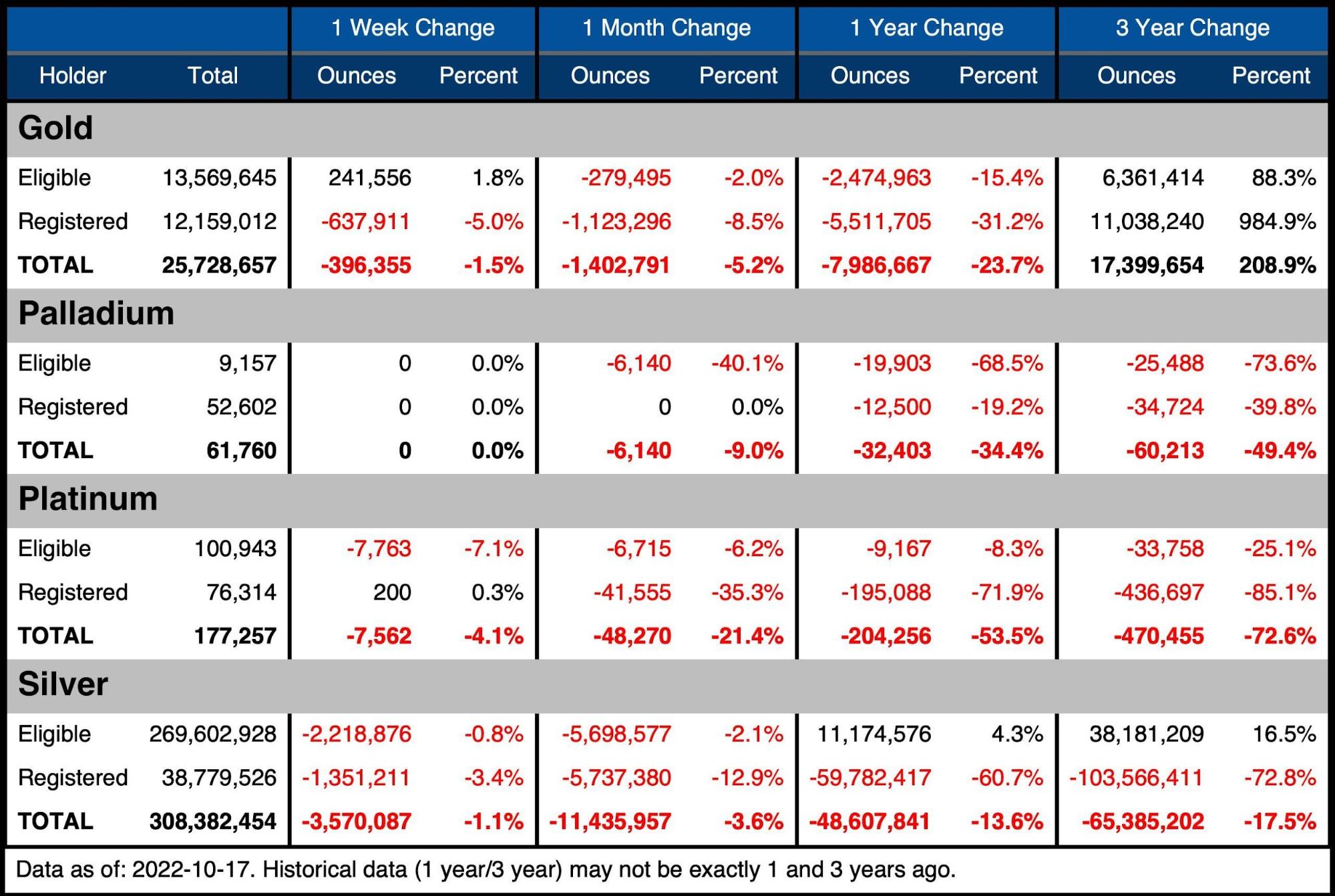

The table below summarizes the movement activity over several periods to better demonstrate the magnitude of the current move.

