‘War Underscores Need’ for Crypto Regulation

Fed Chair Pro Tempore Jerome Powell said Russia’s invasion of Ukraine could emphasize a need for cryptocurrency regulation to prevent sanctioned individuals from using cryptocurrency to evade sanctions.

“[The Ukraine-Russia conflict] underscored the need for Congressional action on digital finance including cryptocurrencies,” Powell said. “We have this burgeoning industry which has many parts to it, and there isn’t in place the kind of regulatory framework that needs to be there.”

The Fed Chair was responding to a question about whether Russia could use cryptocurrencies to bypass sanctions. The U.S., EU and other nations have imposed financial sanctions against Russia in an effort to have it back down from its invasion of Ukraine. Earlier on Wednesday, the European Union cut seven of Russia’s largest banks off from the SWIFT interbank messaging system.

Powell referred to the possibility that terrorists or other malicious actors could use cryptocurrency as further examples of the need for additional regulation.

Powell is testifying in front of the House Financial Services Committee Wednesday on the state of the economy and monetary policy. He will report to the Senate Banking Committee on Thursday.

Congressman Juan Vargas (D-Calif.) asked about the Fed’s recent reports on central bank digital currencies. Powell referred to the papers, saying the Fed is seeking public comment.

“This will be something that we will invest a fair amount of time and expertise … to get it right,” Powell said, emphasizing that “we have not decided to do it.”

Whether the benefits outweigh the costs of a central bank digital currency (CBDC) is an unanswered question, he said.

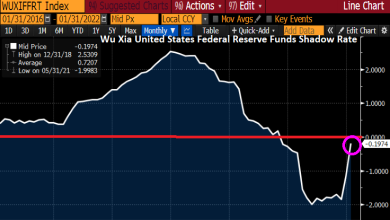

Powell also indicated that the U.S. central bank would try to mitigate inflation by raising rates later this year. He said that the central bank was set to raise its policy rate but that the situation in the Ukraine may have changed expectations.

Still, he told Congress his expectation is that inflation will peak and “come down” by the end of this year.

Powell said he’s inclined to impose and support a 25 basis point rate hike in March.

Traders have been pricing in a possible rate hike since the Federal Open Market Committee’s two-day meeting in March, however, it was unclear until now by how many basis points.

The CME Group’s FedWatch tool showed this morning that futures traders see a 90% chance of a quarter-percentage point hike, as opposed to a half-percentage point, which many thought was very likely just a week ago.

UPDATE (March 2, 2022, 16:05 UTC): Adds additional context.

Source link