USD/JPY Technical Analysis: Risk Aversion Halts Gains

Any gains for the USD/JPY currency pair may be an opportunity to sell as the Japanese yen is one of the most important safe havens for investors in times of uncertainty. We recommend to our valued clients to sell the dollar-yen pair from the resistance 115.75 and it has retreated according to the performance currently to the support level 114.85. The military operations between Russia and Ukraine are still in place and the international sanctions on the Russian regime are expanding, and in return Russia prefers the challenge.

Japan will this week relax strict controls on the coronavirus borders that have been criticized as xenophobic and harmful to the Japanese economy. However, the new rules offer only a slight improvement: 5,000 new arrivals per day, instead of the current 3,500, and nowhere near the 64,000 per day who were entering for long-term visits before the pandemic.

The 5,000 daily arrivals also include Japanese nationals returning to the country, meaning hundreds of thousands of foreigners will still struggle to enter. An estimated half a million foreign students, teachers, and workers accredited as technical trainees and business travelers have been closed for nearly two years. Under the policy, which will take effect on Tuesday, it will take several more months of patience before everyone can enter.

Japan has banned the entry of nearly all non-resident foreigners since the start of the epidemic. The country announced easing in November, but quickly reversed that decision after the omicron variant appeared elsewhere in the world. For his part, Japanese Prime Minister Fumio Kishida said Japan will consider further easing of border controls based on a scientific assessment of the omicron variable, infection levels inside and outside Japan, and quarantine measures in other countries.

The long wait has hurt many people mentally and financially. Some have changed the focus of their studies, careers, and life plans.

According to the economic return. According to a recent survey by the German Chamber of Commerce and Industry for German companies in Japan, 73 out of 100 participants said they saw their project and business volume in jeopardy due to the entry ban, while 23 of them said they had already lost business worth more than $113 million.

As COVID-19 infections slow, the number of daily deaths rose to more than 270 last Tuesday, a record number since the pandemic began, according to the Ministry of Health. Japan has recorded more than 23,000 deaths, which is much lower than in many countries. Most of Japan remains subject to virus restrictions as infections continue to burden the medical system, which tends to be easily overcome because COVID-19 treatment is limited to public or major hospitals.

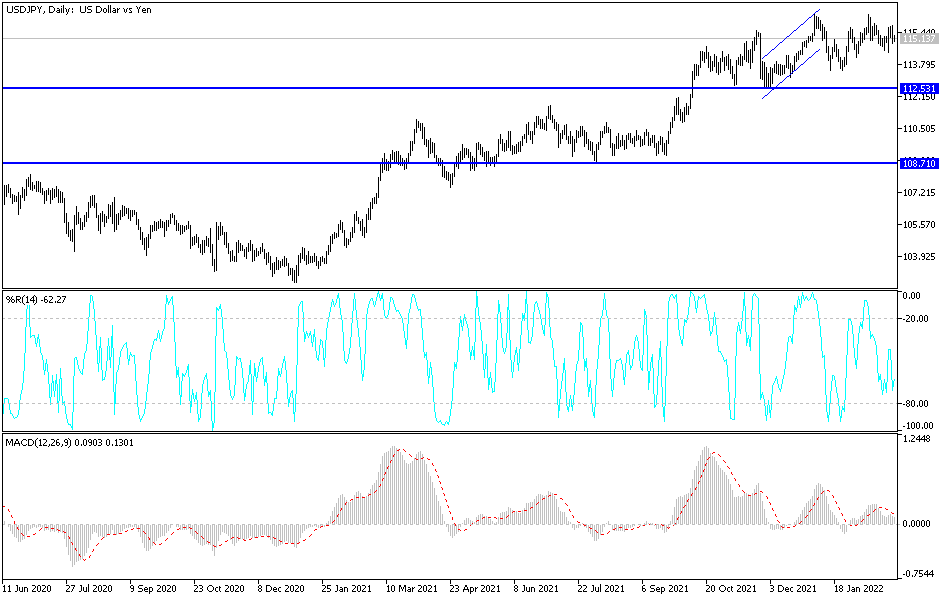

According to the technical analysis of the pair: the bulls are determined to maintain the 115.00 resistance to push the price of the USD/JPY currency pair higher. The stability above it technically supports the move towards stronger resistance levels, and the most important of them after that is 115.65 and 116.35, but I still prefer selling the USD/JPY pair of all bullish level. On the downside, and according to the performance on the daily chart, the support level 114.20 will be important for the bears to regain control of the trend again. The 113.00 support will remain the most important to announce the bearish control of the trend.

The USD/JPY pair will be affected today by the risk appetite of investors, as well as the reaction from the announcement of the US ISM Manufacturing PMI.

Source link