Gold

-

- Over the last month, gold has seen Registered fall of 8.5% or 1.1M ounces

-

- The fall over the last year has been 31.2% which means the last month represents more than a quarter of the aggregate decline in the last year!

- In the last week alone, Registered has fallen by 5%!

-

- Over the last month, gold has seen Registered fall of 8.5% or 1.1M ounces

Silver

-

- Silver Registered is down by 13% in the last month (5.7M ounces)!

-

- Registered silver is down an incredible 60% in the last year and 72.8% over three years

-

- Eligible saw 5.7M ounces removed over the last month

- Combined, inventory has dropped 3.6% in the last month

- Silver Registered is down by 13% in the last month (5.7M ounces)!

Registered silver is falling about 8M ounces a month. At the current pace, inventory could be wiped out within 5 months!

Palladium/Platinum

Palladium and platinum are much smaller markets but that may be where the market breaks first.

-

- Palladium Eligible is down 40% month over month

- Platinum Registered fell by 35% over the last month alone and is down 72% YoY

Figure: 7 Stock Change Summary

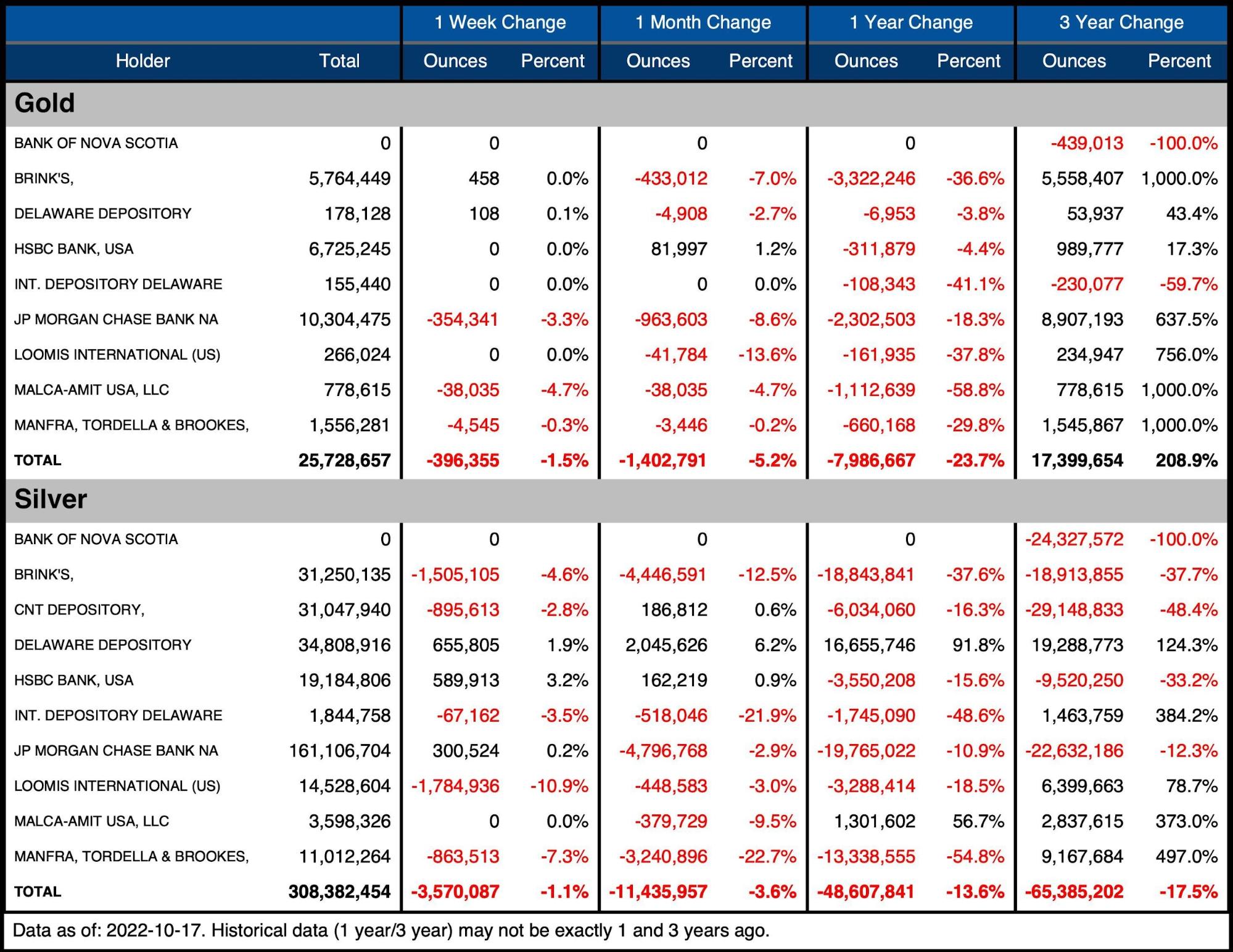

The next table shows the activity by bank/Holder. It details the numbers above to see the movement specific to vaults.

Gold

-

- Every vault has seen inventories fall over the last year with 5 vaults seeing supply fall by more than 30%

-

- Malca is down almost 60%!

-

- Over the last month, 6 of 8 vaults lost gold while only HSBC increased inventory by 1.2%.

- Every vault has seen inventories fall over the last year with 5 vaults seeing supply fall by more than 30%

Silver

-

- Silver has seen some big shuffling with 6 vaults losing metal against 3 vaults gaining metal

-

- Of the vaults losing metal, 4 vaults saw declines of ~10% or more, with two greater than 20%

-

- The last week alone saw 3.5M ounces leave the vaults

- Silver has seen some big shuffling with 6 vaults losing metal against 3 vaults gaining metal

Figure: 8 Stock Change Detail

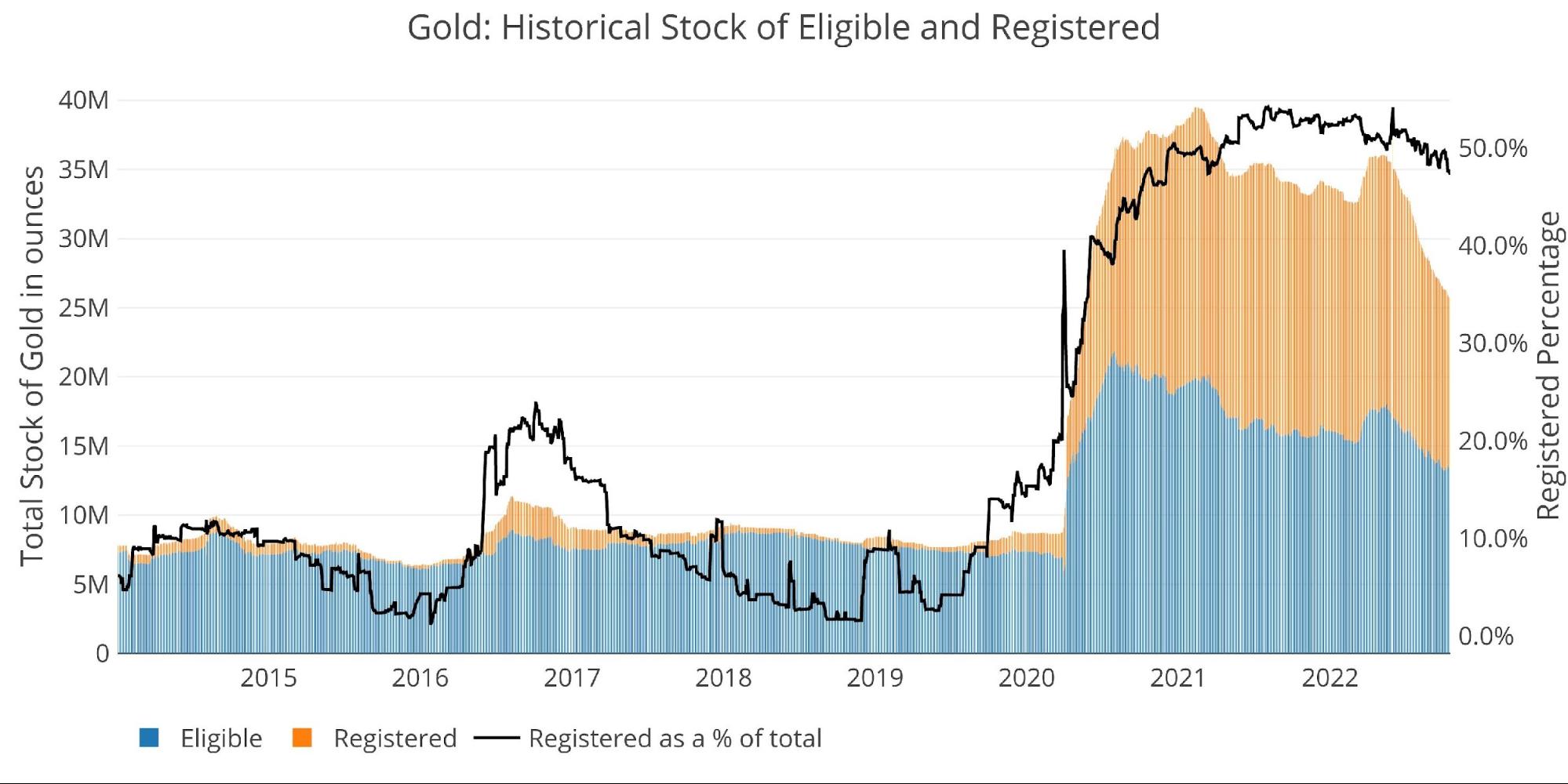

Historical Perspective

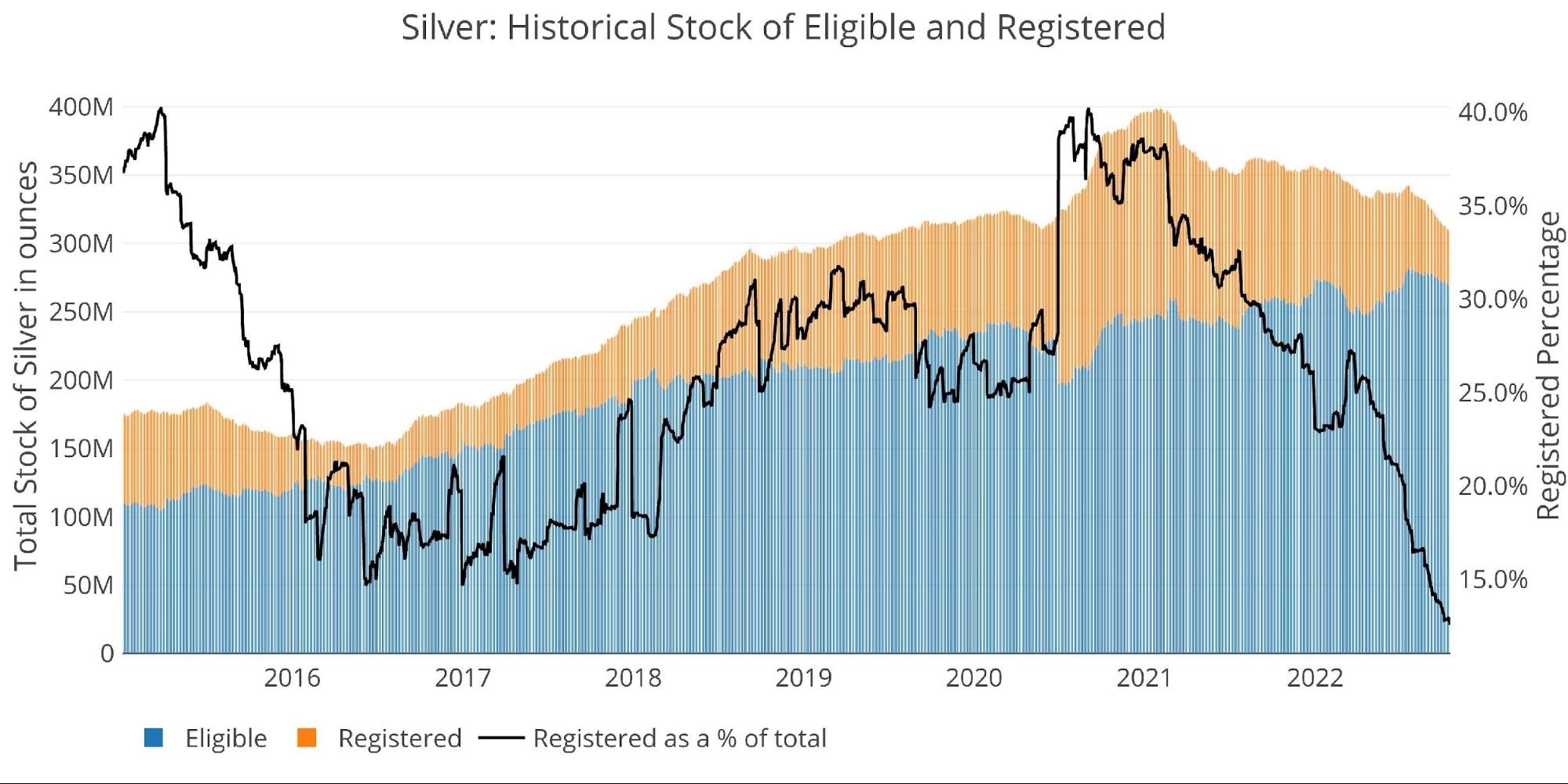

Zooming out and looking at the inventory for gold and silver shows just how massive the current move has been. The decline has been swift and steep, with losses seen in both Eligible and Registered. Registered as a % of total has remained relatively stable as declines have been fairly even in both categories.

Figure: 9 Historical Eligible and Registered

Silver is a different story with the current decrease primarily focused on Registered. Registered as a % of total has crashed to 12.6%.

Figure: 10 Historical Eligible and Registered

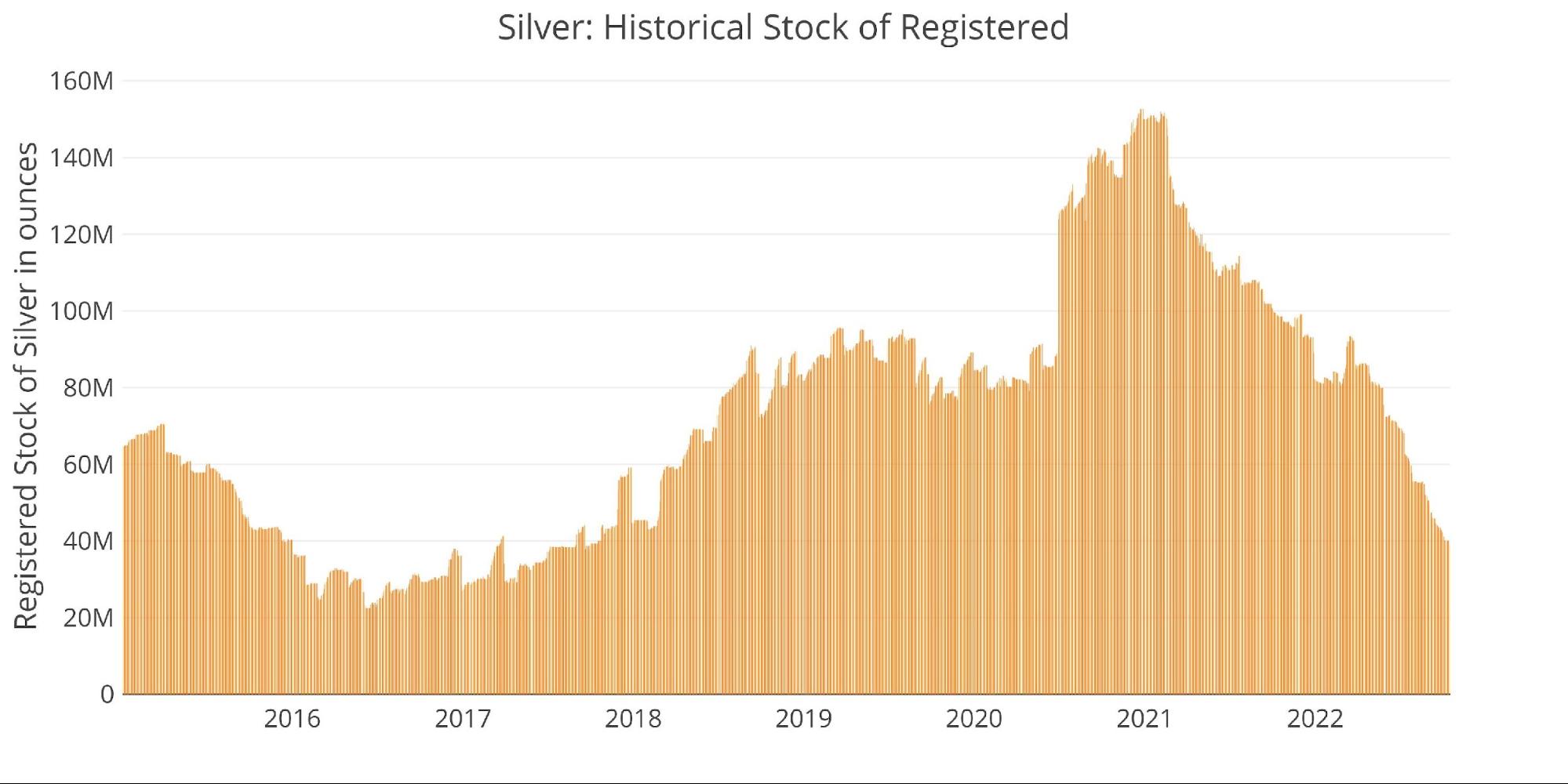

The chart below focuses just on Registered to show the steepness of the current fall. In Feb 2021, there were 152M ounces of Registered. That number now sits at 38M, which is a net fall of 114M ounces. Considering the recent acceleration, total holdings could fall below 2016 levels (23M ounces) within a few months.

Figure: 11 Historical Registered

Comex is not the only vault seeing big moves out of silver. Below shows the LBMA holdings of silver. It should be noted that much of the holdings shown below are allocated to ETFs. Regardless, total inventories have fallen every single month since November. Holdings fell below 1B ounces in June and now sit at 871M ounces as of September. The decline is accelerating!

Figure: 12 LBMA Holdings of Silver

Available supply for potential demand

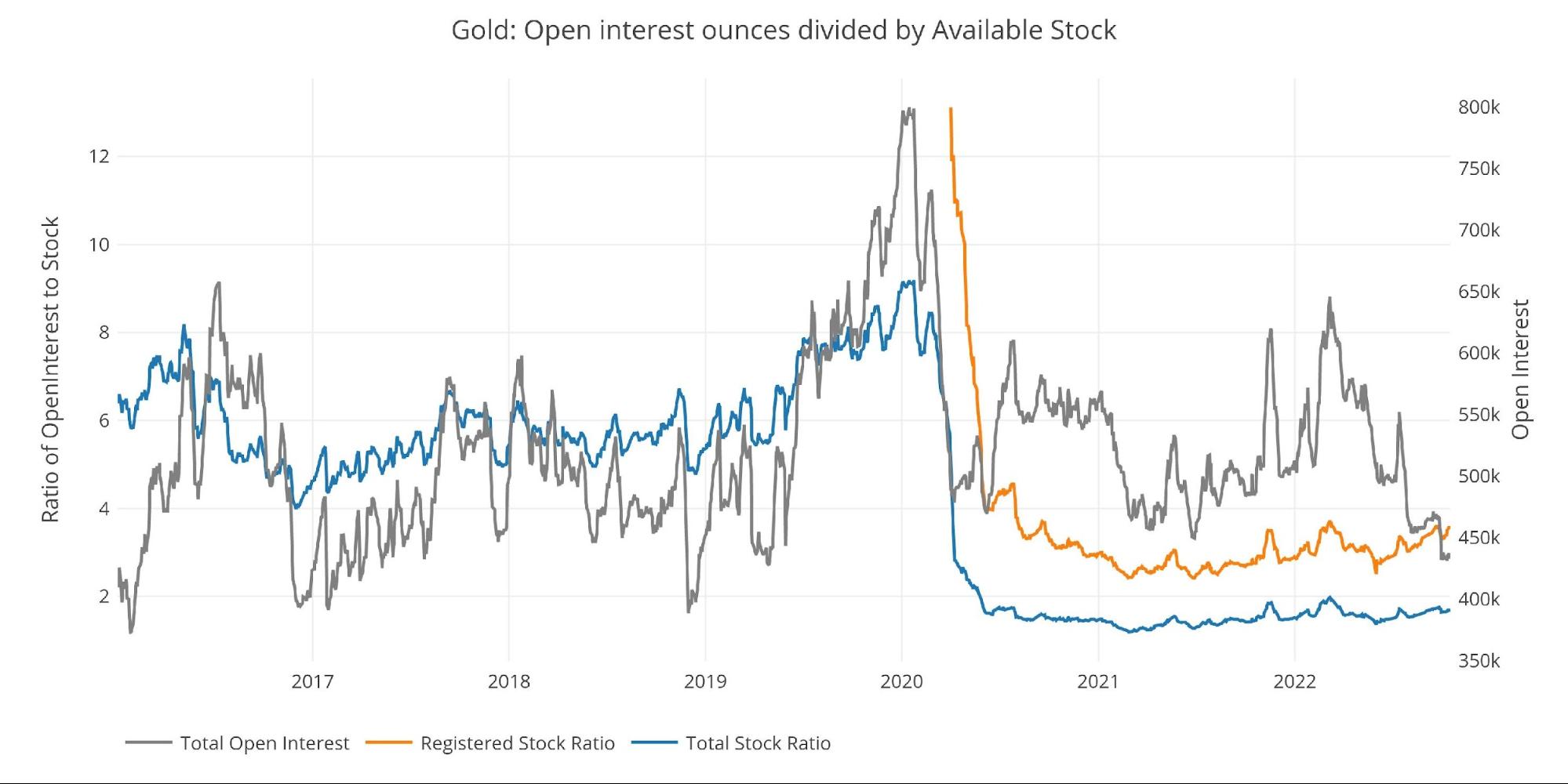

These falls in inventory have had a major impact on the coverage of Comex against the paper contracts held. There are now 3.56 paper contracts for each ounce of Registered gold within the Comex vaults. The coverage would actually be far worse (around 5.2) if the total open interest had not plummeted in recent weeks.

Figure: 13 Open Interest/Stock Ratio

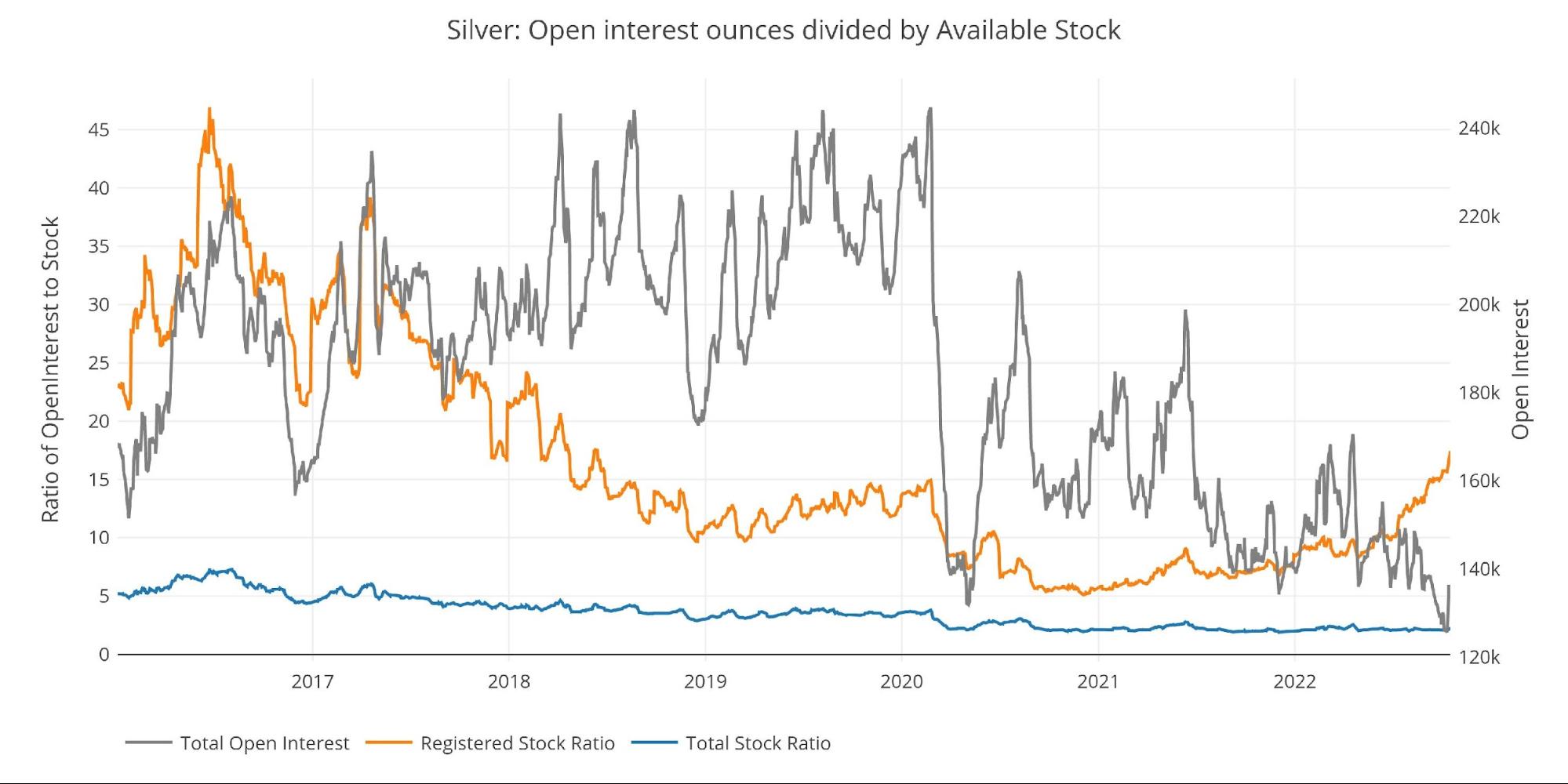

Coverage in silver is far weaker than gold with 17.4 paper contracts for each ounce of Registered silver. If Open Interest was still at Pre-Covid levels, the ratio of paper to physical would be 30.32!

Figure: 14 Open Interest/Stock Ratio

Wrapping Up

The physical demand for gold and silver has been voracious. While the price is still being controlled by the paper market, it’s clear that something in the physical market could trigger a major shift. As supplies continue to dwindle, it’s only a matter of time before shorts will get stuck without being able to deliver. At the current pace, this is not something that will happen in a few years. It could be a few months! When you have 17 paper ounces against 1 ounce of physical, something will give.

The price action in gold and silver does not suggest that supplies are starting to run thin, but the data is ringing the alarm bell for anyone who wants to listen. Physical is in demand and investors want it now! Prices will catch up. Make sure you are positioned before they do.

Data Source: https://www.cmegroup.com/

Data Updated: Daily around 3 PM Eastern

Last Updated: Oct 17, 2022

Gold and Silver interactive charts and graphs can always be found on the Exploring Finance dashboard: https://exploringfinance.shinyapps.io/goldsilver/

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Buka akaun dagangan patuh syariah anda di Weltrade.

Source link